By Refinitiv. Originally published at ValueWalk.

“Over the course of the last 40 years of records, we’ve encountered a number of unprecedented events and we’re now squarely back to the depths of the Great Recession, with US companies seeing the lowest monthly level of merger activity in 11 years. US M&A accounts for 18% of worldwide deals so far this month and we haven’t seen a US deal over $1 billion in April, both levels not seen since February 2009. The full impact of this global economic lockdown on deal making activity remains to be seen, but what is clear is that we’ve entered our next unprecedented event,” comments, Matt Toole, Director, Deals Intelligence, Refinitiv.

Q1 2020 hedge fund letters, conferences and more

April 2020: Global M&A Slumps to Lowest Level Since September 2002

Global M&A: Lowest Monthly Total Since September 2002

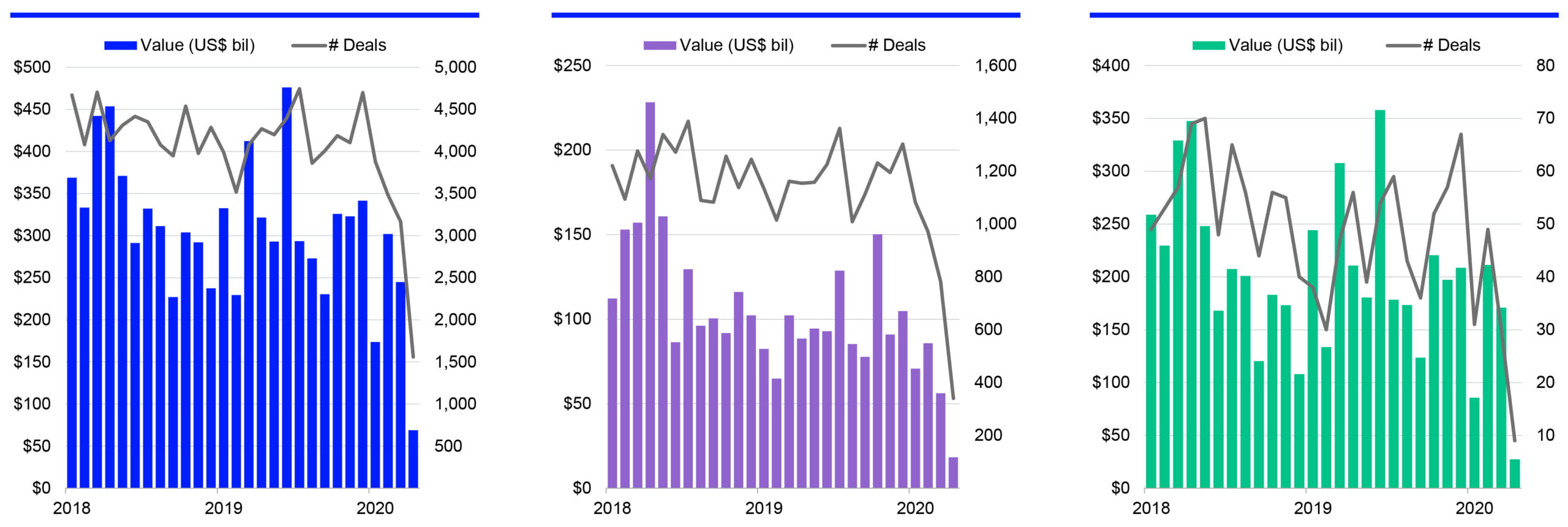

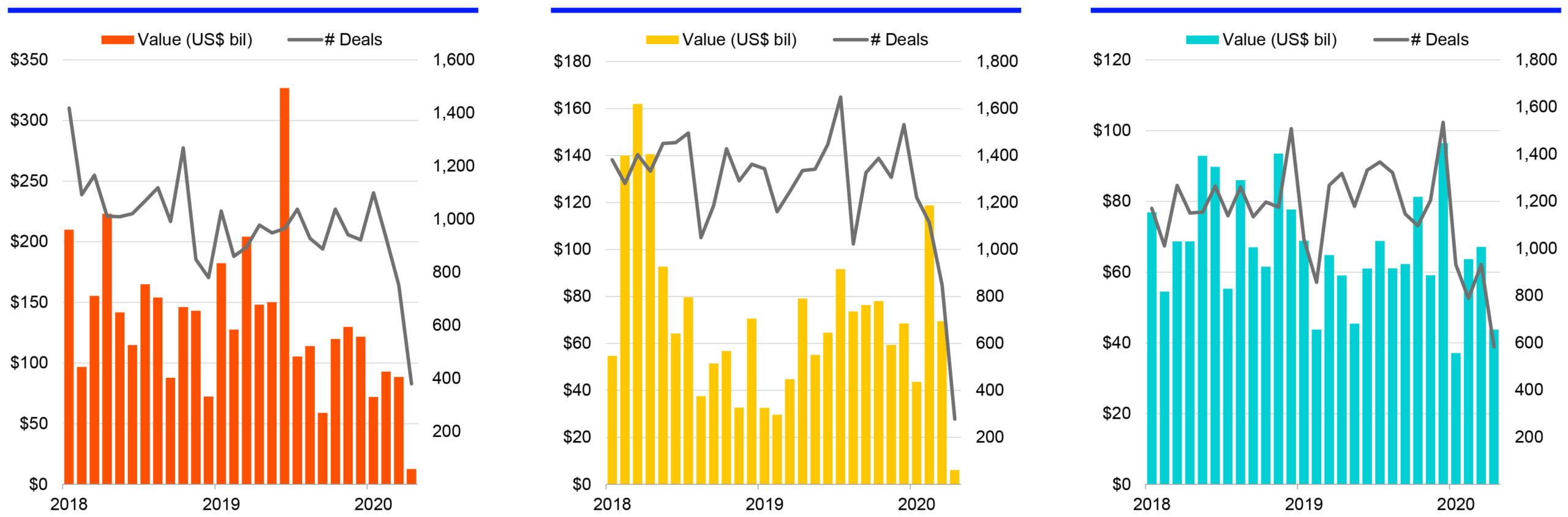

Deals with a combined value of US$69.0 billion were announced globally during the month of April 2020, down 72% from last month and the lowest monthly total since September 2002.

Year to date activity is at the lowest level in seven years. US$789.8 billion worth of deals were announced globally during the first four months of 2020, down 39% compared to last year and the lowest year to date level since 2013.

Cross Border M&A: Slowest Month in More Than 18 Years

Cross Border M&A transactions worth a combined US$18.4 billion were announced during April 2020, down 67% from last month and marking the lowest monthly total since February 2002.

US$231.3 billion worth of deals were announced during the first four months of 2020, down by one third compared to last year and the lowest year to date total since 2013.

Billion Dollar Deals: First Weekly Shutout Since 2004

Just nine deals worth US$1 billion or more were announced during April 2020, compared to fifty six during April 2019. The combined value of April 2020’s billion dollar deals is US$27.4 billion, the lowest monthly total since August 2003.

