Now the FDA and CDC are halting the JNJ vaccine.

Now the FDA and CDC are halting the JNJ vaccine.

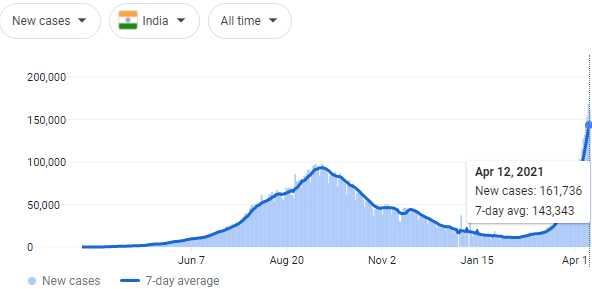

Like the AZN vaccine, blood clots seem to be the issue and, though they are rare side-effects, better safe than sorry – as long as we have two shots left (PFE and MRNA). The World, on the other hand, doesn't have two shots left – as the US and Europe have already scooped up all the PFE and MRNA vaccines that are out there for their people and that's why India had 161,736 new cases of Covid yesterday and 879 deaths.

Don't worry, they still have a long way to go before they beat the US as India has had just 13.7M cases to date and only 171,000 deaths while the US has 31.3M total cases and 562,000 deaths – number one in the World by miles thanks to the leadership of President Trump, who came so close to getting 4 more years to finish the job.

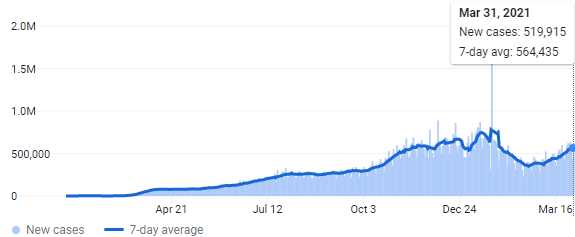

See, this could have been us! Imagine how great America could have been if we had continued to build on our virus cases and death count, rather than tackling the problem and reversing it the way the cowardly Biden Administration has done. And that's what I mean about the rest of the World – there is nowhere near enough vaccines to go around and the rest of the World is now having 500,000 people PER DAY coming down with a deadly, contageous, mutating disease and we like to pretend everything is better because we got a shot? Doesn't the S&P 500 derive almost 50% of their earnings from "the rest of the World"?

You can't fix Covid by vaccinating one country – that's like putting out a forest fire by putting water on one tree. It's up to the G20 to put together a "moon shot" program to stop this virus and that will require a massive effort to get EVERYONE in the World vaccinated in the same 6 month period – only then do we close the window of opportunity for the virus to pull back and mutate in a vulnerable population until it can beat the vaccines and start spreading again – until we invent a new one and the cycle goes on and on and on – like the flu. That's what we do with the flu – we're constantly changing the vaccines and it constantly keeps coming back. Are we content to have Covid Season from now on?

About a month ago, I mentioned that I was concerned about the recovery issues I was seeing then and I thought Booking Holdings (BKNG) the old Priceline and Expedia (EXPE) were good shorts – since so much of their business depends on International Travel, which I think will continue to suffer this summer. Our EXPE trade for our Short-Term Portfolio was:

- Buy 10 EXPE July $190 puts at $28.50 ($28,500)

- Sell 10 EXPE July $165 puts at $14.50 ($14,500)

- Sell 5 EXPE July $190 calls for $10 ($5,000)

That's net $9,000 on the $25,000 spread that's $20,000 in the money to start so we only lose money if EXPE can get back over $180 into the summer. In a Portfolio Margin account (and you shouldn't be doing naked short calls in an ordinary account), it only requires $6,663.40, so it's actually an efficient way to make $16,000 – hopefully.

The July $190 puts are now $26 and the $165 puts are $11 and the short $190 calls are $7.20 so net $11,400 is up $2,400 (up 26%) but still $13,600 (119%) to go in 3 months – so it's still a nice little hedge if you are looking to play for things perhaps not being as much better as everyone thinks they are.

I'm sorry to be a downer but someone has to be realistic. I'm as bad as anyone as I went to play poker last night, even though my second second shot isn't until May 1st. It's been a year since I've been able to play and my friends were having a game – so I went and we had a great time and no one wore a mask (it's Florida – do they still make masks?) and 4 out of 10 people hadn't even had a shot yet, which is really stupid because the vaccinated people can still be carriers.

We all touched the chips and touched the cards and ate from the same snack bowls and after the game we sat outside and smoked cigars and I watched the smoke drift around from one mouth to another and pondered what idiots people are. This is why you need Government to take control of these things but the Government is run by the idiots, for the idiots as well and we used to advance society because the Government would at least take the word of the Scientists when setting policy because we came from a country that valued Education and Science but we lost that country and so, apparently has most of the World – and we're all in big trouble if we don't rediscover it soon.

Be careful out there!