Yes, I am being lazy (some would say efficient), this is Friday morning's Report because not much is going on and these Reviews take forever to write so I'm getting a jump by doing them as we go along today.

Yes, I am being lazy (some would say efficient), this is Friday morning's Report because not much is going on and these Reviews take forever to write so I'm getting a jump by doing them as we go along today.

$1,405,302!

That is up $271,547 (24%) for our paired portfolios since our last review and we've made very few changes to the LTP in the past month – the market's move higher just worked well for our leveraged positions, which are still pretty bullish from that bottom action in March. The S&P 500 was at 2,863 back on May 15th and now it's 3,135 – up 272 points is right about 10%. That's why we keep spending money on those hedges in our Short-Term Portfolio – we want to lock in those ridiculous gains.

We didn't do a lot of buying this month, we added FL, HMY, IMAX, KO and TIF, who were all still bargains from our Watch List but, for the most part, things have gotten too expensive to be of much interest so we are wating PATIENTLY (right guys?) for earnings – when it's certain to be bargin-hunting time again.

Meanwhile, as our Members are certainly aware, I think being up $800,000 from our $600,000 start to the year is a bit too much money to be making so I am VERY inclined to take it all off the table and start from scratch (keeping the $800,000 in our pockets so we can't possibly have a losing year). We could be super-aggressive in the new portfolios and it would be fun but people hate it when I do that (even though it's sensible) so I'm simply going to say that if the combined Long and Short-Term Portfolio values drop below $1.2M (up 100%), we will be shutting them down (along with the rest as their health is a good indicator for all of us).

It's boring when our portfolios are too well-balance, there's not much to do during the day…

