$2,152,773!

$2,152,773!

As I predicted in last month's review, we now need 2 Dr. Evils to sum up our LTP/STP balance as we've gained $185,448 since April 16th as both our Long and Short-Term Portfolios gained ground in this cycle.

Since we started with $500,000 + $100,000 back on 10/01/19 for our paired portfolios, I would say it's time to cash out but we're already 50% in cash and we LOVE our positions. In fact, in the last LTP review, we didn't change a thing and we've added a few new plays since. We have been on a bit of a buying spree the last couple of months – looking to squeeze every last drop out of this rally but I'll say the same thing now that I said back in Sept of 2019 – it's ridiculous to keep playing aggressively when you are up over 200%. Back then, we cashed in $1.4M+ and put the other $600,000 back to work and, because we played aggressively with our winnings – we're back over 200% yet again and again we should put $1.4M into something sensible and have fun with the rest.

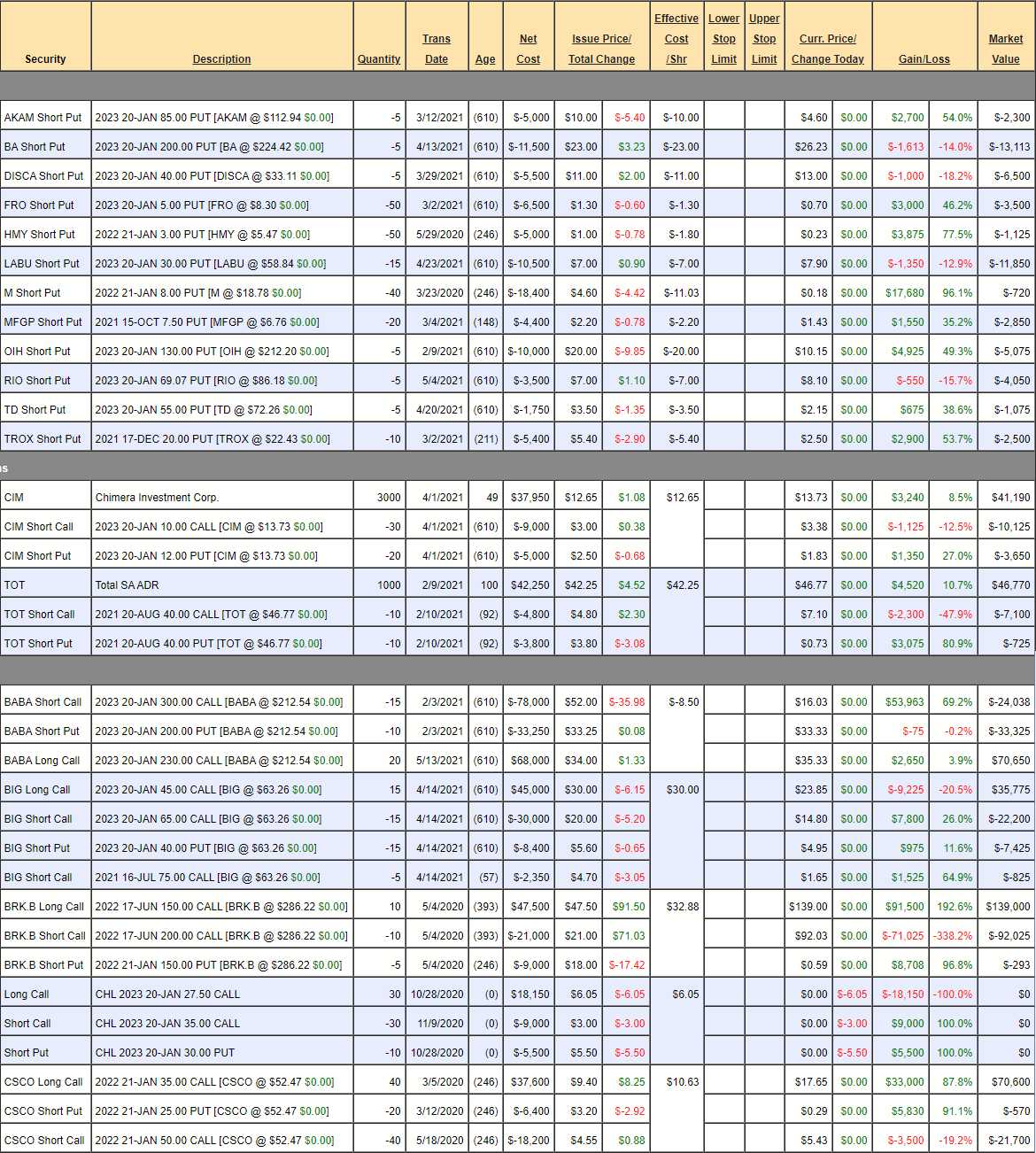

We love our positions, you know that already. I have tried and tried and tried to cash out our positions so the ones that are left are our most dearly beloved – the ones we simply can't quit. In the last 3 months, however, we've sold puts against 12 stocks – these are the ones we are planning to buy on the next dip. We collected $87,450 in exhange for our pomise to buy, for example, AKAM for net $75, BA for net $177, DISCA for net $29, etc…

