Has it been four months?

Has it been four months?

That's right, it was four months ago when we first plunged below our 2,850 "Must Hold" line on the S&P 500 and, as I said back on March 12th, "When the going gets tough, the tough go shopping" and it's not just the lower stock prices we take advantage of when our fellow investors are panicking out of positions but the higher levels of volatility raise the Volatility Index (VIX) and allow us to "Be the House" and sell options for fantastic premiums.

Initially, we sell puts to establish good entries in positions when we think there may be more downside. We'll see how those are doing and decide whether we want to expand on our plays. The first round was taken on March 12th, and these were the trade ideas followed by the current price and profit in caps:

- Boeing (BA) – It's hard to call a bottom on BA but they will be close to $160 this morning and that means we can sell 5 of the 2022 $110 puts for $27.50 ($13,750) in the LTP for just $3,707 in margin. This one could be a rough ride. NOW $20.00 ($10,000) UP $3,750 (27.3%)

- Cisco (CSCO) – Rarely goes on sale and this is a doozy back at $35 this morning. We can sell 10 of the 2022 $25 puts for $3.20 ($3,200) in the LTP to net in for $21.80. $785 margin. NOW $1.00 ($1,000) – UP $2,200 (68.7%)

- Hanesbrands (HBI) – HBI is one of our "safety" retailers. They make ordinary underwear, which even people with the flu have been known to wear. Down at $9.50 is impossible to resist as that's $3.5Bn for a company making $600M a year so 7x earnings AND they pay an 0.60 dividend, which is 6% on this price. We don't have to buy them for $9 to collect 0.60 though as we can sell 20 2022 $8 puts for $2.20 ($4,400) in the LTP to net us in for $5.80. $519 margin. Now $1.60 ($3,200) – Up $1,200 (27.3%)

- IBM (IBM) – Our 2019 Stock of the Year is back where we came in in 2018 at around $110 and we can sell 5 2022 $80 puts for $10 ($5,000) in the LTP to net in for $75. $1,206 margin. NOW $5.40 ($2,700) – UP $2,300 (46%)

- Intel (INTC) – Hasn't been this cheap in a while and $50 is $220Bn in market cap for a company that made $20+Bn in each of the past two years. We can sell 10 of the 2022 $30 puts for $3 ($3,000) in the LTP and net in for $27 – almost half that price. $748 margin. Now $1.13 ($1,130) – Up $1,870 (62.3%)

- 3x Biotech ETF (LABU) – This index is completely falling apart, just caught up in the general selling that's going on in the market. It fell 20% yesterday and another 20% this morning so VERY RISKY to catch this knife at $25 but we can sell 10 2022 $15 puts for $7.50 ($7,500) in the LTP to net us in for $7,500 on 1,000 shares so the risk/reward is pretty good. Margin on that is $607 but we're also going to buy 20 of the 2022 $20 ($15)/$35 ($10) bull call spreads at $5 ($10,000) as that will be net $2,500 on the $30,000 spread with $27,500 (1,100%) upside potential if LABU can get back over $35. NOW $3.20 ($3,200) ON THE PUTS and $47/38.50 ($17,000) ON THE SPREAD FOR NET $13,800 – UP $11,300 (452%)

- Plug Power (PLUG) – This was on our "Stocks of the Future" list but it got away from us before we could buy it at $3 and now it's back to $3.15 this morning and we can sell 50 of the 2022 $2.50 puts for $1.10 ($5,500) in the "Stocks of the Future" Portfolio to net us in for just $1.40. $1,369 margin. NOW 0.45 ($2,250) – UP $3,250 (59%)

- TD Bank (TD) – This is a very solid bank that is not as exposed to the energy sector as other Canadian banks. Testing $40 this morning is under $75Bn for a bank that made $8.5Bn last year and pays a 5% dividend ($2.37) but we're not paying that, we're just going to promise to buy 500 shares by selling 10 2022 $25 puts for $3 ($3,000) in the LTP to net in for $32 if assigned. $1,834 margin. NOW $2.40 ($2,400) – UP $600 (20%)

- Tenet Healthcare (THC) – One of our biggest winners from last year is back on sale at $19 and it's tempting to back up the truck but we'll just sell 10 of the 2022 $15 puts for $3.50 ($3,500) in the LTP so we can remember to keep an eye on them. $2,090 margin. NOW $5 – DOWN $1,500 (43%)

