$2,147,243!

$2,147,243!

That's actually DOWN $5,530 since our last review as our Short-Term Portfolio (our hedges) took a pretty good hit on the recent rally. That's fine as I'd rather have a relaxing summer not worried about losing these ridiculous gains so parking the portfolio in neutral into earnings was a sensible way to play.

We gained $186,448 (almost 10%) in the previous month so locking that in was a good goal but now we're past earnings and past the Fed and we'll have to decide what to do next. We're already 50% in CASH!!! and we love our positions and we even added a few new ones to the LTP over the past month as we have that Fear Of Missing Out disease that's rampant among the investing population.

Still, our overall portfolio performance is a barometer and we can sense changes coming when we can't make money but, as I said, the LTP itself gained $38,000 over the past month, it's the STP that dragged our paired portfolios lower - but that's what it's supposed to do in a bull market - this just indicates we played the month a bit too bearish so we can either hedge less (no way!) or add some more longs. That's a work in progress.

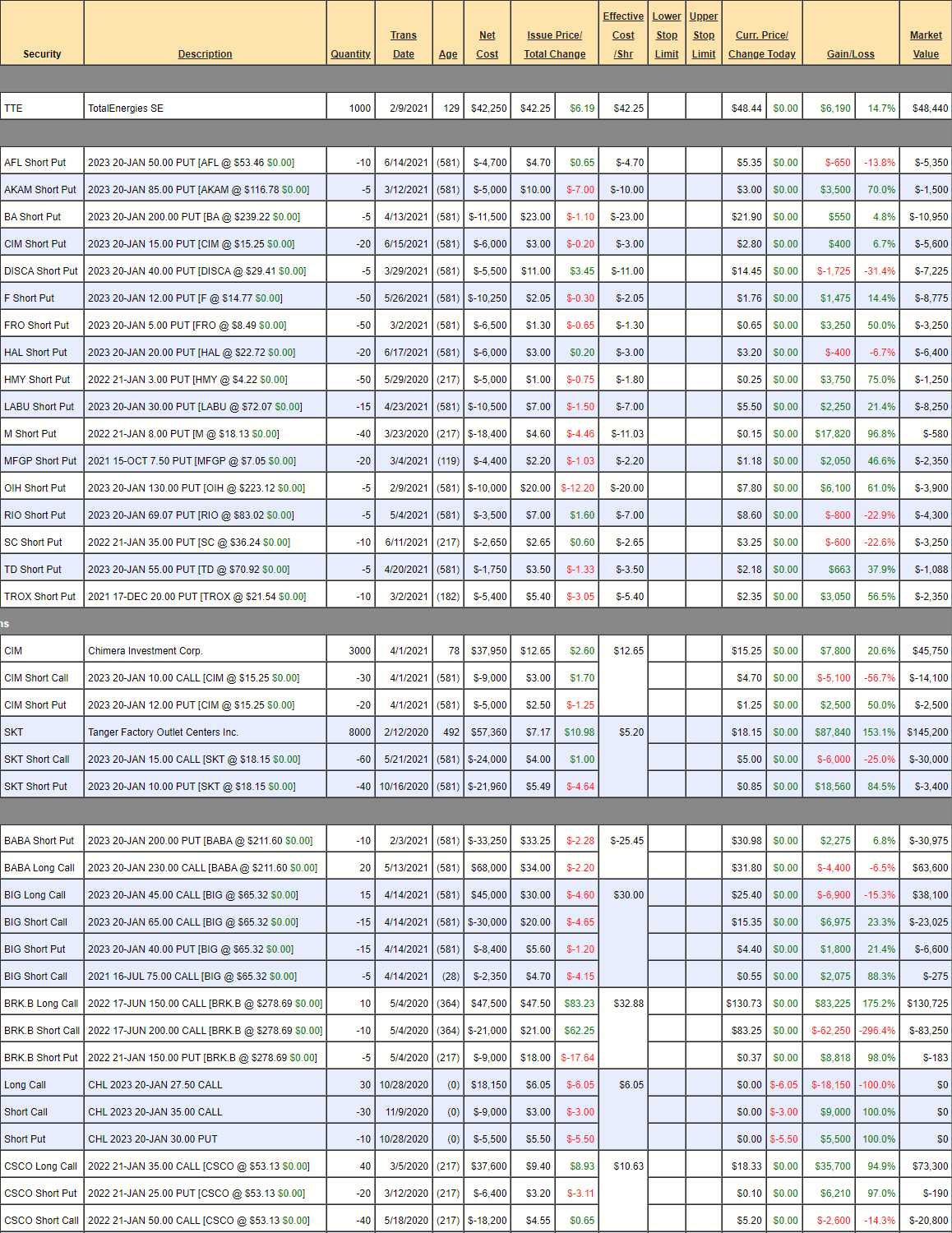

In our last review, we got more aggressive on BABA and SKT and, since then, we added new trades on AFL, CIM, FNF, HAL, MO, RIO, SC and VLO - so it's been a pretty busy month - even though it seems pretty dull day to day. Here's the LTP update:

- TTE - Was TOT and they haven't fixed the options yet so those are missing. Love this company but currently toppy.

- Short Puts - These are essentially a watch list of stocks we'd like to buy if they get cheaper.