$1,862,265!

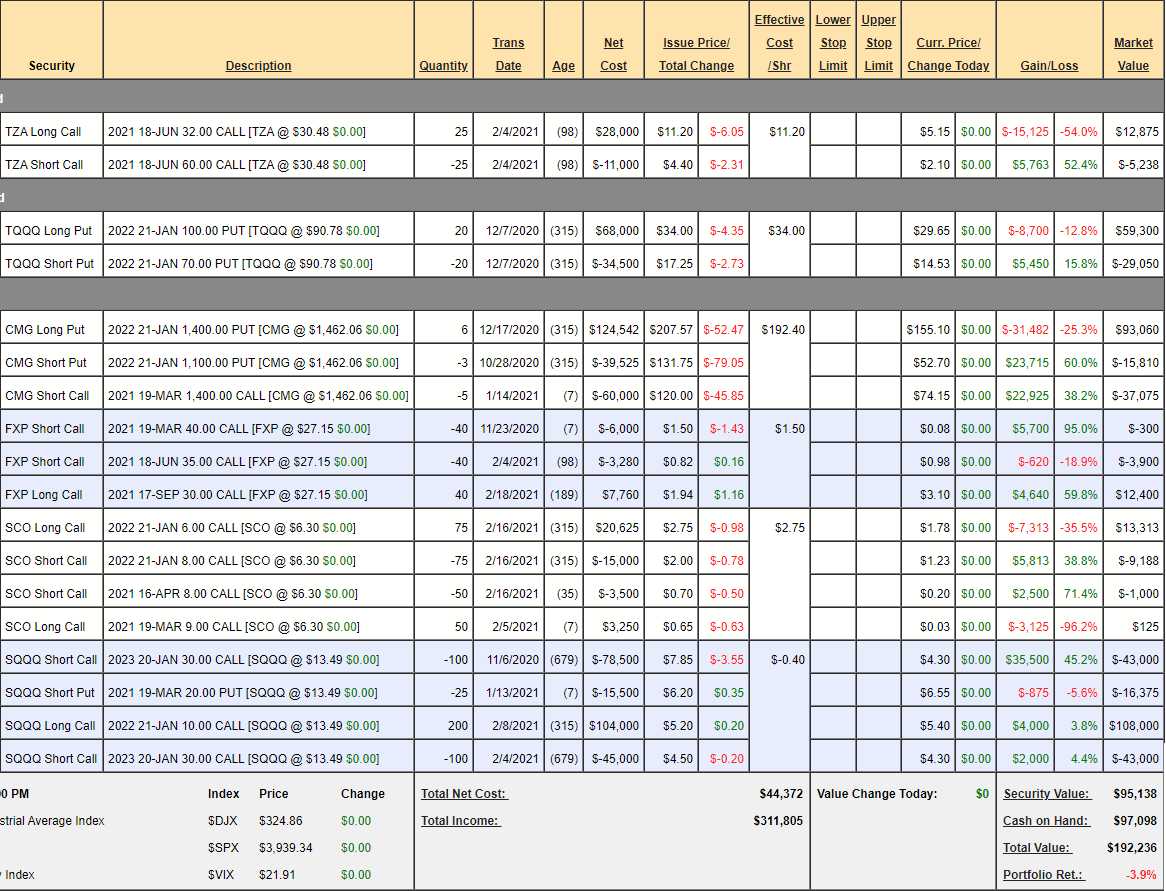

That's a gain of $95,674 since our February Review for our paired Long & Short-Term Portfolios. Our LTP is predominantly bullish and the STP is where we keep our hedges – as they tend to need adjusting more often – as you are about to see. Interestingly, despite the rally, the Short-Term Portfolio gained $40,000 – mostly due to our very well-timed short play on Tesla (TSLA), which we just cashed in last week. One of the reasons we cashed it in is we now have $97,098 in cash to deploy so it's a great time to add to our hedges:

- TZA – They reverse-split on us and this is our new position. They should be $64 short calls (because they were $8s) but TZA only goes to $60. It's a 3x ETF so if the Russell drops 20%, TZA should gain about 60% to $48 – so that's our actual target and, since $60 would be almost a 40% drop and we don't expect that, it means we can afford to sell more short calls if it comes up. June $45s are $3 and that means we can double down on the $32 calls at $5.15 ($12,875) and sell 25 of the $45s for $3 ($7,500) and we have spent just net $5,375 to add $32,500 in additional protection.

- TQQQ – Despite the dip, our Jan $100 put is showing a loss so far. Those are now $29.65 so the first thing we do is look to see if we can improve them and the Jan $120 puts are $43 and we won't pay $13 for $20 and the $110 puts are $36 so $6 for $10 is not much better. We also won't pay $14.53 to buy back the short $70 puts, that are $20 out of the money so the best way to improve this position is to SELL 7 (1/3) of the April $80 puts for $5 to lower our basis by $3,500 and those can't go in the money unless our spread is $40,000 in the money and it's net $20,000 now – so hard to lose and we're BEING THE HOUSE!

- CMG – The thing will not die but we sold a lot of premium so we're winning anyway. Our bet is reality will hit the burrito world by January and we always look to see what we can take advantage of and we can buy the short $1,100 puts back for $15,810 thanks to yesterday's pop and they were $88 last week so let's do that and we'll re-sell them on the next dip. If CMG goes higher, now we have the flexibility to sell higher puts and roll our short puts up – that's a win/win adjustment!

- FXP – It's up nicely since we decided China was overdone and we didn't want FXP to go up too fast since we sold the March $40 calls and the June $35 calls so this one is right on track – no need to adjust. It's a 2x ETF so if the Shanghai falls 20% and we pop 60% that's also $48 for a target and that would be $18 on the calls for $72,000 and the current net of the spread is only $10,200 and we bought it for about $1,000 so this one is fabulous!

- SCO – This is still not working. The March calls are looking like a wipeout but the more sensible Jan/April spread where we're Being the House – NOT the Gambler is working out just fine. We should remember not to be the Gambler, right?

- SQQQ – Topped out at $16.32 on Monday but back to $13.49. The short March $20 puts are expiring about where we sold them, so no harm there and now we can sell 25 of the June $19 puts for $7 ($17,500) to help pay for the spread and our target on SQQQ would be a 60% bump to let's say $25 and that would put our 200 calls $15 in the money for $300,000 and the net of this spread is $5,625 with what I believe is a manageable assignment risk. We've only spent $25,000 so far so let's add 100 of the 2023 $10 ($7)/$25 ($4.25) bull call spreads for $2.75 ($27,500) in the $150,000 spread and that will then allow us to sell more short calls and hopefully make that money back because who doesn't like a free hedge?

As a new trade and since we lost our TSLA short, I want to add another short on Wayfair (W), which is a ridiculously over-priced furniture store. It was our first short trade in the LTP since this cycle began on 2/25 and we can be more aggressive in the STP, so let's play it like this:

- Sell 3 W April $320 calls for $27 ($8,100)

- Buy 5 W Jan $300 puts at $60 ($30,000)

- Sell 5 W Jan $260 puts at $40 ($20,000)

That's net $1,900 on the $20,000 spread and we'll be adjusting it along the way but best to start small and see how it goes.

So now I feel better with a bit more hedging into the weekend to protect the ill-gotten gains in our LTP. The stimulus is in and the virus is cured and it's hard to imagine what fresh catalyst (Infrastructure) there could be to take the markets another leg higer – past 35x earnings for the average stock. Seems a lot more likely we correct 20% to 30x earnings, doesn't it?

Have a great weekend,

– Phil