$1,967,325!

$1,967,325!

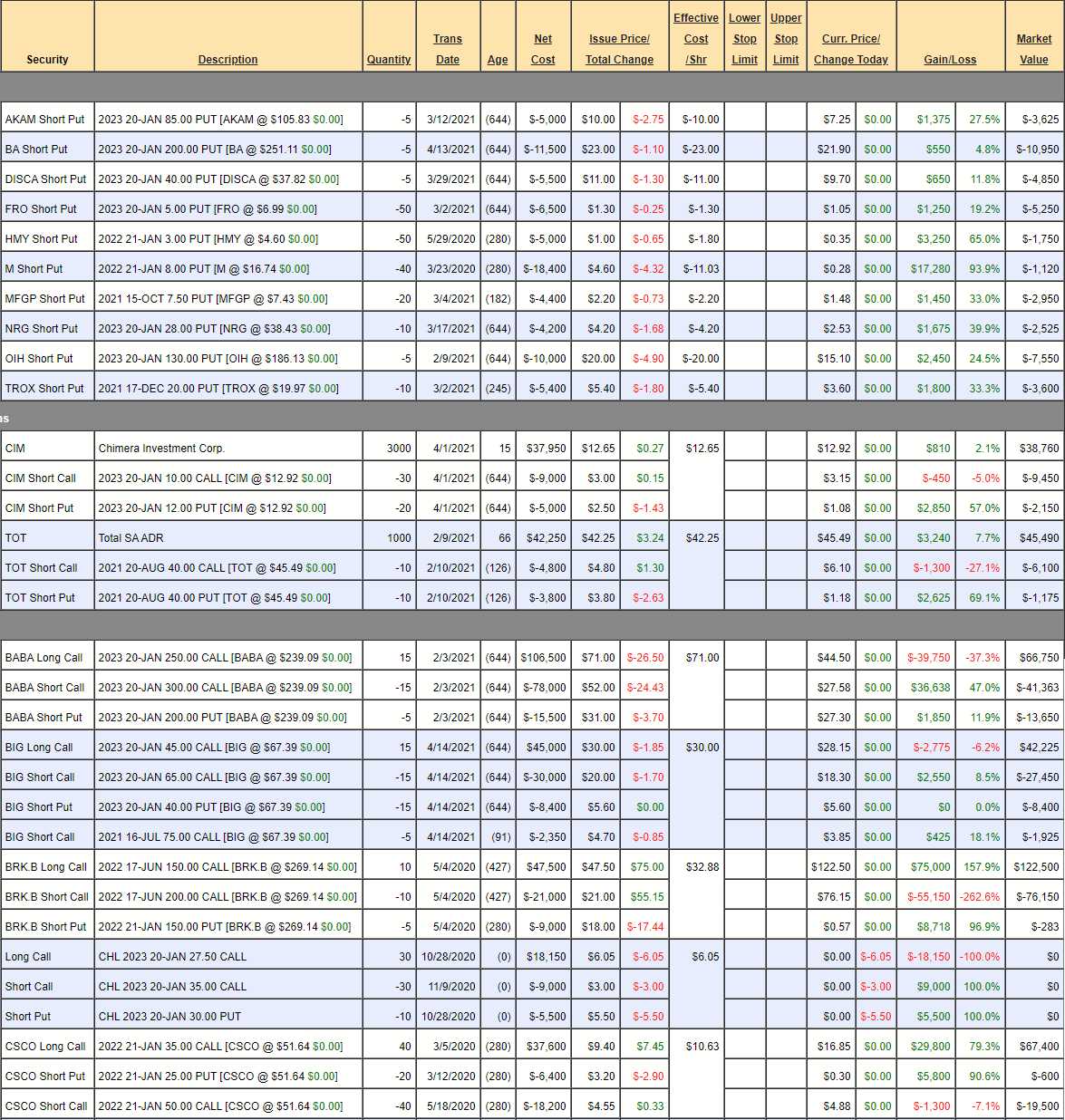

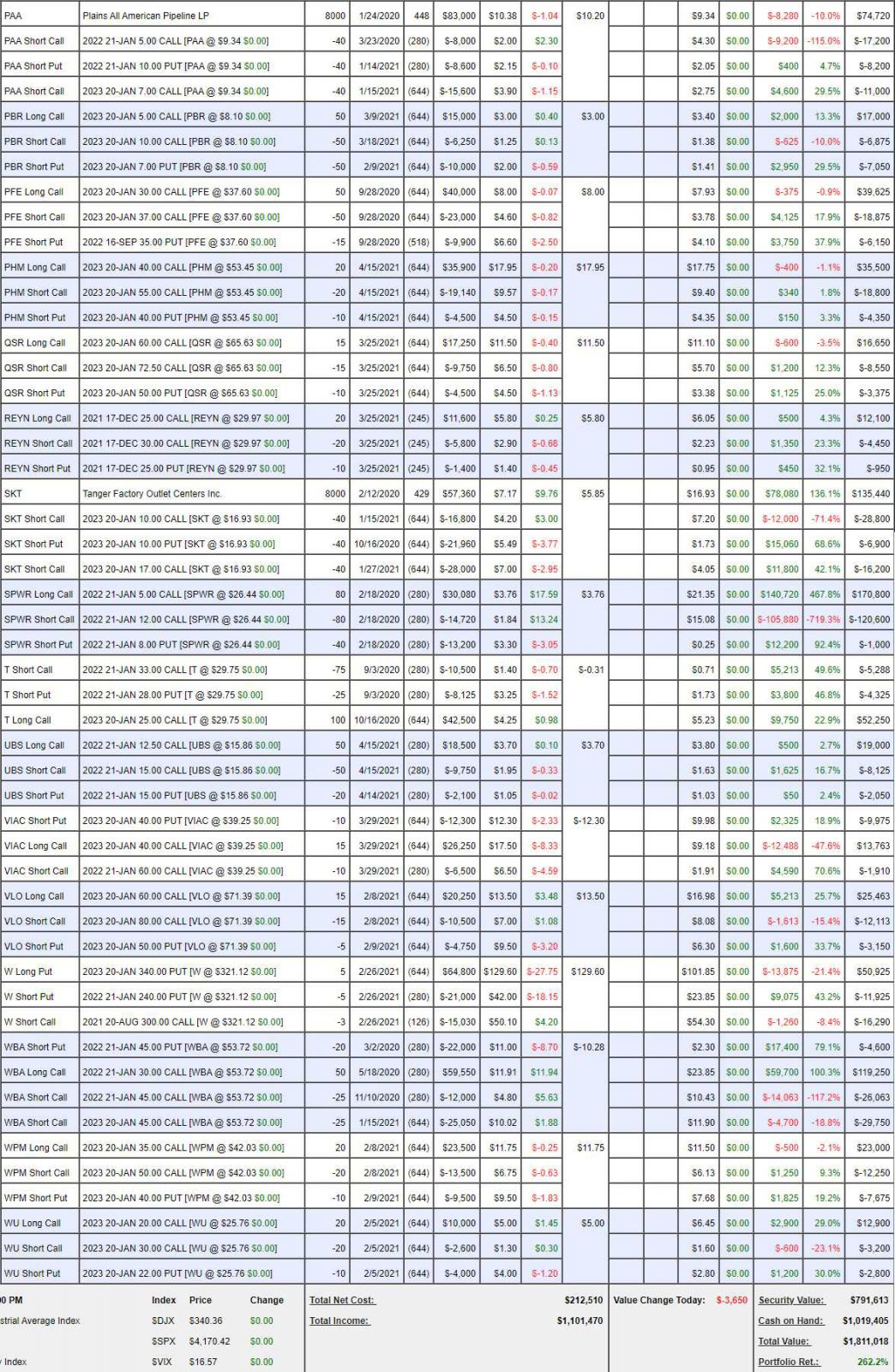

We're going to need 2 Dr. Evils soon to equal our paired Long and Short-Term Portfolios, which began with $500,000 + $100,000 back on October 1st of 2019 (seems like forever, doesn't it?). So we're up over 200% and that makes $1.8M our stop if the market turns lower faster than we can cover it but we're very well-hedged (see yesterday's Short-Term Portfolio Review) and we actually were pretty aggressive this month ADDING positions to the LTP and those positions have helped bring the LTP to $1,811,018, which is up $109,075 since our March 18th review.