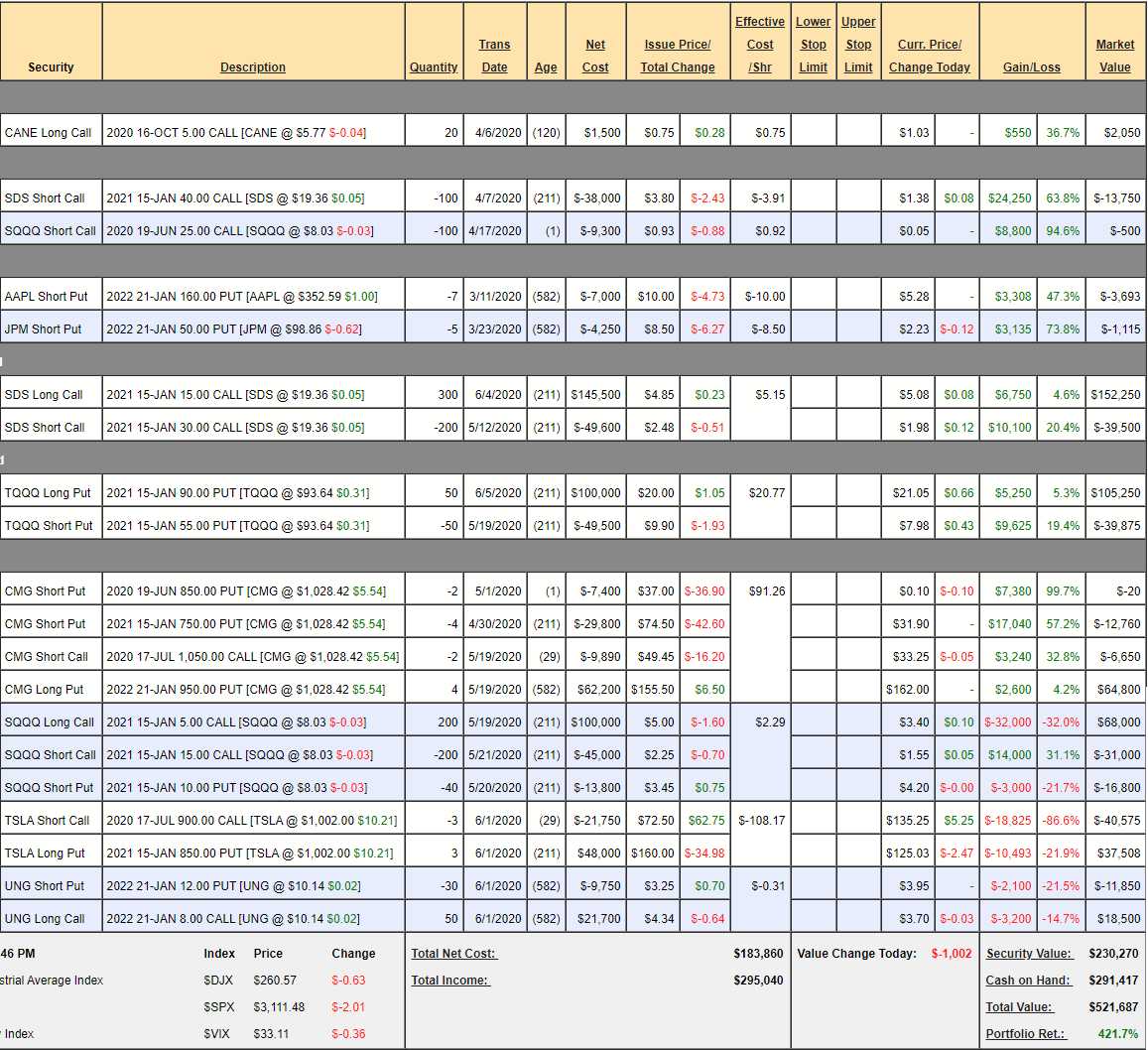

Short-Term Portfolio (STP) Review: The last time we checked in on the STP was way back on June 4th, when the S&P was at 3,122 in the morning, as I wrote our report. At the time it was at $527,965 and we decided to make some aggressive adjustments to lock in some silly gains in the LTP, which had hit $855,428 as of the previous day's close. We've been on a road to nowhere since and now the STP is at $521,587 – very little has changed for the STP in the past two weeks and that's good – because hopefully the LTP is doing it's job and making money on short puts and calls we sold, even in a flat market.

Advill thinks I might have political bias but, if I didn't tell you how I felt, you wouldn't be able to judge for yourselves and clearly, most analysts DON'T tell you how they feel about such things for fear of losing readers. So, if you prefer to have your analysts lie to you and pretend they are neutral, politically and have no views on the World – there are thousands of them happy to lie to you and take your money.

If you want to understand an analyst and how he forms his opinions so you can weigh that and make intelligent decisions of your own. Well, there's me and…… hmmm…..

Anyway, Trump sucks again and these Bolton revelations are horrifying and I think that's a reason to be extra-cautious over the weekend, in addition to 10,000 more people will be infected in Florida by Monday and 100,000 more in the US, etc. That's my premise, these are the trade ideas:

- CANE – Went ripping higher last week and I feel good about the bottom call we made.

- SDS – These are the short calls left over from the old spread. We sold them for $38,000 and they are up $24,250 (63%) in two months, so that's nice but, more importantly, the net of the $15/30 spread was $95,900 so we just paid for 25% of that! SDS is a 2x ETF and the S&P would have to drop 50% to get to $40, so those are pretty safe but a long time to wait for $13,750 so let's clear margin (we don't need but good for people who do) and buy them back. The July $20s are $1 and we have 100 more longs than shorts so why not sell 100 July $20s for $10,000 as they will decay nice and fast (29 days to expiration) and then we'll see how the weekend goes.

- SQQQ – Also a leftover leg but will expire worthless. I'll do the rest later.

- AAPL – Wow, good for a new trade I'd say as the net is $154.72 – less than 50% of where they are now. Not very margin-efficient though.

- JPM – More free money for those of us wealthy enough to promise to buy a stock at a ridiculously low price and then not have to buy it at all and still make $73.8% 3 months later. It's good to be the king!

- TQQQ – This was more for fun than anything as I wanted to see if it would outperform SQQQ and look – it has! More money on a 3x ETF means more room for decay and, even though we're out of the money, the combo is still working. Up $14,875 on our net $50,500 entry (no margin required) is 29.4% in just over a month. Very good to be the king…

- CMG – Are you freakin' kidding me with $1,029? WTF people? Who is buying this? Oh well, we're ahead and shouldn't complain but this is idiotic. Why are we ahead when our premise is that CMG will be below $950 in 2022 and it's $75 over that now? Because we are BEING the House and selling the short-term puts and calls and they are doing the heavy lifting. Now I want to take our $30,000 in profits (so far) and buy back the short puts for $12,760 and then we'll wait for the next dip to sell more. The short June puts will expire worthless but also I'd rather wait for a dip to sell more. We stand to collect another $6,650 on the short July calls anyway.

