What does the Fed think?

What does the Fed think?

Well, at least we'll find out what they WERE thinking on Sunday, March 15th (emergency meeting), just as the virus was starting to shut down the US Economy. At the time, the Fed said: "The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States. Global financial conditions have also been significantly affected. Available economic data show that the U.S. economy came into this challenging period on a strong footing. Information received since the Federal Open Market Committee met in January indicates that the labor market remained strong through February and economic activity rose at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending rose at a moderate pace, business fixed investment and exports remained weak. More recently, the energy sector has come under stress" and they lowered rates 0.5% to essentially zero.

Until the Nobel Prize Committee recognizes my "Microwave Oven Theory of Behavior" I won't be considered one of the World's leading Economorons but this group of Economorons seems particularly clueless, don't they? I mean, it was an EMERGENCY meeting and the Fed had already promised $1.5Tn in QE funding on Friday, the 13th and the market went limit down on that news. As I said that morning:

"Pouring more money on the fire is not going to make the virus go away and won't dampen the economic impact of the virus. It's like giving everyone on the Titanic one Million Dollars and a bucket and claiming you "saved" them. It's what people who aren't actually able to fix things do to buy time (and votes) but it accomplishes nothing in the end – we need to do better!

"So we will sit back today and see what kind of bounce we get from the Fed's action and whatever BS the Government spins out today but none of it matters – even if we move up over 10% to the Strong Bounce line because that then brings us into the weekend, where things could get worse or better – it's a coin flip. So we'll have to maintain our hedges, no matter how great the rally is going…

"Nothing has really changed and what we really need is a well-coordinated response to the virus that restores long-term confidence – that is worth more than any rate cut but, for this Government – it's a very tall order indeed."

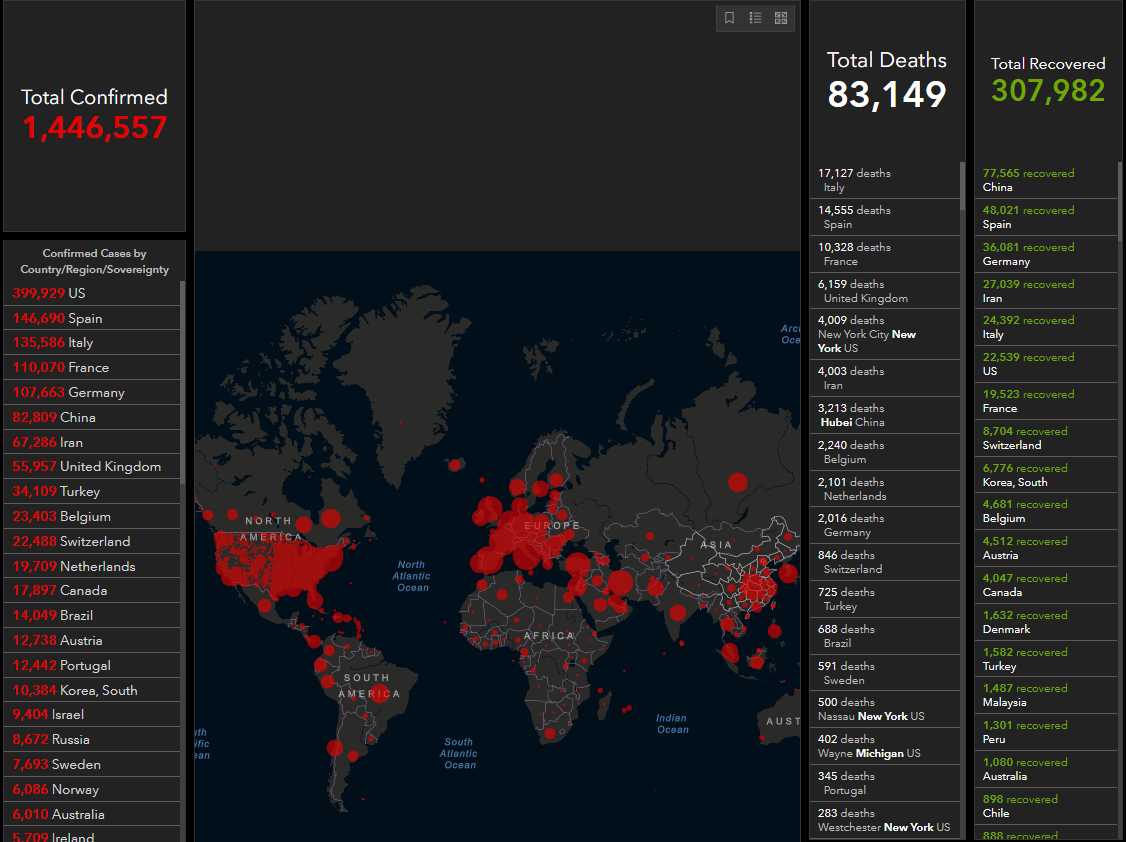

It's almost cute that we only had 135,467 confirmed virus cases in the World less than a month ago and 4,981 deaths with 69,645 people having recovered. Today, after the inept Government response, the US alone has 399,929 cases and, globally, we are at 1,446,557 cases (10x more), 83,149 deaths (15x more) and 307,982 recoveries (3.4x more). These are not good trends when the change in new cases oupaces recoveries by 3 to 1 and the increase in deaths outpaces increasing recoveries by 4 to 1. You don't need to be a World Class Economist to know these are BAD numbers and, if we don't get this thing under control quickly, they will be biblically bad!

The fact that your'e reading this at home in your jammies illistrates how bad things are, right? Is there any point at all at which we will demand new leadership or are we just going to ride it out with Team Trump to the bitter end? Not making a political statement, just morbidly curious at how far people are willing to go before admitting they made a mistake… A month from now, we could be at 10x the above numbers. Do you think our Government is doing enough to prevent that from happening?

