Best-selling author and scientist David Brin shares another excerpt from his book, Polemical Judo, about the current war against democracy and how we can fight back. (Read the first, second and final chapter at the Contrary Brin Blog, and an excerpt from chapter 5, The War on All Fact People, here, and an excerpt from chapter 10, We are Different, Different is Difficult, here.)

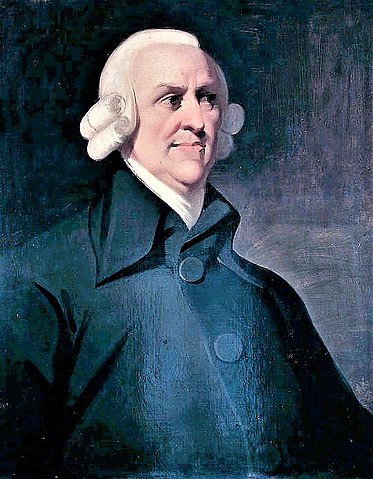

Adam Smith would be a Democrat! Beware common clichés about economics.

Courtesy of David Brin, Contrary Brin Blog

For the longest time, Donald Trump had one issue in which he led Joe Biden… "The Economy." And it drove me crazy! If there is one issue for which the evidence is overwhelmingly open-and-shut, it is the almost perfect record of better economic outcomes across the span of Democratic Administrations versus Republican ones. And yet, no DP politician seems remotely capable of making such a case, in debate or even in position papers.

For the longest time, Donald Trump had one issue in which he led Joe Biden… "The Economy." And it drove me crazy! If there is one issue for which the evidence is overwhelmingly open-and-shut, it is the almost perfect record of better economic outcomes across the span of Democratic Administrations versus Republican ones. And yet, no DP politician seems remotely capable of making such a case, in debate or even in position papers.

Finally, last week, polls showed Biden pulling ahead on economics, as well. But no thanks to self-gelded Democratic Party polemics!

And so, let's resume publishing chapters of Polemical Judo with Chapter Eleven, on that very topic. And yes, this is a long one! So again, I'll be splitting it in half. Because no one has the patience to read, anymore. (Read also: More on why OUTCOMES show Republican "economics" betrays markets, fiscal sense and the future: Chapter 11's second part.)

And yes, as always I have plenty to say about the week's events, as well. But this time I'll hold off, till the end.

No, you don’t get Adam Smith… and Other Rationalizations

“For as wealth is power, so all power will infallibly draw wealth to itself by some means or other.”

– Edmund Burke (1780)

In August 2019 a coalition of executives representing some of America’s largest companies issued a statement that redefines “the purpose of a corporation.”[1] No longer should the primary goal be to advance the interests of shareholders, said the Business Roundtable. “Companies must also invest in employees, deliver value to customers and deal ethically with suppliers.” The statement was signed by nearly 200 chief executives, including the leaders of Apple, American Airlines, Accenture, AT&T, Bank of America, Boeing and BlackRock.

“While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all of our stakeholders,” the statement said. “We commit to deliver value to all of them, for the future success of our companies, our communities and our country.”

Now of course we can all be excused some cynicism, knowing these executives owe their jobs to cartels of the biggest proxy voters. Moreover, many of them have manipulated rules of incorporation and taxation to keep trillions stashed outside of ‘our country.’ And a habit of craven kowtowing to very large, despotic foreign powers has tested every moral claim.

Still, the statement amounts to a long overdue correction of a malignant tumor-meme that infected corporate America since 1970, Milton Friedman’s cant that corporate officers owe duty only to immediate value for big shareholders.[2] Everything else, Friedman soothed, from long range planning to investment, to reputation, to the good of the commonwealth that supports our people and system, would work itself out via basic market forces. Unleashed from any residual sense of complexity or duty, members of an ever-narrowing CEO caste appointed each other to boards that then set ever-escalating executive compensation packages based on quarterly stock performance.

