It's over.

It's over.

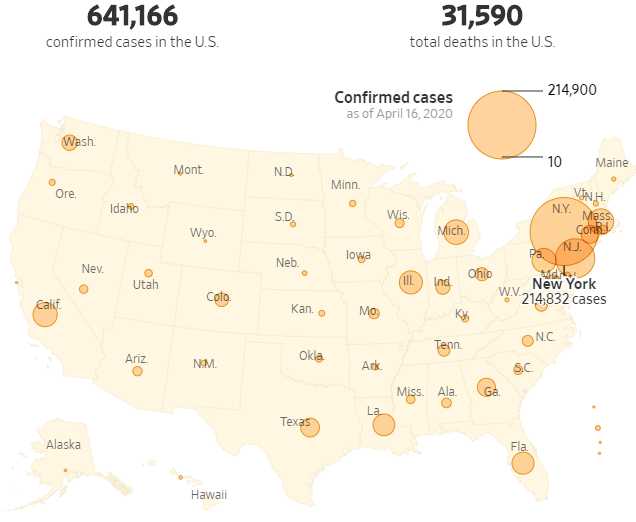

We can all go outside and go back to work and enjoy a ballgame. I'm relieved, aren't you relieved? President Trump declares all is well as the US passes the level of 1/500 citizens being infected and 1/10,000 dead from the virus (so far). One in 500 infected means that, if you go to a football stadium with 50,000 people in it – 100 of those people has the corona virus and can pass it to you easily if they come within 6 feet of you. I'm sure that will be fine.

Trump was enjoying the virus as long as it was giving him "ratings" but now that his approval numbers have dipped in the polls, he's done with it so he's declaring victory and moving on – shifting the responsibility and future blame onto the Governors (as I predicted he would) who will now each be clearly in charge of their own state's timelines and protocols (because there is absolutely no leadership at the Federal level).

Well, there are "guidelines" but The guidelines don’t suggest specific reopening dates. Instead, they encourage States to base their decisions on data. The White House’s plan says States should move to the first phase of reopening after exhibiting a downward trend of documented cases or positive tests over a two-week period. States could move onto the other stages after showing that cases aren’t surging.

Under the first phase, movie theaters (WTF?), restaurants, sports venues (WTF?), places of worship, gyms (WTF?) and other venues could open with strict social-distancing guidelines in place, though bars would stay closed. Schools and day-care centers that are closed would remain shuttered. The plan recommends that vulnerable individuals remain at home during the first phase, and prohibits visits to nursing homes and hospitals. Some people could return to work in phases, though telework is still encouraged under the plan.

Yep, I just can't wait to go to the gym and hold onto that bar that 100 people have been holding before me! I guess we could practice social distancing in the movie theaters, I think they were already practicing it when I went to see Dr Dolittle – as it was just me and my daughters and one other family in the theater… 😉

Moving on to the second phase, nonessential travel could resume and bars could open with some restrictions. Schools and youth activities could reopen. Vulnerable individuals would still be told to stay home and visits to nursing homes and hospitals would still be barred. Telework would continue to be encouraged.

For phase three, there would be no restrictions on workplaces and vulnerable people could resume social interactions, but should seek to follow social distancing. Visits to hospitals and nursing homes could resume, and bars could increase their standing-room capacity. The President said some states could begin to open up as early as this morning – IT'S OVER!

For phase three, there would be no restrictions on workplaces and vulnerable people could resume social interactions, but should seek to follow social distancing. Visits to hospitals and nursing homes could resume, and bars could increase their standing-room capacity. The President said some states could begin to open up as early as this morning – IT'S OVER!

Congratulations, we beat the virus! Of course, Dr. Fauci, who has clearly been taken hostage at this point, did mention: "There may be some setbacks. Let’s face it. We may have to pull back a little, and then go forward." Clearly he is not on board with this plan but, like any hostage video, he has to stick to the script and just hope the people at home will get the message from his tone.

Facuci, who almost got fired last week for disagreeing with Trump in public, has decided he's better off toeing the line than leaving America without an actual expert in Washington but I will tell him now that if he tells Trump to drop dead and quits – he will have 24/7 access to the media anyway. Look how hard it is has been to get rid of Scaramucci!

