"Nothing really matters,

Anyone can see,

Nothing really matters,

Nothing really matters to me." – Queen

Does GDP even matter?

We'll see this morning as we're going to get the worst GDP reading since 2008 – and that's just for Quarter 1, Quarter 2 will be much worse – there's no stopping that now (another Queen song) and that number will show a double-digit decline in GDP so -5% for Q1 is actually tame by comparison.

8:30 Update: As I write this, the S&P Futures are up 0.25% at 3,040 and the Dow is up 0.7% at 25,700. In addition to GDP we have the Durable Goods Report, which is showing a 17.2% drop in April and -7.4% ex-Transportation, which shows you how bad Transportation was in April. We also had another 2.12M Americans file for Unemployment – also worse than expected but none of this seems to be affecting the markets – which are chugging along at their pre-market highs.

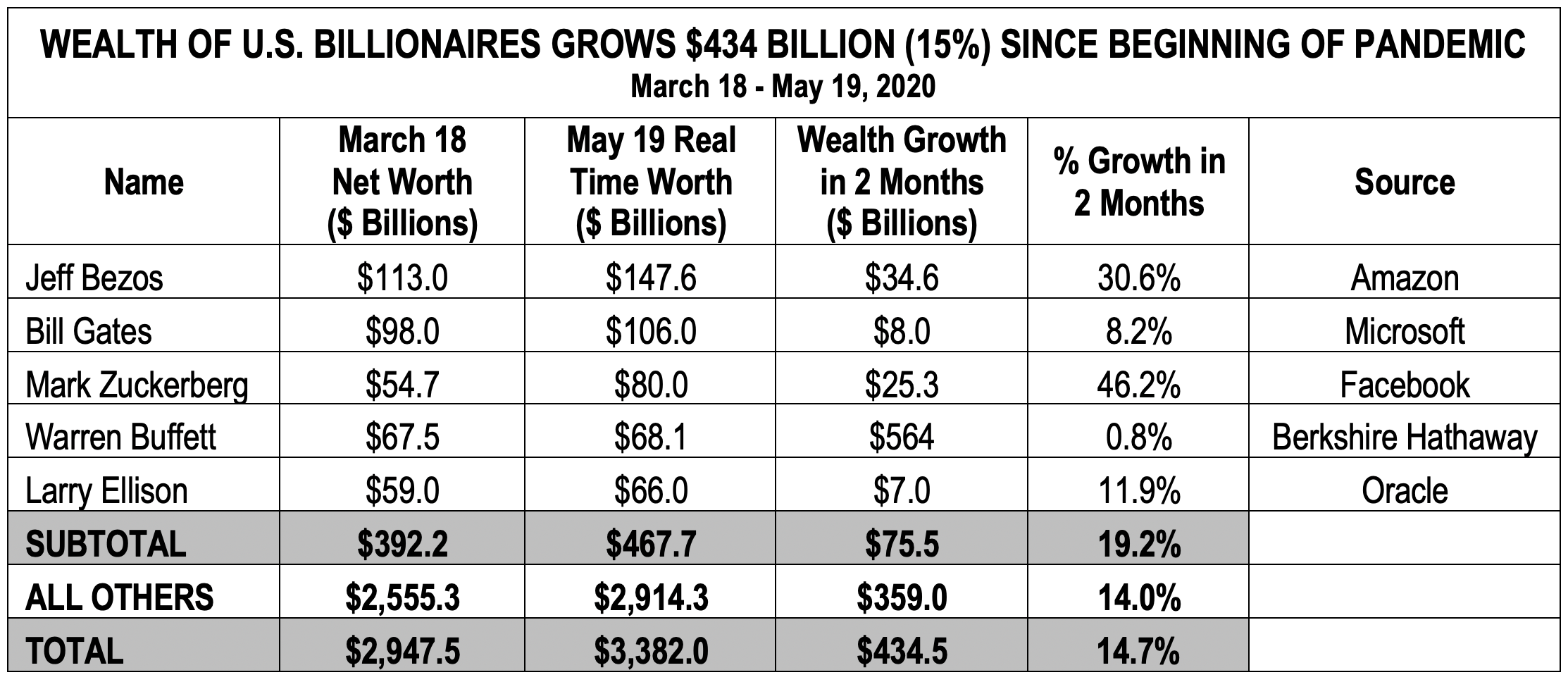

We can only assume that Liquidity Trumps all other things – as does the Oligarchy and that was on full display in this "Tax Fairness" Report which shows how $434Bn of the Government's $2.7Tn bailout (so far) has gone directly to America's 630 wealthiest people (Donald Trump is #248) a 15% increase in their $2.6Tn total wealth in the past two months!

We can only assume that Liquidity Trumps all other things – as does the Oligarchy and that was on full display in this "Tax Fairness" Report which shows how $434Bn of the Government's $2.7Tn bailout (so far) has gone directly to America's 630 wealthiest people (Donald Trump is #248) a 15% increase in their $2.6Tn total wealth in the past two months!