Other than the new trades, we only made 2 adjustments last month – we doubled down on WPM and rolled our short Berkshire March calls to short June calls – very low-touch but, at the time, I said about our positions:

16 trades in this section are good for $357,000 in future profits so, adding up the other half we're projecting $671,000 in future profits between now and Jan 2023 if the market simply maintains these levels (or at least our stocks do). As noted above, some of these stocks are so good we'd almost rather be assigned than make the rest of our money and some of the spreads are so good that it's hard to find a reason to do anything else but sit back and let them make us richer.

As usual, this portfolio is too good to dump so we're going to have to take a licking to motivate ourselves to walk away. As noted before, we have about $600,000 worth of protection in the STP – so we don't think we'll take too much damage on the way down – lots of time to decide to bail and the profits are already built in if the need never comes.

On the whole, we're very well-balanced with a ton of CASH on the sidelines.

Since the market continued to climb relentlessly and since we felt the positions we had with the hedges we had were pretty bullet-proof, we began adding more longs to the mix and that turned out to be well-timed on BA, BIG, CIM, DISCA, FB, PHM, QSR, REYN, UBS and VIAC – 10 new trades added to the LTP in the last 30 days and we STILL have $1,019,405 in CASH!!! sitting on the sidelines – ready to take advantage of fallen angels during earnings season.

I certainly did not thing we'd be pulling the trigger on 10 new stocks after keeping very quiet since the fall but we adjusted our expectations slightly higher and found 10 stocks that were, amazingly, still at or below their fair values – even in this crazy market. While the LTP gained ground, the STP lost $43,097 and, if we gained $109,075 in the LTP, our Future profit potential dropped to about $560,000 so to BALANCE ourselves more bullish – we deployed some more cash and brought our upside potential back over $700,000 – about $50,000/month going forward, if all goes well.

- Short Puts – These are stocks we are promising to buy if they get cheaper and we've been paid $75,900 in exchange for that promise. This is a great way to raise cash, especially if you have plenty of buying power and REALLY would like to buy Boeing (BA), for example, for net $177/share – a 30% discount to the current price. We just got paid $11,500 to make that promise and it's still $11,000 so still good for a new trade but you have to REALLY want to buy 500 shares of BA for net $177 – keep that in mind. Notice how these are almost all new (ish), we cashed out our short puts into the holidays – just in case things went wrong.

- CIM – Still has that new trade smell and pays a lovely 0.30 ($900) quarterly dividend.

- TOT – I love these guys, if they drop we're going to get a lot more aggressive.

- BABA – We're still down so it's still good for a new trade.

- BIG – Top Trade Alert from Wednesday, so still good for a new trade.

- BRK.B – On track, almost too much so at net $46,067 out of a potential $50,000 but that's by the end of the year and we don't need the money or margin so may as well sit here instead of in cash.

- CHL – Options status is up in the air until/if Biden un-suspends the Chinese Telcos.

- CSCO – In the money at net $47,300 out of a potential $60,000 so $12,300 (26%) more to be made between now and January – yawn….

- FB – Still has that new trade smell and we haven't made too much money yet. This was a small initial entry ahead of earnings (4/28) to remind us to keep an eye on them.

- FL – Net $33,975 on the $37,500 spread so another one with about 10% more to gain but not worth worrying about. You can see why we needed new trades.

