Four more years?

Four more years?

Whether Trump wins or loses America has spoken and at least half of us have seen Trump in action for the last 4 years and WE WANT MORE! Even if Biden squeaks out a victory at this point, the Democrats are unlikely to control the Senate – so nothing much will change. Ex-President Trump will tweet just as much as President Trump and, just 3 years from now, he can enter the 2024 race, looking to pull a Grover Cleveland and get elected to non-consecutive terms. No matter what happens, what we have told the World today is that we, as a country, do not reject Donald Trump, his words or his actions – pretty much half of us want 4 more years of it.

Biden will have no mandate to make sweeping changes and Trump, if he loses, will be calling the election a fraud for the next 4 years, rallying his base and inciting more fury and division than we already have. Trump already declared victory last night and threatened to go to his Supreme Court to halt the counting, knowing full well that the uncounted mail-in ballots are very much in Biden's favor. Chris Wallace, on Fox News, reacted to Trump’s speech by saying: “This is an extremely flammable situation and the president just threw a match into it. He hasn’t won these states.”

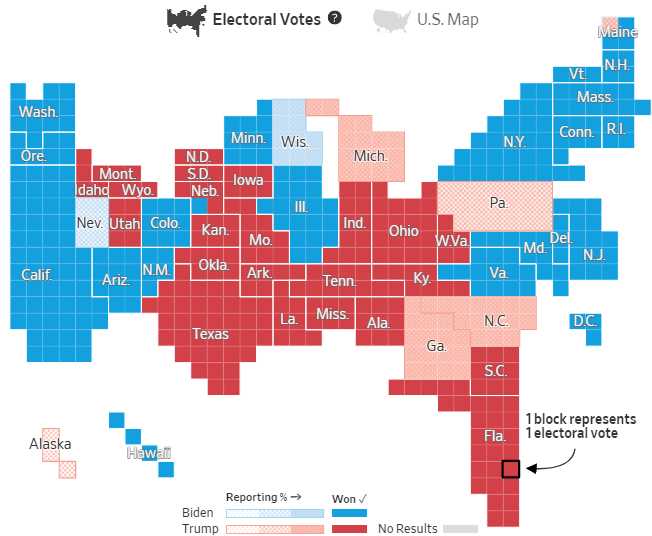

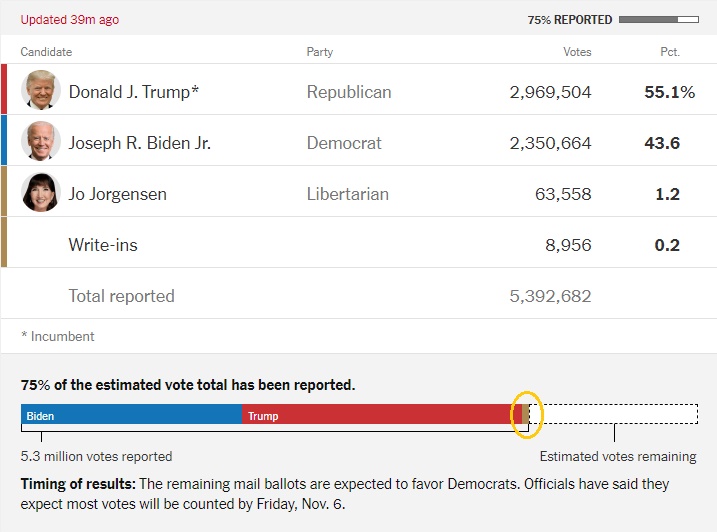

Republicans have filed lawsuits in PA to stop the counting before liberal Philadelphia's votes are counted with two cases to be heard tomorrow. MI, PA and WI are all likely to turn to Biden which currently look like Trump wins and AZ, NV and GA all have a lot of uncounted blue votes.

Republicans have filed lawsuits in PA to stop the counting before liberal Philadelphia's votes are counted with two cases to be heard tomorrow. MI, PA and WI are all likely to turn to Biden which currently look like Trump wins and AZ, NV and GA all have a lot of uncounted blue votes.

In Pennsylvania, for example, you can see that Trump's 600,000 vote advantage has Fox News declaring PA for the President but 25% of the votes (1.5M) remain uncounted and Biden has been winning the uncounted votes by 3:1 and 5:1 margins so far – this is why Trump is so desperate to stop the counting and declare late counting to be a fraud – despite the fact that all votes cast on time MUST be legally counted.

Still, this is no blow-out victory for Biden and, therefore, this is no repudiation of Donald Trump. Whether as President or Tweeter in Chief, Donald Trump will remain the voice of America for quite some time and the Republicans who stuck with him are mostly being rewarded with re-election as well – that's our reality for 2020-2024, so get used to it.

And how are the markets reacting? Up another 200 points in the Futures so all must be well in Trumpland. The Dollar took a huge dive overnight and that's been boosting the markets. Our Long-Term Portfolio is back to $1M – up 100% so all is well with our holdings and we cashed in most of our hedges in anticipation of this bounce, which is now back to our magical 3,420 line this morning so we'll see how that goes. It's also 1,600 on the Russell and 11,666 on the Nasdaq along with 27,500 on the Dow.

As usual, 3,420 is a very tempting shorting line on the S&P but only if it's rejected and VERY TIGHT STOPS over that line, please. The good thing about this level is I get to cut and paste my old reports:

Fabulous Thursday – Testing our Strong Bounce Lines – Again

by phil – October 8th, 2020 8:11 am

Here we are again.

