By Rupert Hargreaves. Originally published at ValueWalk.

Michael Zimmerman’s Prentice Capital returned 3% in June, taking its year-to-date performance to 18.6% net of fees and expenses, according to the firm’s June investor update, a copy of which ValueWalk has been able to review.

Q1 2020 hedge fund letters, conferences and more

Prentice Capital Benefits From “15 Million New Robinhood Accounts”

Prentice Capital employs a low net equity long/short strategy with a specific focus on the U.S. consumer sector, which has recently performed better than the wider market.

For more up-to-date hedge fund content, and exclusive access to value-focused hedge fund managers, check out Hidden Value Stocks.

The firm speculated in its June investor update that some of this performance could be down to the “15 million new Robinhood accounts” activated since the beginning of the coronavirus crisis. These new traders have concentrated on buying “household names,” according to the letter, many of which are in the consumer discretionary sector.

As a result of this, the letter went on opine, it’s difficult to determine the factors that have been driving stock performance over the past few months.

If you’re looking for value stocks, and exclusive access to value-focused hedge fund managers, check out Hidden Value Stocks.

However, the update noted that its long and short book is focused on discretionary companies where “we believe the pent-up demand is waning.” It expects more will be revealed when companies report their second-quarter numbers throughout August.

According to investor correspondence, at the end of June, Prentice Capital’s portfolio was – 2.4% net long with long exposure of 56% and short exposure of 58.3%. This gives some indication of the firm’s outlook for the rest of the year. Year-to-date, shorts have added 2% to gross performance, while longs have added 22.1%.

The highest conviction longs in the portfolio at the end of the month at the end of the quarter included household brand names such as Abercrombie & Fitch, Abercrombie & Fitch, and GoPro.

Prentice tends to run a concentrated portfolio with 20 to 25 long positions at any one time.

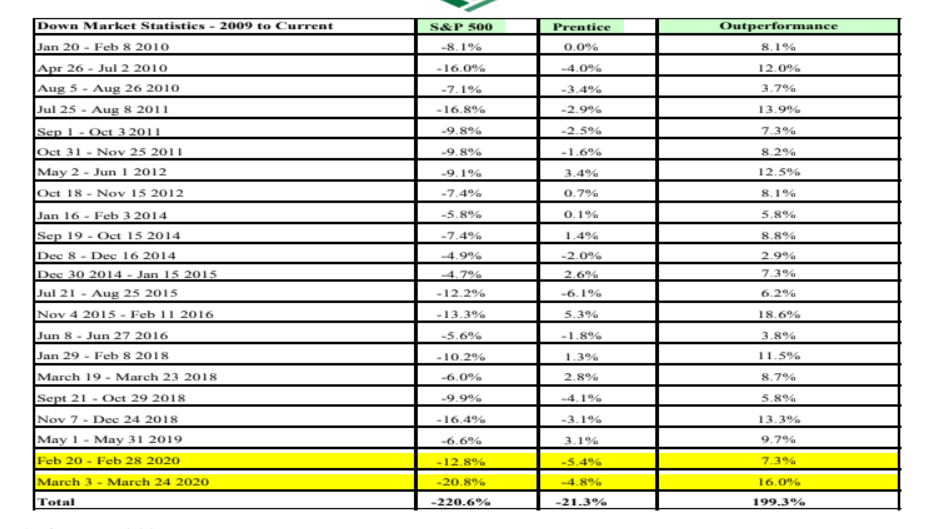

The fund also has a strong track record of generating outperformance in down markets. During the past 11 years, there have been 22 occasions when the S&P 500 has fallen by more than 5% in a short period for a combined loss of 220.6%.

Prentice Capital has only lost -21.3% during these periods, according to its marketing materials, suggesting an outperformance of 199.3%. Since its inception in October 2009, the firm has produced an average annualized return of 10.7% with an annualized volatility of 11% and a correlation to the S&P 500 total return index of 42.8%.

This article first appeared on ValueWalk Premium.

The post Steve Cohen Alum Profits From Markets Driven By “15 Million New Robinhood Accounts” appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.