Everything is proceeding as I have foreseen.

Everything is proceeding as I have foreseen.

In Monday's "The Week Ahead – 200,000 Deaths Weigh Heavily on the Market," we knew the 200,000th American death would put Covid back in the news cycle and there wasn't much chance of Powell making us feel any better as the Fed is pretty much out of firepower and Congress is MIA as far as stimulus goes and NO ONE is actually doing anything about the virus except for claiming what a great job they've done fighting the China virus – but we won't name names as that would just embarrass a normal human being who had either empathy for their fellow man or the intelligence to realize their incompetence has killed twice as many peeople as the Vietnam war – and this one is still going on – and we've all been drafted!

As we noted in Monday's Report:

“We have a very serious situation unfolding,” said Hans Kluge, the World Health Organization’s regional director for Europe. For the first time, he wore a mask at the press conference on Thursday. “The September case numbers should serve as a wakeup call for all of us.”

I'm sorry, I know this is depressing and not what we want to talk about in a stock market newsletter but this is REALITY and, as an investor, you can't afford to put your head in the sand and hide from unpleasantness because denying the reality of the situation can lead to even more unpleasantness in your portfolio when ignoring a problem doesn't make it go away.

As noted above, the global markets are only down 2% since Wuhan was first locked down on January 23rd yet the Global Economy has taken a 20% hit in Q2 and is likely 10% down in Q3 so, if we're not out of the woods as we begin Q4 on October 1st – what the Hell are the markets so happy about?

We saw this coming (early) back on August 22nd, in our first Newsletter, where my opening line was: "GET OUT!!!" The S&P 500 was at 3,373 at the time and we did move up to 3,600 but now we're back at 3,254 and we'll be lucky to hold 3,200 with 3,000 being a more likely target for the next down move.

Well, we held 3,200 SO FAR this week but 3,135 is the actual 10% line according to our fabulous 5% Rule™ and we don't even think that is going to hold in the end. Most likely, we're just consolidating for another move down and that's just fine with us as our Short-Term is positioned very bearish and is up 200% since last Friday's review:

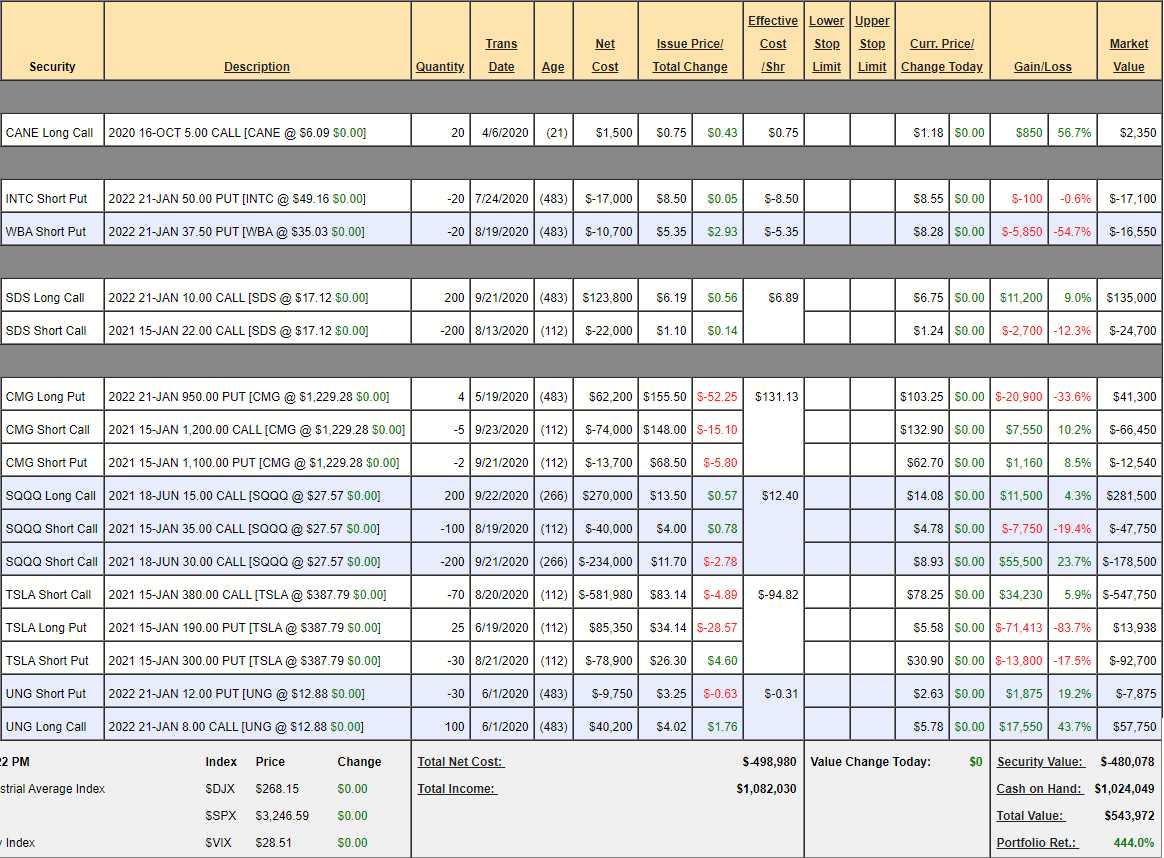

If you are looking for good hedges, these are working very well, on the whole plus we have our Tesla (TSLA) wild-card play that could be good for another $600,000 if we can thread the needle between $300 and $380. The SDS spead is worth $240,000 at $22 and currently net $110,300 so $129,700 left to gain in a correction and the SQQQ spread is worth up to $300,000 over $30 (now $27.57) and the net is currently just $55,250 so $244,750 (442%) makes this a REALLY good hedge.

So we've got a solid $355,050 of downside protection and our Long-Term Portfolio (LTP) lost about $100,000 this week so we're up net $100,000 (20%) in our paired porfolios in a bad market week so I'd say we're safely bearish going into the weekend but we've only got hedges to cover a 20% correction – back to 2,850 – so below the 10% line 3,135 we'll need to start layering in more protection or simply cashing out out longs.

- Covid Death Toll Nears 1 Million, But Real Number May Be Double.

- Worsening Virus Trends Are Raising Alarms for Stock Investors.

- Stocks Pump'n'Dump As Stimulus Hopes (& The Dollar) Slump.

- London Loses Allure for Jobseekers as Covid Hits City Businesses.

- Korea Consumer Confidence Retreats on New Virus Wave, Curbs.

- India’s Animal Spirits Stabilize as Virus Rages Across Economy.

- Oil Rally Stutters as Demand Concerns Offset Stimulus Optimism

- Pay Cuts Become Permanent for Many Americans During Pandemic.

- High Jobless Claims Suggest Slowing in Labor’s Recovery.

- Ohio Mom Tased & Arrested At Middle School Football Game For Not Wearing Mask.

Have a great weekend,

– Phil

"We were waiting for the end of the world

Waiting for the end of the world, waiting for the end of the world

Dear Lord, I sincerely hope You're coming

'Cause You really started something" – Elvis