$1,151,934!

$1,151,934!

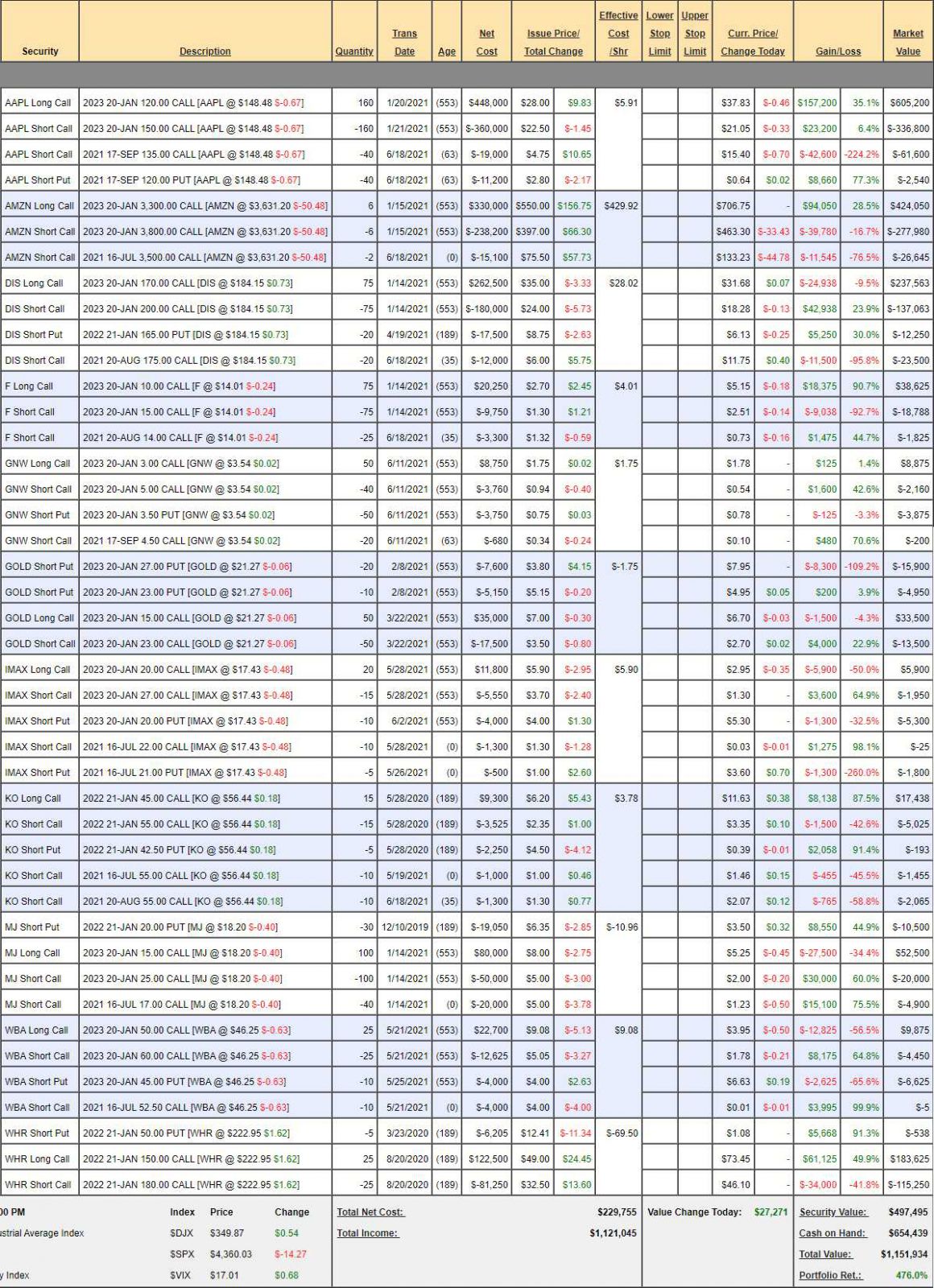

That's up $62,254 since our last review and the Butterfly Portfolio is our oldest and most consistent portfolio as it truly follows the PSW mantra of "Be the House – NOT the Gambler!" This is the only one of our portfolios we didn't cash out in September of 2019 since there's really no reason to – it's market-neutral. Just like a casino, we are happy to take bets on either side of the roll and we simply collect the premiums along the way.

Of course, we do make the occasional bet – that's why we have 160 Apple (AAPL) bull call spreads. It didn't start out that way but they kept throwing a sale on AAPL and we kept buying it and now it's hit our target at $150 18 months ahead of schedule. Even so, our 160 2023 $120/150 bull call spread with the short Sept puts and calls is "only" net $204,350 out of a potential $480,000 so there's $275,650 (134.8%) left to gain if AAPL simply holds $150 18 months from now. Of course we're going to sell more short puts and calls for more income along the way (if they ever pull back).

