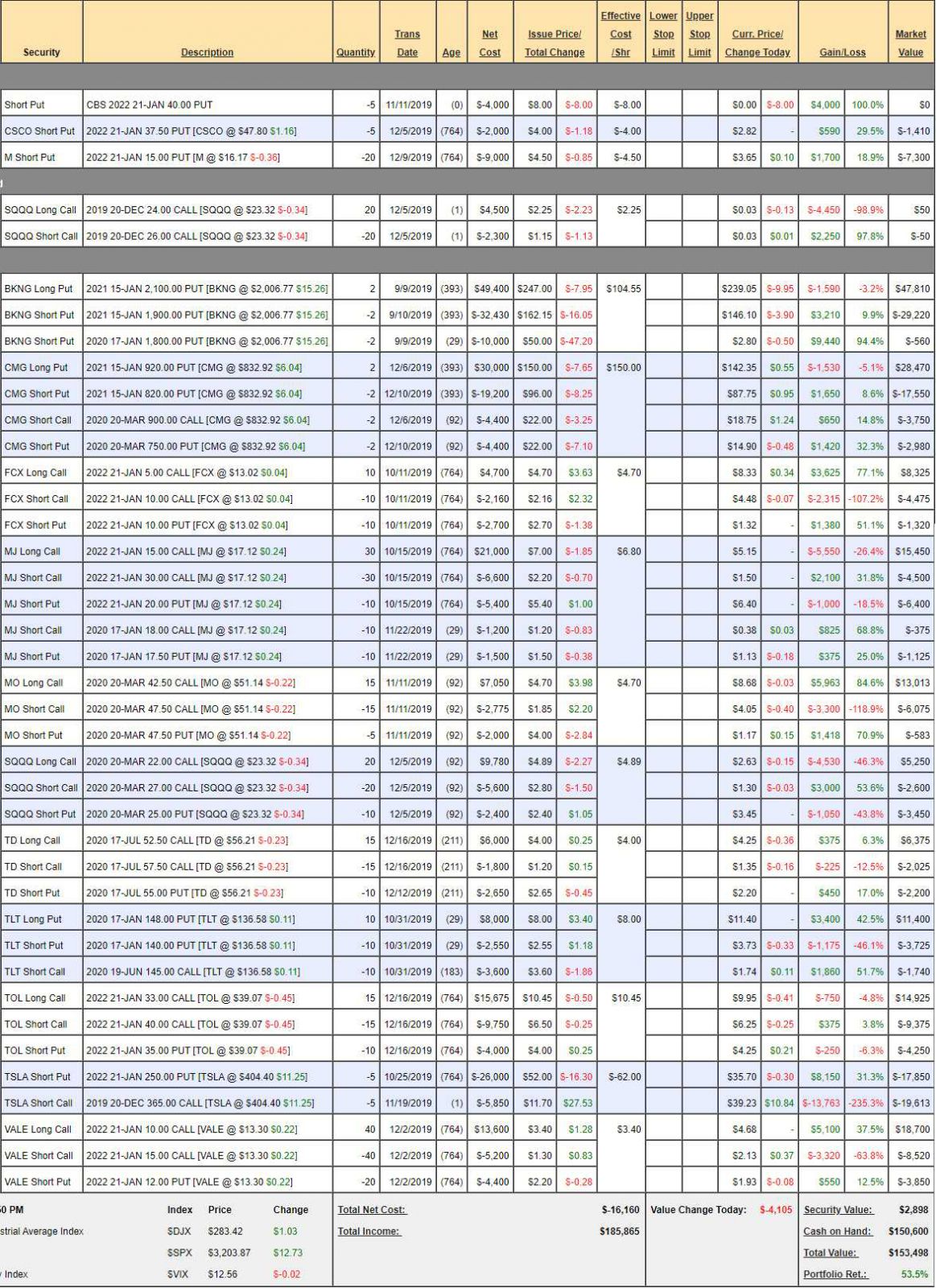

$153,498!

$153,498!

That's only up $1,445 since our last reveiw but it's only been three months and we're up 54% overall – not terrible for our Short-Term Portfolio. As I said to our Members during our STP review on Thursday, in our Live Member Chat Room, the way we will start our Long-Term Portfolio is to simply add cash to the Short-Term Portfolio and rename it and then put a fresh $100,000 into the NEW Short-Term Portfolio. After that, it's just a matter of moving the hedges over and we're all set for 2020.