- SQQQ – The meat and potatoes hedge. Jna $5s are $3 in the money and we paid net $2.75 for them so can't complain, can we? It's a 3x ETF so 20% drop in the Qs (well-deserved) would be 60% pop to $12.80 and our short calls are $15 so they are never going to get paid. Short puts are in the money but they can be rolled so no worries.

- TSLA – Wrong on both ends so far. TSLA fell 60% in the last crash – I want to be there when it happens next so we roll the 3 Jan $850 puts at $124 to the $950 puts at $174 for net $50 on the $100 roll up and we'll sell 2 more for good luck since it's a good hedge that would pay $350 at $600 for about a $100,000 profit on the set – that's our new hedge for the week then.

- UNG – It's a hedge on our hedges, something that will make money in a bullish market. Not so far but may as well do the right thing and buy 50 more 2022 $8 calls for $3.70 – just in case there's a hurricane that shuts more production than the production that's being shut now due to low demand for oil (sometimes same wells).

Long-Term Portfolio (LTP) Review: Other than our 5 new trade ideas for the month, we didn't touch the LTP but it flew up from $599,510 to $883,615 – a massive $284,105 (47%) gain in 30 days! Now you KNOW that's not supposed to happen but it was a huge surge in the S&P and the Nasdaq and we had positioned ourselves very bullishly as we had a lot of hedges to protect us if we were wrong. As I said in the last review: "What a fantastic bunch of positions these are! We still have tons of cash and we're well-hedged so I'm very excited about this portfolio going forward."

Still, these gains are silly and yes, we picked the stocks we thought would benefit most from re-opening, even though I thought the re-opening was going to be a disaster – which it is shaping up to be. If you can gain 47% in a month then you can lose 47% in a month so we're going to take a sharp knife to these positions and cut, Cut, CUT anything we think might be impacted if we go back on lockdown due to rampaging virus, again.

