S&P 3,000 – woo hoo!

That's right, we're almost back to where we were last Summer, 50% higher than we were 4 years ago (that was 2,000 Foxies!) and 100% higher than we were 7 years ago (1,500). In 2013, the earnings per share for the combined S&P 500 were $110.98 so we divide 1,500 by $110.98 and we get a price to earnings ratio of 13.51.

Then we take 2016, when the S&P earnings had bounced back to $101.08 and the S&P was at 2,000 and…. Ha, ha – I fooled you Foxies! – $101.08 is LESS than $110.98… just seeing if you could do the math there. Anyway, we divided 2,000 by $101.08 and we see the P/E shot up to 19.78 – those are nose-bleed levels of valuation – even in a strong growth environment.

Still, the growth expectations were justified as Corporations no longer have to pay taxes or worry about destroying the environment and, in the golden age of Trump, earnings shot up to $140 per share last year and the S&P hit 3,400 – still with a p/e of 24.28 – as if this growth will go on forever. Why, to keep that kind of growth up you'd have to PAY corporations tax money on top of the profits they make.

Still, the growth expectations were justified as Corporations no longer have to pay taxes or worry about destroying the environment and, in the golden age of Trump, earnings shot up to $140 per share last year and the S&P hit 3,400 – still with a p/e of 24.28 – as if this growth will go on forever. Why, to keep that kind of growth up you'd have to PAY corporations tax money on top of the profits they make.

Guess what? That's what we're doing! The Goverment just borrowed $6Tn, mainly to give to large Corporations while gutting what few remaining regulations we had left AND they let 30M jobs be destroyed, loweing the cost of labor for the rest of this decade AND they lowered Corporate Taxes even further. Mission accomplished indeed!

With the S&P 500 back near 3,000, we can now divide 3,000 by 24 to see if we think we're at a realistic level of optimism. 3,000/24 for the Foxies is $125 and $125 is $15 less than $140 and $15/140 is 10.7%. So, in order to be paying 3,000 for the S&P 500 companies as a group, we have to believe that this Global Pandemic did not disrupt corporate earnings by more than 10%. How stupid is that?

With the S&P 500 back near 3,000, we can now divide 3,000 by 24 to see if we think we're at a realistic level of optimism. 3,000/24 for the Foxies is $125 and $125 is $15 less than $140 and $15/140 is 10.7%. So, in order to be paying 3,000 for the S&P 500 companies as a group, we have to believe that this Global Pandemic did not disrupt corporate earnings by more than 10%. How stupid is that?

Q1 earnings are already down 20% and that's with just 2 out of 13 weeks affected by the virus. Q2 is going to be essentially a wipeout so, instead of making (allowing for Christmas to be about 2x a normal quarter) 30 + 30 + 30 + 50 = $140 like last year, we are likely at 24 + 0 + 20 + 40 = $84. $84! That's the most likely projection for the S&P 500 this year and that's assuming the re-opening goes well and things are 80% of full speed by Q4 (that's October 1st, Foxies).

I'm not saying that $84 is terrible – we were down to $18.27 in 2008 after being at $104.26 in 2006 and $81.33 in 2007 (that's right, the writing was on the wall a year before the crash). Then, like now, people ignored the signs and thought Government stimulus would solve everything (remember Bush's checks) and we though bank failures and property crashes happening overseas were not going to be our problem. How did that work out?