Under sway of the ones who would benefit most, Republican Congresses not only passed Supply Side tax cuts that supremely favored the upper crust, but removed controls that the Greatest Generation had put on maneuvers like stock buybacks, in which companies have lately spent many tens of billions in reserves and profits purchasing and inflating their own shares in order to… you guessed it… help officers make their “Friedman goals,” their magic bonus value thresholds.

Results have been uniformly disastrous, with corporate R&D and long term investment rates plummeting while executive pay, including stock and bonuses, went through the roof. So what are we to make of this?

THE BIG LIE: FISCAL RESPONSIBILITY

We’ll soon see clearly that Republican administrations are always – 100% of the time – far worse wastrels when it comes to debt and deficits, a point made with emphatically clear charts, later in this chapter.

Late News October 2019: “U.S. deficit hit $984 billion in 2019, soaring during the Trump era. Budget experts say it is unprecedented for America’s deficit to expand this much during relatively good economic times.” [3]

Further, when your RASR or ostrich Republican mewls about the inevitable demise of Social Security and our failure to act on that slow death spiral, you might mention how – back in 1993 when Democrats had Congress and sincere adult Republicans still existed – President Clinton fostered the Bipartisan Commission on Entitlement and Tax Reform as part of the administration's effort to promote economic growth and control the budget deficit. The purpose of the commission, chaired by Senator J. Robert Kerrey (D-NE) and Senator John C. Danforth (R-MO), was to seek bipartisan agreement on long-term entitlement reform and structural changes to the tax system. [4]

The resulting bill almost passed.[5] It would have gradually cranked up retirement age and saved trillions, in exchange for instituting health care for children and the poor along with meaningful contributions by the rich. But the opportunity was trashed, first by Newt Gingrich and then by Dennis Hastert, who worked with Fox to end all traces of adulthood in the GOP. Danforth-style Republicans are now entirely extinct.

That entitlements reform package is still out there. Fiscal conservatives could make a win-win deal. But then – as happened with Welfare Reform – a major hot button issue to rant at their base might go away! And we can’t have that now, can we?

MUTANT TALENT? [6]

Why are executive compensation packages so vastly higher in the U.S. than anywhere else in the world? Even many of the smartest billionaires, like Bill Gates and Warren Buffett have joined in warning that it’s gone way out of hand. But those denunciations are shrugged off by the right as sour grapes.

“These CEOs and such are worth every penny!” comes the rejoinder without much or any comparative proof. Alas, while countless pundits and critics have denounced these skyrocketing compensations as immoral, what we seldom hear is the objection put in AdamSmithian terms. Tell me if you’ve encountered this:

“These CEOs and such are worth every penny!” comes the rejoinder without much or any comparative proof. Alas, while countless pundits and critics have denounced these skyrocketing compensations as immoral, what we seldom hear is the objection put in AdamSmithian terms. Tell me if you’ve encountered this:

By the very notion of capitalism, when pay for a service goes way up, it should draw in talent from elsewhere, competing for the greater rewards. Many of society’s brainiest and best would drop other pursuits to go into management and finance, till the available talent pool (supply) reaches saturation with demand. Competition then brings pay levels back to equilibrium.

Yet they keep climbing into the stratosphere. Your assertion amounts to a repudiation of the market economics you claim to believe in!

It’s a different and in some ways better argument than the moral ones offered by Gates, Buffett and every decent person. Alas, Oligarchy’s shills have a counter:

“Market forces won’t bring down prices if the commodity is super scarce. These are mutant-level geniuses! No would-be competitors drawn in from other fields can possibly grasp or perform on those mountaintops.”

Ah, good one. But in this back-and-forth we get the last word:

So today’s hand-over-fist U.S. corporate execs are like mutant NBA basketball stars? Each worth whatever the team can possibly afford? But… um… aren’t those sports stars subjected to the most intense scrutiny, tracking and performance metrics of any humans on the planet? Their “mutant” status is verified analytically…

…which is the last thing that most CEOs today want. In fact, a great many writhe to avoid performance appraisal, issuing excuses and distractions that would embarrass any ball court prima donna.

