Young Bulls and Old Bears

Courtesy of Michael Batnick

.jpg) I wrote a version of this post four years ago. It was true then and is true today and will be true tomorrow. The world has always been populated by young bulls and old bears.

I wrote a version of this post four years ago. It was true then and is true today and will be true tomorrow. The world has always been populated by young bulls and old bears.

What do Bill Gross, Sam Zell, Jeremy Grantham and Carl Icahn have in common? They’re all old, they’ve all had brilliant careers, and they’re all bearish on the stock market. (From April 2016)

Whether it be in music or in sports or in markets, the prior generation never thinks “kids” will ever measure up. Even Benjamin Graham- the man who basically invented value investing- fell victim to the “get off my lawn syndrome.”

From Roger Lowenstein’s Buffett: The Making of an American Capitalist.

I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook “Graham & Dodd” was first published; but the situation has changed

Young bulls and old bears is as old as the hills. In Ten Years In Wall Street- which was published in 1870- William Worthington Fowler wrote “Wall Street operators commence their career as bulls, and finish it as bears.”

This was written 150 years ago and it’s still true today. Why? Because it’s easy to be optimistic when you’re young and you have your whole life ahead of you. And it’s normal for people that are several decades past their prime not to understand the world around them and therefore be less optimistic.

If I had to chart the progression of how this works, it would look something like this.

We’re seeing this dynamic play out today.

Who do you got, Druckenmiller, Buffett, and Tepper?

Or Robinhood traders? pic.twitter.com/4AwozRUbOp

— Michael Batnick (@michaelbatnick) May 13, 2020

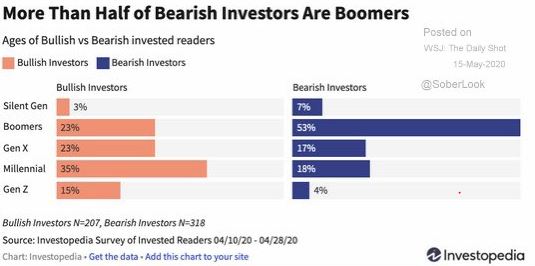

Investopedia took a survey that showed more than half of bearish investors are boomers, and 50% of bullish investors are millennials and Gen Z.

I think part of this has to do with the current market, but I also think that these are the results we’d see at any market at any point in time. The world has always been populated by young bulls and old bears.

Picture at the top by andrea candraja from Pixabay