The Butterfly Portfolio is a low-touch portfolio and we only add perhaps one trade per quarter but that's all we need and the returns compound over time so, after 3 active years (Jan 2nd, 2018), the returns are monstrous – as you can see:

- AAPL – Are we upset that we're down $42,600 on the short calls? Not if it puts our $480,000 spread into the money. We have 18 months to roll the calls and, of course, we gained on the short puts, which we can now buy back and wait for a dip to sell more put premium. Our worst upside case is AAPL goes even higher and we have to buy another set of bullish spreads to cover and we make another $200,000 on that spread – oh no! BECAUSE we have $654,439 on the side, we can do things like that.

- AMZN – Another one where we're getting burned on short calls and those calls expire today so we're going to roll our 2 short July $3,500 calls at $133 ($26,000) to 2 short Sept $3,600 calls at $187 ($37,400). So we're selling another $11,400 in premium and waiting for AMZN to stop being silly and pull back. Meanwhile, our 2023 $3,300/3,800 bull call spread is $180,000 in the money at net $146,070 and a potential $300,000 (2x) at $3,800, so we're only protecting our gains. Unlike AAPL, I don't want to be caught owning AMZN so we're not selling short puts.

So here we have a net $76,700 spread and we previously made money on 4 short April $3,300 calls ($32,000) and 2 short April $2,600 puts ($9,500) so we're actually in this spread now for net $35,200 and we're able to sell $15,000 worth of premium every couple of months! That's why we don't project position gains in the Butterfly Portfolio – they are incidental – we're really in it for the short put and call sales and any gains in the spread – even if it's $300,000 – is incidental. It's just a side effect of the main strategy!

DIS – These positions do get big as the portfolio ages. That's because we tend to add on the dips. The dates look new because we roll but DIS was here from day one. They are right on track to put our $225,000 spread 100% in the money at $200 in 18 months and, at the moment, we're down net $6,300 on the puts and calls we sold due to this week's $15 pop.

- Otherwise, we were nailing the target. We have a month to adjust the calls so we'll see how earnings are but we could roll them to the Jan $190s, which are $11 and that would put our main spread $6 ($45,000) more in the money before we owed a penny of that back. So why should we worry?

- F – We're nailing the short calls on this one.

- GNW – Fairly new but coming along already.

- GOLD – We're waiting for it to get back to $25 to sell more calls. Patience is very important in this portfolio.

- IMAX – They came down hard and fast and the short calls will go worthless but we'll have to roll the 5 short July $21 puts at $3.60 ($1,800) to 10 short Sept $18 puts at $1.65 ($1,650) and they should bounce here after a 25% drop so we'll wait on selling short calls.

- KO – They just popped up and messed up our short calls. I think we'll just close the July calls and see how it plays out as our $15,000 spread is now 100% in the money from our net $1,225 entry so we're not going to sweat losing $455 along the way, are we?

That's why the Key to the Butterfly Portfolio is to pick FUNDAMENTALLY SOUND POSITIONS that will go up over time. Knowing that, we try to sell a little more bullish premium than bearish as we're very well covered to the bull side by our main position. KO went up $2.50 this week and cost us $455 but our long spread went $3,750 more in the money. It's a good trade-off.

- MJ – This thing is crazy but the premiums are great to sell. We sold 40 July $17s for $20,000 and now they are $4,900 so we made $15,100 and the long spread is up $11,050 already. The whole position was a $10,000 credit to start and our 100 long calls are $30,000 in the money. Aren't options fun? We have over $80,000 of upside potential so it's silly not to sell some longs – even if we think we're low in the channel. The premiums aren't what they used to be but let's sell 30 Jan $19 calls for $2 ($6,000) and we already have 30 short Jan puts that are in the money, so let's leave it as that for now.

- WBA – The short July calls will go worthless for a $4,000 profit on the net $2,075 spread in the first two months. For our next trick, let's buy back the 25 short 2023 $60 calls for $1.78 ($4,450) and wait for a bounce off $45 to sell more. We only have 10 short 2023 $45 puts, so let's sell 10 more of those for $6.63 to collect another $6,630 against our $2,075 spread.

That's why that cash balance keeps sneaking higher on us – we're always selling more puts and calls and dropping more and more cash into the portfolio and we only have to get lucky one time with our targets and the shorts expire worthless and we keep the cash and lose the obligations. FUN!

WHR – We're just waiting to collect the full $75,000 on this trade as it's run it's course. What a fantastic company. Currently net $67,837 so all we have to do is wait 6 months to collect $7,163 more and we have nothing better to do with the cash and margin – so fine with us.

It's kind of a boring way to invest but, in any kind of market, the Butterfly Portfolio is good for spitting out steady profits.

Have a great weekend,

– Phil