This calls for an experiment! Let’s see how Boeing and other manufacturing firms do, if they go back to promoting top officers from among the best engineers who actually build stuff?

On that note, I recommend a 1954 Hollywood movie – with William Holden and Barbara Stanwyck – called Executive Suite, which illustrates how we’re not the first to face these issues, with more and more boardrooms taken over by financial wizards instead of folks who came up delivering the goods and services the company is all about. Notably the Chinese – for all their faults – draw most of their ruling officials from a cadre of skilled managers who had been engineers. And that’s doing well by them. [7]

“All for ourselves and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind. As soon, therefore, as they could find a method of consuming the whole value of their rents themselves, they had no disposition to share them with any other persons.”

– Adam Smith

THAT VOODOO THAT YOU DO

You’ve seen this before and will several more times in this collection of essays. For decades we’ve been subjected to cult incantations like the Laffer Curve [8] and Supply Side “economics” that foretold a spectacular – nay miraculous – outcome: that huge tax cuts for the rich would prompt recipients to invest heavily in R&D, product development and new factories! (Thus increasing the “supply” side of the supply-and-demand curve, get it?) Moreover the ensuing boom in stimulated economic activity would result in increased revenue for the treasury, even at the lowered tax rates! And hence, supply side promised almost instantly reduced federal and state governmental deficits.

Prime the pump with a gusher of red ink… and soon you’ll be swimming in lovely black ink surpluses! It’s not surprising that this alluring theory was tried once. Is it shocking that we bought it again and again? And again, when it never once delivered? Among my top five demands for a wager, listed elsewhere in this book, is this one:

Can you name even one Supply Side prediction that ever came true? In science, or indeed most fact-centered professions, repeated failure to predict outcomes is deemed a likely sign of flakery, if not flat-out dishonesty. Hence the war on fact professions.

Evonomics.com – the smartest site online for economic/social analysis – aims not at opposing free markets, but saving them from the oligarchy disease that ruined flat-fair-creative competition in every past civilization. No online site discusses Adam Smith more often. [9] (My own Evonomics page is here. [10]) Take for example, Steve Roth’s essay “Capital’s Share of Income Is Way Higher than You Think,” [11] which dissects how almost half of the market income arriving at U.S. households is received just for being wealthy – owning stuff – and not either work or active investment.

Oh, there are exceptions! Many of the recent tech zillionaires – who spend their days happily working alongside engineers and creative types – recycled their extra cash into R&D, new ventures, new goods, services and productive capacity, even daring exploits in accessing the resources of space! That’s exactly what the mad right said would happen with Supply Side. (Moreover can you guess which way those long-ROI, risk-taking, tech-savvy caste of investors lean politically? With a few exceptions, like Peter Thiel, they are mostly Democrats, [12] or independents who agree that markets must be regulated to reduce the age-old enemy of enterprise –cheating. [13])

But as for the vast majority of Supply Side largesse recipients, they aren’t looking for risk or to sweat hard on some new venture. When they get a sudden burst of income, most of the rich plant it where Smith described aristocrats always pouring their excess wealth, into passive rent-seeking – or rentier – properties with safe or seemingly-guaranteed return. Of course this inflates asset values, not just stock equities but also real estate, even art. (Recent mass-purchases of rental properties by rich families have priced young first time home buyers out of the market.)

Beyond asset bubbles and expanding wealth disparities, perhaps the worst effect is plummeting money velocity, a measure of how often each dollar gets spent. Now there are times – e.g. during high inflation – when you want MV to go down! But generally speaking, a dollar paid to a bridge repair worker, say during an infrastructure campaign, will get spent immediately at the grocer, whose employees spend quickly for their own needs, and so on, hence high “velocity” for that dollar, which gets spent and taxed many times. But when rich folks get a lot richer – even good guys like Buffett – not very many of those dollars go to workers at the yacht factory. (The aspersion that Supply Side is “trickle down” aims in the right direction, but doesn’t do justice to this travesty.) Again, most of that extra income goes into passive rentier investments that send Money Velocity crashing.

