By Michelle Jones. Originally published at ValueWalk.

Feb. 28, 2020 Update: Billionaire Ron Baron believes Tesla could be worth $1.5 trillion by 2030. He offered his latest insight into Tesla stock in an interview with Barron’s this week.

He bought almost all of his 1.62 million shares of Tesla stock between 2014 and 2016 at an average price of $219.14 apiece, amounting to $355 million. Baron noted that the company’s annual revenue was only $2.5 billion in 2013 but grew to $25 billion in 2019. He expects to see it hit $33 billion this year.

By 2024, he predicts Tesla’s revenue will be between $100 billion and $125 billion, and he expects Tesla stock to carrying it to a valuation of $300 billion to $400 billion. By 2030, he looks for Tesla’s revenue to be between $750 billion and $1 trillion with operating profit in the range of $150 billion to $200 billion. By then he expects Tesla to be worth $1.5 trillion.

Tesla stock tanks after news of weak China registrations

Feb. 27, 2020 Update: Tesla stock tanked by more than 10% during regular trading hours today as the rest of the stock market pulled back. The shares’ decline was also worsened by a report of disappointing registration numbers on Tesla vehicles in China before the coronavirus outbreak.

Registration data in China revealed a major month-over-month slowdown in demand there. Data from the government-operated China Automotive Information Net revealed that registrations of new Tesla vehicles tumbled 46% from December to January. There were 3,563 Tesla vehicles registered in China last month. Of those vehicles, 2,605 were models that were actually built in China.

Demand for electric vehicles in China has been waning over the last few months, although Tesla had managed to avoid the problems that struck the rest of the industry. However, January’s steep decline in registration numbers indicates that the U.S.-based automaker isn’t immune to the problems faced by the rest of the Chinese EV industry. The nation’s overall vehicle market looks on track for a third consecutive annual decline amid the economic slowdown, trade tensions and now the coronavirus outbreak.

Tesla stock plunged 7% right after the markets opened. The shares were up 86% year to date through Wednesday’s close. Some of the optimism that’s been driving the stock has been due to the start of production at the factory near Shanghai. The automaker started delivering China-built vehicles last month. Tesla hopes to tap into the tax exemptions and subsidies that are only available on domestically built vehicles.

Concerns about the coronavirus are weighing on both Tesla stock and the broader market. U.S. stock indices also plunged during regular trading hours today.

Tesla stock driven by ESG trends instead of short squeeze?

Feb. 24, 2020 Update: Tesla stock plunged along with the rest of the stock market today, falling more than 7% to $834 per share. The shares have bucked the wider trend of the stock market in recent weeks, continuing to rise even while stock indices were falling, but that’s certainly not the case today.

One firm had some interesting insight into what may have been moving Tesla stock over the last several months. Jefferies analyst Christopher Wood said in a note dated Feb. 20 that the trend in ESG (environmental, social and corporate governance) investing may actually be responsible for a significant portion of the stock’s movement.