- ViacomCBC (VIAC) – They have done nothing but go down and we already have them so not for our portfolio but $18.50 is INSANE as it's $12Bn in market cap for a company that made $3.3Bn last year. If anything, you would think more people will be watching TV as they stay home every night. You can sell 10 2022 $15 puts for $4.50 ($4,500) to net in for $10.50. $743 margin. NOW $2.85 ($2,850) – UP $1,650 (36.7%)

See, you literally can't win them all! 1 of our first 10 Trade Ideas did not fare well and we decided to pull the plug on BA (client bankruptcies), TD (oil industry loans) and THC (unable to perform profitable surgeries) because our premise for playing them fell apart as the scope of the crisis unfolded over the past four months but we more than tripled down on VIAC AND got more aggressive on the puts – ending up with this much larger spread in our Long-Term Portfolio:

| VIAC Short Put | 2022 21-JAN 17.00 PUT [VIAC @ $22.93 $0.83] | -30 | 3/23/2020 | (557) | $-27,000 | $9.00 | $-5.33 | $1.90 | $3.68 | – | $15,975 | 59.2% | $-11,025 | ||

| VIAC Long Call | 2022 21-JAN 5.00 CALL [VIAC @ $22.93 $0.83] | 50 | 3/23/2020 | (557) | $35,000 | $7.00 | $11.05 | $18.05 | $1.10 | $55,250 | 157.9% | $90,250 | |||

| VIAC Short Call | 2022 21-JAN 15.00 CALL [VIAC @ $22.93 $0.83] | -50 | 3/23/2020 | (557) | $-15,000 | $3.00 | $7.33 | $10.33 | $0.42 | $-36,625 | -244.2% | $-51,625 |

As I said, the primary reason we sell short puts is to INITIATE potential long positions and it reminds us to focus on the stocks and, over the past four months, we have determined that Viacom/CBS is extremely undervalued – so we put a lot more money to work on it though, even now, the position is only net $27,600 out of a potential return of $50,000 if VIAC is over $15 in January of 2022 for a potential gain of another $22,400 (81%) from where it is now if VIAC can simply stay above $15.

So we tried it and we liked it and we put a bit more money in. Our net on the new spread was actually a net credit of $7,000 so, if all goes well, we'll make $57,000 total profit on that set-up – aren't options fun?!?

Overall, the first 10 trade ideas we had early in the crisis netted us a profit of $26,620, which is 61% of the $43,350 we collected and our margin was $9,901 so our gain against margin is 268% in just 4 months on our first set.

Our next set of 10 dip-buying ideas came on March 17th, as the market neared the bottom and we began getting more aggressive with our purchases as we felt better about holding the line at S&P 2,280, 20% below our Must Hold Line at 2,850. That led us to add the following trade ideas for our readers:

- Intel (INTC) – $44.60 is $190Bn in market cap for a company that has made over $20Bn for the past two years. Yes there will be a slowdown this year but this is not a Zombie Apokalypse, this is a virus and, looking into the future we still see billions of people who will still want computers, phones and tablets. Again, we're not looking to buy them for $44.60 but we can sell the 2022 $30 put for $4, which is promising to buy them for net $26 and requires just $463 in margin selling 10 of them for $4,000 in our Long-Term Portfolio (LTP). NOW $1.10 ($1,100) – UP $2,900 (72.5%)

See how easy that is – that's a trade. We COLLECT $4,000 for promising to buy INTC for $30 between now and 2022. If it goes below $30, we are obligated to buy but, no matter what, we keep the $4,000 so our net cost on 1,000 shares would be now worse than $26,000, which is 56% below the current price!

- Apple (AAPL) – Is nowhere near cheap enough at $240 as I hear FoxConn, who make IStuff, are testing all 200,000 workers every day but, when one of them tests positive, they have to shut the line down and clean everything and they are doing it over and over and over again because it's way too soon to push all those people back to work. Still, any chance to buy AAPL on sale is something we don't like to pass up and we can sell 5 of the June 2022 $150 puts for $14.50 ($7,250) in the LTP and that net's us in for $135.50, a nice 44% discount off the current price. Margin $1,667. NOW $4.00 ($2,000) – UP $5,250 (72%)

- Automatic Data Processing (ADP) – You would think people are never going back to work the way ADP is selling off. I doubt revenues will take the hit that is being baked in at the moment but what I find really attractive is that you can sell the 2022 $80 puts for $12 and that nets you infor $68, 43% below the current price so let's sell 10 of those in the LTP for $12,000. Margin $3,163. NOW $5.00 ($5,000) – UP $7,000 (58%)

