Happy Valentine's Day!

Happy Valentine's Day!

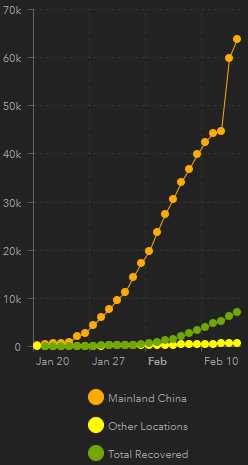

64,456 people are now infected, 1,384 are dead, 7,155 (11.1%) have recovered in the month since this virus began. There are over 8,000 people hospitalized in "serious" condition, that's almost 15% of those infected – especially if you include the dead, who were probably considered "serious" at some point as well. Still, the markets are generally ignoring not only the actual virus but the effects it is having on the global economy.

The Nasdaq is, in fact, 5% higher than it was before the virus oubreak and 7.5% higher than it was when it sold off on that news. I guess you can say it simply resumed it's climb, now up almost 20% since December because, you know, that's how the stock market works now.

Unfortunately, that's also how viruses work and I'm not going to bore you with any doom and gloom stuff other than to point out that we are heading into a 3-day weekend in the US (President's Day on Monday) and, even if we are only adding 4,000 new cases per day, that means we'll be at about 80,000 on Tuesday and around 100,000 by next Friday so I'm still very concerned about next week – as people tend to freak out about 6-digit numbers.

Unfortunately, that's also how viruses work and I'm not going to bore you with any doom and gloom stuff other than to point out that we are heading into a 3-day weekend in the US (President's Day on Monday) and, even if we are only adding 4,000 new cases per day, that means we'll be at about 80,000 on Tuesday and around 100,000 by next Friday so I'm still very concerned about next week – as people tend to freak out about 6-digit numbers.

Last Friday, there were 31,523 (1/2) infected, 638 (1/2) dead and 30 in Singapore (1/2), 25 in Thailand (.75), 25 in Hong Kong (1/2), 25 in Japan (.86) and 24 in South Korea (.86). That's what we have to watch closely as Singapore and Hong Kong are a huge worry with a 100% gain in a week and, of course, you can see how 100,000 by next Friday is OPTIMISTIC as we're projecting a 50% slowdown from the current pace of the spread.

Even as the virus is mostly contained to Japan, the economic impact is already spreading across the globe with Germany reporting ZERO (0) GDP growth in Q4 and, due to the virus, possible NEGATIVE GDP in Q1 – pretty much a recession with 2 non-positive quarters.

"The impact from the coronavirus on the Chinese economy is likely to delay any rebound in the manufacturing sector as it at least temporarily disrupts supply chains," Carsten Brzeski, chief German economist at ING, told clients Friday. "Stagnation, with a risk of a technical recession, currently looks like the only dish served," he continued.

The big picture: The world's fourth largest economy, and Europe's biggest, had a feeble 2019 amid weak global auto sales, the US-China trade conflict and the prospect of a disorderly Brexit. The spread of the new coronavirus means that it won't start off 2020 in better shape. Similar fears spring up when looking elsewhere in Europe. GDP for the eurozone grew by just 0.1% in the last three months of 2019, according to data published this morning.

Needless to say we're heading into the weekend with our index hedges. In the Futures, we had a chance to short the Dow (/YM) at 29,500 yesterday, along with 3,376 on the S&P 500 (/ES), 9,615 on the Nasdaq (/NQ) and 1,689 on the Russell (/RTY) and all the indexes are still above our entry except the Dow this morning – so I still like those shorts for weekend protection – just in case…

Have a great weekend,

– Phil