By Jacob Wolinsky. Originally published at ValueWalk.

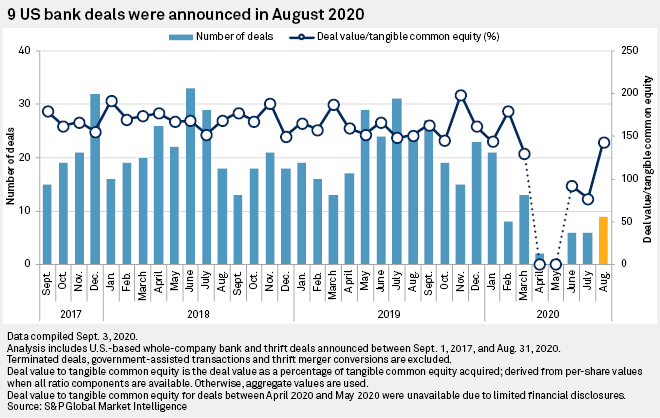

According to a new analysis from S&P Global Market Intelligence, deal volume among US banks is slowly picking back up as some of the uncertainty surrounding COVID-19‘s economic impact clears and banks feel more confident and optimistic.

Q2 2020 hedge fund letters, conferences and more

There were nine U.S. bank deals announced in August, a slight improvement from six in both June and July. Many of the deals announced in August were relatively small in size, in- or adjacent-market transactions, and in the works prior to COVID-19.

US bank M&A slowly picking up as some banks feel more ‘confident and optimistic’

Deal volume among U.S. banks is slowly picking back up as some of the uncertainty surrounding COVID-19’s economic impact clears and banks feel more confident and optimistic.

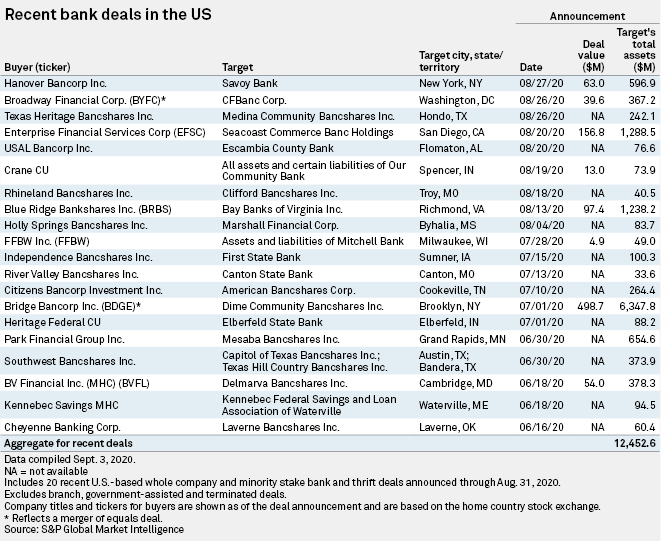

There were nine U.S. bank deals announced in August, a slight improvement from six in both June and July. Many of the deals announced in August were relatively small in size, in- or adjacent-market transactions, and in the works prior to COVID-19. While the trajectory of the economy remains unclear and a presidential election in November could bring tax and regulatory changes, the key drivers for M&A have only been magnified by the pandemic, deal advisers said.

“That need for scale, cost-spreading, the need for efficiency, the need to seize opportunity — all those things that drive M&A were overwhelmed in March and April with the cloud that brought along asset quality and general uncertainty. As that cloud of asset quality and other general uncertainty dissipated a little, those drivers that were there before are still there and are maybe even more enhanced,” James Stevens, a partner at Troutman Pepper Hamilton Sanders LLP, said in an interview.

A deal that is in- or adjacent-market and represents a small portion of the buyer’s size reduces the risk profile and offers greater cost savings, important factors in a recession, said both Stevens and Kirk Hovde, managing principal and head of investment banking for Hovde Group LLC. Among the deals announced in August, the largest target had $1.29 billion in total assets.

Read the full article here by S&P Global Market Intelligence

The post M&A Deal Volume Among US Banks Slowly Picking Up appeared first on ValueWalk.

Sign up for ValueWalk’s free newsletter here.