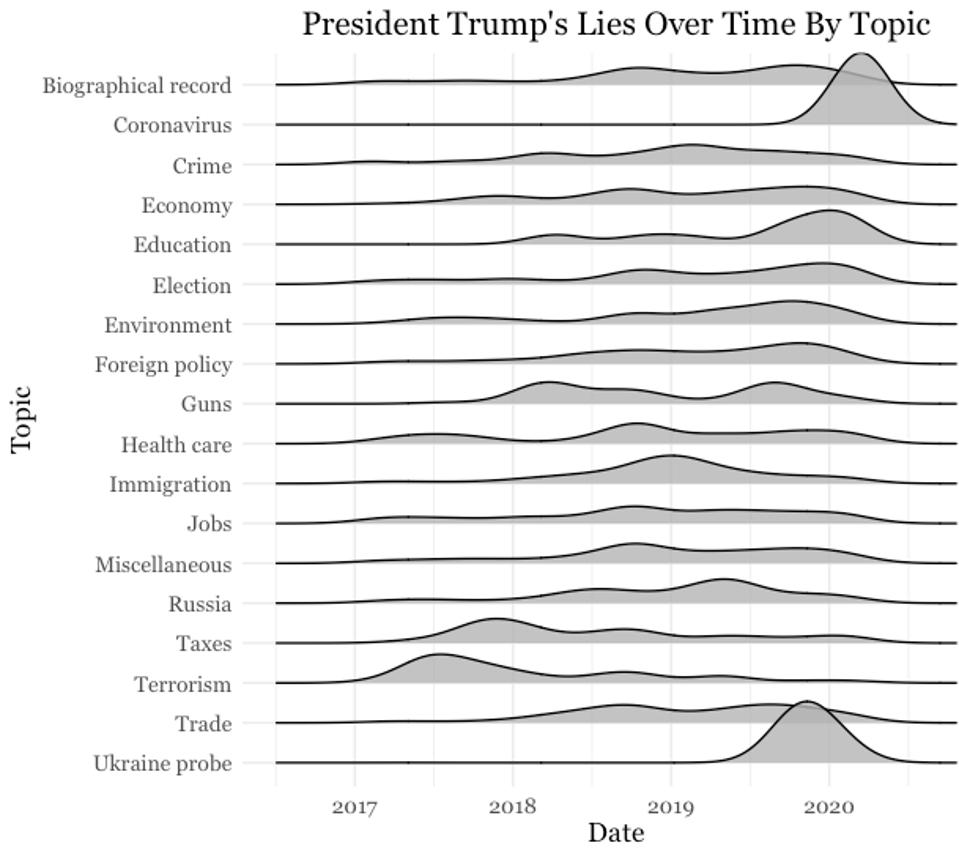

We had massive bailouts in 2008 and earnings came all the way back to $60.92 in 2009 and 91.09 in 2010 and 99.45 in 2011 so only 3 years to get back to where we were before the crash. But this crisis, we're playing like it's going to be 3 months and that's because the Administration, who has lied to us an average of 10 times each day Trump has been in office and is now lying to us an average of 23.3 lies per day in 2020 – a feat not likely to be equalled by any other President.

So why do we choose to believe the economic lie? Mostly because we REALLY want it to be true. And what is true about investors and consumers is that, if you can convince them to be bullish – you can actually create a bullish economy. Usually. Unfortunately, while the Investing Class may be getting a ton of free money thrown at them at the moment – the Consumer Class is falling further and further behind and their prospects for the rest of 2020 are not looking good – even if the virus "ends" tomorrow – which is not very likely, no matter how bravely we go outside.