At the moment, the longs in the STP are just smal positions we've been poking around with but there's lots to like for the long-term so they'll make a good base for the eventual $500,000 LTP. The function of the $100,000 STP is to protect the $500,000 LTP but, at the moment, there is no LTP, so the STP is doing double-duty.

As we made 52% in the first two months, I was not into taking chances into the holidays. The indexes have been flying higher but there are still plenty of bargains to be had – our most recent Top Trade Ideas were for TOL (12/16), TD (12/12), M (12/9), CMG (12/6) and VALE (12/2) so we found 4 things we liked and a neutral spread on CMG this month. In the STP, we added short puts on CSCO, an SQQQ hedge, CMG and VALE – leaving us well-diversified into the two slowest weeks of the year.

Here's the consolidation of last week's reviews:

Short-Term Portfolio Review (STP): $153,498 (53.5%) is flat to the last review as our hedges killed us and so did TSLA. Still, I'd rather lock in a $50,000 gain over 3 months than risk giving it back so we got cautious after making ridiculous 2-month gains. Next month, we can start an LTP by simply renaming this one and removing the short-term plays and the hedges and putting them in a new STP – see how easy that was – we already started our LTP – and it's our STP!

- Short puts – All on track with $8,710 of additional potential.

- SQQQ – The December spread was a bet, not a hedge and offset by the CSCO puts – though it's a long time before we get this loss back. Just dead money here.

- BKNG – Very nice as we bought back the short calls and now we can sell them again. Unfortunately, we shorted BKNG over China Trade issues affecting travel (it did) but that's over now and they really aren't that expensive at $2,000. Also, I no longer feel strongly about the bear put spread so let's just cash this one in – it's been very good to us.

CMG – Meh so far but right in our range.

- FCX – Big pop off trade deal but it's a $5,000 spread and only net $2,530 so 100% to gain if we just wait. Yawn – I guess we may as well wait for the other $2,470….

- MJ – See, we didn't sell enough calls so a fail so far. Still, we only paid net $7,200 for the $45,000 spread and our 2-month (out of 26) short puts and calls brought in $2,700 so 12 more of those is $32,400 of premium left to sell – I like those odds!

- MO – Over our target already so another one of those boring ones that goes up before we get to double down or even adjust. Net $6,355 on the $7,500 spread means we have to wait until March to collect our last $1,145, but that's still 18% more in 3 months – what better do we have to do with the cash than wait when it's almost a sure thing?

- SQQQ – Now this one is a hedge. Like the Earnings Portfolio, we should make the same adjustment, which was: "we can still cash in our March $22 calls for $5,250 – that's more than we paid! I don't care about the puts because we'll roll them forever but, while SQQQ is low, let's buy some cheap, longer-term insurance like 40 June 20 ($4.60)/27 ($2.50) bull call spreads for net $2.10 ($8,400) so we're paying $3,150 for much more insurance and we are double covered on the short March $27 calls, now $1.30 and if we put a stop on 10 (1/2) of them at $1.70 ($1,700) it's very doubtful we'll get in trouble on an upside move."

- TD – On track.

- TLT – Should get our full $8,000 on that one!

- TOL – Brand new and good for a new trade.

- TSLA – Yikes – it blew over our short calls but fortunately, we made a lot on the short put side too. The short Dec $365 calls are now $40 but, fortunately, the short March $400 calls are $40 so let's roll our 5 short Dec $365s ($20,000) to 5 short March $400 calls at $40 ($20,000) and make it a problem for another quarter. Keep in mind, if TSLA keeps going up, we still have $17,850 more to collect on the short put side.

- VALE – A nice $20,000 spread that's on track at net $6,330 so 200% left to gain makes it perfectly lovely as a new trade!

Money Talk Portfolio Review: Only up 3% at the moment but it's only been a month and we only have 3 positions that we can't touch – so I guess it's going well but, yawn…

- SPWR – They are spinning off a division or I would have gone for the bull call spread too. I love these guys long-term and we can just sit on the short puts without worrying about the mess from the splits. I expect to collect the full $2,935 on this one.

- GOLD – Our Trade of the Year so it better pay off! Was only net $1,665 at the last review and now $2,947, so up an additional $1,282 (77%) in a month was a nice trade, even if you were late. I fully expect to collect the remaining $9,053 (307%) – so still good for a new trade but nothing like our original entry anymore.

