The Permanent Portfolio

Courtesy of Michael Batnick

Everything is working.

Whether you’re an equity investor, hiding out in bonds, or waiting for the dollar to collapse, you’re making money.

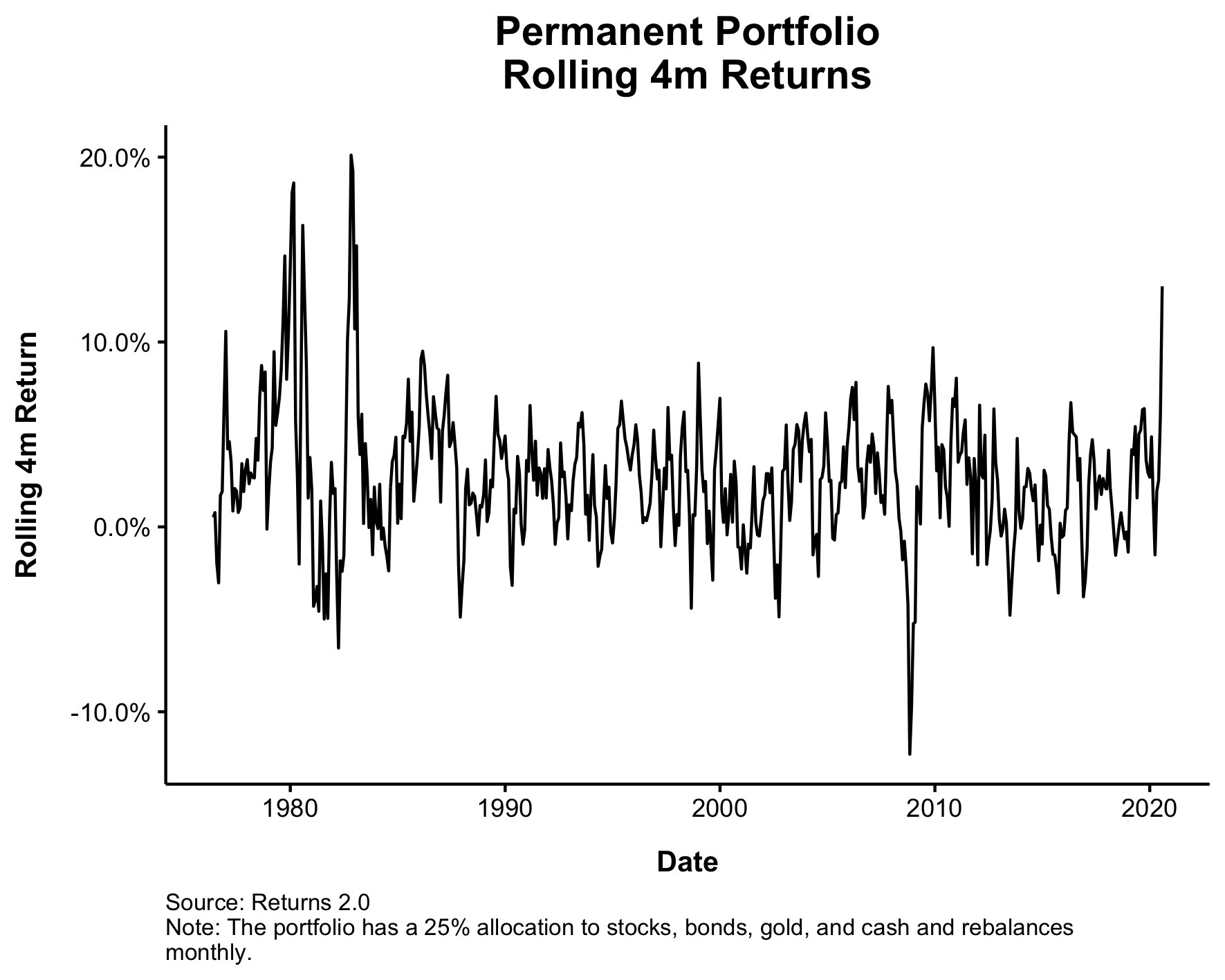

The permanent portfolio, which is an equal-weighting of everything from stocks to bonds, gold, and cash, just had its best run in 40 years!