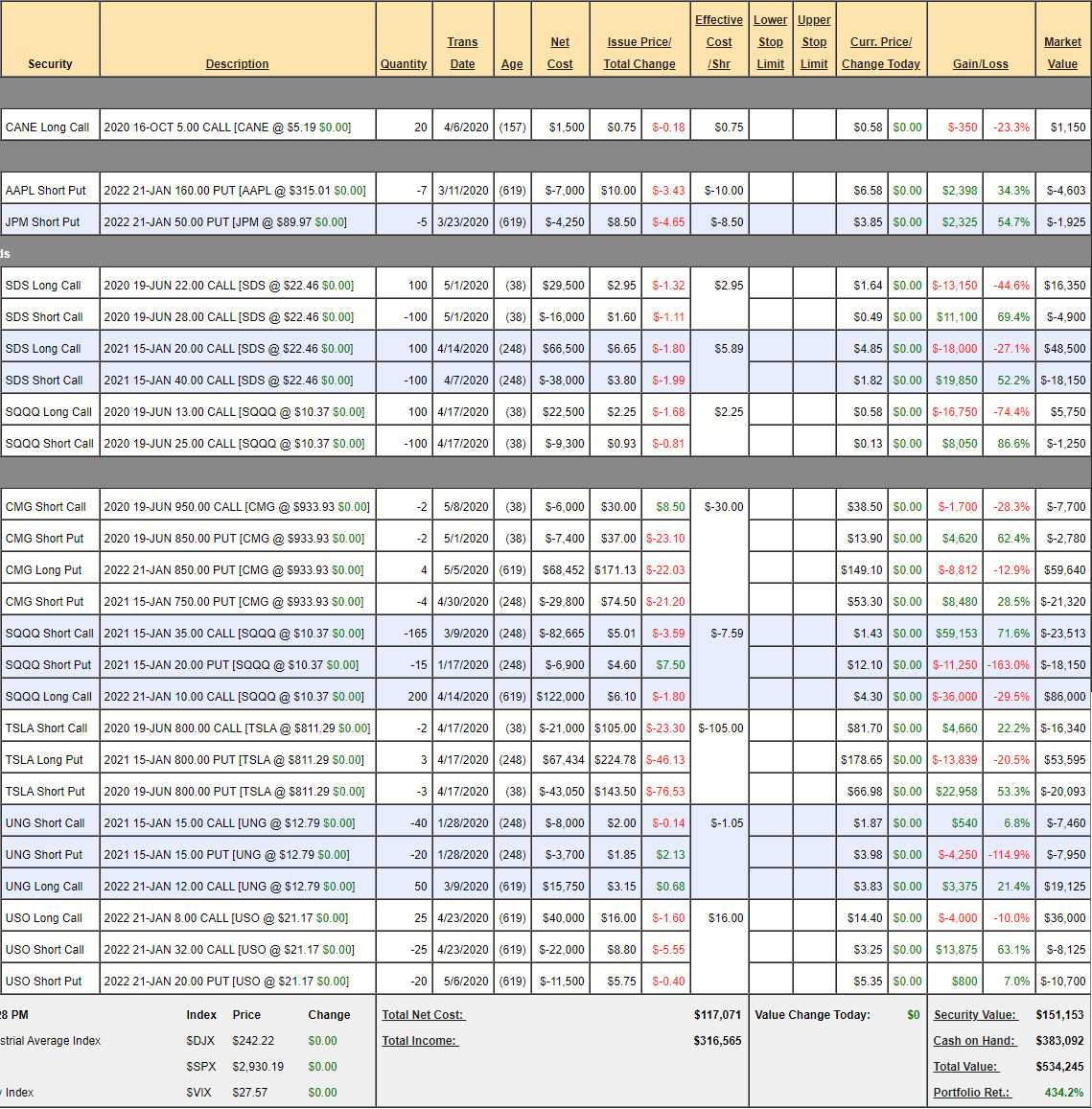

So hedging, hedging is key to maintaining our portfolios. Our Long-Term Portfolio, which started the year at $500,000 had recovered well in our last review and was sitting at $542,305 almost a month ago and, since then, the S&P 500 has gone from 2,750 to 2,950 and our LTP has popped to $649,193 so we're up $106,888 (19.7%) for the month. The S&P is only up 7.2% so that's a lot of leverage and we can lose the money just as quickly so, in order to lock in our gains – it's logical to boost our hedges.

As a rule of thumb, we put 25-40% of our unrealized gains back into our hedges, depending on how worried we are. As noted above, I'm a lot closer to 40% worried than 25% so let's say we have a $40,000 budget for adjustments to our Short-Term Portfolio (STP), which was at $522,026 (up 422%) last month and is now at $534,245 (up 434.2%) thanks to very nice profits on our TSLA trade, despite the losses in our index hedges.