The last time we did position projections was back in March and, at the time, we had $671,000 in projected gains. Next month we'll do a full review but the LTP was at $1.7M on March 18th and it's $1.9M now so +$200,000 is well ahead of projections for 2 months, which is why we bumped up our hedges. As a rule of thumb, 25-33% of your unrealized gains should be going into hedges to lock them in.

We added short puts on HMY, LABU, RIO, TD as well as full positions on PHM, UBS and we made adjustments on BABA, FB, NRG and VIAC in the past 30 days – not too much work considering it's earnings season. Let's see how we feel about the overall portfolio now:

- Short Puts – These are stocks we are promising to buy if they get cheaper and we've been paid $87,450 in exchange for that promise. This is a great way to raise cash, especially if you have plenty of buying power and REALLY would like to buy Boeing (BA), for example, for net $177/share – a 21% discount to the current price. We got paid $11,500 to make that promise and it's now $13,113 so still good for a new trade but you have to REALLY want to buy 500 shares of BA for net $177 – keep that in mind. Notice how these are almost all new (ish), we cashed out our short puts into the holidays – just in case things went wrong.

- CIM – Still has that new trade smell and pays a lovely 0.30 ($900) quarterly dividend.

- TOT – I love these guys, if they drop we're going to get a lot more aggressive.

