Isn't Trump doing a great job?

As the President says, he has ABSOLUTE POWER (much like Palpatine) to do whatever he wants and that includes ordering the Governors to lift quarantine restrictions so we'll all be going back to work "soon" – despite what those "scientists", "other World Leaders" and "Governors" have to say about it. Only Trump's decision matters and that was made very clear by Dr. Fauci's opening ass-kissing of the President at yesterday's briefing.

Don't blame Dr. Fauci, Trump threated his job over the weekend and Fauci is swallowing his pride and kissing the President's ass to keep us alive because he is the only voice of sanity we have to cling to in this crisis and he has been some help in getting Trump to do some of the right things – which is far better than NONE of the right things. That's why the US "only" has 1/4 of the World's virus cases and that's "only" 7 times the number of infections in China, which has 4 times our population.

In case you weren't convinced by Fauci's gun-to-the-head performance yesterday, Trump had a propaganda video prepared (at the Taxpayers' expense) that re-spliced history to make it look like he was the ONLY person who saw this crisis coming early on and took the decicive action necessary to save us followed by more hostage videos from Governors who were told to say nice things about Trump if they wanted to get Federal Aid (remember that last week?):

See, Trump is doing a PERFECT job so let's stop saying otherwise and, if the virus continues to rage out of control or if quarantine is lifted too early and the virus comes back for a second round – that will certainly not be Trump's fault either because he has ABSOLUTE POWER – but no fault at all. Clear?

Good, now we can get back to other idiocy, like Tesla (TSLA), which is back at $700 this mornng, up 20% in 2 days as the company announced that they delivered 88,400 vehicles in Q1 and produced about 103,000 vehicles before being forced to shut down the plant. That measn Q2 will be at ZERO for April and maybe May so I can't imagine what traders are so excited about as TSLA lost $862M on $24.5Bn in sales in Q4 and thely lost $1.1Bn on $21.4Bn in sales in Q3 and those Q1 numbers indicate about $21Bn in sales so TSLA is likely to lose another $1Bn in Q1 and more like $1.5Bn in Q2 – so go figure…

You would think that a Global Pandemic would make investors more cautious – or at least more rational but, apparently, $6,000 Billion Dollars still has nowhere to go but US equities and all this money given to Corporations and all these low rates (pretty much 0% now) leaves investors no choice but to put their money in the market and that's the rising tide that will lift all ships – even the ones that are leaking $1Bn per quarter like Tesla.

You would think that a Global Pandemic would make investors more cautious – or at least more rational but, apparently, $6,000 Billion Dollars still has nowhere to go but US equities and all this money given to Corporations and all these low rates (pretty much 0% now) leaves investors no choice but to put their money in the market and that's the rising tide that will lift all ships – even the ones that are leaking $1Bn per quarter like Tesla.

You could see it in progress yesterday, as the Nasdaq finished the day up 0.5% while the other indexes were in the read. The Nasdaq 100 is back to 8,500 and it topped out at 9,750 in February and fell to 7,000 (28%) but then up 1,500 (21.4%) is more than halfway back, putting the Nasdaq on track to make a "V-Shaped Recovery" even though the majority of the Global Economy is shut down. Amazing!

I don't think we get back to the highs. I think we will settle into the 10% range between 8,000 and 8,800 but, the way things are going – who knows? You would think it would worry investors more to have the economy shut down and no actual end date to the viral emergency but they are running right back in. I know I called a bottom at 7,000 back in March and that's not conrtadictory of me – I did think we'd stop going down but I certainly didn't think we'd be up 20% 3 weeks later – this is getting silly already!