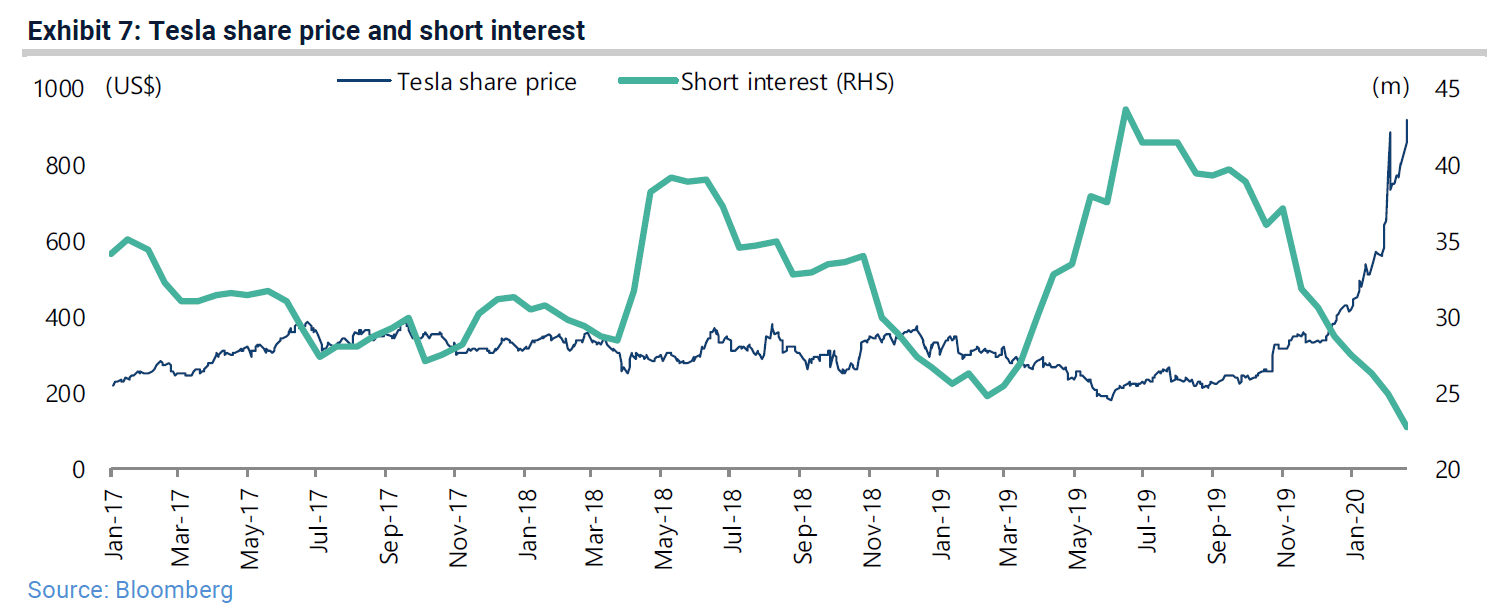

It has been widely reported that a short squeeze has driven the meteoric rise in Tesla stock, but Wood notes that ESG funds have seen massive flows recently. Tesla may be the quintessential ESG stock.

Wood argues that “big money can be made” in identifying stocks that are likely to capture ESG fund flows. He also suggests that the massive flows to ESG funds may actually be what has been driving the automaker’s shares rather than short covering. He pointed out that Tesla stock had surged 119% so far this year by the time of his report, and its short interest declined only 13% during that same timeframe.

Given the number of hedge fund managers who have said that they are still short Tesla, it is an interesting argument to consider.

Tesla closes stock offering with $2.31 billion gain

Feb. 20, 2020 Update: Tesla informed the Securities and Exchange Commission that it has successfully closed its latest stock offering. The automaker raked in $2.31 billion, easily unloading all 2.65 million shares. The underwriters also immediately exercised their options to buy shares, although they had 30 days to do so.

The total share sale in the offering was 3.05 million shares, which sold for $767 each. The amount expected to be raised was $2.01 billion to $2.31 billion, and Tesla easily managed the full amount at the high end of the range. The automaker said it would use the proceeds for general corporate purposes and to strengthen its balance sheet.

Even though share offerings dilute current shareholders’ investments, Tesla stock soared since the latest offering. However, on Thursday, the shares tumbled following a report about how McAfee was able to trick a Model S into speeding up by 50 miles per hour — using only a piece of tape.

These major funds bought Tesla stock right before it soared

February 18, 2020 Update: Tesla stock continues to soar, unimpeded by anything else in the market. The shares are up another 6% in early trading today after the long three-day holiday weekend. Now we’re hearing that two major hedge funds bought shares just before the latest meteoric rise.

Hyperion Asset Management’s Global Growth Companies Fund is in the top 1% of hedge funds based on returns. It has managed a 28% return over the last three years, surpassing 99% of its peers.

According to Bloomberg, the fund has been focused on investing in companies that can thrive when growth is low through the efficient use of technology. The strategy emphasizes companies that center on different trends of themes Hyperion management believe will last for at least 10 years. Hyperion usually holds stocks for 10 years, and its top holdings include Amazon, Microsoft and Visa.