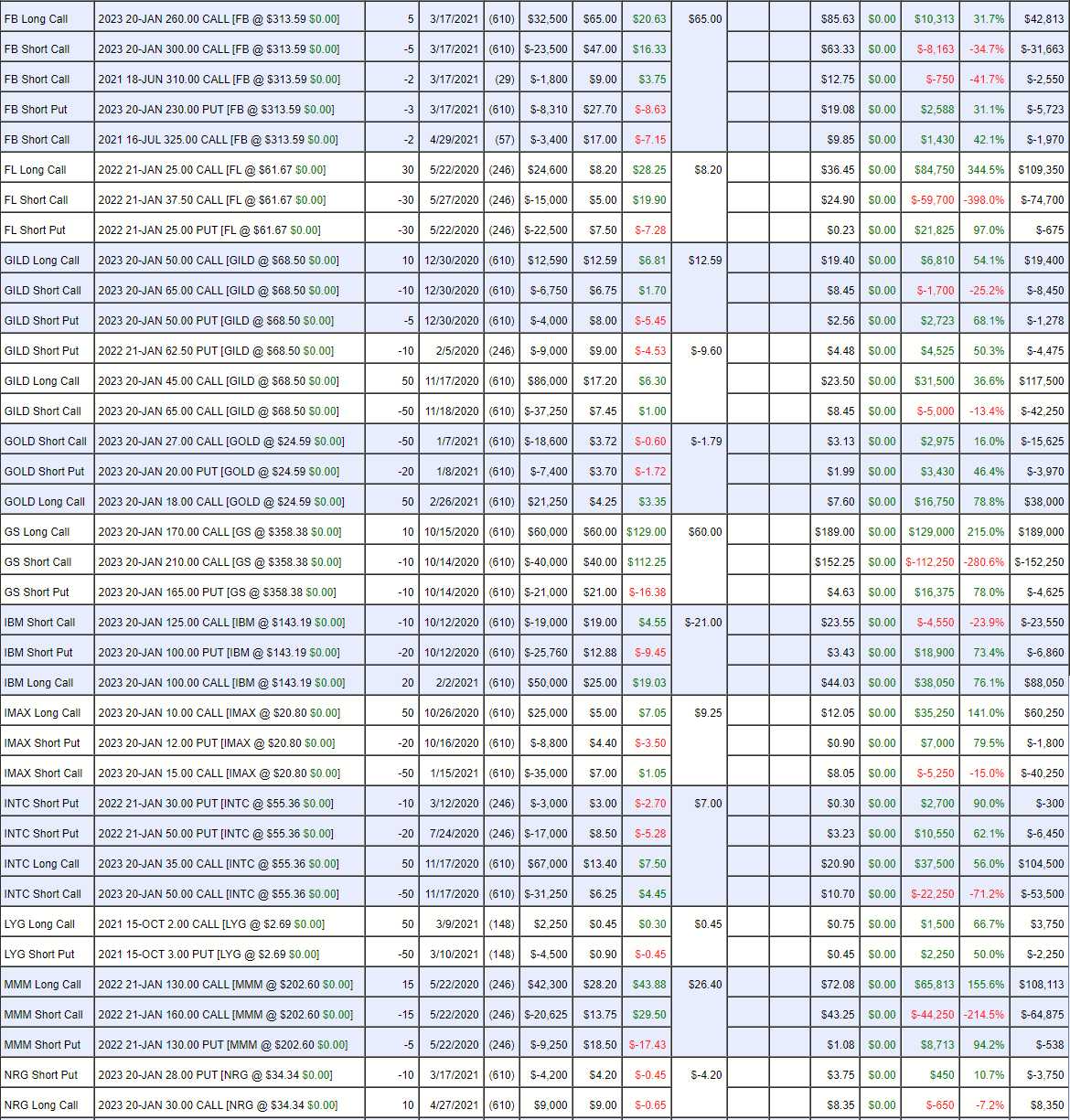

- BABA – They dropped and we got more aggressive and rolled the long calls down last week. Let's get even more aggressive now and buy back the short calls now.

- BIG – Top Trade Alert, still good for a new trade.

- BRK.B – On track, almost too much so at net $46,682 out of a potential $50,000 but that's by the end of the year and we don't need the money or margin so may as well sit here instead of in cash.

- CHL – Options status is up in the air until/if Biden un-suspends the Chinese Telcos.

- CSCO – In the money at net $48,330 out of a potential $60,000 so $11,670 (24%) more to be made between now and January – yawn….

- FB – Doing better now and we had great timing on our new short calls.

- FL – Net $33,975 on the $37,500 spread so another one with about 10% more to gain but not worth worrying about. You can see why we needed new trades.

- GILD I – At the money but plenty more to make.

- GILD II – Net $70,775 with $29,225 left to gain is up $10,000 from last time, when I said it was good for a new trade!

- GOLD – Coming back already, our timing was perfect.

- GS – Just had blowout earnings.

- IBM – Deep in the money already.

- IMAX – Movies are opening back up.

- INTC – Our Stock of the Year for 2021! Still deep in the money after the pullback

- LYG – We got in before the pop.

- MMM – Deep in the money already at $40,000 out of $45,000ish but we don't need the money for anything else.

- NRG – Just added on the dip, so still good for a new trade and way too low to cover.