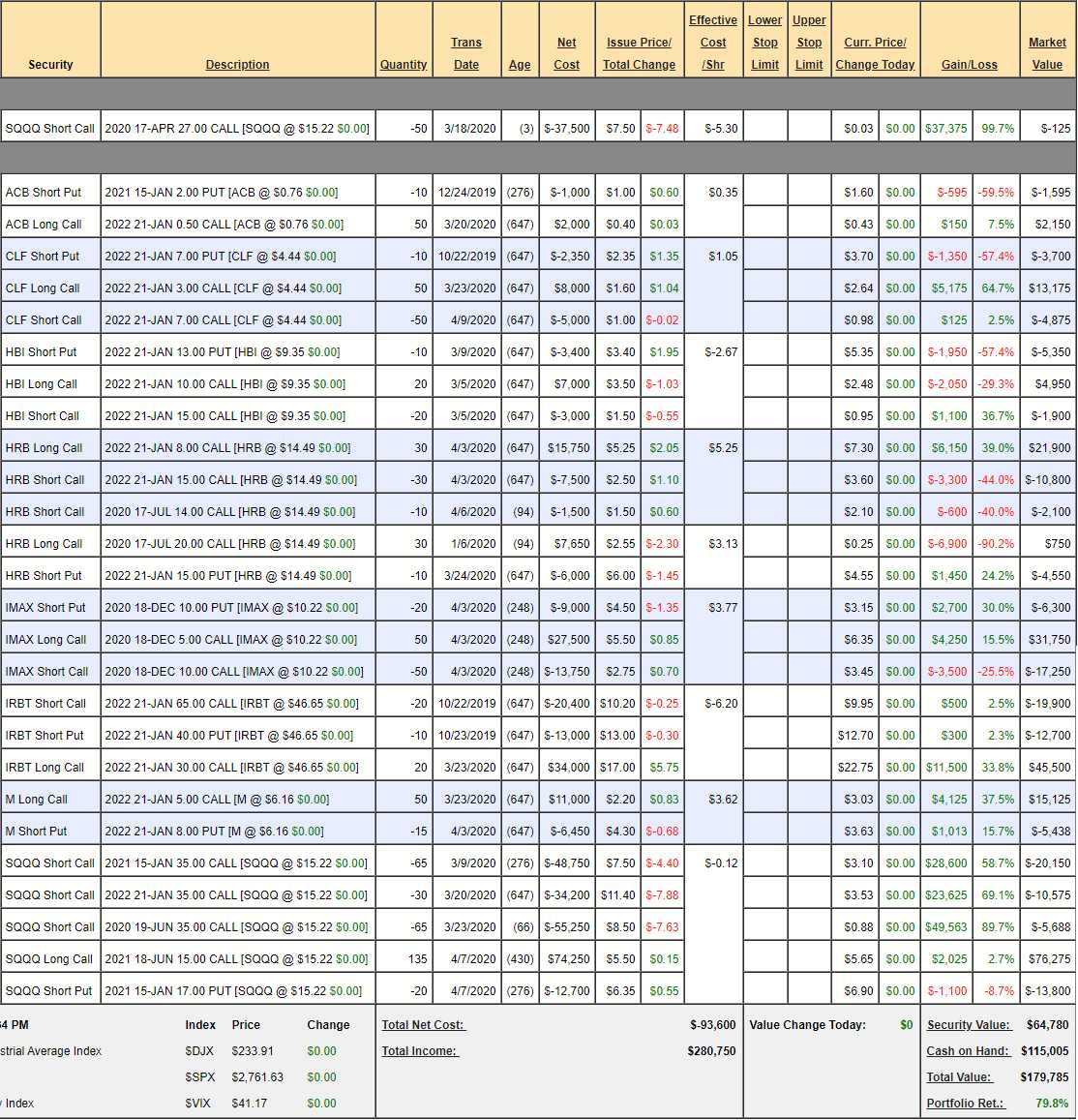

We're content to go with the flow at the moment as our portfolios are well-hedged but also very bullish. Last Tuesday, in our Portfolio Protection Workshop, we featured our Earnings Portfolio, which was at $155,148 at the time and we made only a couple of minor adjustments but, thanks to a 150-point gain (5.6%) in the S&P, we're already at $179,785 – up $24,637 (15.9%) for the week and up $79.8% for the year.

The only change to our longs was selling 50 short CLF 2022 $7 calls for $1 ($5,000) as we didn't want to be greedy after CLF had such a nice run-up. Not being greedy is a very important part of our balanced portfolio strategy and very hard for most traders to learn. All of our longs made good money this week and, so far, we haven't taken too much of a hit on our SQQQ hedges but that may change if the Nasdaq goes over 8,500 so, once again, we pro-actively adjust our hedges:

- The 2022 $10 calls are only $7 so we want to take advantage of the low premium on those and roll our June 2021 $15 calls at $5.65 over to those for $1.35 (might be $2 but still worth it if we open higher on QQQ).

- We'll buy back the 65 short June $35 calls for about 0.75 and that leaves us just 90/135 covered with a very wide spread.

We have $30,725 worth of short calls covering our $94,500 worth of long calls (the new $10s) and that $60,000 is our 2-year cost of insurance in this portfolio. We can sell 40 June $25 calls for $1.50 ($6,000), using just 66 of our 647 days and 10 sales like that would pay for our whole hedge but there's no hurry, let's see how early earnings play out.

- ACB is a craps roll.

- CLF is a $20,000 spread at net $4,600 so $15,400 left to gain.

- HBI is a $10,000 spread at a net $2,300 credit so $12,300 left to gain.

- HRB #1 is a $21,000 spread at net $9,000 so $12,000 left to gain.

- HRB #2 is a craps roll.

- IMAX is a $25,000 spread at net $8,200 so $16,800 left to gain

- IRBT is a $70,000 spread at net $12,900 so $57,100 left to gain

- M at $10 will pay $25,000 and now net $9,687 so $15,313 left to gain

That's $128,913 of expected gains and $270,000 worth of hedges that are $67,500 in the money so it's impossible for them to lose unless the longs are doing well and we have a plan to pay off a lot of those hedges and I'm sure we'll find some more longs but it's a very simple 6 position portfolio (not counting our 2 gambles) with a hedge that's likely to make well over 30% in each of the next two years.

So, if the Nasdaq wants to rally back – God Bless but we're still staying very well-hedged, just in case the traders who are buying this dip turn out to be the same dummies who were buying the market in February. Remember our rule of thumb, you have to burn the dip buyers 3 times before they learn their lesson!