Another fund, Renaissance Technologies, also invested in Tesla stock before the latest meteoric rise. According to Business Insider, the fund boosted its holdings in the EV maker in December to 3.9 million shares. At the time, the position was worth approximately $1.6 billion. The shares are now worth nearly $3.2 billion following the 91% increase in their value so far this year.

Charlie Munger: I would never buy or short Tesla stock

Feb. 13, 2020 Update: Charlie Munger of Berkshire Hathaway, longtime business partner of Warren Buffett, spoke about Tesla during his address at Daily Journal Corp’s annual meeting. He said he would never buy or short Tesla stock. He called Tesla CEO Elon Musk “peculiar,” adding that “he may overestimate himself, but he may not be wrong all the time.”

Tesla stock initially declined today after the company said in a statement that it will sell $2.3 billion in shares to raise capital. However, after the premarket decline, the shares recovered quickly and were up nearly 2% by 11 a.m. Eastern.

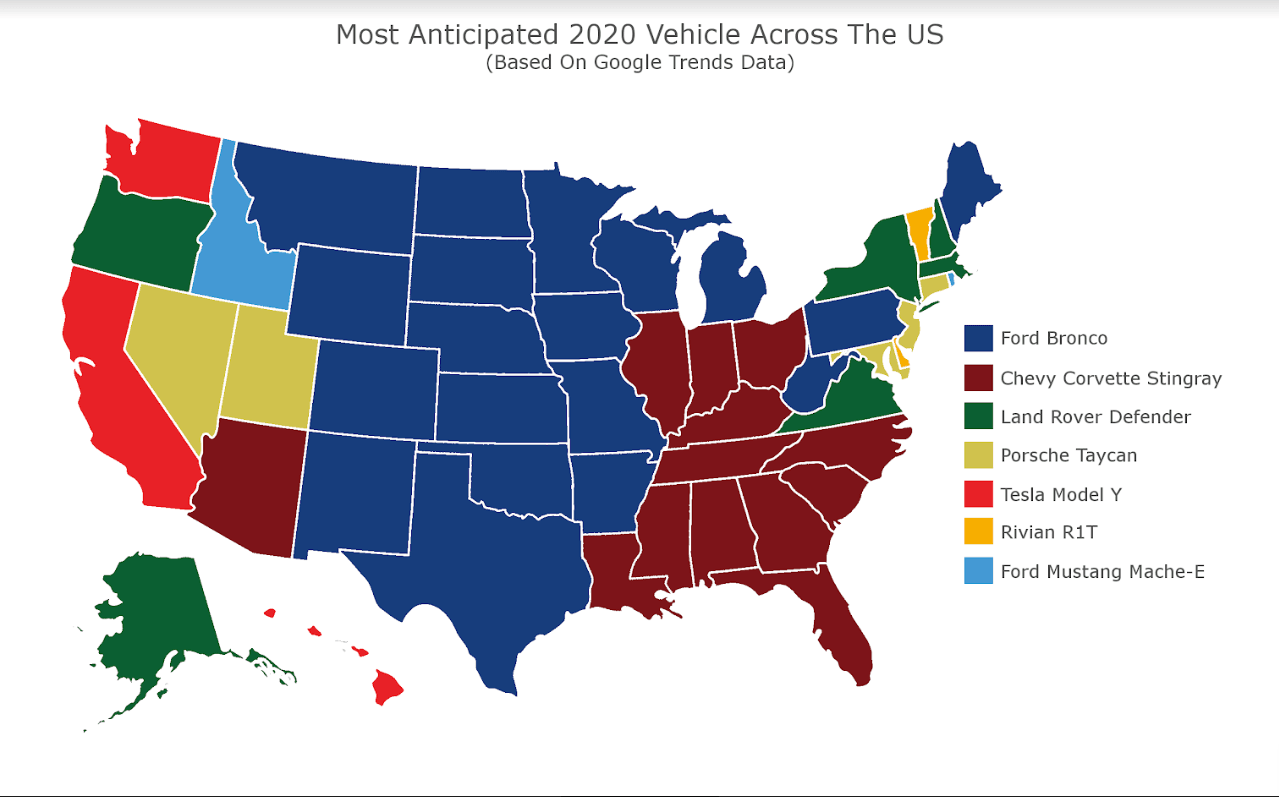

Model Y is one of the most-anticipated vehicles

Feb. 11, 2020 Update: Tesla stock finally seems to be taking a breather today with a climb of less than 1% at midday. Of course, it takes hardly any news to lift Tesla stock, and what we have to report could serve as a bit more fuel for the fire.