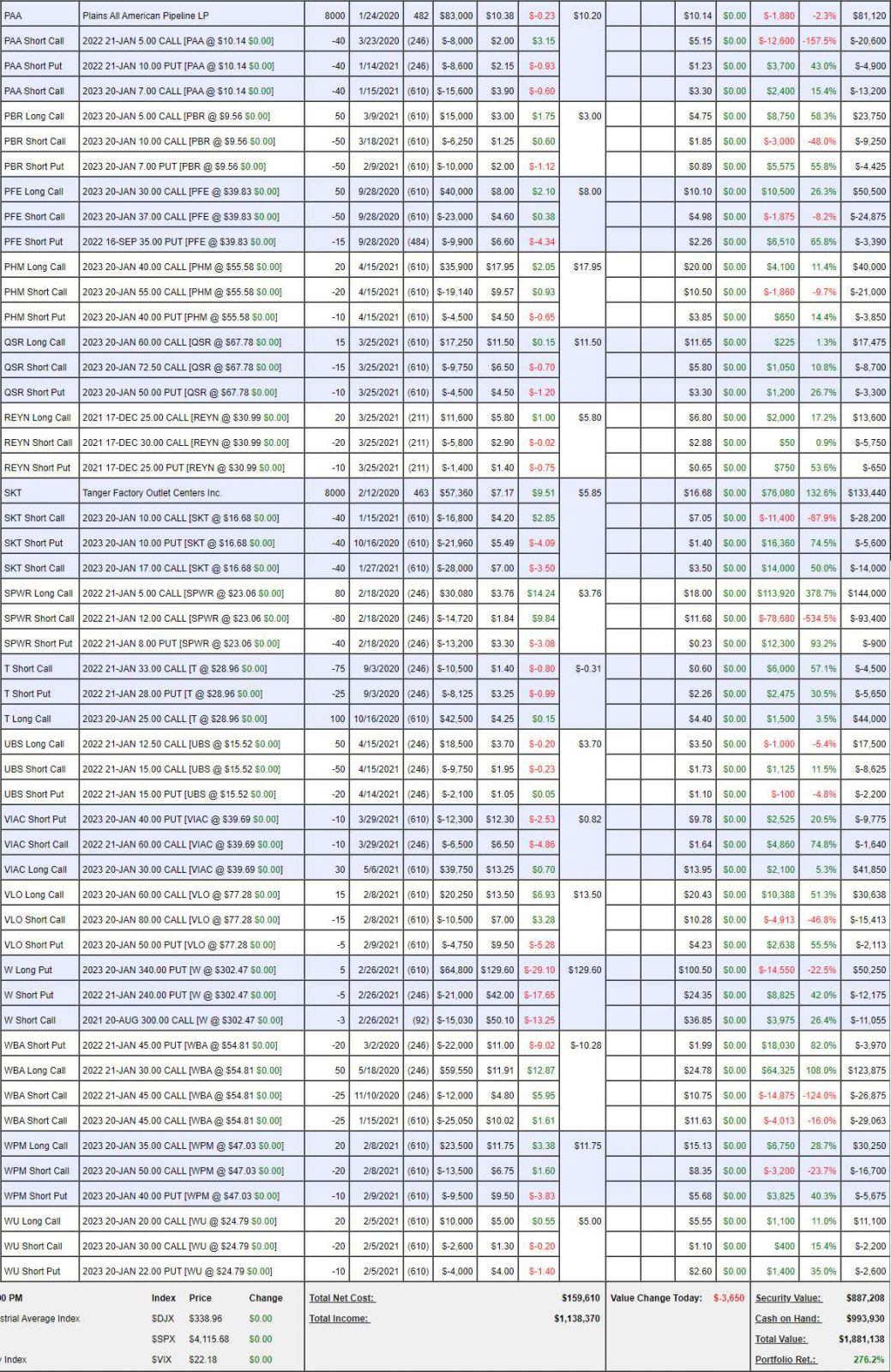

- PAA – $1,440 dividend coming April 29th.

- PBR – On track

- PFE – Already in the money.

- PHM – New trade, already up.

- QSR – Already doing well.

- REYN – Already at our goal.

- SKT – Hard to believe how hard I had to work to get people to pay attention to this one. Since we sold the $10 calls when we doubled down in Jan, let's buy back the 2023 $17 calls we already made money on (50% at $14,000) and roll the 40 2023 $10 calls at $6.40 (dip this morning for $25,600) to 60 of the 2023 $15 calls at $4 ($24,000). So we're spending net $15,600 and raising our call-away strike by $5 ($40,000) and now we're only 2/3 covered.

- SPWR – I think we have them in every portfolio! This is an old one and stupidly in the money now – even after the pullback.

- T – Got cheap again and I love them down here so let's buy back the short Jan $33 calls for $4,500 and sell them again when they are back around $32.

- UBS – Consoldidating for a move up I think and still good for a new trade.

- VIAC – Added them back in as they got cheaper and it's a small position – in case they get even cheaper we are thrilled to double down.

- VLO – Earnings were good but hard to imagine things get better from here. We're at our target with plenty to gain though so no pressing reason to take them off but this is the first position I have doubts about so far.

- W – The only short in the portfolio. I can't believe they are still over $300.

- WBA – Another one I used to have to bang the table on.

- WPM – Last month, I said I liked them as a new trade. Now they've popped.

- WU – On track at net $6,300 on the $20,000 spread. We're already up $3,200 but it's still better than most trade ideas you'll find – even after our first 100% gain.

Still not much to change. Earnings didn't damage us and we're chugging along but it's not likely we'll make another $185,000 this month as we're so far ahead of schedule the gains simply aren't there to be gotten – it's math! That's why we monitor how much money we expect to make from our positions – it has to be worth the bother and, if not, then of course we should be cashing out.

We'll do an intensive review next month as we'll be post earnings and post dividends with a clear view of Q2 in the rear-view mirror.

Until then – keep those hedges!