Recession in Europe – again?

Recession in Europe – again?

The eurozone economy has suffered a weak start to the year, with high coronavirus infection rates and government restrictions increasing the risk of a second recession since the pandemic first struck last year. Fresh Covid-19 outbreaks that authorities have struggled to contain are continuing to weigh on economic activity and have damped expectations for a strong global recovery in the first half, a reality that US Investors, so far, have refused to face.

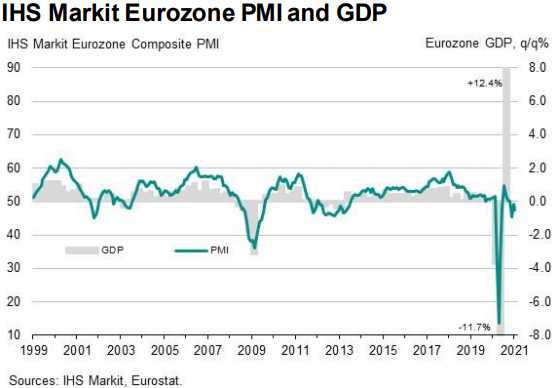

In the early months of the year, a number of large economies face the threat of declining output as restaurants, cinemas and a wider range of businesses that involve close physical proximity are closed or have had their activities severely curtailed. Data firm IHS Markit said its Composite Purchasing Managers Index, which measures activity in the manufacturing and services sectors, for the eurozone fell to 47.5 in January from 49.1 in December. A reading below 50 points to a decline in activity.

A similar survey for Japan pointed to a bigger contraction in the services sector, while figures for the U.S. to be released later Friday are expected to point to a slowdown in the services recovery.

Seriously people – we're not shocked by this, are we? Most of the investing community is playing ostrich and have been keeping their heads firmly in the sand and pretending the vaccines will somehow "fix" everything but we've had flu vaccines for decades and, guess what, people still get the flu! We are simply refusing to have realistic discussions about our future because it's just too depressing to contemplate but to go the opposite way and invest as if things could not possibly be brighter for our near-term future is simply foolish.

Seriously people – we're not shocked by this, are we? Most of the investing community is playing ostrich and have been keeping their heads firmly in the sand and pretending the vaccines will somehow "fix" everything but we've had flu vaccines for decades and, guess what, people still get the flu! We are simply refusing to have realistic discussions about our future because it's just too depressing to contemplate but to go the opposite way and invest as if things could not possibly be brighter for our near-term future is simply foolish.

We are still in the middle of a Global Catastrophe and it is NOT fixed. We haven't even seen the real repurcussions of the damage it's caused because we are filling all our economic holes with endless supplies of money and we're acting as if that has no long-term consequences. Now that Joe Biden is President, the GOP is worried about the debt again and is seeking to block his $1.9Tn spending program. Then where would we be?

Seriously people, 20% of your GDP can't be stimulus – it's simply not a sustainable situation! DESPITE Germany kicking in 40% of their GDP, Italy 49% (half!), France 29% and the UK 26%, Europe is STILL entering its 2nd Recession in 12 months or, what used to be called a Depression. Technically, a Depression is a severe and prolonged downturn in economic activity commonly defined as an extreme Recession that lasts three or more years or which leads to a decline in real GDP of at least 10% – so we are not, technically, there yet but, if this vaccine doesn't work out as hoped – it will already be year two.

Studies of South African Virus Strain Raise Immunity Concerns

I'm sorry, I know this is depressing but this is REALITY and we've been taking a very long break from reality but now we're back and we need to show backbone to face up to our REAL problems and find REAL solutions – not to pin our faith on false panaceas.

That's not to say we can't still invest – we just need to keep our heads. IBM was our Stock of the Year in 2019, when it hit $120 in Novermber of 2018 and, at that time, we determined the fair value for the company to be $150 but last night they had disappointing earnings and fell back to $120 (-8.5%) this morning so, once again – we love them. As I said to our Members last night in our Live Chat Room:

IBM – Q4 Sales were $20.4Bn, down 6% from last year but there was a 9% increase in cloud offset by a 24% decline in transaction processing BECAUSE EVERYTHING IS CLOSED!!! IBM is the backbone to most of retail since they were there first and they are still the legacy systems for most major retailers. Similarly, Global Tech Services was down 6% BECAUSE EVERYTHING IS CLOSED!!! Systems were down 18% (no one is investing this year) and that caused Financing to be down 5% SINCE THEY FINANCE THE SYSTEMS!!!

For 2021 IBM projects Free Cash Flow of $11-12Bn and, at $122.30, you can buy the whole company for $117Bn.

This will be a good one to jump on.

We already have a position on IBM in our Long-Term Portfolio from the March crash and we'll be taking advantage and adding to that in today's Live Member Chat Room and we'll also be looking for a new trade idea for our Top Trade Alert Members.

This is why we have CASH!!! on the sidelines into earnings season – to take advantage of sales on blue chips! And there is no bluer chip than Big Blue!

Have a great weekend,

– Phil