- IBM – Last year's Trade of the Year is a resurrection play – as we've already cashed in the originals at $150. $135 got attractive again so we're back in with a $16,000 spread that's currently net $60, up $140 from our $80 credit so far. Still great for a new trade with a $16,940 (28,233%) upside potential over just $140! I

Only a month old and up $2,958 is on a good track and the potential for our trades is another $28,928 PLUS that $2,958 is $31,886 should be enough money to beat the S&P over the next two years so no worries. We're only using $8,000 in margin and none of our Cash (we have more than we started with) so PLENTY of room for expansion.

My next show is likely in Jan but not set yet.

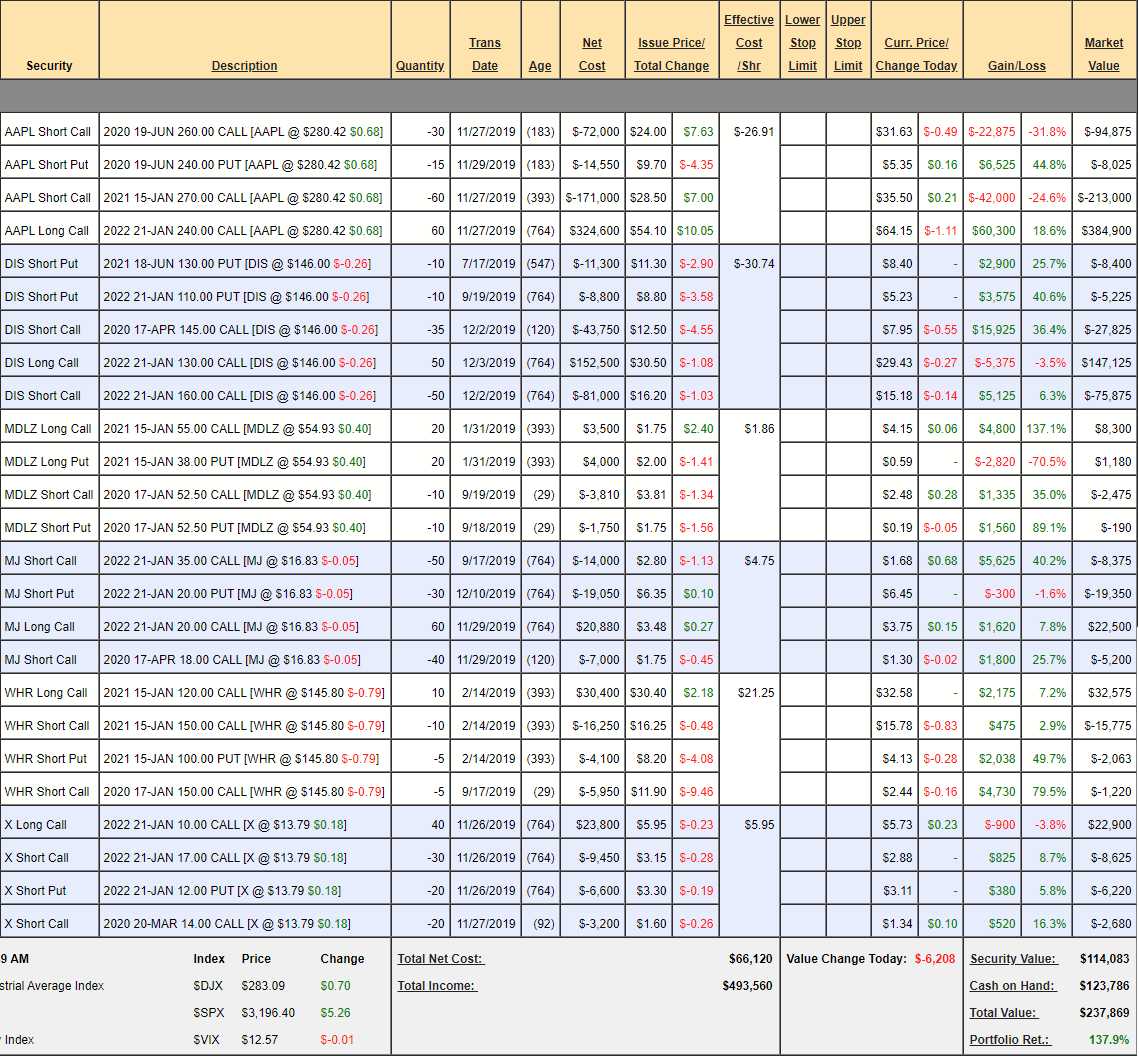

Butterfly Portfolio Update: $237,869 is up $137,869 (137.8%) in our oldest portfolio (initiated 1/2/18) as we close out our 2nd year. There's no point to closing butterfly plays as the whole point is to generate a quarterly income selling puts and calls. It is, by far, our steadiest portfolio year over year – as it's generally market agnostic but, month to month – it can have pretty wild swings on changes in the VIX or even a big move up or down in single stocks.

