What inflation?

What inflation?

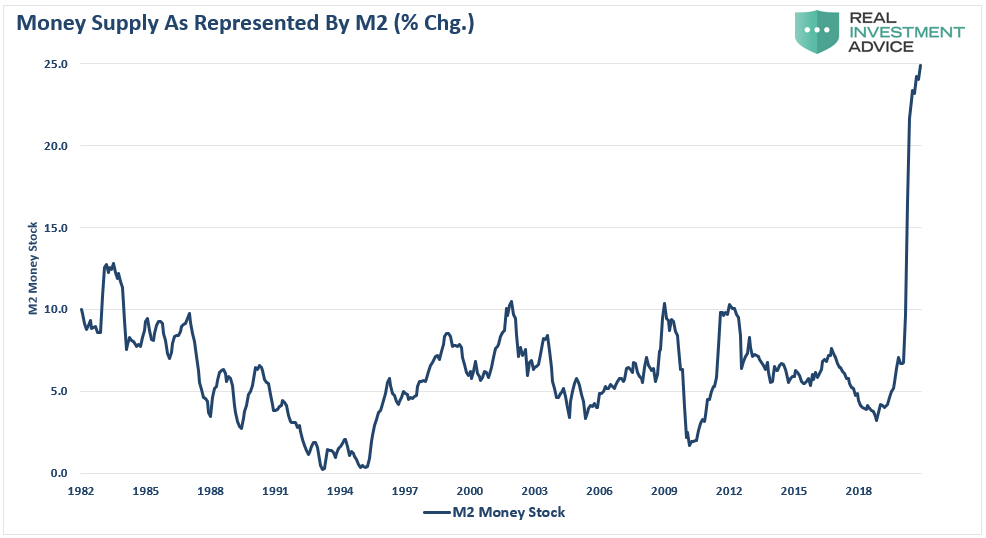

That's been the Fed's consistent message as they like to pretend they can print $9Tn in a single year – adding 25% to the money supply – and it will have no effect on inflation (so we should keep pretending that less than 1.5% for a 10-year note is a fair rate of return). Any child who's played Monopoly knows that, as more money is put into the game by the banker – more money is spent on things like properties and hotels. This is toddler economics.

President Toddler owns a lot of hotels and he was well aware that if, we pumped $9Tn into the economy, some of it would trickle down into his organization. President T's pals also did very well, with America's 660 Billionaires getting over 1,000 Billion Dollars (1Tn) richer during the pandemic. A 38.6% gain in their fortunes since March of 2020. In fact, before the pandemic there were only 614 Billionaries – 46 people became Billionaires in the past year!

The chasm between those at the very top of America's economic ladder and those in the middle and at the bottom was immense before the damage inflicted by the pandemic on the U.S. economy. That divide has widened. According to a study released Monday by economists Bruce Meyer from the University of Chicago and James Sullivan of the University of Notre Dame, America’s poverty rate increased by 2.4 percentage points over the final six months of 2020. That’s the largest increase since the 1960s and is nearly double the largest annual increase in poverty over the last 50 years. We truly are Great Again for the 666 that are taking in all the wealth. All hail the ruling class!

An additional 8 million people nationwide are now considered poor – and that makes sense because you have to take $5,000 away from 8M people in order to give $1Bn to 40 people – that's just math, folks! Black Americans (5.4% increase) representing a disproportionate share of those thrust into poverty. More than 70 million individuals (or roughly 40% of the labor force) have filed unemployment claims in the U.S. since the start of the pandemic. 10M more people are still unemployed than there were last March.

“U.S. billionaires are delinking from the rest of the society, an extreme form of social distancing. Their fortunes soar while most Americans are facing unprecedented health and economic challenges,” said Chuck Collins, director of the IPS Program on Inequality, in an email to Forbes. “We are further eroding our social fabric—the sense of solidarity that binds us together.”

According to an IPS and ATF press release, the gains made by America’s billionaires during the pandemic could “pay for all the relief for working families” in President Joe Biden's $1.9Tn stimulus package, “while leaving the nation’s richest households no worse off than they were before” the arrival of the coronavirus. All of the other 165M taxpayers combined have a total of $2.4Tn while the top 666 have over $4Tn. Most of them can give up half of their wealth and still be multi-Billionaires and that money would DOUBLE the wealth of EVERY OTHER PERSON IN AMERICA. That's what insane, unsustainable inequality looks like – it's like when the banker cheats in Monopoly – ordinary players don't stand a chance…

This is the game that only a few of us are playing but, rather than revile that, we just elected one of the winners President, didn't we? This is our problem, America, we are economic masochists – we like to be in financial pain! How else do you explain how we put up with this insanity and vilify people like Elizabeth Warren, who is simply trying to look out for the 165Bn of us who aren't sitting on over $1Bn in our bank accounts? But don't worry, you'll get your $1,400 soon and all will be well, right? 666 special Americans got 1,000,000 times more than you but don't try to fix that – it's unAmerican.