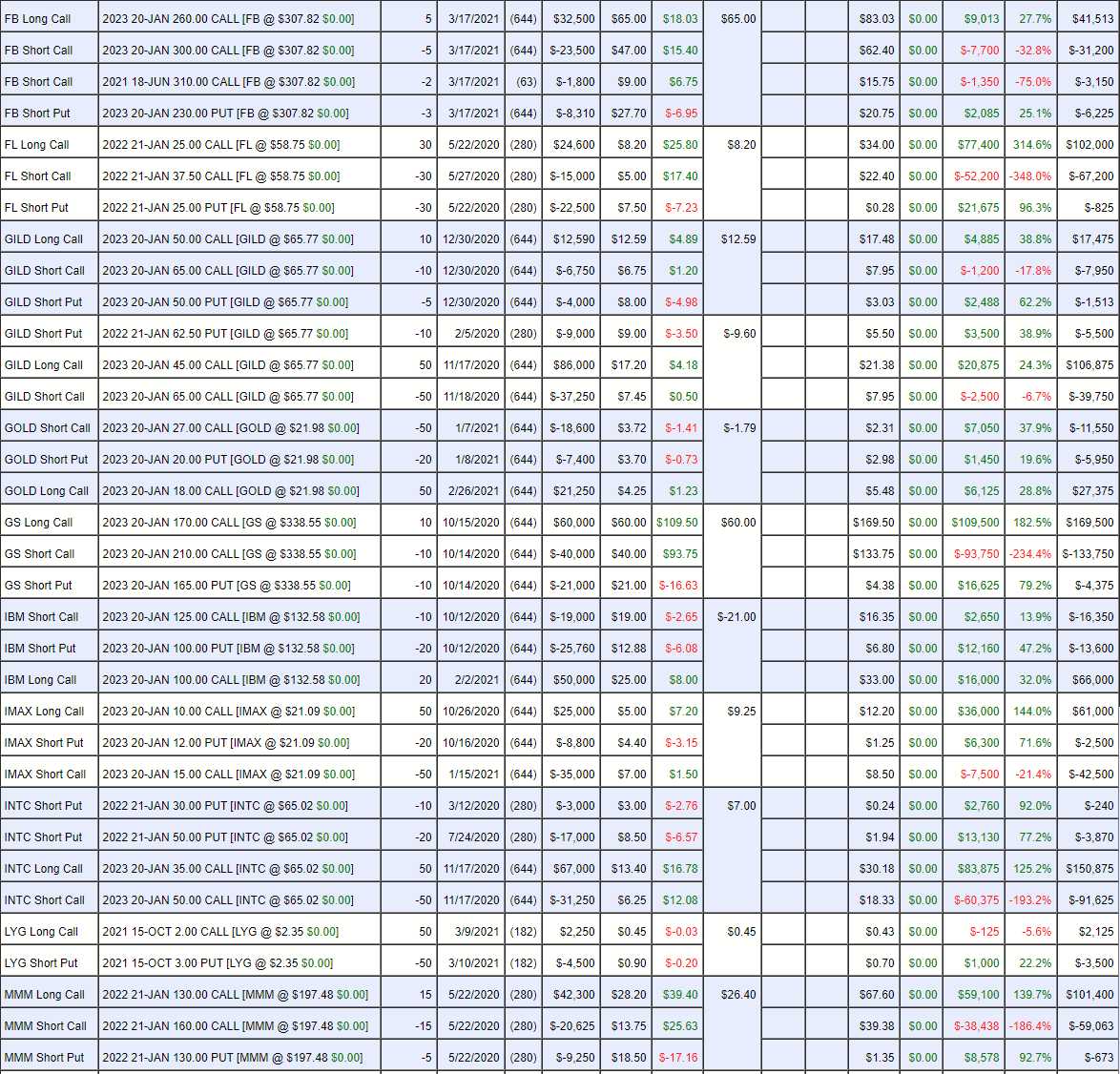

- GILD I – At the money but plenty more to make.

- GILD II – Net $60,000 with $40,000 to gain is almost good for a new trade.

- GOLD – Coming back already, our timing was perfect.

- GS – Just had blowout earnings.

- IBM – Deep in the money already.

- IMAX – Movies are opening back up.

- INTC – Our Stock of the Year for 2021! Already deep in the money.

- LYG – We're expecting good earnings.

- MMM – Deep in the money already.

- PAA – Paid a $1,440 dividend on Jan 28th, next one is April 29th and this one is still playable at net $38,320.

- PBR – On track

- PFE – Already at the money.

- PHM – Brand new trade.

- QSR – Already doing well.

- REYN – Already popping.

- SKT – Hard to believe how hard I had to work to get people to pay attention to this one.

- SPWR – I think we have them in every portfolio! This is an old one and stupidly in the money now.

- T – Still cheap but we already made the easy money.

- UBS – Popped on earnings already.

- VIAC – Just added them back in as they got cheaper and it's a small position – in case they get even cheaper we are thrilled to double down.

- VLO – Should have great earnings.

- W – The only short in the portfolio – not doing well but too soon to adjust.

- WBA – Another one I used to have to bang the table on.

- WPM – We just doubled down on them last month so of course I like them as a new trade.

- WU – On track at net $6,900 on the $20,000 spread. We're already up $3,500 but it's still better than most trade ideas you'll find – even after our first 100% gain.

Wow, not one thing needed changing! We'll see how earnings go and we'll see if theis market ever manages to correct and test our new balance. With 25% more long positions, I think we may lose a bit of ground on a downturn (we gained last time) – but we can always add more hedges to the STP.

IN PROGRESS