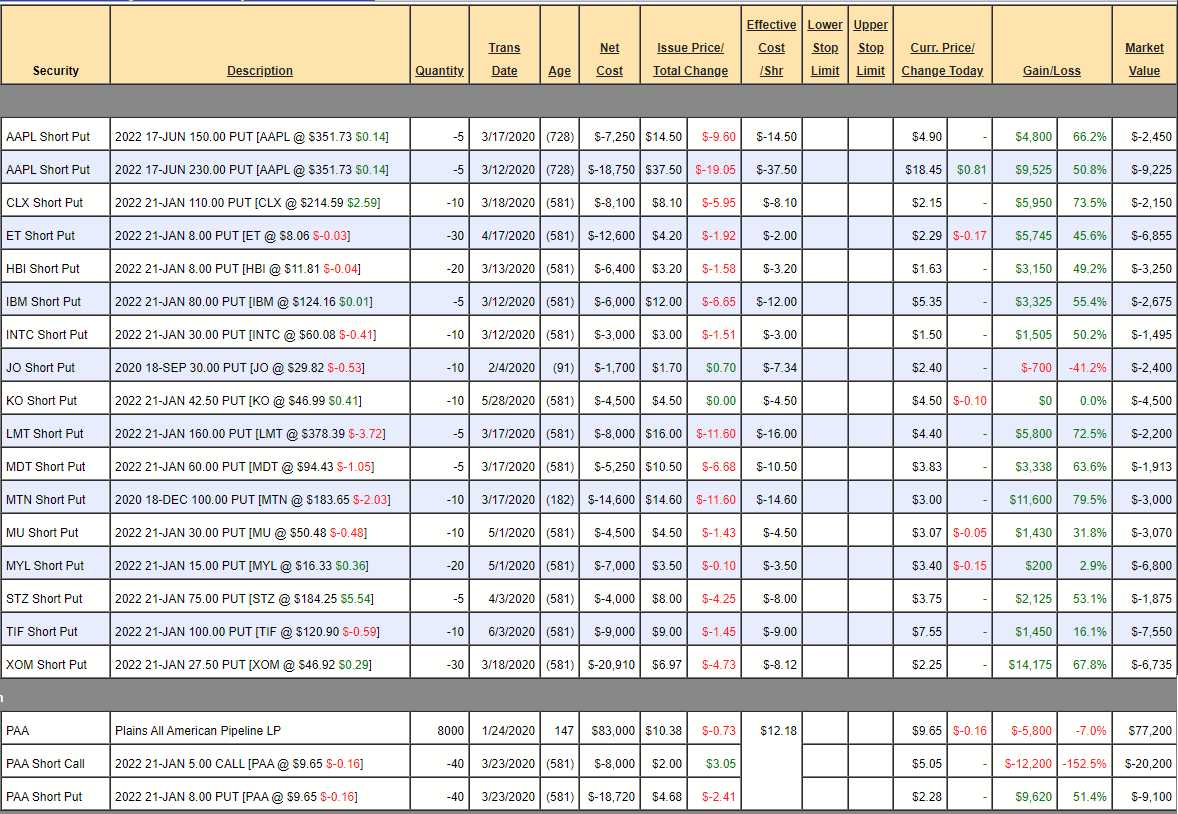

Short Puts – We're certainly going to take ones that are up over 60% off the table so here's a list of those and the rest we keep (unless we have a particular worry). Most of these will go right back on our Watch List.

- AAPL – Though it's a silly price, AAPL is still toppy at $350 in a global recession and we have to wait 2 years to make the last 33% – not worth even a tiny risk. That goes for both puts. If AAPL goes lower – we'll be the first ones selling puts again.

- CLX – Again, though I have no worries, why wait 18 months to make $2,150 (26.5%)? We can do better with our cash and margin.

- ET – I don't love them.

- HBI – Weak consumer.

- LMT – It's our Stock of the Decade but the decade is just starting and we're already up 72.5%, not worth waiting 18 months for the other 27.5%.

- MDT – Wow, I'm selling all my favorites – I must be worried.

- MTN – Simply went up far too fast to not cash in. I love Vail, I wish we had a bigger position so back to the Watch List.

- STZ – Such a ridiculous price for the put that it's almost good for a new trade so we're KEEPING it – despite being up more than 50% in two months.

- XOM – Oil back to $40 is good for the king but that's enough of that nonsense.

- PAA – It's interesting that it shows a loss since our net entry is only $10.38 and we sold the $8 puts and $5 calls (on 1/2) so our net entry is $7.05 and 1/2 will be called away at $5 leaving us in 4,000 at about $9 so all the losses are simply premium that WILL burn off so this position is well-protected and has $18,000 coming to it in premium burn alone.

