Just a quick blip down.

Just a quick blip down.

That's all we got yesterday on the Nasdaq as the Russell fell 1.5% and the Dow droped 500 points but the Nasdaq shot right back up and went on to even higher highs, now sitting very close to 15,000 – 200% higher than it was in the Dot Com crash and 100% over last year's low. Jeff Bezos has gone along for that ride and he's once again the World's Richest Man at $211Bn after gaining $8.4Bn yesterday as Amazon (AMZN) fueled the Nasdaq rally after the Pentagon reversed a decision to give Microsoft (MSFT) a $10Bn military contract for cloud computing..

Does it make any sense at all that Amazon MAYBE winning a $10bn contract should go right into Jeff Bezos' pocket? Of course not! Even if it were 100% certain that Amazon wins the contract and EVEN IF the contract were 100% profit for Amazon, Bezos still isn't Amazon's only shareholder. Logic has very little do do with the markets these days. Jeff's ex-wife, MacKenzie, made another $2.9Bn yesterday – that's as much money as she has given to charity since the divorce, proving she literally "can't give the money away fast enough."

Wealth of that size is like a black hole, money around it gets sucked in by the gravity of it and very little money escapes from it – so they just get bigger and bigger as time goes by. What does "sucked in" mean? Well Bezos has $211Bn (Musk is right behind him) and just putting it into 10-year notes at 1.36% requires $2.87Bn in interest per year. More likely though, Bezos invests his money and gets at least 5% a year, which would be over $10Bn annually and that money has to come from someone, right?

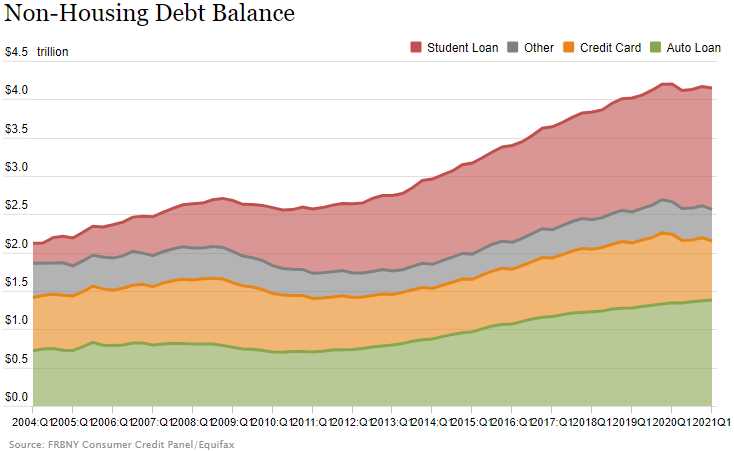

US Consumer Debt is $15Tn and $10.5Tn of that is Mortgage Debt, which is concerning but not terrible with house prices going up (so, presumably, those loans can be paid) while non-housing debt is $4.5Tn, led by almost $2Tn in Student Loan Debt. If the average Student Loan has a 3.5% interest rate, then they are paying $70Bn a year in interest and $10Bn (14.2%) of it would be required just to maintain Bezos' wealth.

US Consumer Debt is $15Tn and $10.5Tn of that is Mortgage Debt, which is concerning but not terrible with house prices going up (so, presumably, those loans can be paid) while non-housing debt is $4.5Tn, led by almost $2Tn in Student Loan Debt. If the average Student Loan has a 3.5% interest rate, then they are paying $70Bn a year in interest and $10Bn (14.2%) of it would be required just to maintain Bezos' wealth.

That's how it works – the money comes from somewhere and people have to pay Jeff Bezos for the use of his wealth even if, like MacKenzie, he has no use of it for himself. This is how money trickles UP, from the poor to the rich – no matter how much they insist it is otherwise.

If, on the other hand, Bezos and others were taxes half their wealth, then the Government could afford to subsidize the student loans or just pay for college and then students would bottow less money AND less money would be required to feed Bezos' black hole so the rates could drop 7% for Bezos and 7% for Musk and 5% for Gates (who already gives his money away as fast as he can) and tens of millions of college students would be more happy and start lives out with less of a financial burden while poor Jeff Bezos would have to stuggle along with only $100Bn. But this is America – we would never let that happen!

In the 2008 crisis, Personal Debt topped out at $2.7Tn so $4.5Tn is up 66.666% and if that isn't a sign, I don't know what is! Housing Debt is what did us in then and that was $10Tn at the time and now $10.5Tn so only $500Bn (5%) has gone into home debt in the past 12 years while the much more expensive revolving debt has increased by 66%. Imagine the nightmare this will become for consumers if rates go higher and their monthly servicing costs begin to rise.

In 2008, the Nasdaq was at 2,000 and fell back to about 1,200 during the crash – so up about 10x since then. Why has tech run up so much and why has consumer debt run up so much? Because now we need tech to live, don't we? Jeff Bezos makes his money taxing you for the products you buy. We used to go to the store and get things ourselves but now we pay Jeff to deliver them and we pay $10/month to be Amazon Prime Members. There are 100M people in the US who are Prime Members so that's $1Bn per month sent to Amazon – just to belong.

But Prime TV doesn't do it for us so we have Netflix (NFLX, $20) and Comcast (CMCSA, $200) and Disney+ (DIS, $10) etc. and my kids watch TV on their iPhones (AAPL, $200 for 4 phones) which are connected by AT&T (T, $200) and suddenly I'm spending $640/month (15% of the average household income) just to have my family connected to this brave, new world we all live in. Even if we assume the "average" family can do it for half as much (I can't see how), that's still $320/month (7.5%) x 100M families = $32Bn/month or $384Bn per year pushed into tech spending that didn't even exist 20 years ago.

And that's the US alone. And, of course, those of us who have businesses know there's another solid 15% that is spent on technology. For most businesses, it's the 2nd leading expense behind Employees, now eclipsing rent for most companies. That's money we spent essentially $0 on 20 years ago. Back then we used to BUY Windows and keep it for 5 years before upgrading – now we have to rent it, along with office, etc. That keeps the money flowing steadily up the ladder – right into Gates' pockets and, oh yes, he and Bezos have your data on their servers now…

Tech is a whole new catagory of things we now NEED to spend money on. Even our money is going technical and that means our businesses now pay a fee for every transaction we make. The customer can't just come into the store and buy a can of beans and give us $1 – it has to be on a credit card and they take 0.015 of it which, for the grocery store, is half their profits.

Think about how much money you spend on technology that we didn't when we were kids and then you'll know where all your money went. Maybe it's not a bad thing, technology certainly makes us more efficient but it's not necessarily a good thing either – not when we've been slowly put into a position where around 10% of our earnings go to something we didn't have 20 years ago. That's 10% people could have saved for their retirement and maybe that's why we're facing a massive retirement crisis now.

It's also why the Nasdaq goes up and up, driven by Trillions of Dollars of newly valuated companies which were barely on the radar 20 years ago. The problem for Consumers is Tech isn't a substitution, we don't spend less on food, cars, clothes, housing, college, etc., do we? No, it's an additional expense and the only thing it could have taken was our savings and now we have a society in which you pretty much can't function without it – hence all the borrowing.

Even the Unibomber had Internet up at the cabin.