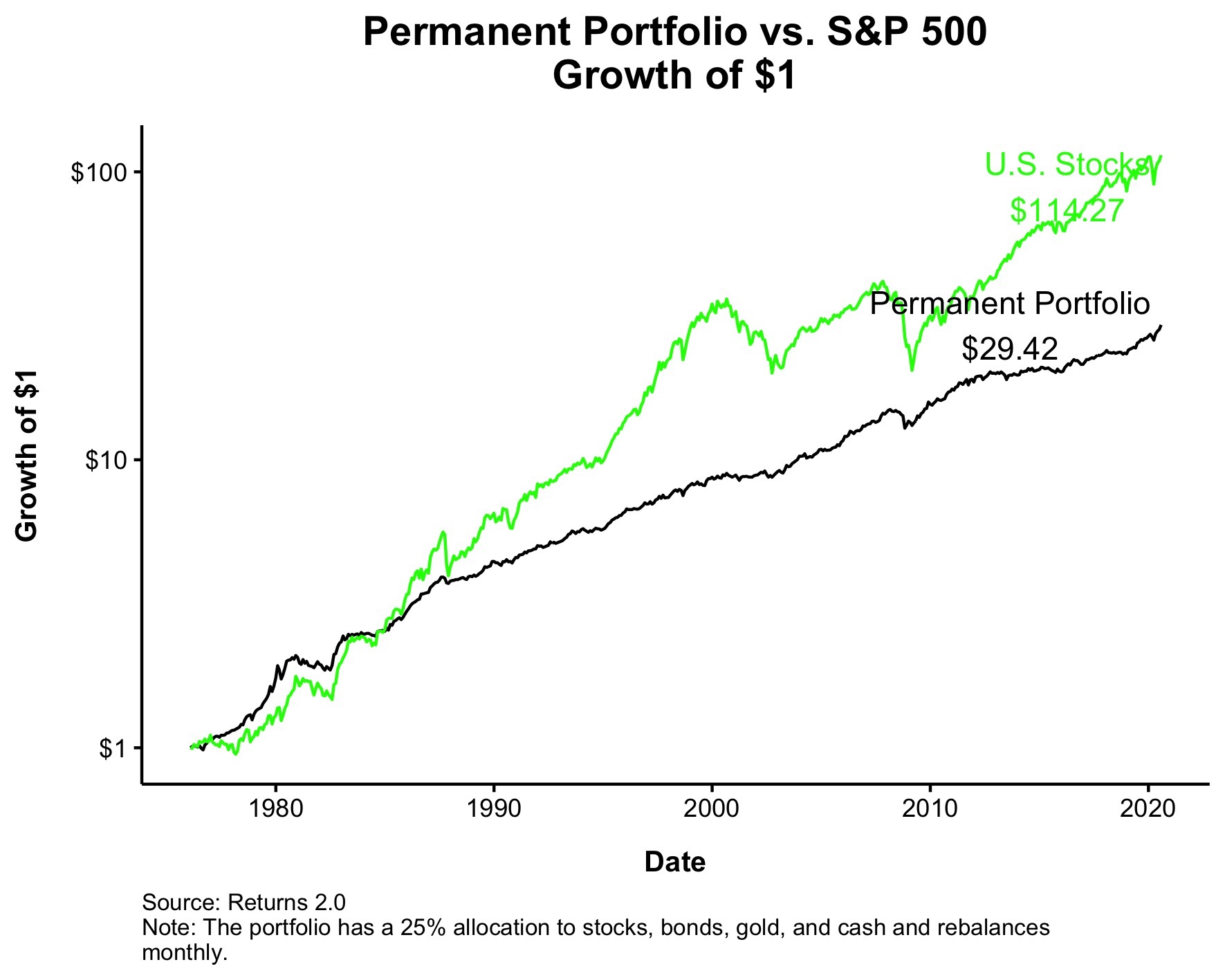

The main tenet behind this type of strategy is based on the old adage, don’t have all your eggs in one basket. This means, by definition, that you’ll be underexposed to the best basket, stocks in this case.

Since 1976, the S&P 500 gained 11.2% a year. The permanent portfolio gained 7.9% over the same time.