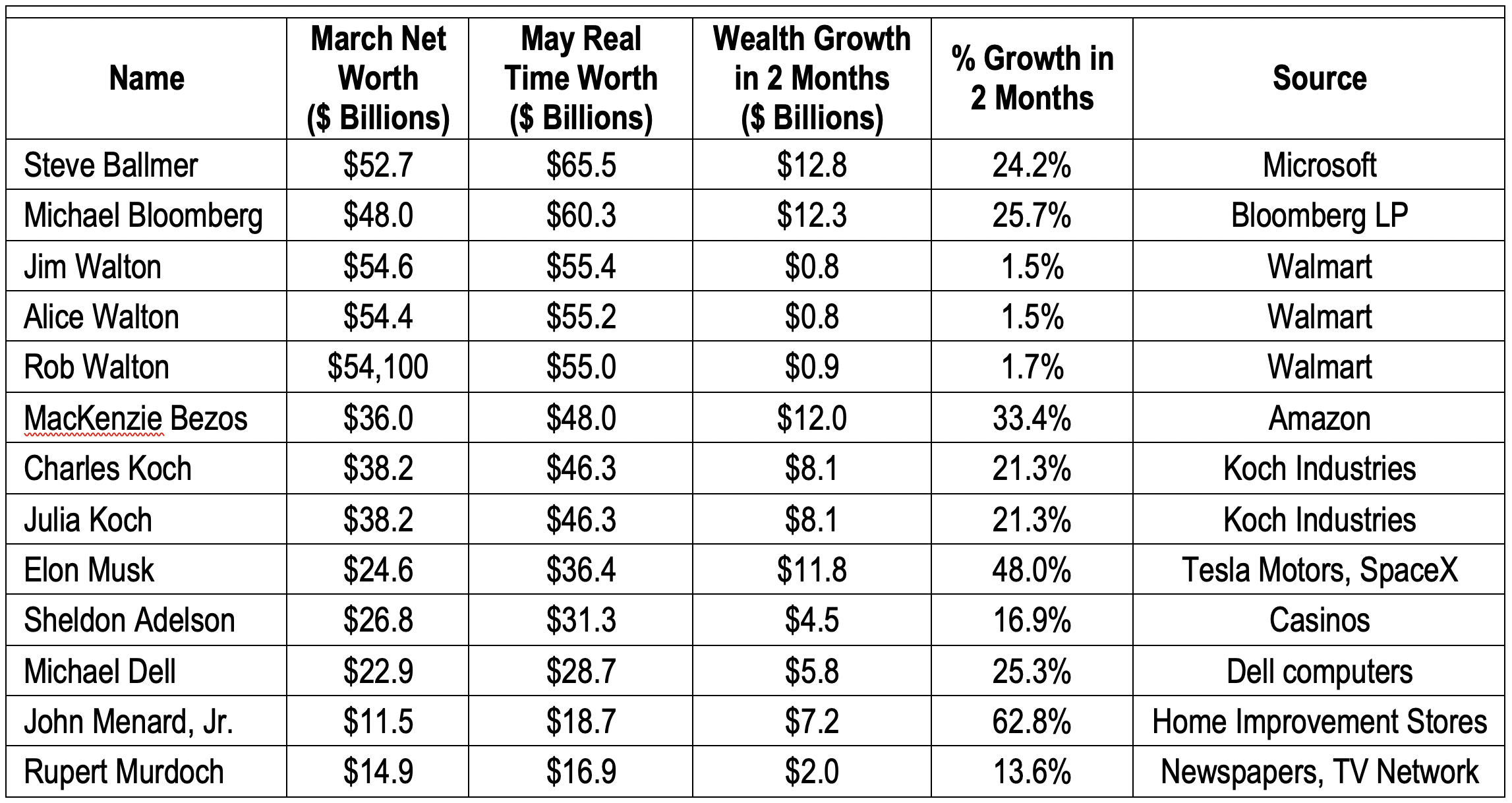

16 new Billionaires were added to the Forbes List, including Trump's pal Kanye West – that's in the past 60 days! During that same 60 days, 38M American's lost their jobs, 1.5M became infected with Coronavirus and 100,000 died but, as the President says – they are soldiers going to war for Capitalism, right?

“The surge in billionaire wealth during a global pandemic underscores the grotesque nature of unequal sacrifice,” said Chuck Collins, director of the IPS Program on Inequality and co-author of the Billionaire Bonanza 2020 report. “While millions risk their lives and livelihoods as first responders and front line workers, these billionaires benefit from an economy and tax system that is wired to funnel wealth to the top.”

That says it all, Carlin said it 10 years ago and and things have certainly not gotten better since, have they?