Tesla’s Model Y is one of the most-anticipated vehicles for 2020 so far. PartCatalog put together a list of the most-anticipated vehicles for each state in the U.S., and the Model Y captured California, Washington and Hawaii. It’s no surprise that Tesla took its home state of California, but it is interesting that there’s interest in two other states as well.

The most-anticipated vehicle is the much-hyped Ford Bronco with 19 states. The Chevy Corvette Stingray is in second place with 13 states, and the Land Rover Defender is in third place with six states.

Image source: partcatalog.com

Tesla stock climbs as Shanghai factory reopens

Feb. 10, 2020 Update: Tesla stock continued its rapid climb early today as the company reopened production at its factory in Shanghai. The shares briefly topped the $800 level again but dropped back below that level as the early hours of trading continued.

Reuters reported on Friday that Shanghai authorities said they would help companies like Tesla restart product as quickly as possible. The factory there reopened today after an extended Lunar New Year holiday caused by the spread of the coronavirus. Tesla stock continues to be very speculative as today’s gains come days after it was revealed that production in China would restart today.

A short squeeze is also driving Tesla stock as short-sellers are being forced to cover their positions. However, some short-sellers aren’t willing to give up yet, as evidenced by the letters from hedge funds that continue to short the stock.

Concern over Tesla

Feb. 7, 2020 Update: Gene Munster of Loup Ventures, previously known for his analyst reports on Apple, is concerned about Tesla. The venture capitalist noted in a blog post that Tesla stock has soared, doubling the company’s market capitalization over the last month and tripling it since the end of the third quarter. He also said that the excitement that has driven the meteoric rise in Tesla stock presents risk in the short term. He believes bulls may be overlooking a few things.

For example, he expects the first quarter to bring a sequential decline in deliveries. The automaker delivered 112,000 vehicles during the fourth quarter. Munster pointed out that Tesla removed an important statement from its fourth-quarter letter to shareholders. In the second and third quarters of 2019, the company wrote that “deliveries should increase sequentially,” but that statement doesn’t appear in the Q4 letter.

Tesla stock and China

Munster believes it means a significant decline quarter over quarter is in order. He also noted that the company said production will probably outpace deliveries this year. Model 3 production is set to ramp in Shanghai, and Model Y production is beginning in Fremont.

The venture capitalist also noted that the first quarter is usually seasonally weak for automakers due to poor weather, discounts at the end of the year and releases of new models. Tesla also said in its fourth-quarter letter that its finished vehicle inventory level was at 11 days of sales, the lowest in the last four years. Munster said that means the automaker delivered every vehicle it could in the fourth quarter, “leaving many showrooms empty and online inventory searches yielding ‘no results.’”

He also notes that the company has been teasing its upcoming Plaid powertrain, and many Model S and X buyers are likely to wait until it is released. Other factors include the coronavirus impact on Shanghai production.

Tesla stock rumbled 0.46% to $745.52 during regular trading hours.

Hedge funds short Musk

Feb. 6, 2020 Update: Aristides Capital published an update on its short of Tesla stock in its letter to investors dated Feb. 3, 2020, which was reviewed by ValueWalk. Managing Member Christopher Brown had some very harsh words for Tesla CEO Elon Musk.

After doing well shorting Tesla stock most of the year in 2019, Brown said he should have stayed away after covering most of the position in the low $200s. However, he said he dug in a bit too hard in the fourth quarter, explaining that he has written so much on Tesla stock that he has lost his willingness to change to a different view on it.