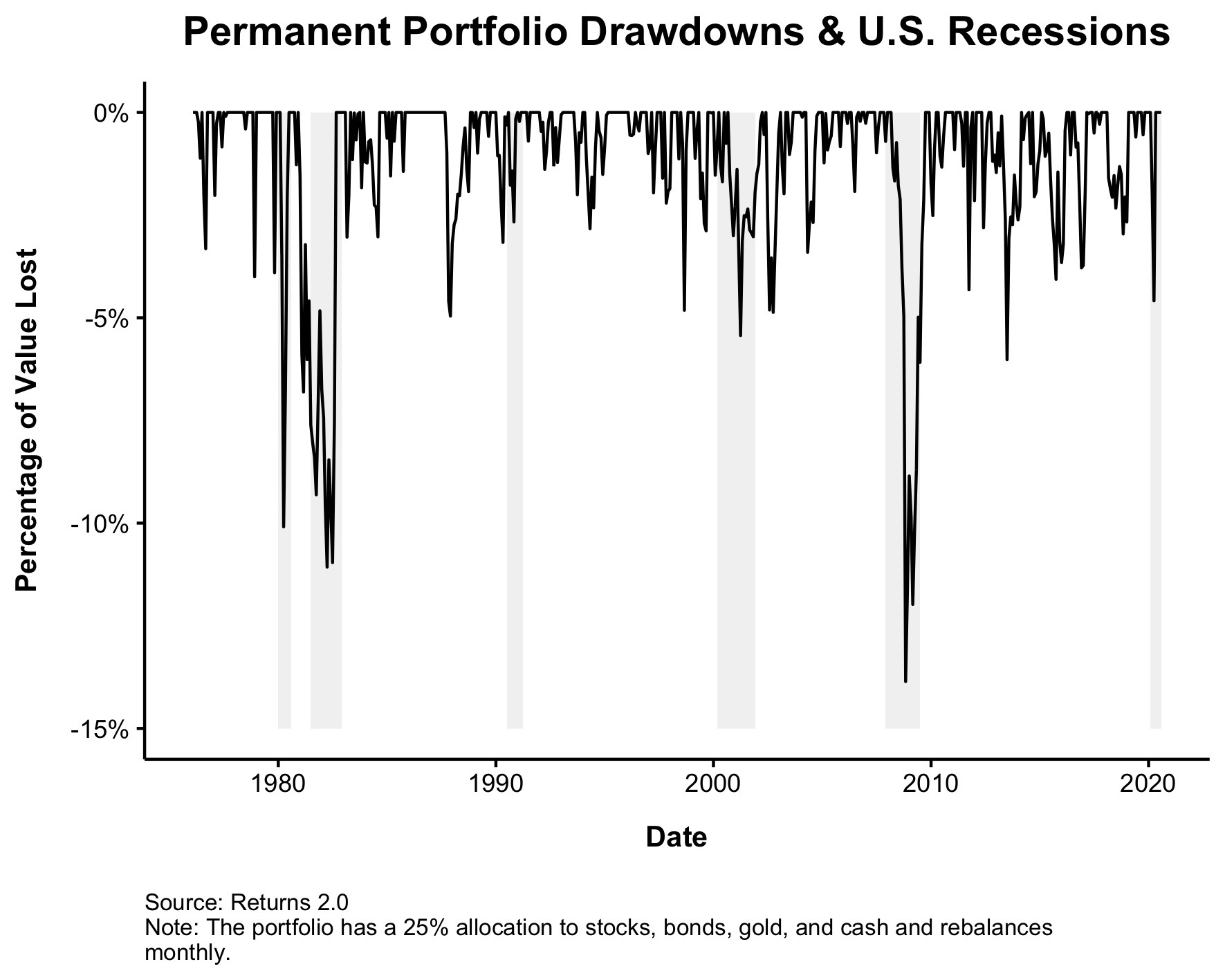

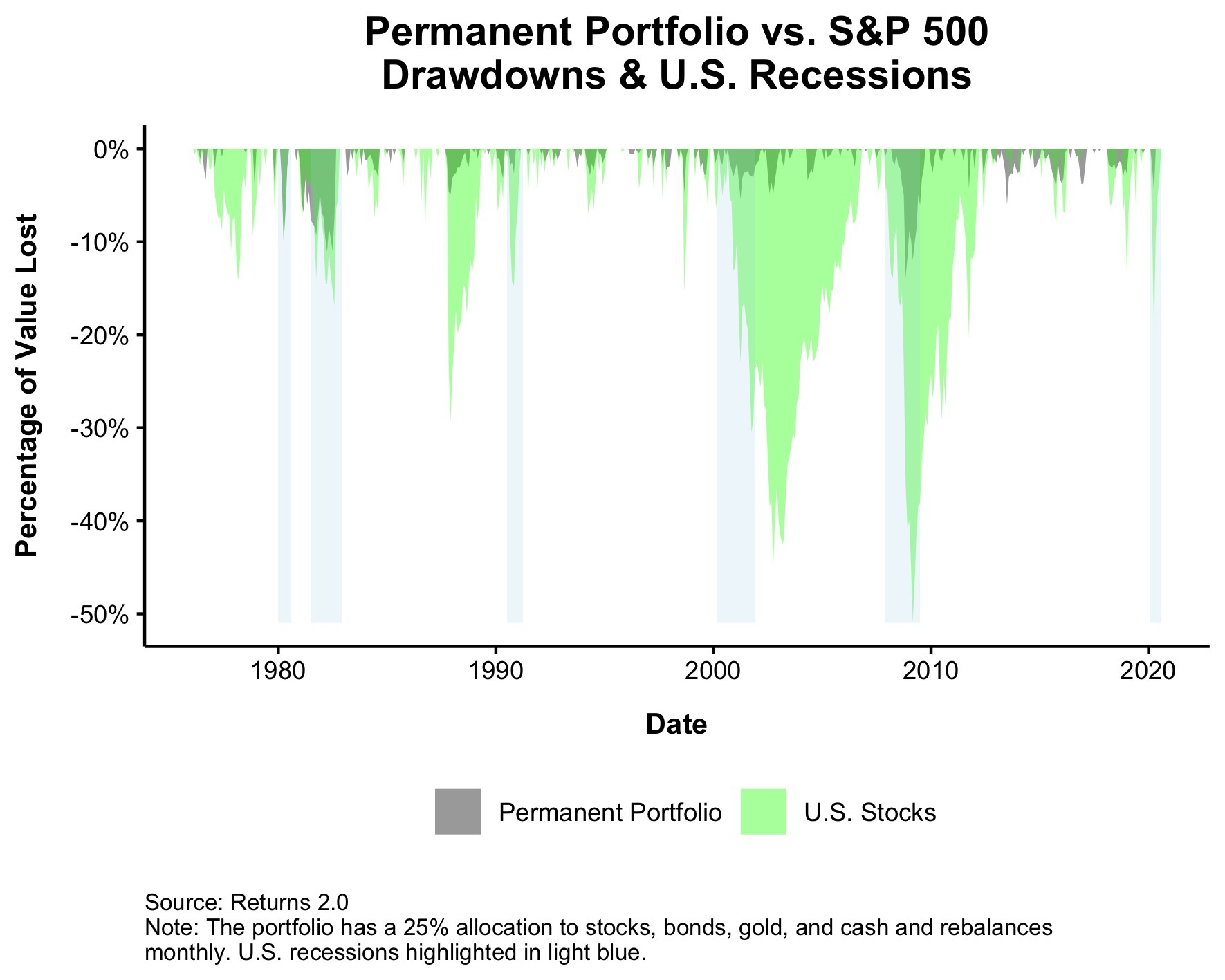

The appeal of this portfolio, as I see it, is it is an effective way to avoid a catastrophe. In the aftermath of the dotcom bubble, the stock market fell nearly 50%. The maximum drawdown of the P.P. was 5%.

Stocks fell more than 50% during the GFC. The maximum drawdown for the P.P was less than 15%.

And during the most recent bear market, stocks fell more than 30%, while the maximum drawdown for the P.P. was just 5%*.

Sure, you gave up a lot of upside compared with stocks, but you also missed out on a lot of the downside.

One of the biggest risks to the permanent portfolio is not the investments, but the investor. Boredom, and fear of missing out makes this a difficult strategy to implement in real life. I suppose these risks are not limited to the permanent portfolio, but considering that it would have underperformed the stock market 64% of the time, it takes a certain type of person to stick with this through thick and thin.

I think of this as a set it and forget it portfolio. A sleep at night portfolio. A go live your life portfolio. Or at least that’s what it used to be. This is a different world we live in. With bonds giving you 1-2% and cash giving you 0, I wouldn’t expect much upside from here. The good news is, if history is any guide, you shouldn’t expect much downside either.

*I used monthly data for this. Using daily data, the max DD for 2020 was 6.8%. Still pretty great considering stocks fell more than 30%.