Testing is still key and the President did his best to encourage people to take tests:

“I was a victim of the first test, meaning I had to go through it and I didn’t like what was happening when they tell you that it goes up your nose and they hang a right at your eye and it goes right to your eye,” Mr. Trump said. “You’ve got to be kidding. I called it an operation, not a test.”

Kind of reminds me of when Matt Lauer encouraged people to get prostate exams, right? We have, in fact, tested 3.4M Americans for the virus and currently testing 150,000 people per day so just 326M people (98.7%) left to test although letting them all go to a ballgame to see who spreads the most is also a good way to test, I suppose. Doing it through "operations" will only take us 2,173 days to test everybody but, of course, the tests are unreliable so it won't prove much anyway.

Kind of reminds me of when Matt Lauer encouraged people to get prostate exams, right? We have, in fact, tested 3.4M Americans for the virus and currently testing 150,000 people per day so just 326M people (98.7%) left to test although letting them all go to a ballgame to see who spreads the most is also a good way to test, I suppose. Doing it through "operations" will only take us 2,173 days to test everybody but, of course, the tests are unreliable so it won't prove much anyway.

By the way, that virus count is already out of date as the official Hopkins Tracker shows 671,425 cases in the US as of 7:38 this morning and that's up 31,761 (4.7%) since yesterday morning. Globally we have 2,172,031 (+96,000, 4.6%) cases and 146,071 (+8,000, 5.8%) deaths with deaths, so far, being 6.7% of infections yet you hear Fox news and Team Trump downplaying the death rate by trying to convince everyone who had the sniffles this year that they are uncounted coronavirus victims.

The purpose of this deception is to make you more comfortable going back to work – as if the 20% hospitalization rate and long-term lung, heart and kidney damage caused by the disease is simply a mild side-effect – like one of those drugs they advertise on TV has (but at least you won't have to pee in the middle of the night or get heartburn from eating spicy food, right?). After all, workers are disposable but losing Corporate Profits – THAT is what we call unacceptable losses!

Insight/2020/03.2020/03.06.2020_EI/S&P%20500%20Earnings%20Growth%20by%20Sector%20Q1%202020.png?width=912&name=S&P%20500%20Earnings%20Growth%20by%20Sector%20Q1%202020.png) Earnings for Q1 have not been that bad so far but no one is giving guidance for Q2 as we're starting it off (April, May, June) with a full lockdown while Q1 was only really affected in the last two weeks of March. So, if we get everyone back to work by May 15th, the overall economic damage will be mild and Trump can redirect that $500Bn Jared is in charge of towards – well, you can guess where it will go….

Earnings for Q1 have not been that bad so far but no one is giving guidance for Q2 as we're starting it off (April, May, June) with a full lockdown while Q1 was only really affected in the last two weeks of March. So, if we get everyone back to work by May 15th, the overall economic damage will be mild and Trump can redirect that $500Bn Jared is in charge of towards – well, you can guess where it will go….

BUT (and I like big buts), let's suppose for just a moment that Trump's magic wand does not work and today we gain another 5% and 5% on Saturday and 5% on Sunday – that will put us at 775,000(ish) infection on Monday morning and there are still two week's left to the month so we'll be well over 1M (1/100) infections by May 1st UNLESS, of course, letting people back into the clubs, restaurants, movies and stadiums is exactly what we do need to stop the spread of the virus (otherwise, why the F are we doing it?).