It's generally a low-touch portfolio, we try to only make adjustments when we have to:

- AAPL – We just rolled 20 short March $210 calls to 30 short June $260 calls and now those are burning us for a $22,875 loss already. Fortunately we also added longs but they are not keeping up so far. AAPL is at $280 at the moment and we sold the calls for $24 so $284 is where it starts getting really annoying but they are due for a pullback into earnings next month. Our key safety feature here is we sold 2021 $270 calls against our 2022 $240 longs and the $270s ($35.50) can be rolled to the 2022 $300s ($33.50) to add another $180,000 of upside if AAPL does keep climbing – so we've got that going for us, which puts our current, unrealized short call loss into perspective.

DIS – Also recently expanded and adjusted and now right on track with a big profit.

MDLZ – This has been a good income producer and it was a proper Butterfly Play, where we bought the long puts and long calls to protect our short puts and calls – but we hardly actually do them that way in this never-ending bull market and you can see why as the puts are nearly worthless already and too far out of the money to be effective. The calls are up nicely, however so we're going to lock them in and extend our time as follows:

- Buy to close 20 2021 $55 calls at $4.25 ($8,500)

- Buy to close 20 2021 $38 puts at 0.60 ($1,200)

- Buy 20 2022 $55 ($6)/$62.50 ($2.80) bull call spreads for $3.20 ($6,200)

- Sell 10 2022 $50 puts for $4.20 ($4,200)

So we're taking net $7,700 off the table and we're still covering the upside with a $20,000 spread and we're generating about $5,000 a quarter in premium sales. Very nice!

That's the beauty of the Buttefly Plays – sometimes we are so on track that we have tons of cash we can wring out of the position. This will put the portfolio at over $130,000 in cash, giving us about $250,000 in remaining buying power to add more positions with.

- MJ – We're testing my theory that if we'd just stick to the plan and sell lots of calls – this can be a very profitable ETF to hold onto. Since we can buy back the 50 short 2022 $35 calls at $1 ($5,100) last sale was $1 yesterday, don't pay more), let's do that and sell 30 of the 2021 $21 calls for $2.05 ($6,150). We can always roll the short 2021 calls back to 2022 but, meanwhile, they burn premium twice as fast so we make $6,150/393 ($15.65/day) vs $5,100/764 ($6.67/day). These moves don't seem like a big deal but they add up fast!

- WHR – We didn't panic and now the short calls are coming back for us – all seems well but let's put a stop on them at $4 now.

- X – Our newest play and right on track.

