Wheeeee, what fun!

Wheeeee, what fun!

The Dow fell 353 points yesterday and that's not a big deal but it was a great deal for our PSW Report Members who were alerted, pre-market, to the idea of shorting the Dow Futures (/YM) at the 27,000 line. The Dow ended up falling all the way to 26,450, a 550-point drop that paid $2,750 per contract but we took the money and ran at about $1,200 per contract early and as the Futures shorts are just extra protection while we wait for our primary hedges to kick in.

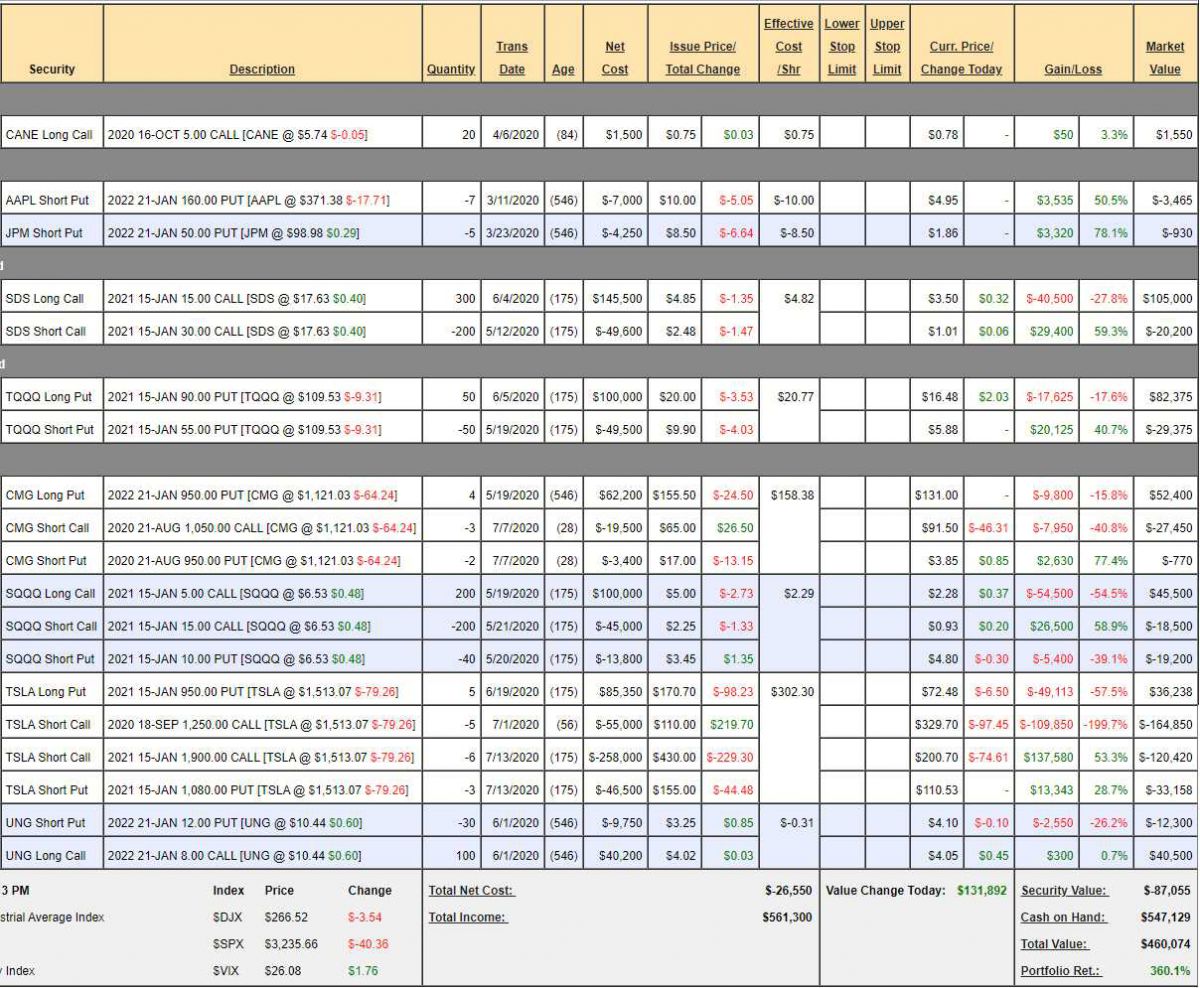

And what are our primary hedges? Well those are the positions in our Short-Term Portfolio, which we reviewed last Tuesday at $405,464 and, as of yesterday's close, the STP stood at $460,074, up $54,610 on the dip and the portfolio itself is up 360% for the year – despite the generally bullish market. That's because of clever (though sometimes painful) trades like our Tesla (TSLA) short, which is only just beginning to pay off.

At the same time, our Long-Term Portfolio (LTP), which we reviewed last Wednesday at $901,428, is now at $966,958 so that's up $65,350 for the week so it does turn out we are correctly bearishly balanced – and now you can see why we didn't make any portfolio changes last week (other than mechanical changes on expiring positions). We knew the "rally" was a house of cards so we were very happy to be neutral on the way up, knowing that we'd make a very nice gain on the way back down.

3,135 is the top of our range on the S&P 500 and we are still way over that but it's just a blip on the weekly calendar so don't get excited, especially when the unemployment bonuses and other stimulus measures are running out and Congress does not seem able to step up to the plate with additional funding.

As we are all painfully aware, the virus is still raging out of control and the US is up there with other 3rd World countries in the number of new cases per day as a percentage of the population as we STILL have virtually no public policy to get the virus under control other than "wear a mask". No one is clearning our streets or handing out PPE equipment and our hospitals are overflowing with patients.

I hate to keep saying it but I want to dissuade you from "buying the dip" as we are only 45 days away from September 7th (Labor Day) and then it's flu season and the kids will be going back to school under the Trump/Devos extermination plan and how confident do you think consumers will be when every little sniffle or cough sends people into a panic?

I hate to keep saying it but I want to dissuade you from "buying the dip" as we are only 45 days away from September 7th (Labor Day) and then it's flu season and the kids will be going back to school under the Trump/Devos extermination plan and how confident do you think consumers will be when every little sniffle or cough sends people into a panic?

This is the middle of Summer, when Trump told us the virus would die off on it's own through the magic of sunshine. He even had "experts" explain to us how UV rays killed corona. It was complete nosnese, of course, but it bought him the time he needed to make things much, much worse.

Now Trump promises things are going to get worse before they get better – I guess he's also looking forward to voting for Joe Biden…

Have a good weekend,

– Phil