They'd better be because a month after that, we'd be up to 30M infected in the US and 1M dead – that's the trajectory we're on and every day they drop the ball, Team Virus gets closer to that goal. New York City alone has 4,000 deaths already (12,000 US) and that city has the best hospitals on the planet! What if Las Vegas gets hit that hard – have you even seen a hospital in Las Vegas?

While I'm sure Las Vegas has a hospital somewhere off the strip, Nevada as a whole has 2.1 hospital beds per 1,000 citizens and New York City has 6.4 hospital beds per 1,000 people in Manhattan and they are completely overwhelmed and keeping the corpses in refrigerated trucks because the morgues are full. Do you think the Government is doing enough to help? People are actually dying – every single day – 4,000 dead in NYC is now worse than 9/11 but at least the Government responded to 9/11 and didn't pretend we had it under control when we clearly did not.

While I'm sure Las Vegas has a hospital somewhere off the strip, Nevada as a whole has 2.1 hospital beds per 1,000 citizens and New York City has 6.4 hospital beds per 1,000 people in Manhattan and they are completely overwhelmed and keeping the corpses in refrigerated trucks because the morgues are full. Do you think the Government is doing enough to help? People are actually dying – every single day – 4,000 dead in NYC is now worse than 9/11 but at least the Government responded to 9/11 and didn't pretend we had it under control when we clearly did not.

As I said on Monday the 16th, after the Fed's Emergency Rate Cut:

"So we have a complete crisis of confidence and that's why EVERYTHING is liquidating, including gold ($1,475), silver ($12.00 – a buy at this price!), copper, oil ($29.50 – a buy at this price), cattle (yes, cattle is down 45%), corn, soybeans, wheat – no asset is safe as people go to cash but the Fed Funds rates are now so low that you will soon have to PAY the banks to hold your money – yet another stealthy way Trump is going to tax the American people (and the tariffs are still on too).

"The Dollar, as you can see, is down 1% today but up 3% in the past week, that's making it very expensive to convert your assets into CASH!!! but that's what people are doing at an alarming rate. Why, because they have NO CONFIDENCE that the Government can fix the virus problem and, as I said to our Members over the weekend:

I’m just keeping an eye on progression but more importantly looking at the reaction in other countries who are willing to tank their economies to stop this virus indicates to me that this is much worse than our government is letting on. Our government does not get it, they only care about saving the economy when it is the people who need to be saved.

.jpg) I was wrong about oil, though that changed due to the Arab/Russia squabble but we just cashed in our 3rd set of Silver (/SI) longs for a very nice profit, which more than made up for it. We took our money and ran on all our Futures longs in yesterday morning's rally because, as I noted in the PSW Morning Report, the bounce was a bit much and we expected a pullback.

I was wrong about oil, though that changed due to the Arab/Russia squabble but we just cashed in our 3rd set of Silver (/SI) longs for a very nice profit, which more than made up for it. We took our money and ran on all our Futures longs in yesterday morning's rally because, as I noted in the PSW Morning Report, the bounce was a bit much and we expected a pullback.

We adjusted the hedges in our Income Portfolio to get ready for the pullback and our timing was perfect and we finished the day at $172,985 thanks to the rally reversal – up another $17,837 thanks to our hedging adjustment. We did similar adjustments in our Short-Term Portfolio as well, of course, and that was the final stage (#5) of our portfolio adjustment system.

Usually we have to wait months for these lessons to play out but, in this crazy market, you can see the effects of our portfolio moves in a market reversal in less than a day!

There is much more craziness ahead but, if you want to know how I can see things better than the Fed – it's because I stick to what's real in my analysis – the same as I do with stocks. As I noted above, I don't care what the politicians SAY is happening and I'm 57 years old and an expert in my field and I know a lot of these "experts" that give their opinions on the virus, the economy, the markets, etc. and what I do know for sure is that they are generally no better at this than I am – so I'm not swayed by their opinions either (I don't ignore experts, I just don't overweigh their authority). Generally, I look at the FACTS and form my own conclusions.

That's why, despite my concerns about the Government handling the actual virus, I decided we were oversold on Monday, March 23rd and we added VAC to our Long-Term Portfolio and, on Tuesday, the 24th, I titled the article: "Turnaround Tuesday – Yes, $3Tn is a LOT of Money!" because it is and maybe now it's $6Tn and soon it will be $8Tn – whatever it takes to keep the economy running while we're all shut in for the duration.

You can read what I wrote about a bottom for the economy on that Tuesday but that Friday (27th), it was: "Fallback Friday – US Passes China to Become Most Infected Nation," where I said:

It is 24 hours later and the US has gone from 69,000 to 85,000 cases in the past 24 hours. There will be well over 100,000 cases on Monday and 200,000 by the end of next week and, if we are still not getting things together and responding to desperate needs for protective gear in the hospitals and SERIOUS protocols to halt the spread of the virus, the only thing we'll have by Easter (4/12) is 500,000 cases of the virus – almost 10 times what we have on this curent(ish) map.

So we're right on the money 2 weeks later and I'm not saying this to brag – there are a lot of people spewing a lot of BS in the media and I'm just throwing my hat in the ring to remind you that I am a pretty reliable predictor of things to come – if you should be in need of such a thing. Also, since we are on track with my prediction, then we're probably on track with my economic premise as well but I did warn that next week was going to be the tipping point and, if the Government has not gotten things under control by the time we hit 500,000 cases (this weekend), then they could spiral out of control and all economic bets will be off.

So stay safe and STAY HEDGED!