What is your plan?

What is your plan?

Come on, I'm not messing around here – WHAT is your trading plan? Surely you have one if you are in charge of trading your portfolio, right? If you were a General in the Army and you didn't have a plan – your troops would very likely be screwed. If you were head coach of a football team and you didn't have a plan – your team would likely lose. If you were the CEO of a company and you didn't have a plan – your company would likely do poorly.

These things are obvious and while you know it's a bad idea to perform surgery without a plan or mount a legal defense without a plan – somehow some of you business owners, doctors, lawyers and other professionals who trade the markets think it's OK to trade without a plan. It's not – it's a very bad idea!

On the right are some good trading guidelines but #1, as it should be, is HAVE A TRADING PLAN. And it doesn't mean "Until it Fails" – it's even more important to have a plan to FIX your positions AFTER the first plan fails. Very sadly, a lot of people take 3, 4 and 5 too seriously and hold tight and cross their fingers when faced with a major market sell-off but your plan CANNOT BE waiting until the market recovers. That is not a plan – that is FEAR!

What we need to do, when the market drops, is have a very rational look at our positions – under the new circumstances – and decide if they are still worth keeping in our portfolio and, most importantly, whether or not we have realistic targets for them to recover.

Let's take Boeing (BA) for example. If you owned BA at $350 and watched it fall to $300 but then back to $350 so the next time it hit $300 you weren't worried but then $275 and back to $300 and suddenly $250 but you thought surely it would bounce back from that and then below $200 the same week and now it's too late to do anything about it but cross your fingers and then down to $100, where you know you should Double Down but now you hate them and now back to $150 – what do you do?

First of all – do you still hate them? Clearly continuing to stand like a deer in the headlights is not an ideal strategy. Is Boeing worth $300/share ($170Bn)? That is the first question you need to ask yourself. BA lost $636M last year and this year, so far, they haven't sold very many planes because they CAN'T sell the 737 Max's until they fix them and the airlines are all shut down with many close to bankruptcy so not only is BA not getting new orders but they may start losing old ones as their customers close up shop.

On the other hand, it seems like the Airline Industry is being bailed out so maybe BA will do well if they can start pushing 737s out the door in Q3. I know I have put off business trips and family visits this year and I'll probably fly again as soon as they give the all clear – just like we all flew again after 9/11 so I don't think air travel is dead – I just think it will have some pains. Still, is BA going to make $6Bn to justify a $90Bn valuation? Certainly not this year and maybe not next year either so $300 is right out the window but I do like owning them at $150.

But we don't own them at $150 do we? We own them at $350 and the stock is now at $150 so – HOW DO WE FIX IT?

If I have 200 shares ($70,000) they are now worth $30,000 and we could buy $60,000 more to have 600 shares at $130,000 or $216.66/share. So we'd be spending $60,000 and STILL not very comfortable with the target. BA is not going to be paying a dividend so we don't actually NEED to own the stock, however. That means I can show you a nice options trick to fix the trade:

- Cash out 200 shares of BA at $150 ($30,000)

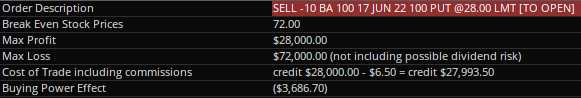

- Sell 10 BA June 2022 $100 puts at $28 ($28,000)

- Buy 20 BA June 2022 $100 calls for $82.50 ($165,000)

- Sell 20 BA June 2022 $150 calls for $59 ($118,000)

- Sell 5 BA July $200 calls for $15 ($7,500)

That transaction nets you an $18,500 credit on the $100,000 spread. You started with $70,000 so your new net is $51,500 so you can still almost double up (+$48,500) your net if BA manages to be over $150 into Jan 2022. The net margin on the short puts, since they are 33% out of the money, is just $3,686.70 but you are OBLIGATED to buy 1,000 shares of BA for $100 per share ($100,000) – that is what you were paid $28,000 to promise when you sold 10 short puts.

That transaction nets you an $18,500 credit on the $100,000 spread. You started with $70,000 so your new net is $51,500 so you can still almost double up (+$48,500) your net if BA manages to be over $150 into Jan 2022. The net margin on the short puts, since they are 33% out of the money, is just $3,686.70 but you are OBLIGATED to buy 1,000 shares of BA for $100 per share ($100,000) – that is what you were paid $28,000 to promise when you sold 10 short puts.

That would put us in 1,000 shares of BA for net $151,500 or $151.50/share so, if you don't REALLY want to own 1,000 shares of BA for $151,500 – don't obligate yourself with the short puts but, since we already have 200 shares we paid $70,000 for – it seems like a worthwhile trade-off to me!

This is what we call an Artificial Buy/Write where, rather than continuing to own the stock, we set up an in-the-money bull call spread to simuluate ownership. We limit both our downside ($51,500) and our upside ($48,500) though we can sell more short calls along the way (1/4 cover 33% out of the money is not very risky). Amazingly, we are able to make a profit even if BA never goes back above $150 and our break-even is about $126 – not bad for a stock you entered at $350 and dropped over 60% on you, right?

Another way to reset your position is to simply sell those short puts. Let's take Macy's (M), for example. That retailer fell from $16 to $5, down almost 70% but we still like them (they are laying off all their workers today) so if, for example, we had 1,000 shares at $16 ($16,000) and they are down to $5.37 ($5,370). Rather than doubling down, which would give us 2,000 shares at $10.685 ($21,370), we could replace them by selling 40 of the 2022 $8 puts for $4.25 and that puts $17,000 in our pocket plus the $5,370 we cash out is $22,370 so now we're into M for a net $6,370 credit and, if assigned 4,000 shares at $8 ($32,000) our net entry would be $25,630 or $6.40 per share.

So, for about $4,300 more than it would cost us to double down now to 2,000 shares and pray for M to get back to $10.68 (+100%) so we could be even, we now risk owning 4,000 shares but we only have to get to $8 (+50%) to make $6,370 and our break-even is $6.40 despite starting the trade out at $16. Aren't options FANTASTIC?!?

And don't let people tell you this is complicated – it isn't. We teach our Members how to trade options every day and they are valuable tools in any trader's tool belt – especially in troubled, volatile times like these.