Courtesy of Pam Martens

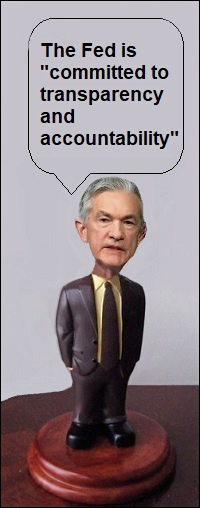

During his appearance before the Senate Banking Committee this past Tuesday, Federal Reserve Chairman Jerome Powell told Senator Jon Tester that the Fed “has committed to disclose all of the borrowers and the amounts in a timely way.” Powell was referring to the alphabet soup of emergency bailout programs for Wall Street that the Fed has established under Section 13(3) of the Federal Reserve Act.

In a statement released by the Fed on April 23, it also said this on the subject of transparency:

“…the Board will report substantial amounts of information on a monthly basis for the liquidity and lending facilities using Coronavirus Aid, Relief, and Economic Security, or CARES, Act funding, including the: Names and details of participants in each facility; Amounts borrowed and interest rate charged…The Board will publish reports on its CARES Act 13(3) facilities on its website at least every 30 days and without redactions.”

The Fed has a website page that publishes its reports to the public and Congress every 30 days. If you click on the PDFs for the Primary Dealer Credit Facility, the Commercial Paper Funding Facility, and the Money Market Mutual Fund Liquidity Facility – three programs to benefit Wall Street – you will not find one iota of information on the names of borrowers or amounts they borrowed. (The Primary Dealer Credit Facility is not slated to use CARES Act money but it is established under the 13(3) emergency programs of the Fed.)

The Primary Dealer Credit Facility and Money Market Mutual Fund Liquidity Facility showed up on the Fed’s balance sheet on March 25 of this year, with balances of $27.7 billion and $30.6 billion, respectively. As of yesterday, the Fed showed the following balances for those two programs: $7.5 billion and $36.4 billion, respectively.

But when the Fed released its March 25 and April 24 reports on these two programs, there was not a scintilla of information on the names of borrowers or amounts borrowed.

…