Small Cap Stock.

Small Cap Stock.

The kind that should give us an indication of the health of the broad economy but, according to the Russell 2000 this past year – 2020 could not have been better as our small cap index rallied back from below 1,000 in March all the way to 2,300 early this morning – that's up 130% in 11 months! Let's say we started the year at 1,600, a 700-point gain is still a nice 43% gain on the year.

We should have a virus every year – is the only possible conclusion we can draw from this action. The Russell topped out at 1,740 in 2018 and was down 42.5% 18 months later – so it's kind of a finicky index but this is truly amazing though the Nasdaq is up from 9,000 to 13,700 and that's 4,700 points, or 52%, but I guess with the Nasdaq we can argue that Tesla (TSLA) and GameStop (GME) deserved their 500% gains in the past year, right?

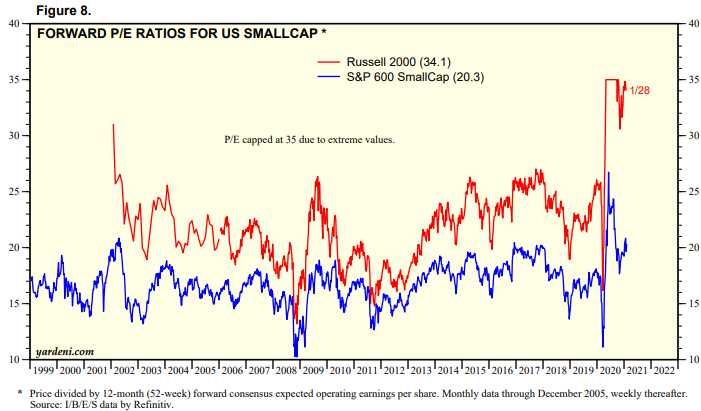

The secret, of course, is to completely ignore the true value of stocks and just assume that, whatever price they are now, they can be higher later. Fortunately, what can't be higher later is the price/earnings ratio of the Russell, which is pinned at 35 and they cap the p/e measures at 35 so stocks that have p/e's of 1,000 don't throw off the scale but, of course, 35 was a number they picked because it was exreme and ridiculous and it was very unlikely ANY stock would exceed 35 for very long before the public became outraged and dumped it.

The secret, of course, is to completely ignore the true value of stocks and just assume that, whatever price they are now, they can be higher later. Fortunately, what can't be higher later is the price/earnings ratio of the Russell, which is pinned at 35 and they cap the p/e measures at 35 so stocks that have p/e's of 1,000 don't throw off the scale but, of course, 35 was a number they picked because it was exreme and ridiculous and it was very unlikely ANY stock would exceed 35 for very long before the public became outraged and dumped it.

Of course, that's not happening at all now and, in fact, almost ALL of the Russell 2,000 stocks now have P/E Ratios higher than 35 so the P/E for the Russell is – 35. If 1,999 stocks had a P/E of 35 and ONE stock had a p/e of 10, the Russell 2,000's average P/E would be 34.9875 but it's not, NO Russell stock has a P/E of 10 and no 2 are under 15 and no 4 are under 20 and no 8 are under 25 and no 16 are under 30 and not even 32 stocks are even under the maximum P/E of 35 – which again was considered so ridiculous that is was to be thrown out as bad data – since there had to be some mistake for a stock to be so ridiculously priced!

And those, by the way, are the OPTOMISTIC Forward Expectations – the ACTUAL earnings of the Russell 2000 are roghly 40% below that but hope does spring eternal and investors are an optimistic bunch and the Government will just keep printing money because there are no consequences for your actions on this planet, are there?

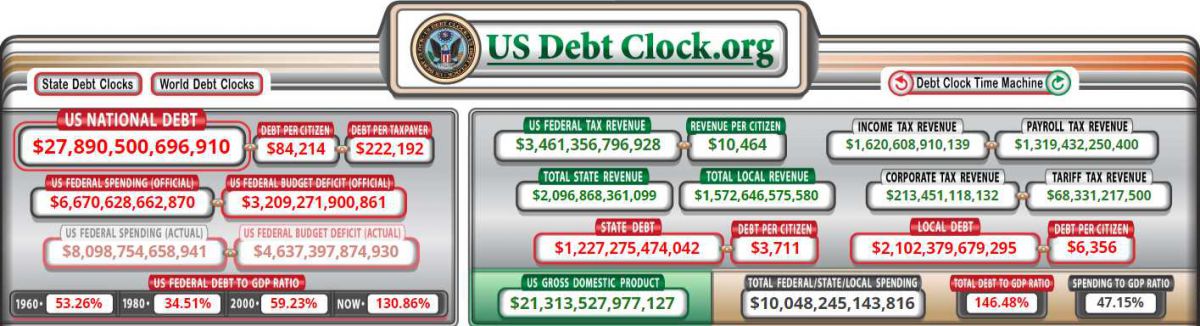

Pay no attention to that debt behind the curtain. $4.6Tn was spent in 2020 by the Government to float our $21Tn Economy so a bit more than 20% of our economy is deficit spending but that doesn't count another $4Tn spent by the Fed, expanding their balance sheet because that's an "off book" transaction – nothing to see there…