Aristides covered some of its short of Tesla stock before the company posted its earnings and then covered most of the rest of the position by the end of the month. Brown noted that when companies shift from needing a continual supply of capital to being sustainable on their own, which is how Tesla fans now see the company, the valuation gets expanded.

Another problem for his short of Tesla stock is that the company’s EV competitors didn’t gain as much ground in the market as he thought they would have by now. Additionally, he thought Tesla’s “poor reliability would catch up to it” as the owner base expanded beyond fanboys, but that didn’t happen. Brown sees the automaker as “one of the least reliable brands and also the most loved/highest in loyalty.”

Elon Musk a liar?

Finally, Model 3 orders in the U.S. seems to be going much better than what Brown had expected. But it was his words about Elon Musk that really had an impact.

“Yes, Elon Musk is a narcist and a liar, yes, he has committed multi-billion-dollar securities fraud on more than one occasion, and yes, there is certainly the appearance of some accounting shenanigans at Tesla, but none of that seems to matter,” he wrote. “It’s a ‘cool’ car with a CEO who lied to bailout [sic] Solar City, lied about a takeover, libeled an actual hero, attacks journalists and whistleblowers, and never faces any serious consequences for it whatsoever.”

He also said he won’t promise that he will never short Tesla again, but if he does, it will be because he sees “a huge near-term edge on some sort of catalyst.”

Updates on Tesla stock

Dorsheimer continues to see Tesla as “the leading EV juggernaut and expects the upcoming battery day in April to be a major milestone to help investors understand the automaker’s lead in the EV maker. However, he also believes that patient investors will see a better entry point for Tesla stock if they wait.

Interestingly, advice on Tesla stock is trending so much on Feb. 5 that if you type in “should I” into Google, the top two auto-fill suggestions are “should I buy Tesla stock” and “should I sell Tesla stock.”

Previously: Tesla stock continues its hot streak on Feb. 4, 2020 with another $200 gain in a single day. The shares topped $700 on Monday and then $900 on Tuesday following another 20% gain. The EV maker’s stock has been on a run for months, and it received yet another shot of adrenaline last week from the fourth-quarter earnings release. Tesla Inc. (NASDAQ:TSLA) stock shows no signs of slowing down, and short-sellers have really been taking a hit on it.

Tesla stock: running of the bulls

Shares popped on Feb. 4 following bullish commentary from billionaire Ron Baron on CNBC‘s Squawk Box. The automaker’s valuation topped $160 billion, dwarfing General Motors’ $49.4 billion market capitalization.

In fact, GM, Ford and Chrysler are worth a combined $110 billion, and their combined revenue in 2019 was $425 billion, compared to Tesla’s $25 billion in revenue. Tesla’s stock rise puts it on track to compete with Toyota, which is the most valuable automaker in the world at a market cap of $232.1 billion.

Baron told CNBC that he sees Tesla hitting “at least” $1 trillion in revenue over the next decade. He also said he sees “a lot of growth opportunities from that point going forward.” His fund Baron Capital owns almost 1.63 million shares of Tesla stock, and he said they won’t be selling any of those shares. He believes the latest bull run in the shares is “just the beginning” and predicts that the automaker “could be one of the largest companies in the whole world.”

Tesla stock ratings

Numerous analysts updated their Tesla stock ratings following the company’s 4Q19 earnings release. The most astonishing price target increase came from ARK Invest analysts, who wrote on Feb. 1, 2020 that they expect the shares to be worth $7,000 by 2024. Interestingly, that’s their base case.

Their bull case puts Tesla stock at $15,000 or higher, while their bear case has it at $1,500, well above the $900 current price. One of the biggest factors in their price target increase is their expectation that the automaker will be able to slash costs and boost margins. They see an 80% probability of Tesla reaching 40% margins.

Wedbush analyst Daniel Ives boosted his price target for Tesla stock from $500 to $710 following the company’s Jan. 29 earnings release. He set his bull case for the shares at $1,000 and said he expects the “bull party” to continue. He has a Neutral rating on the stock.