I don't even have to write anything new today, I'll just copy and paste what I said on September 15th, in: "Terrific Tuesday – S&P 3,420 Yet Again":

As we discussed last week (when we failed at 3,420), 3,420 is our Strong Bounce Line and the 20% Line so we knew we were likely to re-test it – the question is whether or not the S&P passes the test and we may find that out this morning as the Futures are pointing up yet another 1% – just like yesterday when we made most of our gains in the thinly-traded pre-market session.

Our 5% Rule™ told us 3,420 would be our Strong Bounce line on the way back up but it was much easier to call a short the first time we tested the line, as we did on the 9th in our Live Member Chat Room, because we had not consolidated for a move higher at the time. Now the markets have had time to digest the bounces and we're above on all the indexes but the S&P 500 as back on the 9th it was:

Another chance to short at 3,420 on /ES with tight stops above. Lined up with 28,200, 11,475 and 1,540.

So the other indexes are much higher than they were last time we tested this level, a month ago. Here we are again but it's a dangerous play with all this election uncertainty so we'll just have to go with the flow and stay nimble.

- October ADP Jobs Report: +365K vs. +650K consensus, +749K prior.

- Large employers added 116K jobs, midsized 135K, and small 114K.

- Service-producing jobs were up 348K, and goods-producing up 17K.

- Cantor Fitzgerald analyst Pablo Zuanic weighs in on the cannabis industry after the election results. He notes a GOP Senate is less bullish for the industry, but notes that there are 8 Republican Senators now from recreational states (MT, SD, AK, and MI one or two) that may be supportive of marijuana reform.

- In regard to individual stocks, Zuanic says Curaleaf Holdings (OTCPK:CURLF) is a clear beneficiary of recreational approval in New Jersey (where it has #1 share) and Arizona (#2 share). He also notes that Neutral-rated Harvest Health (OTCQX:HRVSF) generates 50% of its sales from Arizona.

- Cantor has an Overweight rating on Curaleaf and a Neutral rating on Harvest Health.

- The ETFMG Alternative Harvest ETF (NYSEARCA:MJ) is down 2.15% in premarket trading.

- Earlier: Pot stocks get smoked despite latest marijuana legalization

- The votes are in and sports betting initiatives don't need a recount.

- Voters in Louisiana approved sports betting in 55 out of 64 parishes. Lawmakers still must draft the rules and regulations necessary to implement sports wagering.

- Voters in South Dakota also approved sports betting. Legislation will still need to be passed to determine tax rates and regulatory measures. Sports betting is expected to be active in South Dakota by the end of the year.

- Maryland also passed a sports betting initiative (see details).

- Nebraska and Colorado voters approved measures for land-based casinos that opens up revenue opportunities and should support sports betting as well.

- For investors, the approvals in the new states resets the long-term expectations.

- "Our analysis of current and proposed legislation indicates a clear path to as many as 35% of Americans having access to online sports betting by the start of the 2021 NFL season," notes Evercore analyst Kevin Rippey.

- "Covid has pulled forward the legalization of online gambling in several major states, which we argue will accelerate a broader domino effect. By 2025, we model 60% of U.S. having access to legal OSB."

- DraftKings (NASDAQ:DKNG) is up 2.22% in premarket action. Penn National Gaming (NASDAQ:PENN) is 0.40% higher and Fanduel-owner Flutter Entertainment (OTCPK:PDYPY) is 1.52% higher in London. MGM Resorts (NYSE:MGM) is up 0.55%.

- The firearms pure-play sector is slightly higher with the U.S. election results still pouring in.

- As it stands now, betting markets (Betfair, PredictIt) favor Joe Biden winning the presidency and the GOP holding the Senate, although those markets have swung around wildly over the last 12 hours.

- Smith & Wesson Brand (NASDAQ:SWBI) is up 0.11% and Sturm, Ruger (NYSE:RGR) is 0.78% higher.

- Smith & Wesson and Sturm, Ruger have outperformed the S&P 500 Index over the last year on strong firearms demand, which was due in part to concerns over a Democratic sweep of Congress and the White House.

- Those looking for election 2020 stocks need to look no further than the defense sector, which soared yesterday on the eve of Election Day.

- It's one of the industries that shouldn't be affected by a drawn-out or contested result, with both candidates pledging to put more resources into military spending.

- "Defense spending is always a bipartisan issue," analysts at Goldman Sachs said in a research note. "Both sides want to spend money on defense. To what extent they will that's a different story but both sides want to spend money on defense."

- Joe Biden said he may increase spending in areas the Pentagon "desperately needs to innovate" such as "unmanned capacity, cyber and IT." His advisors have also suggested that "certain areas the [military] budget is going to have to be increased."

- Defense stocks have climbed sharply overall under President Trump, even with the COVID-related selloff hitting the sector, and generally tend to do well under GOP-led administrations.

- Shortly after winning the election in 2016, Trump added more than $200B to the defense budget for fiscal years 2017 through 2019, and in December of 2019, he signed a $738B defense bill for fiscal 2020.

- Premarket: LMT +2.6%, GD +2%, NOC +1.8%, ITA +1.6%, RTX +1.1%, BA +1.1%, LHX +1%, HII, ITT, TXT, LLL, AVAV, KTOS, PPA, XAR