4 more years!

4 more years!

At this pace, in 4 more days anther 240,000 American citizens will hve the "China Virus" – named so by the President despite the fact that, to this day, less than 100,000 Chinese citizens have caught the virus – TOTAL! By election day, 480,000 more Americans will be infected, more than Germany's 8-month total and, at over 60,000 infections per day (more than Singapore or Ireland's totals), we are now pacing at a new record of infections heading into an election to decide between a candidate who belives the virus is a major threat and one who doesn't.

Keep in mind these infections are increasing and, with 8,637,000 Americans now infected (one in 38 people), if we don't DRASTICALLY change our ways (hint, hint for next Tuesday!), we are on a truly disastrous path that is not only a threat to your health – but a dire threat to our economy as well. This is the ticking time bomb Trump is leaving us, whether he stays in office or not. Like George Bush II's economic collapse before him, the Democrats will inherit a disaster in progress which the next Republican Candidate will try to blame on the Democrats – and not the man who truly caused it.

I would almost hope Trump does get re-elected – so that people will truly see him trapped in a bankruptcy he won't be able to walk away from but that bankruptcy – Moral, Ethical, Evironmental, Financial, Health and Reputational – is our bankruptcy and the bankruptcy of our children, which will take many, many years to recover from.

I would almost hope Trump does get re-elected – so that people will truly see him trapped in a bankruptcy he won't be able to walk away from but that bankruptcy – Moral, Ethical, Evironmental, Financial, Health and Reputational – is our bankruptcy and the bankruptcy of our children, which will take many, many years to recover from.

The problem is, we simply can't afford 4 more years of this – one can only hope that's finally becoming clear to the swing voters, most of whom are forced to either to risk voting by mail or risk going to the crowded polls with their masks on, waiting hours in line knowing 1 out of 48 people around them has been infected with the virus already.

My oldest daughter was disenfranchised, she's a likely Biden voter from New Jersey who is going to college in Pennsylvania and her absentee ballot simply didn't come – despite several attempts by her to contact them and re-request a ballot. Not sending ballots to college students who are likely not to support the President is a great way of cancelling Millions of votes, so don't count Trump out yet, he could still win this thing.

A Memphis, Tenn., poll worker turned away people wearing Black Lives Matter T-shirts, saying they couldn’t vote. Robocalls warned thousands of Michigan residents that mail-in voting could put their personal information in the hands of debt collectors and police. In Georgia, officials cut polling places by nearly 10%, even as the number of voters surged by nearly 2 Million. Trump's recently-appointed judges have gotten into the act as well:

- The 9th Circuit Court of Appeals, overturning a lower court, refused to give Arizona voters a second chance to sign mail-in ballots. Without a reversal, unsigned mail-in ballots will now be discarded.

- Another federal appellate court also reversed a lower court and prohibited voters in Texas from clearing up signature mismatches. Voters will only learn after the election if their vote didn’t count.

- The U.S. Supreme Court stopped a South Carolina court order that said mail-in voters should not be required to have a witness sign their ballot. All mailed ballots will now have to include a witness signature, despite concern that the requirement is overly burdensome during the COVID-19 pandemic. The ruling also prohibits voters who forgot to get a witness from fixing — or “curing” — their errors.

- The Supreme Court on Wednesday overturned a lower court ruling that allowed Alabama counties to offer curbside voting, in a bid to lessen voters’ exposure to the coronavirus. In a 5-3 ruling, the court’s conservative majority blocked drive-up voting. The decision was criticized as harmful to Alabama’s Black voters during a health crisis that has disproportionately affected Black and Latino Americans.

- Republicans are trying to prevent changes to allow the counting of ballots that arrive after Nov. 3. in three other battleground states — Michigan, Wisconsin and Minnesota.

- On Friday, the GOP went to court to try to stop the counting of mail-in votes in Nevada. The party said it needs observers to scrutinize the process, in a state where Democrats have mailed in more than two times as many ballots as Republicans.