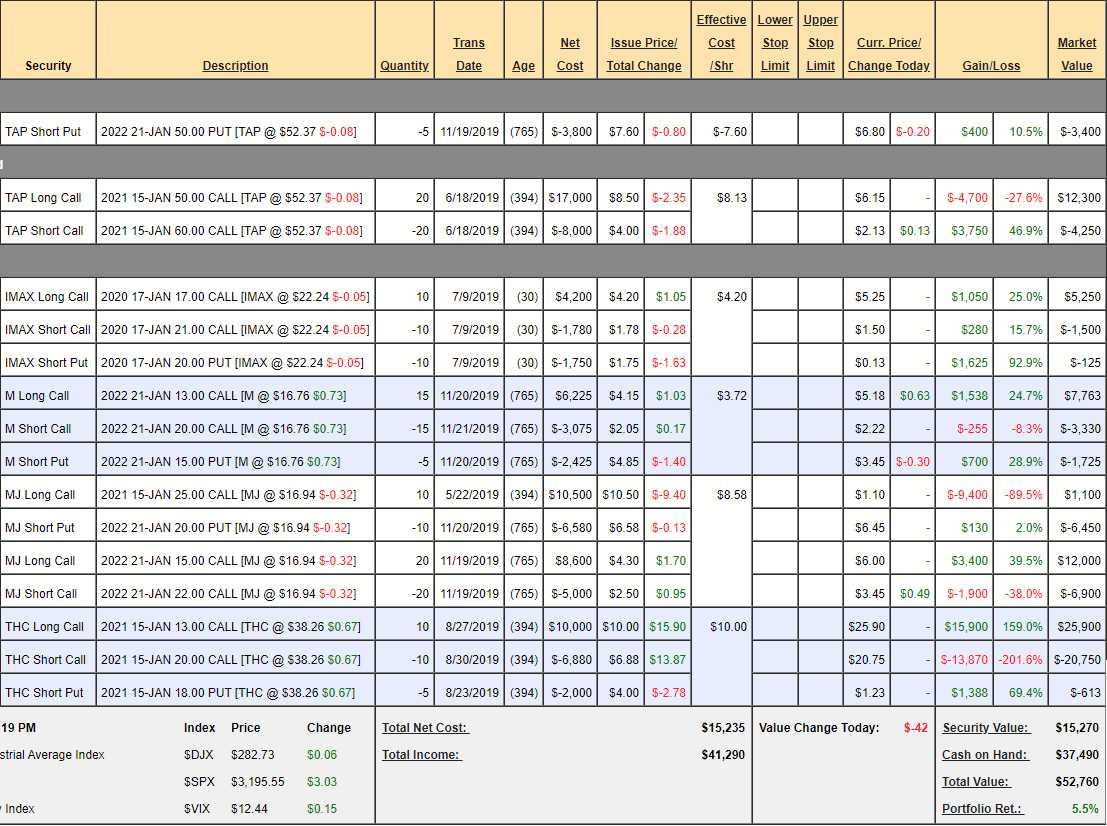

Hemp Boca Portfolio Review: Up 5.5% is nice considering MJ is hitting us for a $7,770 (15.5%) loss so we'd be on track without MJ and, hopefully, it will get us on track again one day. Other than that, we seem to be in pretty good shape, fighting back from that loss and up 5.2% since last month with no changes at all.

- TAP – They bumped up their dividend – hopefully not priced in Canadian Dollars… We just added puts to the bull call spread but our conservative entry is net $42.40 and I have no worries about that so I fully expect to gain the remaining $3,750 (98.7%) on the puts, so still good for a new trade. On the bull call spread, we're down $1,250 – so also good for a new trade at net $7,750 on the $20,000 spread so $12,250 expected to be gained there but $7,900 is $54 and I need more evidence before I begin to say I'm counting on that money – so no green on the rest!

- IMAX – As noted in the Earnings Portfolio, I feel very good about this one and we're already in the money at net $3,625 on the $4,000 spread so $375 (10%) left to gain if they hold $21 for 1 more month.

- M – Finally popping! Nice $10,500 potential spread at a net $2,708 and that's up $5,926 since last month… Still, it's a $10,500 spread so $7,792 (287%) potential gain if M can make it to $20 in two years is still pretty good – even if you IGNORED ME the other 1,000 times I said I loved this stock at $15.

- MJ – Well, we took a shot at fixing it a couple of weeks ago, leaving our old long calls as they weren't worth cashing but certainly we're not counting on this money.

- THC – Another one we love to buy whenever investors lose faith. Miles in the money now at net $4,575 but it's a net $7,000 spread that's 50% in the money so not bad for a new trade with $2,425 (53%) left to gain, We entered for net $1,000(ish) so up 350% already but now it's pretty much a sure thing so 53% is not boring when you don't even have to think about it.

So that's $14,342 left to gain despite not counting a thing on MJ or most of TAP (another $12,000 potential) and that's 28% of a $50,000 portfolio but we still have 75% of our $100,000 buying power and we will find ways to deploy that over time. Keep in mind we only trade this one on the Tuesday Radio Show.