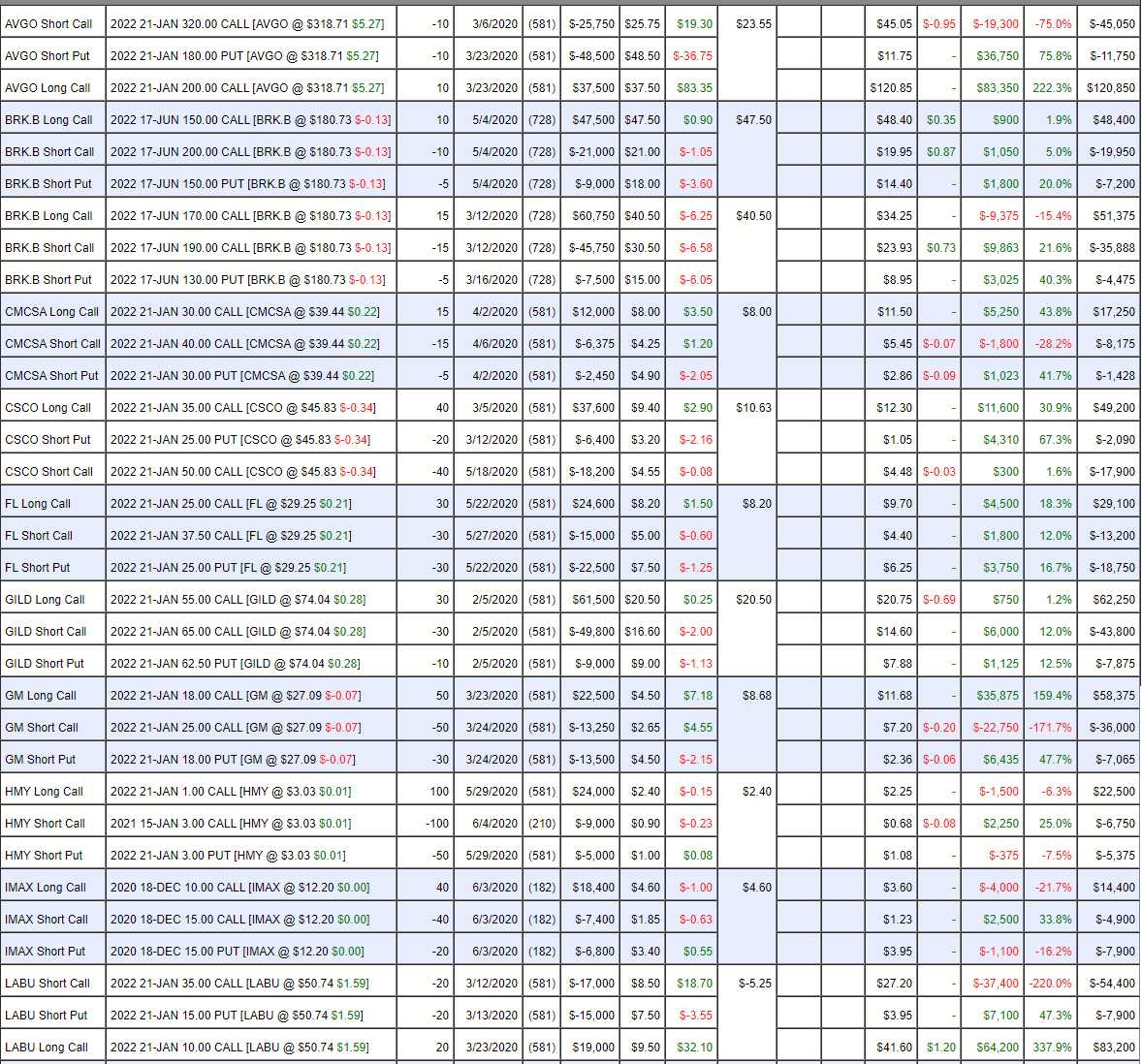

- AVGO – I think they can withstand the storm. Only $64,000 on a $140,000 spread that's in the money so I guess it's worth holding, right?

- BRK.B – If they fall apart, we're all doomed!

- CMCSA – They are sports heavy so we're going to kill them. Back to the Watch List!

- CSCO – All these shut-ins need their internet (though that was a strength of Comcast too).

- FL – Brand new and already popping. Even infected zombies need sneakers.

- GILD – Not worried.

- GM – Going to be rough but only net $15,000 out of $35,000 so let's stick it out.

- HMY – Still has that new trade smell. Gold plays are good hedges – that's why we added them.

- IMAX – They are back but it might have been too soon to jump back in though Asia seems to have the virus more under control than we do and that's half their Box Office so I'll give it until earnings, which is early Aug.

- LABU – We're very deep in the money but only net $22,000 out of potential $40,000 so good for a new trade, actually.