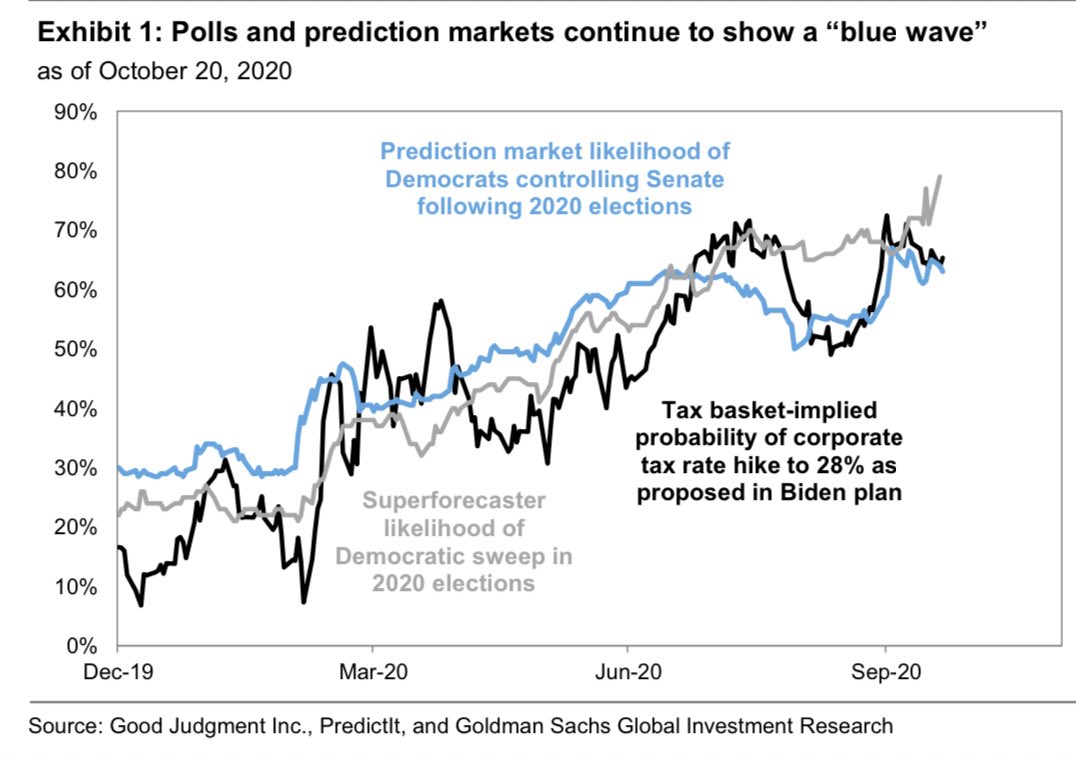

So what? It's just Democracy being trampled. We used to go to war with other countries over such atrocities, now it's happening in our own back yard and people just have too many other things on their minds to worry about it, apparently. All this uncertainty is not good for the markets and our Futures are down about 1% this morning – our first down Monday in a long time and we're back below 3,420 on the S&P 500 – again.

We talked about shorting the S&P (/ES) Futures in Friday Morning's PSW Report so congratulations to all who played along. It's going to take a catalyst to get us much lower as the 50-day moving average is at 3,408 and that should be solid support as it's rising so certainly this area will be bouncy in the very least and we've already calculated 3,450 to be the weak bounce line according to our 5% Rule™ while 3,480 would be the strong bounce line, which was harshly rejected on Friday (as we expected). Still, we know who we have to thank for the rally we've had so far:

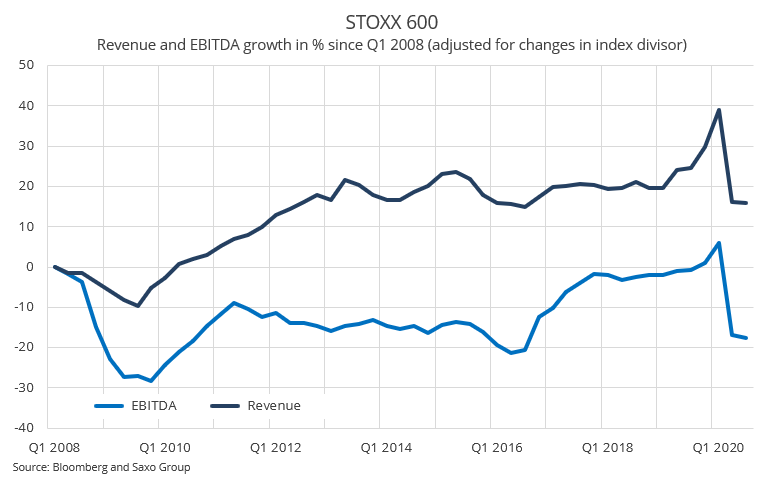

See, it only cost $7Tn so far this year to keep the GDP down 10% and $7Tn is 35% of our GDP – that's a pretty expensive habit if we can't break it on November 3rd, isn't it?

It's a busy week on the Economic Calendar as we hear from the Chicago, Dallas and Richmond Feds today and tomorrow, followed by the first look at Q3 GDP, which is supposed to be up about 31% but, before you get too excited, that's after being down 31% last Quarter and you would think that is net 0 but 100% less 31% (31) is 69% and 69% plus 31% (21) is only 90% so Q3 GDP is still down 10% from Q1 (which also sucked) but, of course, that's not the number Trump will be touting to his endlessly gullible base, is it?

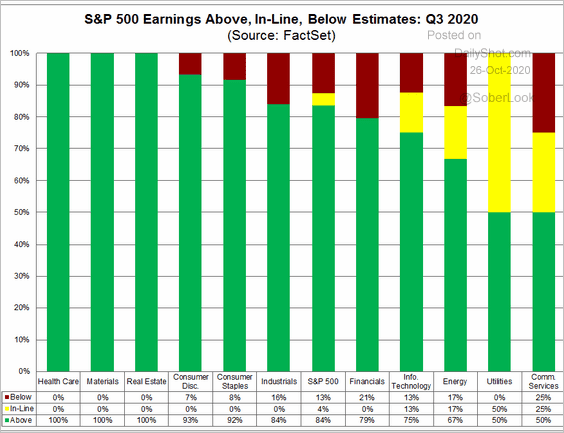

Earnings continue to come in hot and heavy with too many big names to count so buckle in for a wild ride on that front as well. So far, earnings haven't been much worse than they were in Q2 – but they aren't much better either…

Healh Care, Materials and Real Estate seem to be the places to be in Q3! Still:

Just remember, no matter who wins next week – half the people are going to be very unhappy and, if even some of those people want to sell their stocks – do we have anywhere near enough buyers to stop the prices from plunging? What if those people worry Biden might raise Capital Gains taxes next year and they want to take their low-tax profits while they can?