We're short.

We're short.

That's what happens next. Our portfolios are long but very well-hedged and positioning ourselves pretty neutral going into the long weekend (markets are closed tomorrow for Good Friday) so we are able to use just a couple of S&P 500 (/ES) Futures shorts to flip ourselves more bearish into the weekend.

We discusses our reasons in detail in yesterday's Live Trading Webinar, after which I reiterated to our Members in our Live Chat Room:

I find it hard to believe people won't sell into the weekend, 2,750 is a good short on /ES with tight stops above.

As expected, we hit our entry goal this morning and we're back to 2,735 as of 7:10 but I expect a lot more selling into the weekend as Congress has no concrete plan for more stimulus and Team Trump continues to look inept in their handling of the situation and the numbers (which we also went over yesterday in detail) paint a pretty disturbing picture as 1/500 people in the US will be infected by Monday and World Wide Deaths will cross over 100,000 and, a week from Monday, over 2M people World Wilde will be infected with less than 500,000 recovered so it's a LOT early to be declaring victory.

Victory in the US is not victory. Team Trump doesn't get that. They don't even get that victory in Red States isn't a victory if Blue States still have the virus – they have an imaginary wall that runs through everything. The Trump Administration won't even allow masks to be exported to Canada – Canada! – it's like a state!

Ontario's Conservative Premier Doug Ford also expressed disappointment.

"It's like one of your family members (says), 'OK, you go starve and we'll go feast on the rest of the meal.' I'm just so disappointed right now," Ford said. "We have a great relationship with the U.S. and they pull these shenanigans? Unacceptable."

China is helping out by sending Canada 8M masks so, while we are distracted, Trump is alienating our allies and sending them into China's open arms, further destablizing America's position in the World and tearing apart what it took 44 Presidents 224 years to build. I wonder what he has planned for the next 4 years?

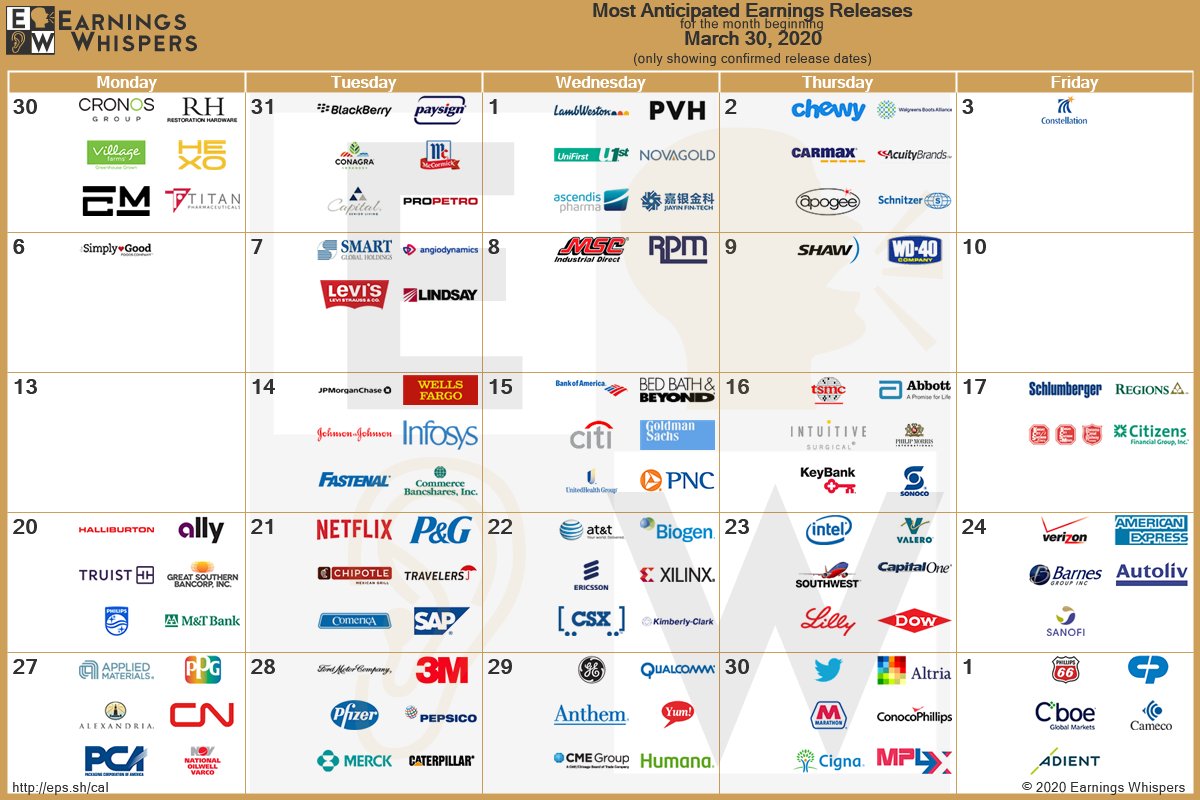

So we are concerned that the data next week will be scary and also earnings season begins next week. We'll take our /ES profits this morning at 2,700(ish) if it bounces (locking in $3,000 gains at least) as Jerome Powell is spreaking at 10am and that has a chance of boosting the markets (and he will likely announce more stimulus after the jobs numbers) a bit higher and Mary Daly (SF Fed) speaks at 1pm so clearly there's an attempt to talk up the markets but then we'll be shorting again into the close as I imagine there will be some profit-taking ahead of the long weekend:

As you can see, the S&P is sticking to our range and we're not expecting to get over the 10% line for the rest of the year and we should settle into the +/- 10% range around 2,850 once the virus is behind us but the upcoming earnings for Q1 will be a disaster that will then be ecliped by the horrific earnings of Q2 and THEN we can get more bullish – but that's August, not April!

We hit the ground running on Tuesday with JPM, WFC, INFY and JNJ and then it's Bank Day on Wednesday and the following week we're right in the thick of things so it's going to be an extra-exciting earnings season and it would be very foolish to bet too heavily one way or the other this early in the game.

Stay safe and stay hedged!

Happy Easter/Passover,

– Phil