6,000 infections.

6,000 infections.

It's still growing at 50% per day and 132 people are now dead, 30% more than yesterday yet the markets are up on good news from Apple (AAPL), who beat earnings by 10% and Boeing (BA), who "only" expect an $18Bn write-down on the 737 Max – so far. Boeing only earns $10Bn a year so 2 years of earnings are shot to Hell and the plane still isn't certified to fly again yet BA stock is back to $325 pre-market – up over 2.5% on the news. I'm starting to think all the lithium from those batteries we're using is leaching our brains and rendering traders incapable of worrying about anything…

No one seems to care so I'm not going to spend time discussing it this morning. Just keep an eye on the rate if increase and, if it gets worse – then it is time to worry! Not that 50% per day is better but steady is much better than worse. We can deal with 9,000 (more than SARS), 13,500, 20,250, 30,000, 45,000, 67,500 – but next Wednesday, if we are at 100,000 cases or more – then we'll be on the edge of a Global Catastrophe. Hopefully the spread will slow by then but don't be the last one to be worried if it doesn't.

Unfortunately, the only other big thing going on is Trump's Impeachment – and we're all sick of that too. The GOP is so sick of it they are desperately trying to block John Bolton from testifying because he was right there and was an eye-witness to the whole thing and could settle the matter of what actually happened. Where's the fun in that?

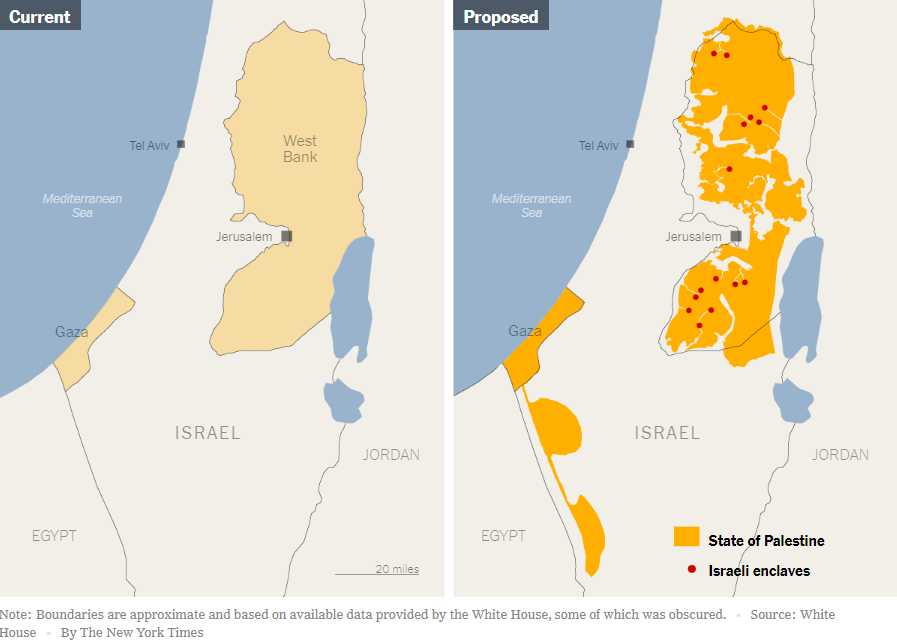

Trump and Netanyahu (who is also being indicted on corruption charges) have unveiled their "Deal of the Century" Peace Plan for the Middle East that has already been firmly rejected by the Palestinians – even though Trump offered to give them $50Bn (of your money) to accept it. It's not surprising as no one bothered consulting the Palestinians during the drafting of the agreement – it was simply announced yesterday as Trump and Bibi unveiled their new map, which seems to have been drawn by someone who doesn't actually understand how borders work.

President Mahmoud Abbas of the Palestinian Authority immediately denounced the plan as a “conspiracy deal” unworthy of serious consideration, making the decades-long pursuit of a so-called two-state solution appear more distant than ever. “We say a thousand times over: no, no, no,” Mr. Abbas said on Tuesday in Ramallah, in the West Bank. Trump called Abbas a good friend and said he was on board with the plan…

President Mahmoud Abbas of the Palestinian Authority immediately denounced the plan as a “conspiracy deal” unworthy of serious consideration, making the decades-long pursuit of a so-called two-state solution appear more distant than ever. “We say a thousand times over: no, no, no,” Mr. Abbas said on Tuesday in Ramallah, in the West Bank. Trump called Abbas a good friend and said he was on board with the plan…

Before returning to Israel on Tuesday, Mr. Netanyahu told reporters that he would ask his cabinet to vote Sunday on a unilateral annexation of the strategically important Jordan River Valley and all Jewish settlements in the West Bank, a move that is sure to further inflame the Palestinians.

On the whole, it's yet another reason to be happy with our oil longs (see Monday's Morning Report) – things can turn ugly over there very quickly.

Not at all ugly is L Brands (LB) this morning, who are up more than 10% on rumors the CEO is stepping down and the company is considering a sale. We have been playing LB for 2 years now and, just last Thursday, we added a nice position to our brand new LTP (Long-Term Portfolio) in our Live Member Chat Room:

Submitted on 2020/01/23 at 2:30 pmSpeaking of undervalued companies, my precious is taking off:

I'm not going to let that get away (and I certainly don't need to reiterate my value proposition) so, for the LTP, lets:

- Sell 20 LB 2022 $20 puts for $5 ($10,000)

- Buy 50 LB 2022 $17.50 calls for $6.30 ($31,500)

- Sell 50 LB 2022 $22.50 calls for $4 ($20,000)

That's net $1,500 on the $25,000 spread so we have $23,500 (1,566%) of upside potential and, oh look – we're almost there already. Don't you love options? TOS says margin on 20 short puts is just $2,830 so this is an incredibly efficient use of margin.

If they do get bought over $22.50 – we collect our full balance 2 years early! Congratulations to all who played along with us.

The indexes are tee'd up for a strong open with Apple (AAPL) earnings giving us a big boost but, other than that – what are we so excited about? We have some light shorts on the Futures and we'll see how those go at 28,800 on the Dow (/YM), 3,280 on the S&P (/ES) and 9,120 on the Nasdaq (/NQ) and, once again, we're long on Natural Gas (March contracts) at $1.86.