Other ratings

Feb. 5, 2020 Update: Analysts at Canaccord Genuity downgraded Tesla stock in a note dated Feb. 4, 2020. Analyst Jed Dorsheimer said he now rates the shares at Hold, down from Buy, with a $750 price target. Tesla stock powered past $960 per share in trading on Feb. 4 but then pulled back on Feb. 5 following the firm’s downgrade. The stock plunged more than 12% to fall closer to $775 per share.

In his report, Dorsheimer said he saw a balanced risk/ reward for the shares following this week’s meteoric rise. He said they saw a clear buy signal for the stock entering the year, but he believes the coronavirus in China is a clear headwind for Tesla’s new Shanghai factory, which he said calls for “a more pragmatic position.”

“Given the 3,000 per week China Model 3 production expectations in a country that remains on lockdown, we feel a reset of expectations in Q1 is likely and thus needs to be reflected in the valuation,” he wrote.

Ivey wrote in an update on Feb. 3 that he believes the automaker will see 150,000 units of demand out of China alone in the coming year. He also believes the company’s guidance of achieving 500,000 deliveries in 2020 is achievable. He believes Wall Street is looking for between 530,000 and 550,000 deliveries in 2020. The big factor in the number of deliveries to expect include the automaker’s ability to ramp production and demand in China this year and next.

Analysts can’t keep up with price surge

Canaccord Genuity wrote analyst Jed Dorsheimer wrote in his Jan. 30, 2020 update on Tesla stock that the company is “feeling more like Space X.” The automaker posted $7.4 billion in revenue and earnings of $2.14 per share for 4Q19, compared to consensus estimates of $7 billion and $1.77 per share. Dorsheimer said one thing that’s important to note is that the company ended the fourth quarter with $6.3 billion in cash and generated $1 billion in free cash flow, which he believes should quiet concerns about the automaker’s balance sheet. He had a Buy rating and new $750 price target on Tesla stock as of Jan. 30, but the shares have now surpassed $900, putting that target underwater.

Morgan Stanley analyst Adam Jonas remains extremely bearish on Tesla stock with an Underweight rating and $360 price target as of Jan. 31, 2020. He said that in the almost nine years he has been covering the stock, investor commentary has not been as optimistic as it is now following the 4Q19 earnings release. Jonas downgraded the shares to Underweight on Jan. 16.

Hedge fund views of Tesla stock

Multiple hedge funds have covered Tesla stock in their letters to investors. Lakewood Capital wrote about its short of the shares in its fourth-quarter letter to investors dated Jan. 14, 2020. Unsurprisingly, the fund’s short of the automaker was its biggest losing position during the fourth quarter at 85 basis points.

The shares rallied into the end of the year after the company posted a “slight” profit in its third-quarter earnings release, Lakewood’s Anthony Bozza wrote.

“We’ve done this long enough to know that sentiment on stocks like Tesla can be nearly impossible to predict and are [sic] subject to large, sudden price fluctuations, and hence, we size our shorts prudently,” he told investors.

He described the fourth-quarter rally as “frustrating” but added that the position didn’t significantly detract from the fund’s full-year 2019 results.

Although we have seen this story countless times, what’s rather unique in the case of Tesla is the sheer scale of the situation,” he added.

Short-sellers feel the pain

Data from S3 Partners reveals that short-sellers have lost over $8 billion just in the last month alone. On Feb. 3, 2020, short-sellers lost a staggering $2.5 billion just in a single day. Despite the sizable paper losses they have recorded in the last few years, short interest in Tesla remains high with about 24.4 million shares being borrowed and bets against the company valued at more than $15 billion. That amounts to more than 18% of Tesla’s float.

Tesla is the most-shorted stock, and short interest is significantly higher than interest in the next two companies with the second- and third-biggest short interest. Less than 1% of the float is being bet against Apple and Microsoft each.

Short-sellers have been forced to cover some of their position in Tesla. According to S3, they have covered $12.6 billion worth of shares since they were below $200 in June 2019. It’s likely that some of the post-earnings run in late January and early February is the result of short-sellers finally caving and covering their positions.

The post Tesla stock could carry it to a $1.5T valuation in 10 years appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.