Indeed, MV has crashed, even as deficits and debt go through the roof with every double-down we’ve seen on Supply Side voodoo. And yes, I will gladly make this a wager as described in Chapter 15.

Now let me be clear yet again. I want competitive-flat-fair-creative markets to work well. I know where the taxes come from that pay for liberal programs that uplift poor children, so they can then innovate and compete, in a virtuous cycle never before seen in human annals. But there are reasons why oligarchs, Laffer cultists and other fanatics had to change so many rules to get those gushers flowing into aristocratic maws. Because the Greatest Generation knew better. Massive stock buybacks etc. were banned! And if you wanted tax relief to help you to invest in long ROI product development, or factory equipment, you took generous deductions specifically targeted for those things! Moreover, when the state invested in your workers’ sanitation, health and children, plus the R&D and infrastructure that maintain a forward moving civilization, you saw that as ultimately beneficial to your shareholders… and everyone else.

Now let me be clear yet again. I want competitive-flat-fair-creative markets to work well. I know where the taxes come from that pay for liberal programs that uplift poor children, so they can then innovate and compete, in a virtuous cycle never before seen in human annals. But there are reasons why oligarchs, Laffer cultists and other fanatics had to change so many rules to get those gushers flowing into aristocratic maws. Because the Greatest Generation knew better. Massive stock buybacks etc. were banned! And if you wanted tax relief to help you to invest in long ROI product development, or factory equipment, you took generous deductions specifically targeted for those things! Moreover, when the state invested in your workers’ sanitation, health and children, plus the R&D and infrastructure that maintain a forward moving civilization, you saw that as ultimately beneficial to your shareholders… and everyone else.

So, again… name one reason we should trust a supply sider with more than a wet match?

However beautiful the strategy, you should occasionally look at the results.

– Winston Churchill

AGAIN, CRISES OF CAPITALISM

Let’s get back to the Business Roundtable’s revised notion of corporate duty, rejecting Milton Friedman’s at-best-myopic commandment to fixate solely on quarterly share price. Fine, thanks BR. It’s now recommended that companies also invest in employees, deliver value to customers and deal ethically with suppliers. I would certainly expand that customer service goal to thou shalt fulfill what the company exists for!

If it’s widgets, take pride in those widgets. And if you’ve branched from widgets into cloud based AI, doesn’t it make sense to prioritize doing that well? Sure, this desideratum overlaps with customer service. But sometimes your vision will stretch beyond what customers currently desire. It should.

Many times in this volume I recommend getting a better than clichéd notion of what Karl Marx and Marxism (seldom the same) were about. Remember when it seemed that both were consigned to history’s dust-bin? Well, old Karl’s tracts are flying off the shelves now, on university campuses and in worker ghettos around the globe. And the smarter billionaires are starting to notice. They’ll consider what kind of society could serve their enlightened self-interest over the long run. In my novels, Earth and Existence, I forecast that some members of a world aristocracy might even hold conferences about it, and perhaps we are seeing crude, preliminary signs.

“It’s not whether we should be capitalist or socialist. It’s how do we make sure that capitalism is working the way it has in the past,” said top investor Alan Schwartz at the recent Milken Conference, [14] warning of “class warfare.” He noted that salaries and wages as a percentage of the economic pie are at a postwar low of 40%, prompting a “throw out the rich” mentality that would require some form of income redistribution to head off.[15] The rise of inequality is discussed in great detail – and placed in historical context – in Thomas Piketty’s tome, The Economics of Inequality, as well as in Capital in the Twenty-First Century, where Piketty notes, “At the heart of every major political upheaval lies a fiscal revolution.”