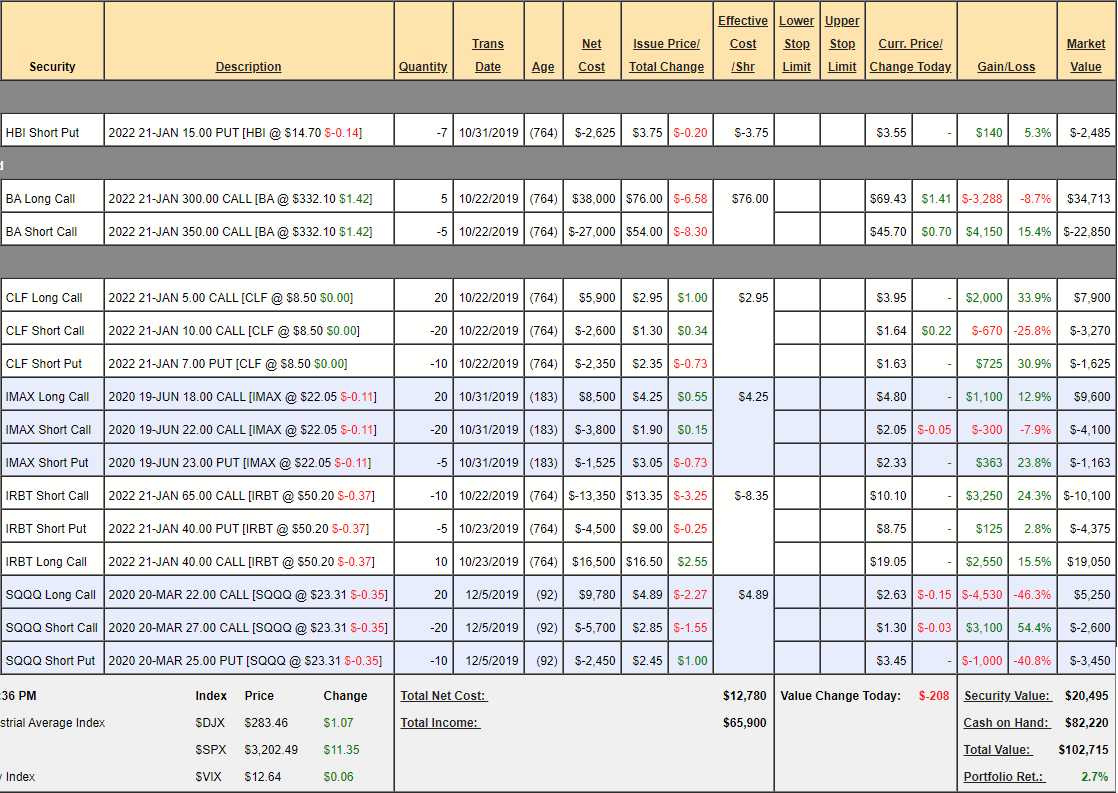

Earnings Portfolio Review: $102,715 is only up 2.7% in 6 weeks and, though that's considered great by most people – it's kind of boring for us. Our SQQQ hedge has sucked up $2,430 of our gains but, otherwise, we do love the positions and they are scheduled to make another $42,293 over the next two years – so we have to take the hedge in context as future adjustments are much cheaper than the initial entry and, of course, we will be adding more as next earnings season commences.

Anyway, that means this entire portfolio is good for a new trade and I love every one of our positions (except BA, which I'm worried about).

- HBI – Another hidden retail gem.

- BA – The were up $3,000 so this cost us since the last review. Very tempting to sell a put here but we don't know what the outcome will be so I think this spread is enough of a gamble by itself for now.

- CLF – Finally woke up and on track.

- IMAX – Star Wars is getting bad reviews but I doubt that keeps people from going. My Mom asked us if we wanted to go on Sunday AND she's bringing her boyfriend!

- IRBT – Very happy with that bottom call. Sometimes they do work out…

- SQQQ – In trouble already but that's OK, the idea is the portfolio needs insurance and this was our first policy. Unfortunately, we didn't die – so we wasted our first payment! Still we paid net $1,630 for our insurance and we can still cash in our March $22 calls for $5,250 – that's more than we paid! I don't care about the puts because we'll roll them forever but, while SQQQ is low, let's buy some cheap, longer-term insurance like 40 June 20 ($4.60)/27 ($2.50) bull call spreads for net $2.10 ($8,400) so we're paying $3,150 for much more insurance and we are double covered on the short March $27 calls, now $1.30 and if we put a stop on 10 (1/2) of them at $1.70 ($1,700) it's very doubtful we'll get in trouble on an upside move.

See how cheap it is to adjust a hedge once you establish it? And now it's a $28,000 hedge vs $10,000 before at the same upside point ($27).

