Courtesy of Pam Martens

“This raises the serious question as to whether the Senate Banking and House Financial Services Committees should be investigating the gamification of markets or the monetization of the stock market via Wall Street’s ownership of federally insured deposits.”

By Pam Martens and Russ Martens

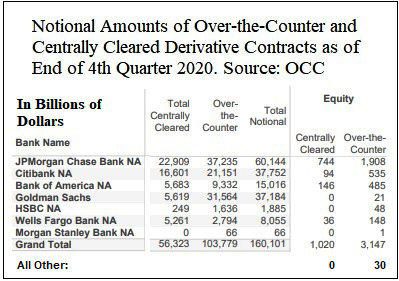

In late March, the Office of the Comptroller of the Currency (OCC) released its quarterly report on “Bank Trading and Derivatives Activities.” Graph 15 of the report shows that using data submitted by banks on their form RC-R of their call reports, JPMorgan Chase’s federally insured bank had exposure to $2.65 trillion in notional equity (stock) derivatives as of December 31, 2020. (Notional means face amount.)

That’s a stunning figure for the largest federally-insured bank in the United States to have in exposure to the stock market. But more stunning is the fact that according to the OCC, JPMorgan Chase’s equity derivative contracts represent 63 percent of the total $4.197 trillion of equity derivative contracts held by all federally insured banks and savings associations in the United States. To put it another way, there were 5,033 federally insured banks and savings associations in the United States as of September 30, 2020 according to the Federal Deposit Insurance Corporation (FDIC). But just one of them, JPMorgan Chase, accounts for 63 percent of all equity derivatives. (See Editor’s Note below.)

Making the situation even more jaw-dropping, of the $2.65 trillion that JPMorgan Chase holds in equity derivative contracts, 72 percent of them are private, bilateral contracts, known as over-the-counter contracts. This means that federal regulators likely have little to no knowledge of the terms of those contracts; who the counter-party is to JPMorgan Chase; if that counter-party has also obtained leverage under similar contracts at other Wall Street banks and is at risk of blowing up the whole of Wall Street if it implodes. (Think Citigroup, AIG and Lehman Brothers in 2008.)

As to just how effectively the Obama-era Dodd-Frank financial reform legislation of 2010 actually reined in risk on Wall Street, the following statistic offers significant insight: According to OCC data, at the height of the financial crisis in the fourth quarter of 2008, equity derivative contracts held by federally insured banks totaled $2.2 trillion, versus $4.197 trillion today.

…