.jpg) Amazing!

Amazing!

Nothing seems to stop this market for more than a moment. We flew right back to the strong bounce line (see yesterday's Report) at 4,292 and went all the way to 4,340 before pulling back to 4,322 this morning. That is a very strong market and, as I said to our Members, the only caveat is that the volume is much lower (99M) on the way up than it has been on the way down (223M) in the past few days. That means the recovery has, so far, left us weaker than we were when it started – with less actual dollars supporting the prices that failed to be supported before.

That's OK, though, stocks don't actually need INVESTORS to go up in price. Do you think people bought $500Bn worth of AAPL stock since June 1st? Of course not! AAPL trades an average of 84.5M $146.15 shares per day (and it was $122 at the start) so that's $12.3Bn/day and 30 days would be $370Bn so EVEN IF EVERY SINGLE TRADE ON AAPL was just a buyer and not a single seller (not possible) – we'd still be 30% short of the money we need to account for the gain in valuation over the last 45 days.

That is because the stock market is a very distorted pricing mechanism that values the entire company based on the last price paid for a share. Clearly that is idiotic and my favorite example is this.

Let's say you have a town with 100 potential drivers who make an average of $50,000 a year and can afford, generally, to buy a $25,000 car and they ALL want Beetles. That's good news for the VW dealer, who has 100 Beetles on his lot that he bought from the factory for $20,000 ($2M). Unfortunately, they all have cars now so he has to wait for people to decide they want new ones.

So he sells 5 cars the first week at $25,000 and makes $5,000 per car, which is a $25,000 profit. He can anticipate that his STOCK of Beetles is worth $25,000 per car (share) and he'll make 95 x $5,000 on the rest ($475,000) on the rest of his portfolio of Beetles ($500,000 total). Now, in week 2, the factory gives out bonuses to all the workers and 20 people come in to buy cars but there aren't 20 cars ready to go so a bidding war ensues and, by the time it's done, he's sold 5 more for $25,000, 5 for $30,000, 9 for $35,000 and the last guy who came in HAD to buy it right away and paid $40,000.

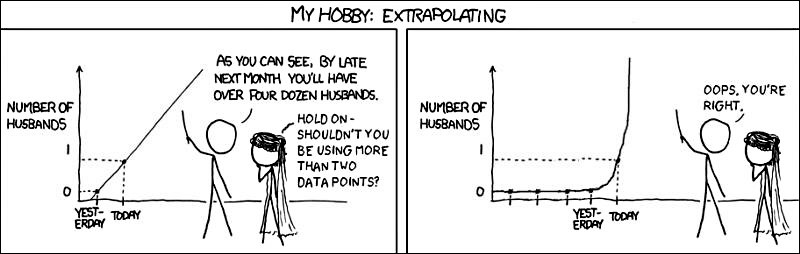

So now the dealer has sold 20 more cars for $125,000 + $150,000 + $315,000 + $40,000 ($630,000) and that's an average of $31,500 and he made $230,000 selling 20 more cars plus the first $25,000 for a 2-week moving average of $10,200 per car but, instead of assuming he'll make $10,200 on the next 75 cars, he EXTRAPOLATES the $20,000 he made on the last car at $40,000 and says his 75 remaining cars are worth $3,000,000 with $1.5M of that being profit.

It's all great on paper but we don't understand the motive of the guy who paid $40,000 for the last car but we do understand that the entire population of drivers only makes $5M a year and 25% of them just bought cars so that leaves $3.75M available in the pool of potential customers and probably less if they aren't as well-paid as the guy who paid $40,000 for the last car.

The dealer may keep those $40,000 stickers on the cars and sales (volume) may slow down or stop as less and less people are left who can afford $40,000 for a car come by and, eventually, he is forced to start dropping his price until he comes back to a price people can actually afford. THAT is when we might begin to discover the true value of his stock – NOT while it's on the way up.

That's the problem with market pricing. You are basing Apple's $2.5Tn valuation on whatever the last person paid for a single share of stock ($146). If the next person buys a share for $138, did AAPL suddenly become worth $102Bn (4%) less? Of course not – but neither was it worth $102Bn more just because the last trade of the night went off at $146. Banksters know that traders don't understand this and they use those last trades and low-volume trades to manipulate their perception of the market and the value of stocks. Don't fall for it.

Like the factory bonuses in the example above, our own Government is distorting the market with cash giveaways and low-rate financing and that does make it very hard to establish a true value but one thing we can be sure of is that THESE valuations are artificially enhanced and that means buying at these prices can leave you holding a very hot potato.

Like the factory bonuses in the example above, our own Government is distorting the market with cash giveaways and low-rate financing and that does make it very hard to establish a true value but one thing we can be sure of is that THESE valuations are artificially enhanced and that means buying at these prices can leave you holding a very hot potato.

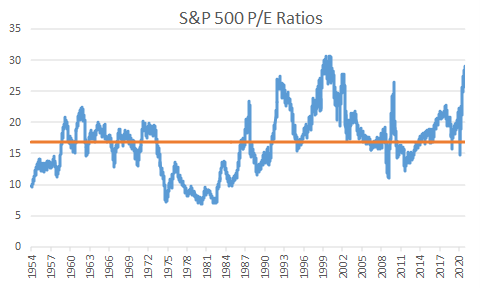

We began 2021 with the S&P at 3,800 and we're up over 500 points (13%) since then, pushing the P/E ratio from 28.5 to 32.2 and the only time we've EVER been this high was before the great crash of 2000. This is NOT normal and not normal can last long enough to make you think it's normal and that's the danger we're in now.

I hate to be a party-pooper but it's my job to keep you grounded and the behavoir of this market is not natural and, more importantly, it's not sustainable because there simply isn't enough money in the World to actually pay this much of it for stocks. These prices are based simply on the extrapolation of a buying frenzy that COULD wear off at any time and WILL wear out as soon as the Government and the Fed stop feeding it with free money.