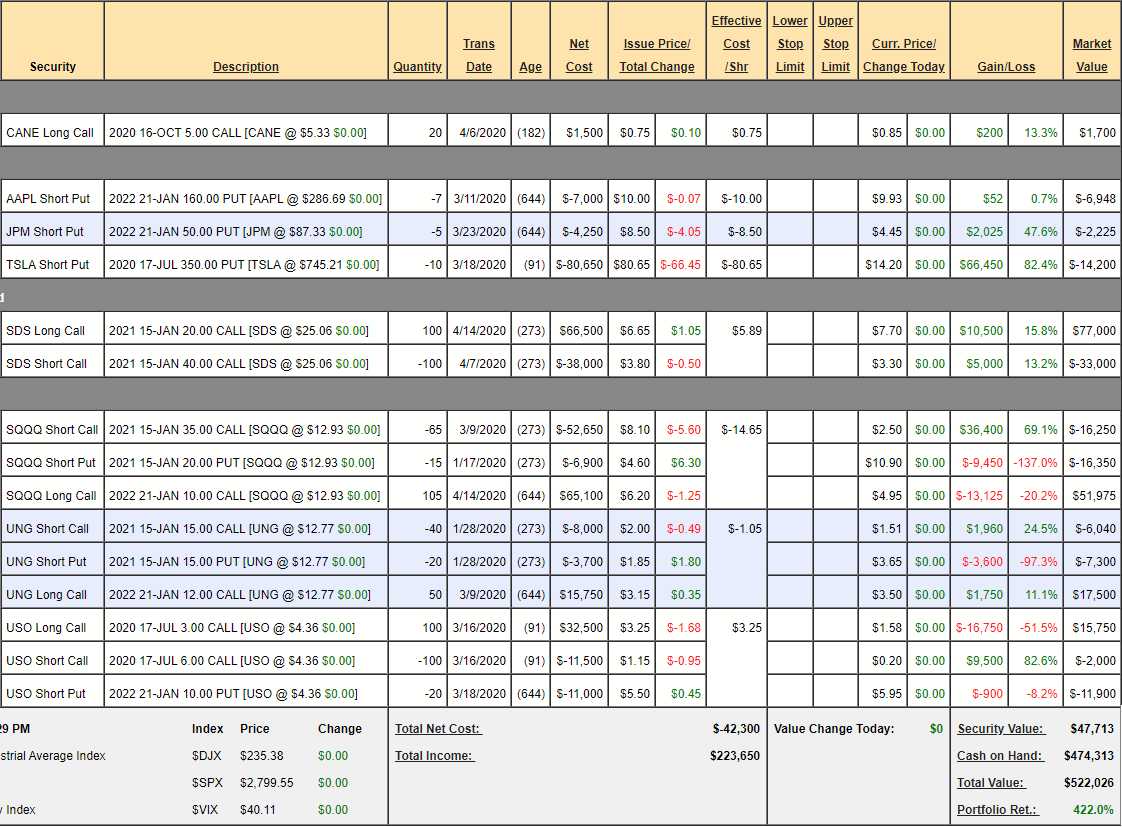

If that is the case, we might want to short the Trump Believer's rally this morning and that certainly means playing the S&P 500 Futures (/ES) short on a cross below our 2,850 line but we can also push the hedges in our Short-Term Portfolio to better protect our long portfolios:

-

Sugar ETF (CANE) – Just a bet that sugar will bounce.

Sugar ETF (CANE) – Just a bet that sugar will bounce.

- Apple (AAPL) – Our worst case is having to buy 700 shares of AAPL for net $150. Yes please!

- JP Mogan (JPM) – Never bet against these guys.

- Tesla (TSLA) – They are now at the point where I'd rather short them so let's take the money and run on this one. In fact, someone is willing to pay us $100 for the June $800 calls so let's sell 2 of those for $20,000 and buy 3 Jan $800 ($220)/June 800 ($152) bear put spreads for net $68 ($20,400) so we're in the spread for net $400 if all goes well and, if TSLA is below $800 in June, whatever premium value remains in Jan will be our profit.

- S&P Ultra-Short (SDS) – SDS is a 2x short on the S&P and it's now at $25 so a 20% drop on the S&P will push it up 40% to $40 and that would be a $200,000 net and currently the spread is net $44,000 so we have $156,000 of downside protection in this position.

- Nasdaq Ultra-Short (SQQQ) – The Nasdaq has been very strong and this is a 3x ultra-short so, even at $13, a 20% drop bumps us 60% to $21 and that would put our $10 calls $11 in the money for $115,500 and the current net is $10,625 so we have $104,875 of downside protection in this position but we can sell 100 June $25 calls for $1 ($10,000) and buy 100 June $13 calls for $2.25 ($22,500) and that will give us another $120,000 worth of protection and, if SQQQ does spike up, we can cash out the long calls quickly because the short calls will be covered by the 2022 $10s. Not bad to add net $107,500 worth of protection for $12,500 – I know I will sleep better over the weekend!

See how easy it is to hedge your portfolio? Wouldn't it be foolish not to do it?

Have a great weekend,

– Phil