- Amazon (AMZN) – Is HIRING 100,000 people because they are being overwhelmed by demand. Very obviously, if people are not leaving their home, they will buy more things on-line and that should be great for Amazon. I would never pay $1,700 for the stock as that's still over 50 times what they earn but I don't mind promising to buy them for $900 by selling the 2022 $900 puts for $47.50. That nets us in for $852.50, 50% off the current price and we can sell 5 of those in the LTP for $23,750. Margin $13,078. NOW $9.00 ($4,500) – UP $19,250 (81%)

- Caterpillar (CAT) – Is one of our all-time favorites that we always buy when it's on sale and, while $95 is nice, wouldn't $45 be nicer? We can sell 10 of the 2022 $50 puts for $5 ($5,000) in the LTP and those are so far out of the money that the margin is just $1,863. NOW $2.20 ($2,200) – UP $2,800 (56%)

- Clorox (CLX) – Bleach is one simple way to kill the coronavirus (but don't drink it!) and CLX has gone up, not down during this crisis so not on sale and not cheap but it's a stock we know will be doing well and, because we know how to use options to our advantage, we don't have to pay $175 or even $125. We can promise to buy CLX for $110 and get paid $7.50 for selling 10 of the 2022 $110 puts for $7,500 against $4,944 in margin in our LTP. NOW $1.80 ($1,800) – UP $5,700 (76%)

- Lockheed Martin (LMT) – Is our Stock of the Century and miles above where we picked it when it was well below $100 but we're happy with any chance to own the company most likely to develop a working fusion reactor and, of course, virus or no, the Military still wants their planes. We can sell the 2022 $160 puts for $16 to net in for $144, 50% off the current price so 5 of those in the LTP nets us $8,000 but, frankly, I'd be happier if this one were assigned to me than expire worthless. Margin $2,483. NOW $4.75 ($2,375) – UP $5,625 (70%)

- Medtronic (MDT) – Is an old favorite that hasn't been cheap in a long time. They will have a bad quarter or two as all non-emergency surgery is being pushed back to keep beds open for virus victims. Still, it's a fantastic long-term play and we can sell 5 2022 $60 puts for $9 ($4,500) in the LTP to remind us to keep an eye on them as I'd love to add a bull call spread when we find a bottom. Margin $2,028. NOW $3.95 ($1,975) – UP $2,525 (56%)

- Square (SQ) – Is those little white payment terminals you see in so many retailers these days. It's been a very hot stock and we felt like we missed the rally but now is a great time to jump in as it's more than 50% off it's highs – as if no one will ever shop again. These are the kind of stocks we like – there's no competitor taking them down – just the irrational fear that life will never go back to normal and SQ has over $2Bn in cash and made $375M last year – they can weather a bad quarter or two. We can sell the 2022 $30 puts for $6 and that nets us in for $24, which would be 40% below the current price. Let's sell 5 for $3,000 in our Future is Now Portfolio as this is truly a Stock of the Future. Margin $471. NOW $1.40 ($700) – UP $2,300 (77%)

- Exxon (XOM) – Is a diversified company that refines and sells oil as well as drills it so they still make good money selling gasoline when oil is cheap (it's an ingredient in gasoline, of course) and $34.50 is about the same as the low they hit after 9/11 and far lower than the $60 they held in 2008 and, both of those times, oil was below $20 a barrel for a while. We can promise to buy 1,000 shares of XOM at net $21.50 by selling 10 2022 $27.50 puts for $6 ($6,000) in the LTP. Margin $753. NOW $2.55 ($2,550) – UP $3,450 (57%)

Well, it seems like sometimes you CAN win them all – 10 for 10 on our second set of Panic Picks for our readers. Of course it's not really that complicated – these were all stocks that were on our Watch List, which we compiled last fall with the intention of initiating positions if we got a good dip in the markets. We did – so we did. Make a plan and follow through, but check your premise along the way….