- CANE – A bullish bet on sugar that was going well and then derailed. Still good for a new trade (and I like the /SB futures above the $10 line with tight stops below).

- AAPL – Selling short puts is a way to offset our hedges. I expect to collect the remaining $4,603.

- JPM – Another short put and we expect to collect the remaining $1,925 as JPM stays over $50.

- SDS – Here's the most important hedging trick of them all but it requires you to have a good amount of margin. Note the net of the spread was $2.95/1.60 or $1.35 and now the June $22 calls, which are at the money, are $1.64. $1.64 is MORE than we paid for the spread so we can rescue our entire investment by cashing in the June $22 calls. SDS is a 2x S&P Ultra-Short so for it to climb $7.50 33%, the S&P would have to fall 16.5% and that would only put the $28s at the money – and we could roll them from there. The other SDS spread, the Jan $20/40 spread, is $2.46 in the money at net $3.03 but $40 is not very likely and the $30s are $2.80 so the Jan $20/30 spread is $2.05 – just 0.41 more than our June $22 calls.

- So, we will cash our June $22 calls for $1.64 ($16,400) and buy 100 Jan $20/30 bull call spreads for $2.05 ($20,500), spending net $4,100 to place our 100 SDS longs $24,600 in the money and giving us $200,000 of protection at $30 (a 20% drop in the S&P) covering the 100 short June $28s. When they expire, we can sell more short-term short calls for additional income. The net of this spread is $45,900 and we expect to lose it at some point if the market stays bullish – it's insurance money!

- SQQQ #1 – We should have rolled these sooner as it was a net $1.32 spread but that's no reason to sit on it. Let's just cash the June $13s for 0.58 ($5,800) and leave the short $25s as they are very likely out of reach, needing a 33% drop in the Nasdaq to get in the money, so they are not worth 0.13 to buy back (unless you need the margin, of course).

- CMG – I can't believe how high they are! Still it's right on target for our short put sale and we have a slight profit on the spread so we can leave it alone for now. There is $10,480 left to collect on the short June contracts and our goal is to do that over and over again for 2 years.

- SQQQ #2 – Bear in mind we need to be protecting the 100 short calls from SQQQ #1 but that's well-handled with the 200 2022 $10 puts. While they are far out in time, they are at the money so, rather than spend more on the longs, let's buy back the fairly useless Jan $35 short calls for $23,513 and we will sell more short calls (at a lower strike, if we get a bounce). If we do not get a bounce, we can sell 150 Jan $20 calls for $2 ($30,000) and spend $2 ($40,000) to roll the 2022 $10 calls down to the $5 calls. Bottome line is we have at least $300,000 worth of protection here and net $64,850 tied up in the 2-year hedge that is the cost of our insurance.

- TSLA – This one is right on track for our first sale and we're already up net $13,779. I expect to collect the remaining $16,340 from the June contracts and we have 8 more cycles to sell!

- UNG – We are about even so this is good for a new trade. Natural Gas has not recovered like oil but it's not the season for /NG, so we have to be paitent. It's a $15,000+ (more potential) spread at net $3,715 so $11,285 potential gain but too risky to count on. The reason it's good for the STP is because it offsets our hedging costs since we can expect a good economy (bad for our hedges) will lead oil and gas prices higher and make us money here to offset the losses above.

- USO – Had a very nice pop, which was great for our longs and this one is on track with $20 not unrealistic so we'll call it a $50,000 potential currently at net $17,175 so $32,825 (191%) upside potential if oil is up about 50% ($38) by the end of the year. Again, should work if the hedges fail and this one is more likely so we'll count on it and call it good for a new trade.

So we only spent net $21,813 and we have $500,000 of downside protection in a bearish market (20% down) and we expect to lose net $44,577 over the next two years as the cost of our insurance so, as long as our LTP positions keep performing – we should be in excellent shape.