Mega investor Ray Dalio warns that unless the American economic system is reformed “so that the pie is both divided and grown well” the country is in danger of “great conflict and some form of revolution that will hurt most everyone and will shrink the pie.” [16]

Later in this chapter we’ll see those charts I promised, revealing how Republicans are vastly worse regarding debts and deficits. But let’s start with the one below, which repudiates every claim of the Supply Side cult. It shows how U.S. wealth disparity underwent steady decline under Rooseveltean social-economic arrangements, as the share owned by the bottom 90% rose steadily compared to the portion held by the top 0.1%, all of it accompanying rapid GDP growth and scientific/technical advancement. This ongoing augmentation of the middle class shattered every prediction made by Karl Marx, making his followers look dimwitted…

.png)

… that is, until the Reagan era’s reversal of post-WWII tax, regulatory and labor policies weakened unions while undermining investment in infrastructure and R&D, pouring wealth instead into the “job creators” – an “investor class” whose behavior began mirroring every anti-competitive, “rentier” syndrome described by Adam Smith, in Wealth of Nations.

Even more ominous, resurgent Marxists are now nodding and grinning, diagnosing the Greatest Generation’s experiment – in flat-fair-competitive-creative market enterprise bolstered by a vigorously progressive nation – as mere a historical blip, temporary aberration that no nation could sustain, as top oligarchs manipulate the system toward self-destruction, in patterns that exactly follow Old Karl’s forecasts, in Das Kapital.

Maintaining a civilization of empowered citizenship and fair-competition is a dilemma summed-up by famous historians Will and Arial Durant, in The Lessons of History:

"…the unstable equilibrium generates a critical situation, which history has diversely met by legislation redistributing wealth or by revolution distributing poverty.”

You’ll see that cogent quotation in several of this book’s chapter-essays. “Redistribution” is one of those words that can trigger apoplexy and get you called all sorts of names. But it’s exactly what the poorest two-thirds across the globe will demand, when they see that they can double their book wealth just by transferring title from say the 50 wealthiest families. It might happen quicker than you think, in a fit of fervent politics, without even needing guillotines. And would that be the end of the world for hundreds of millions of entrepreneurs and business owners, inventors and regular capitalists? Their chief concern won’t be to protect the uber-most lords who are striving daily to make Marx’s final scenario come to life. Their aim will be to prevent the revolution from radicalizing and crushing market enterprise, altogether.

Again, take a “redistribution” example that few ever discuss, but I mention in several places – when the American Founders (hardly viewed as the most radical of socialists) seized and parceled out up to a third of the land in the former colonies, an act of redistribution that makes FDR look like a minnow. And it was matched later by the taking of “property” from Southern slaveholders and redistributing that ownership to… well… to those freed people themselves. Oh there are precedents. And each time, market enterprise survived.

Each time, thereafter market enterprise thrived.

The lesson? Moderate resets don’t have to be the end of the world. But worlds can end if you greedily defer all moderate resets, tempting fate by tempting mobs.

Part Two of this economics chapter of POLEMICAL JUDO — including those promised charts on comparative fiscal responsibility, deficits and debt — can be found here. Or just order the book, here.

Footnotes:

[1] “Milton Friedman Was Wrong: The famed economist’s “shareholder theory” provides corporations with too much room to violate consumers’ rights and trust.” https://www.theatlantic.com/ideas/archive/2019/08/milton-friedman-shareholder-wrong/596545/

[2] Friedman’s cult of quarterly profit: https://www.theatlantic.com/ideas/archive/2019/08/milton-friedman-shareholder-wrong/596545/

[3] U.S. deficit hit $984 billion in 2019: https://www.washingtonpost.com/business/2019/10/25/us-deficit-hit-billion-marking-nearly-percent-increase-during-trump-era/

[4] In the 1970s capitalists were terrified by the fact the Union Pension funds seemed – if funded at projected rates – to be the main accumulating pools of capital. Indeed, by 2020 workers would ‘own the means of production’ that way, organically, without revolution. I believe much of the Reagan and after "revolution" was specifically targeted to end that dire ‘threat.’ They succeeded… and not one pundit today even remotely recalls those old worries, or sees or mentions how it was prevented, even though it was much discussed in the 1970s.