Our second set of trade ideas has made a very nice net $55,900 in just four months for our readers against the $81,000 we collected, so we're already up 69% of our potential gains. We decided to take the money and run on ADP (less people working means lower comps) and AMZN (just too expensive now) but the rest can ride and we turned CAT into a bigger play, adding on May 11th:

- Buy 15 CAT 2022 $100 calls for $24 ($36,000)

- Sell 15 CAT 2022 $120 calls for $15 ($22,500)

- Sell 5 CAT July $120 calls for $3.60 ($1,800)

That's net $11,700 but we sold the first round of short puts for $5,000 so our spend on the spread is now net $6,700 and it's a $30,000 spread with $23,300 (347%) upside potential if CAT is over $120 in Jan 2022. Along the way, we can sell more short calls and hopefully pick up more cash (the options expire before the July earnings report). The short calls don't add margin because they are offset by the margin already committed on the short puts.

| CAT Long Call | 2022 21-JAN 100.00 CALL [CAT @ $128.01 $2.28] | 15 | 5/11/2020 | (557) | $36,000 | $24.00 | $10.83 | $22.80 | $34.83 | – | $16,238 | 45.1% | $52,238 | ||

| CAT Short Call | 2022 21-JAN 120.00 CALL [CAT @ $128.01 $2.28] | -15 | 5/11/2020 | (557) | $-22,500 | $15.00 | $7.60 | $22.60 | $0.67 | $-11,400 | -50.7% | $-33,900 | |||

| CAT Short Call | 2020 17-JUL 120.00 CALL [CAT @ $128.01 $2.28] | -5 | 5/11/2020 | (4) | $-1,800 | $3.60 | $4.75 | $8.35 | $1.25 | $-2,375 | -131.9% | $-4,175 |

As you can see, we're not doing anything very complicated but what we are doing is VERY profitable. We simply take advantage of a sell-off (and these happen every earnings season without a virus) of stocks we like on our Watch List providing, of course, that we feel the reason the stocks sold off is temporary. Of course we also stick with solid, blue chip stocks – no fad chasing.

THAT is how you play a crisis!

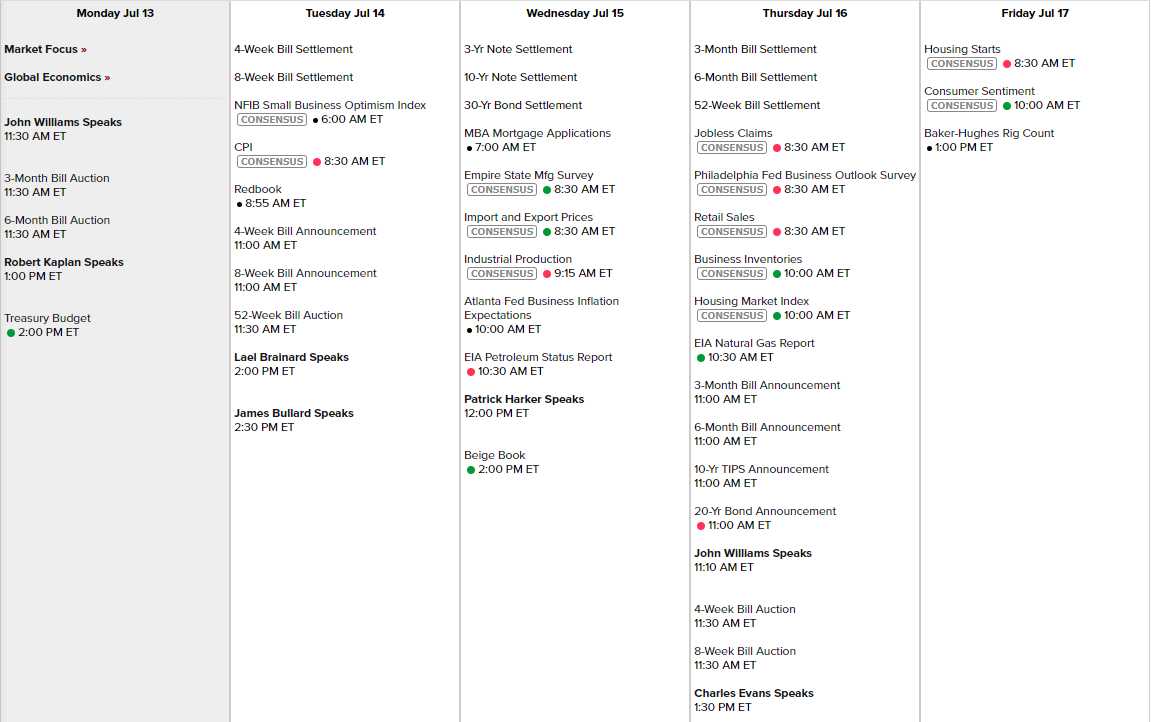

So far, although I'm VERY concerned, we haven't had much reason to pull the plug as the market just keeps going up and up but we'll see how earnings look before we start counting our chickens. Here's this week's upcoming ones:

Lots of Fed speak this week as well around the Beige Book release on Wednesdy (2pm).