So, politics aside, how do those of us in the Top 1% (poor us!) keep up with our pals in the Top 0.000001%? That brings us back to the market rally? What do these people do with an extra $434Bn? They put it in the market, of course! Banks are for suckers and Bonds pay you nothing and metals are expensive and even Mark Zuckerberg knows BitCoin is BS so that leaves good old US Equities as the only logical place for the wealthiest to store their money.

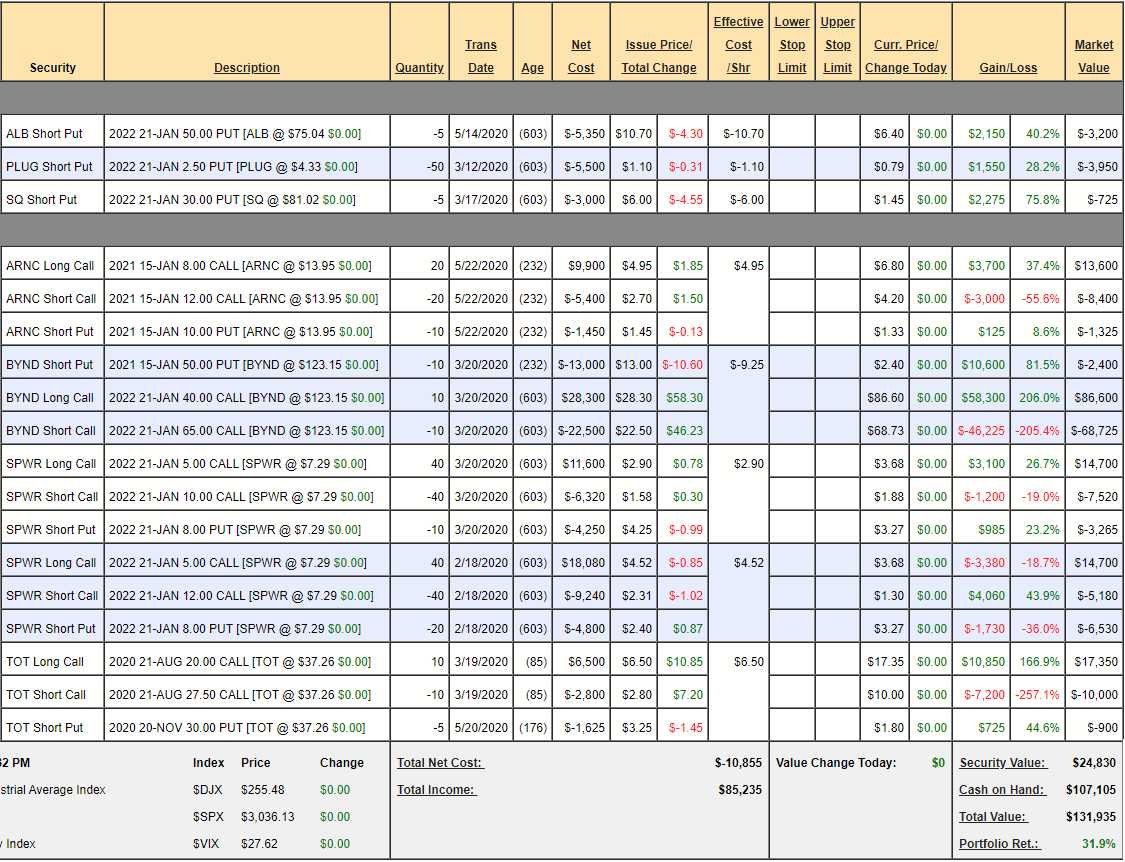

I think we should give all our money to Shelly Adelson's financial guy – somehow the owner of a shut-down casino empire still netted a $4.5Bn profit from this crisis – that's really amazing! Of course, as I noted in our May Portfolio Review, our own Member Portfolios also flew up during the same period. Take our Future is Now Portfolio for example – in our May 18th review, the portfolio we initiated on 12/12/19 (my Father's birthday!) with $100,000 was up to $124,515 (up 24.5%) since the March 20th reveiw, when it was at $89,235 (down 10.8%) and now, the same positions (we added ARNC on 5/22 in our Live Chat Room) are at $131,935, adding another 7.5% in 10 days.

.jpg)

In our detailed analysis of each position at the time (5/20), we noted that the current positions were on track to make $65,000 over the next 18 months and we sold the short TOT puts to put another $1,625 into our pockets and ARNC is an $8,000 spread currently at net $3,875 so $71,000 over 18 months is $3,944/month that we EXPECT to make from these positions (and of course we will be adding more as opportunities come up).

That's a 4% MONTHLY gain on our investments and, as you can see from the growth of the wealth of the Top 630 – yes, you can make that kind of money at scale as well!

Just keep in mind that, like Shelly Adelson's adviser, you have to know how to hedge those bets so, even when your main assets take a dive – some other portfion of your portfolio jumps in to save you.