The Bond Market is Talking

Courtesy of Michael Batnick

Interest rates are the lifeblood of a country’s economy. Everything is priced off of them, in one way or another.

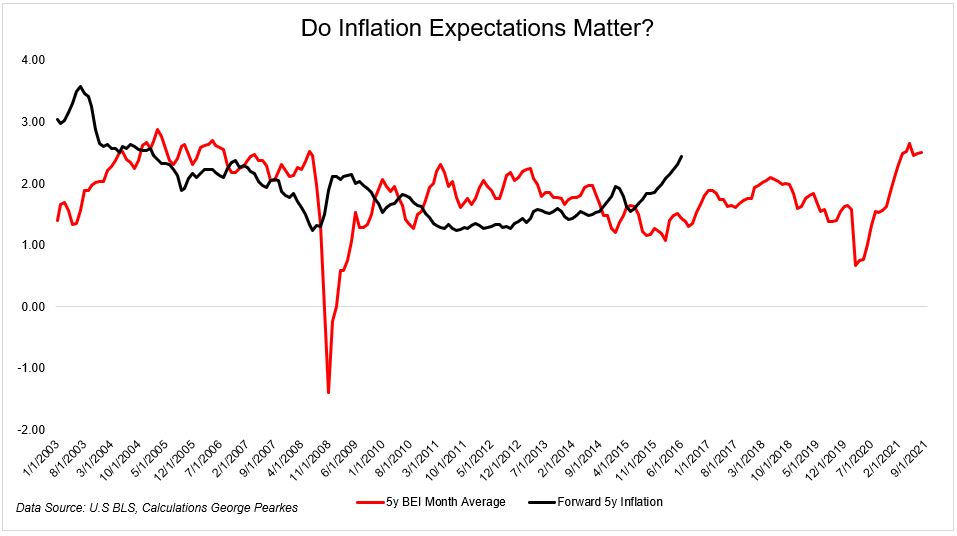

When the bond market talks, people listen, and right now it’s saying that inflation is coming in hot. The difference between nominal and real interest rates right now, or “breakevens,” are at the second-highest levels of the 21st century. The bond market is pricing in 2.5% inflation over the next 5 years.

So the question is, how accurate are these expectations? Actually, not terrible. George Pearkes made this chart that shows breakevens versus actual inflation on a forward basis. In 2003, breakevens were 3%. Over the next 5 years, actual inflation was 1.4%.

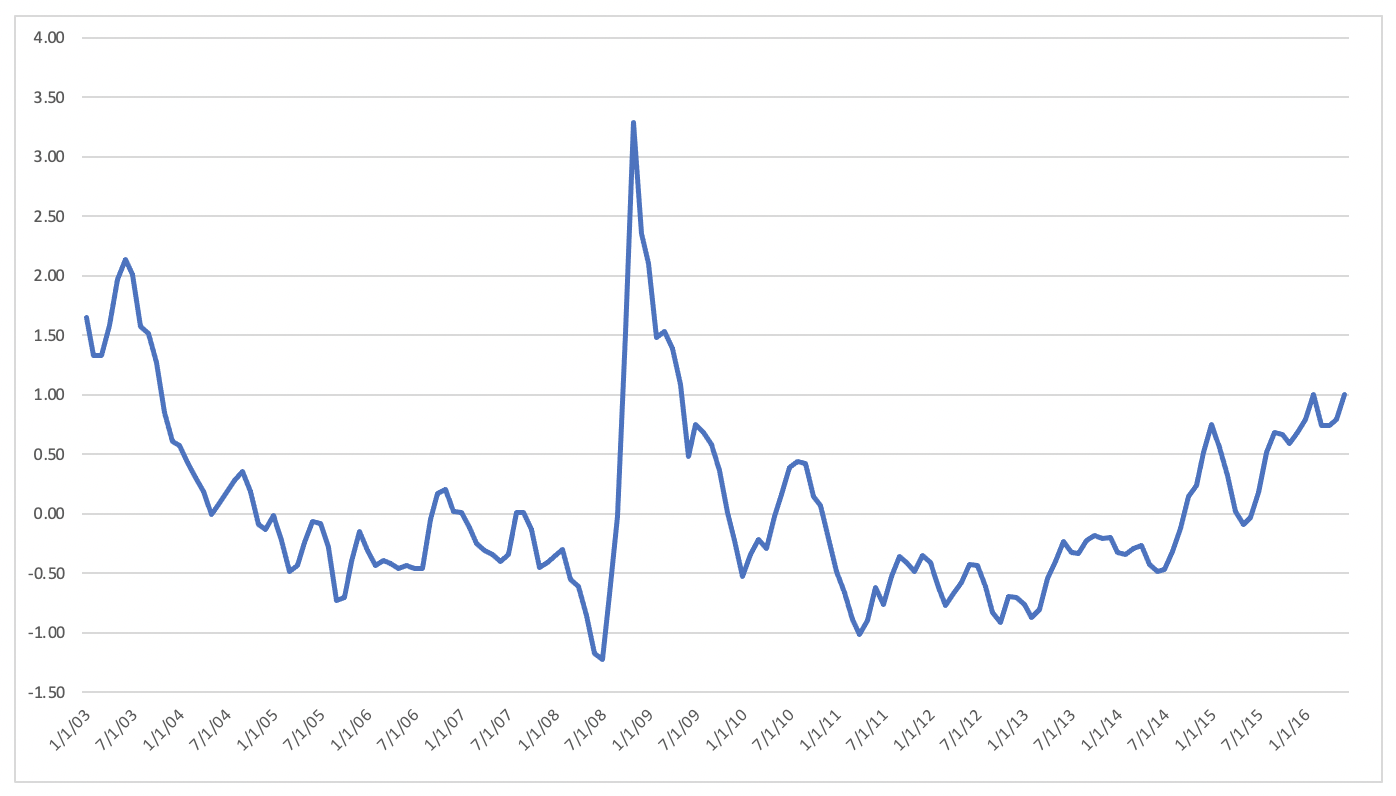

To better visualize the accuracy of bond market expectations, I took the difference between the two lines above and plotted it below. The line at 0 shows perfect foresight.

People refer to the bond market as the smart money, but it’s not all-knowing. Just because the market is pricing in a certain level of inflation, that doesn’t mean it will come to pass.

Josh and I are going to discuss this and much more on tonight’s What Your Thoughts?

Subscribe to the channel. You’ll get a notification as the show is about to premiere each week.

Josh and Michael use YCharts when creating visuals for this show and many aspects of their business.