Not a single deal valued at US$1 billion or more was recorded during the week commencing April 12 th 2020 , marking the first weekly shutout since 2004.

April 2020: European M&A Slumps to Lowest Monthly Level Since Early 1990s

United States: Lowest Monthly Total Since February 2009

Deals involving a US target totalled US$12.6 billion during April 2020, down 79% from March 2020 and the lowest monthly total since February 2009. US deals accounted for 18% of total global activity during April 2020, the lowest monthly share in over a decade.

Year to date activity is at the lowest level in eight years. US$266.2 billion worth of deals were announced during the first four months of 2020, down 60% compared to last year and the lowest year to date level since 2012.

Europe: Lowest Monthly Total Since Early 90s

M&A involving a European target totalled US$6.1 billion during the month of April 2020, dropping 91% from last month to the lowest monthly total since August 1992.

Despite the monthly decline, M&A activity in the region is up 28% from this time last year. Propped up by a number of high value deals earlier in the year, European M&A totalled US$238.3 billion during the first four months of 2020.

Asia Pacific: M&A at Three Month Low

Deals with a combined value of US$43.8 billion involved targets in Asia Pacific during April 2020, down 35% from last month and a three month low. China target M&A totalled US$28.5 billion and accounted for 41% of global activity during April 2020, a higher share than the US for the first time since our records began in the 1970s.

US$211.9 billion worth of deals were announced in Asia Pacific during the first four months of 2020, down 10% compared to last year and the lowest year to date level since 2013.

The post Global And European M&A Slumps To Lowest Level appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.