[5] https://www.ncbi.nlm.nih.gov/pubmed/7999185

[6] Other economic topics: About liberals reclaiming Adam Smith: http://davidbrin.blogspot.com/2013/11/liberals-you-must-reclaim-adam-smith.html About Smith and Friedrich Hayek http://evonomics.com/stop-using-adam-smith-and-hayek-to-support/

Recall from Chapter 9 how Americans Spent Themselves into Ruin… But Saved the World http://davidbrin.blogspot.com/2009/11/how-americans-spent-themselves-into.html Crucially, the world still needs America to keep buying, so that factories can hum and workers send their kids to school, so those kids can then demand labor and environmental laws and all that. And for that to happen, U.S. inventiveness – the golden egg-laying goose that paid for it all – must be preserved.

Finally, in an economics riff that was too complex to be included in this political book, I explore how nearly all “leaders” fool themselves into thinking they can “allocate” a nation’s resources better than market forces. Those in the West who most loudly proclaim Faith in Blind Markets – or FIBM – are members of a narrow, incestuously conniving CEO caste who ‘pick winners and losers’ far more narrowly and with far less competitive knowledge than those communist or kingly allocators of old. http://davidbrin.blogspot.com/2006/06/allocation-vs-markets-ancient-struggle.html

[7] Take the downfall of Boeing Inc., which began when the aircraft manufacturer’s executive offices moved far away from the design, safety and production centers in Seattle and Omaha, with top positions filled from the CEO-managerial caste, instead of engineers. My rascally-impudent suggestion that could save America in dozens of ways. Ban the undergraduate business major. Let folks come back for a masters after they’ve spent some years creating and delivering goods and services. There, I said it. See other crackpot suggestions in Appendix #2.

[8] In fact, there are levels at which the Laffer Curve is true! If you tax everything, business will halt and you’ll get nothing. So? The 1980s incantation was that the curve was always in the over-taxed, business suppression zone. No proof. None. And subsequent experiments – at the extreme in Kansas during 2015-2018 – showed diametrically opposite lessons.

[9] Except, of course, scholarly sites dedicated to the study of Adam Smith! https://evonomics.com

[10] “Best-of-Brin” essays about the world, economics, politics and philosophy at the Evonomics site. http://evonomics.com/author/davidbrin/

[11] From Evonomics: http://evonomics.com/capitals-share-of-income-is-way-higher-than-you-think/?utm_source=newsletter_campaign=organic

[12] My anecdotal assertion. But I’ll consider sincere offers of wagers. While Wall Streeters & oil-guys are “risk-taking” they remain short-ROI and hostile to science.

[13] "Ironically, Smith's epic work The Wealth of Nations, which was first published in 1776, presents a radical condemnation of business monopolies sustained and protected by the state, in service of a lordly owner-caste. Adam Smith's ideal was a market comprised of small buyers and sellers. He showed how the workings of such a market would tend toward a price that provides a fair return to land, labor, and capital, produce a satisfactory outcome for both buyers and sellers, and result in an optimal outcome for society in terms of the allocation of its resources. … He made clear, however, that this outcome can result only when no buyer or seller is sufficiently large to influence the market price–a point many who invoke his name prefer not to mention. Such a market implicitly assumes a significant degree of equality in the distribution of economic power–another widely neglected point." – from David C. Korten's book, When Corporations Rule the World.

[14] https://www.latimes.com/business/la-fi-milken-conference-ray-dalio-20190502-story.html

[15] “Throw out” is of course a euphemism for what folks risk, if they let disparities reach levels of 1789 France or 1917 Russia. And those thresholds are closer than most think.

[16] Ray Dalio. https://www.barrons.com/articles/billionaire-ray-dalio-income-inequality-education-u-s-at-risk-51554468777

*******

Picture of Adam Smith by Unknown author – http://www.nationalgalleries.org/object/PG 1472, Public Domain, https://commons.wikimedia.org/w/index.php?curid=20413810

Picture of Winston Churchill by digitized by: BiblioArchives / LibraryArchives – Flickr: Sir Winston Churchill, Public Domain, https://commons.wikimedia.org/w/index.php?curid=41991931