That's why the Dollar is 10% lower than it was at the beginning of the year – back where it was when Trump rolled out his Dollar-unfriendly tax cuts and spending spree in his first term. We were "only" $19.5Tn in debt so Trump has added $8.3Tn (42.5%) in 4 years and Biden is going to break the one-year record in 2021 (although this is still Trump's budget through June) so it's very possible the value of our savings will be down another 10% at the end of this year as well.

That's why the Dollar is 10% lower than it was at the beginning of the year – back where it was when Trump rolled out his Dollar-unfriendly tax cuts and spending spree in his first term. We were "only" $19.5Tn in debt so Trump has added $8.3Tn (42.5%) in 4 years and Biden is going to break the one-year record in 2021 (although this is still Trump's budget through June) so it's very possible the value of our savings will be down another 10% at the end of this year as well.

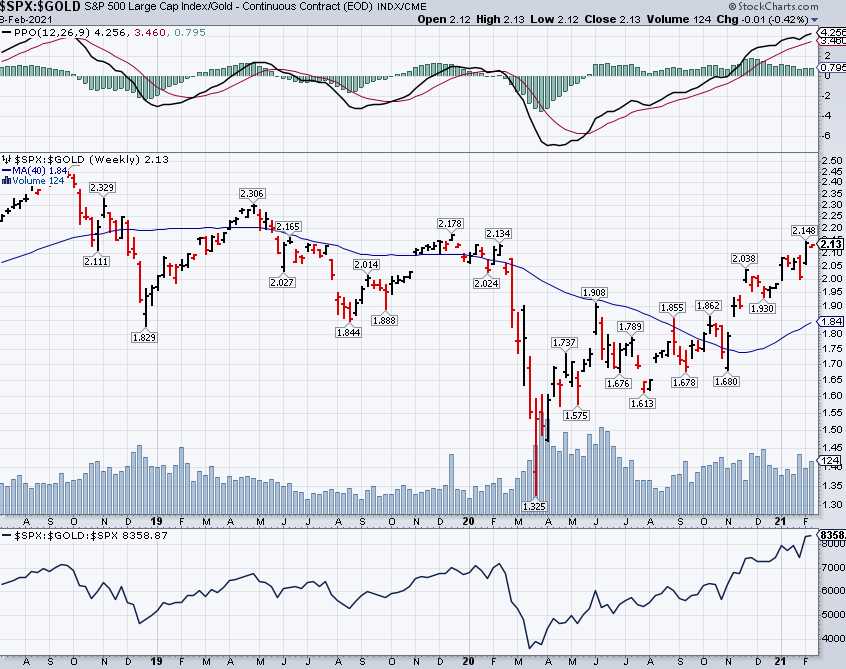

Since we pay for stocks (and commodities) with Dollars, the PRICE of those items goes up – or at least seems to – when the Dollar gets weaker. But what if the market were priced in something else, like BitCoin? Well that would give us a very different picture because, unlike the Dollar (or because of the Dollar), BitCoins have soared in value and, if the S&P 500 were priced in BitCoin, you would need less than 1/10th of a BitCoin to buy a unit of the S&P 500 – and that's down from 0.45 at the start of the year so down 0.36 is an 80% decline for the year so thank goodness BitCoin isn't more popular, right?

Maybe Elon Must is right to start accepting BitCoins for his cars (you only need one or two!) – you sure can't trust the Dollar to hold it's value anymore. And you might think that this is just an extreme example but, for hundreds of years, Gold has been the benchmark for a steady value vs changing currencies and, if you price the S&P against Gold in 2020, it's flat. Not up 40% but flat.

So more and more Dollars are being printed and they are being exchanged for stocks, BitCoins and Gold (don't forget Bonds are totally fake now as the Fed buys them) and that inflates everything and we talked about inflation yesterday in our Morning Report and, later in the day, we added 4 Inflation Hedges to our Member Portfolios (see our recent Top Trade Alert). Even in a crazy market like this, there are rational ways to make money and our trade idea for Barrick Gold (GOLD), which was last year's Stock of the Year at PSW, hitting $27 in 2023 (now $22.50) can return 4,100% on our cash in 24 months.

That's better than BitCoin!