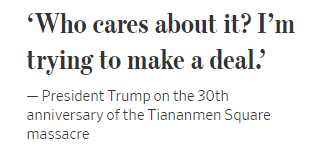

According to the exerpt from the Wall Street Journal (hardly part of the "Liberal Media"): "The president pleaded with Chinese leader Xi Jinping for domestic political help, subordinated national-security issues to his own re-election prospects and ignored Beijing’s human-rights abuses." I'm sorry about the "politics" but some of this stuff you just have to read:

In Buenos Aires on Dec. 1, at dinner, Xi began by telling Trump how wonderful he was, laying it on thick. Xi read steadily through note cards, doubtless all of it hashed out arduously in advance. Trump ad-libbed, with no one on the U.S. side knowing what he would say from one minute to the next.

One highlight came when Xi said he wanted to work with Trump for six more years, and Trump replied that people were saying that the two-term constitutional limit on presidents should be repealed for him. Xi said the U.S. had too many elections, because he didn’t want to switch away from Trump, who nodded approvingly.

Trump closed by saying Lighthizer would be in charge of the deal-making, and Jared Kushner would also be involved, at which point all the Chinese perked up and smiled.

Trump spoke with Xi by phone on June 18, just over a week ahead of the year’s G-20 summit in Osaka, Japan, where they would next meet. Trump began by telling Xi he missed him and then said that the most popular thing he had ever been involved with was making a trade deal with China, which would be a big plus for him politically.

Trump then, stunningly, turned the conversation to the coming U.S. presidential election, alluding to China’s economic capability and pleading with Xi to ensure he’d win. He stressed the importance of farmers and increased Chinese purchases of soybeans and wheat in the electoral outcome. I would print Trump’s exact words, but the government’s prepublication review process has decided otherwise.

Trump’s conversations with Xi reflected not only the incoherence in his trade policy but also the confluence in Trump’s mind of his own political interests and U.S. national interests. Trump commingled the personal and the national not just on trade questions but across the whole field of national security. I am hard-pressed to identify any significant Trump decision during my White House tenure that wasn’t driven by re-election calculations.

Remember the Trump Administration stopped Bolton from testifying during the impeachment hearings – for obvious reasons. They fought for months to prevent this book from coming out and had much of it redacted but what's left is still a very damning view of the President and his entire Administration.

Remember the Trump Administration stopped Bolton from testifying during the impeachment hearings – for obvious reasons. They fought for months to prevent this book from coming out and had much of it redacted but what's left is still a very damning view of the President and his entire Administration.

In a scathing account of his 17 months working for the President, Mr. Bolton describes Mr. Trump as “stunningly uninformed,” easily swayed by authoritarian leaders and often the subject of scorn among his own advisers. Among the episodes he recounts are June 2019 meetings with Chinese President Xi Jinping in which he says Mr. Trump pleaded with his counterpart to help him win re-election by purchasing agricultural products from the U.S. and gave China his blessing to continue building camps for Uighur Muslims, which Mr. Bolton likened to concentration camps.

Mr. Bolton echoes allegations that were at the center of the President’s impeachment trial, writing that Mr. Trump repeatedly ordered White House officials to withhold military assistance from Ukraine as retribution for perceived slights during the 2016 election and as leverage to pressure the country to investigate Joe Biden, then a potential and now his presumed election opponent this year. Mr. Bolton describes the objective as a fantasy based on conspiracy theories pushed by the now missing Rudy Giuliani, the President’s personal attorney.

Trump has turned the Government's Justice department into his own personal hit squad, so the book has been leaked in advance to make sure this information gets out to the public – who am I to stop it? Joe Biden read the exepts and said:

“If these accounts are true, it’s not only morally repugnant, it’s a violation of Donald Trump’s sacred duty to the American people to protect America’s interests and defend our values.”

Hard to see how this will not negatively affect the markets into the weekend with more political turmoil. As usual, we will be adding more hedging power to protect our Member Portfolios.