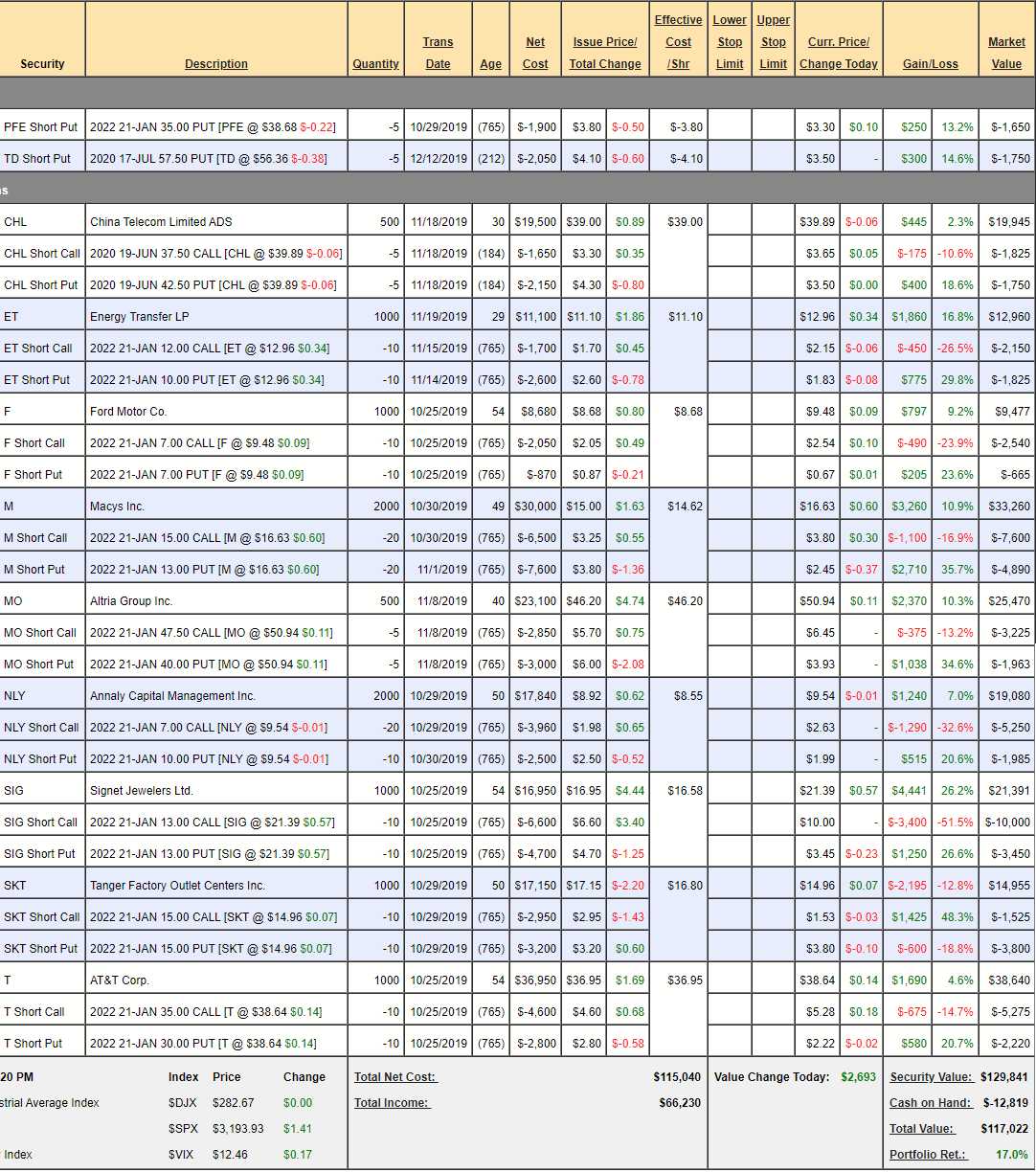

Dividend Portfolio Review: Well, we filled this up already and it's already up 17% at $117,022 and that's well ahead of projections as we were only looking to make 37% for the year but we did well at the outset so we got a little more aggressive, adding TD short puts to close out the set. If all goes well, we won't touch this portfolio at all and simply let the money flow in over the course of the next two years.

So far, we've collected $756 on M, $740 on NLY, $370 on SIG and $355 on SKT – that's $2,221 in our first quarter with 5 more positions to pay but already 2.2% of $100,000 in a quarter alone is far better than we'd do in a bank!