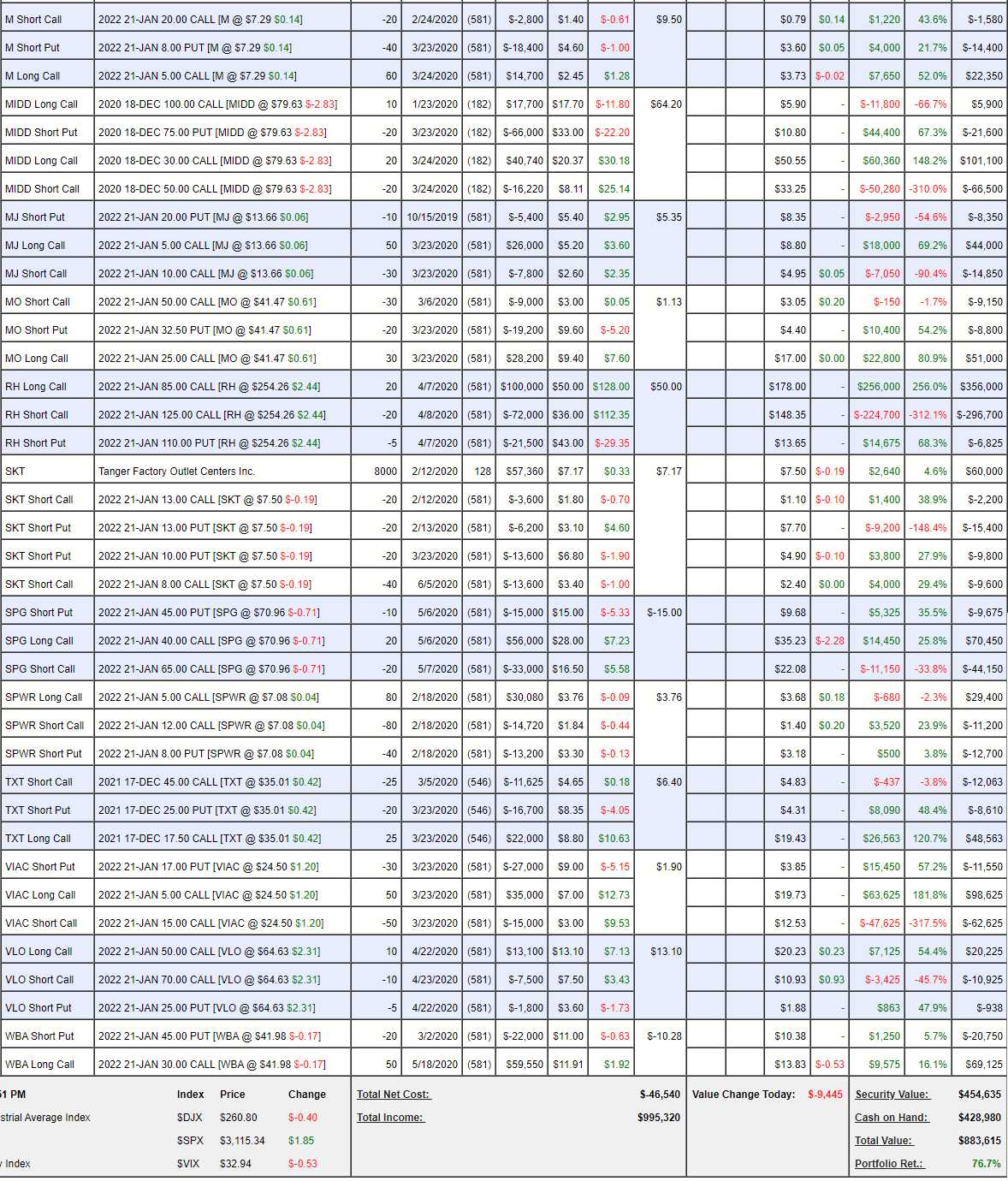

- M – Too much of a bargain to sell while it's profitable.

- MIDD – I could have sworn we killed this already? Ah, I just checked and I said " I don't think a lot of restaurants will be buying new ovens this year though so I won't be too patient if this one starts to falter." Hmm, tough call but it's just hitting technical resistance on the downtrend and it's potential $40,000 and currently net $14,000 (not the Dec $100s) so I guess we'll give them a chance.

- MO – $75,000 spread at net $33,000 has too much room to grow and you know what people will do for a cigarette…

- RH – Pretty new and I love them at net $53,000 out of $80,000. So deep in the money we may as well wait as it's 50% up from here so worth waiting for.

- SKT – Showing signs of life. As long as they hold that $7.50 line I'm good.

- SPG – Another mall REIT! In good shape already, added just before our last review.

- SPWR – This is in every portfolio so a big keeper.

- TXT – Room to run at net $28,000 on the $68,000 spread so we can keep this.

- VIAC – $23,000 on the $50,000 spread has 100% to go and it's in the money and I love them. See how easy that is.

- VLO – Net $10,000 out of $20,000 is a keeper.

- WBA – Uncovered. Nope, have to be aggressive on these guys. Earnings July 9th and I say back over $45 by then.

Well, we didn't get to kill too many longs because our positions are SO GOOD!!! Still, we took some off the table and we killed some puts and overall we reduced our downside exposure considerably and raised our buying power and that makes our STP hedges much more powerful (because they are protecting less) so all in all – it's a good set of adjustments.

IN PROGRESS