And we're out!

And we're out!

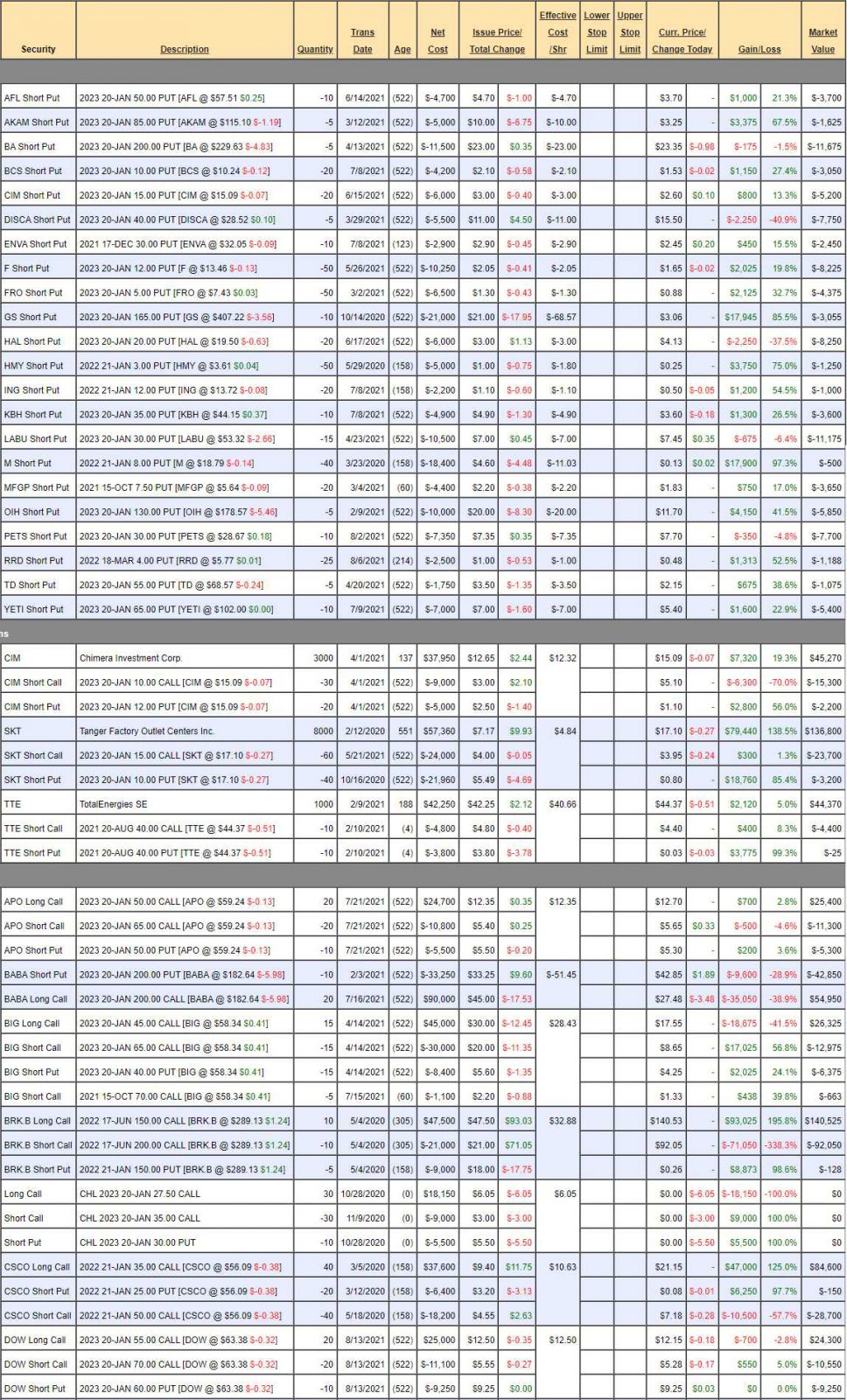

Our Long-Term Portfolio hit $2,027,896 yesterday, which is up $1,527,896 (306%) since we started the portfollio with $500,000 back on October 1st of 2019. We had cashed our previous LTP with about $2M as well as I was worried that the market was overbought and we didn't have a correction until March – and that was due to the virus, not really a proper market correction. Then the stimulus made every trade a winner so here we are – back at $2M again and we're not 100% cashing out but we are paring back our positions significantly.

The LTP is already over 50% in CASH!!! so cutting 1/2 of our positions should bring us to about 75% CASH!!! and then the CASH!!! is our hedge – as we've got tons of money to go bargain-hunting if there is a sell-off and, if there's not – well clearly we know a lot of ways to win.

I started the LTP Review in yesterday's Live Member Chat Room and we'll finish it up here this morning:

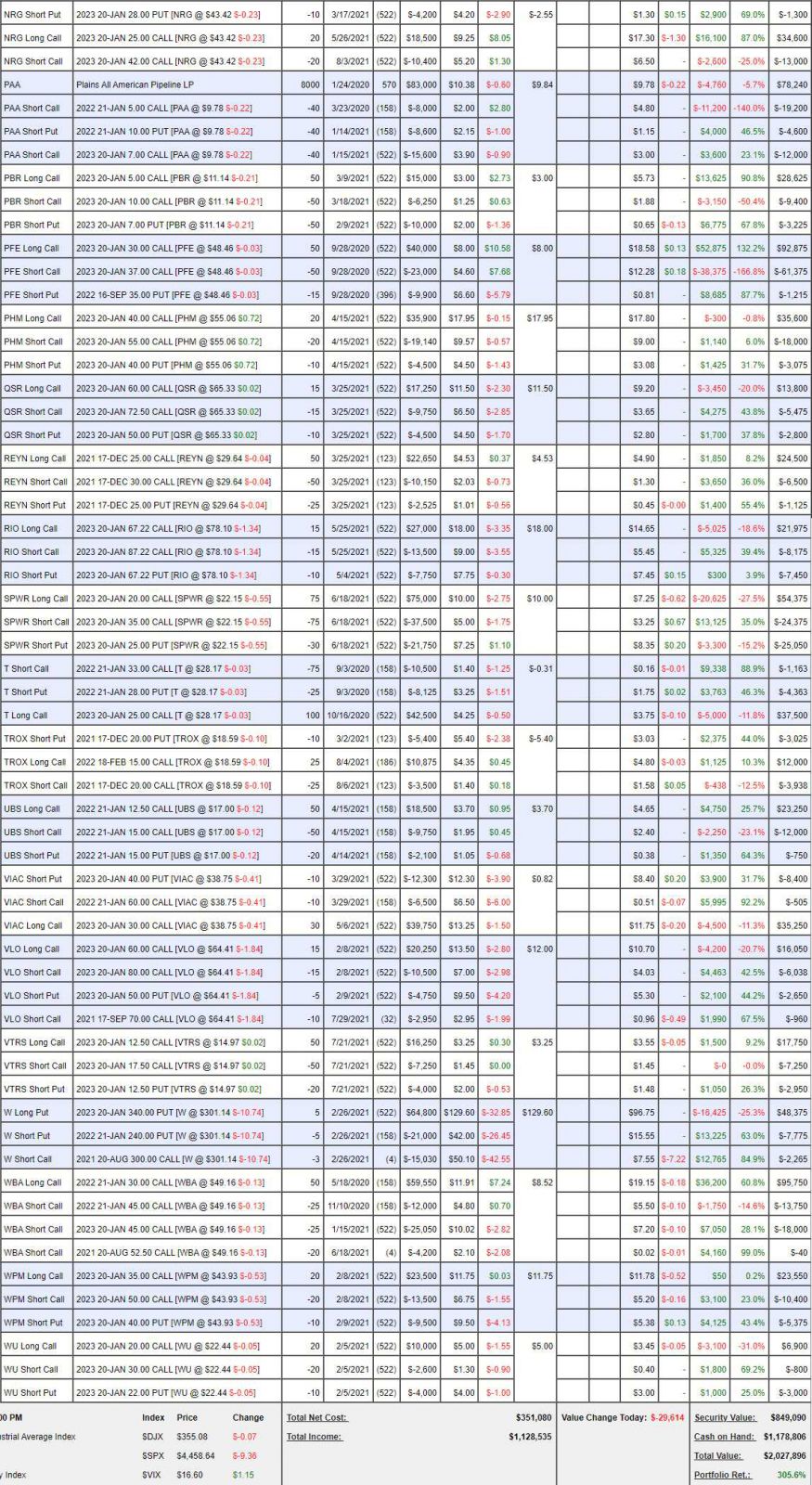

Long-Term Portfolio Review: $2,027,896 is $68,608 since our June 15th review. Keep in mind we only started this portfolio with $500,000 on 10/1/19 so $68,000 is 13% of our original base in a month! That's the value of compounding your gains but, unfortunately, we're also compounding our risks and that is making the hedging more and more expensive to protect ourselves. The STP is, in fact, back down to $90,000 as it took a huge hit from CMG and, of course, the index hedges so, on the whole – we're at the same $2.1M we've been at for the whole summer.

Still, the question here is whether or not to cash out the LTP and today is one of those days when you do feel like it's silly not to participate in this market as it does seem to bounce back from anything. Also, I don't have a great alternative to put the money – that's another issue. What would we do with $1.5M if we cashed in and started from scratch. I guess I'd buy a lot of T and VZ and GOLD and SPWR – but those are positions in the LTP already and the LTP is already over 50% in CASH – so perhaps what we need to do is just cut back our downside risk? Let's see…

- AFL – Downside is owning 1,000 shares of AFL at $50. So far, we made 20% in two months but we have to consider the risk of being forced to buy $50,000 worth of shares and how it limits our ability to adjust the portfolio. In a risky market, unless we're dying to own the stock – it's too much risk for too little reward so we'll kill it.

- AKAM – Already up 65% so why risk anything? Kill it.

By the way, the trades we kill in the LTP pretty much automatically go onto our next Watch List.

- BA – $100,000 – Kill it.

- BCS – Only risking owning $20,000 worth at net $7.90 and we can make $3,000 more so KEEPER!

- CIM – If we are forced to buy 2,000 shares for net $12, the $1.32 dividend would be 11% before we even sell more puts and calls. KEEPER!

- DISCA – Bad consumer sentiment means kill it.

- ENVA – Too cheap to kill. KEEPER!

- F – $60,000 is too much bulk. Kill it.

- FRO – Net $3.70 would be a shame if we don't get assigned. KEEPER!

- GS – Up 86%, kill it.

- HAL – 2,000 shares at net $17 is actually appealing. KEEPER!

- HMY – Up 75%, kill it.

- ING – Up 52%, kill it.

- KBH – 1,000 shares at net $30.10 is a KEEPER.

- LABU – Interesting pullback. If we didn't already have them, I'd be selling puts now. Might actually make a full play out of these. KEEPER!

- M – Those are done, kill it.

- MFGP – Not much risk here so KEEPER!

- OIH – Good enough, kill it.

- PETS – Brand new, KEEPER!

- RRD – Up 50% already, kill it.

- TD – About halfway, kill it.

- YETI – Up 22.9% in a month, very nice. KEEPER!

So we got rid of 12 of 22 short puts and especially our expensive ones. That means we'll have more buying power if there is a downturn so we've increased our margin of safety considerably without spending any money.

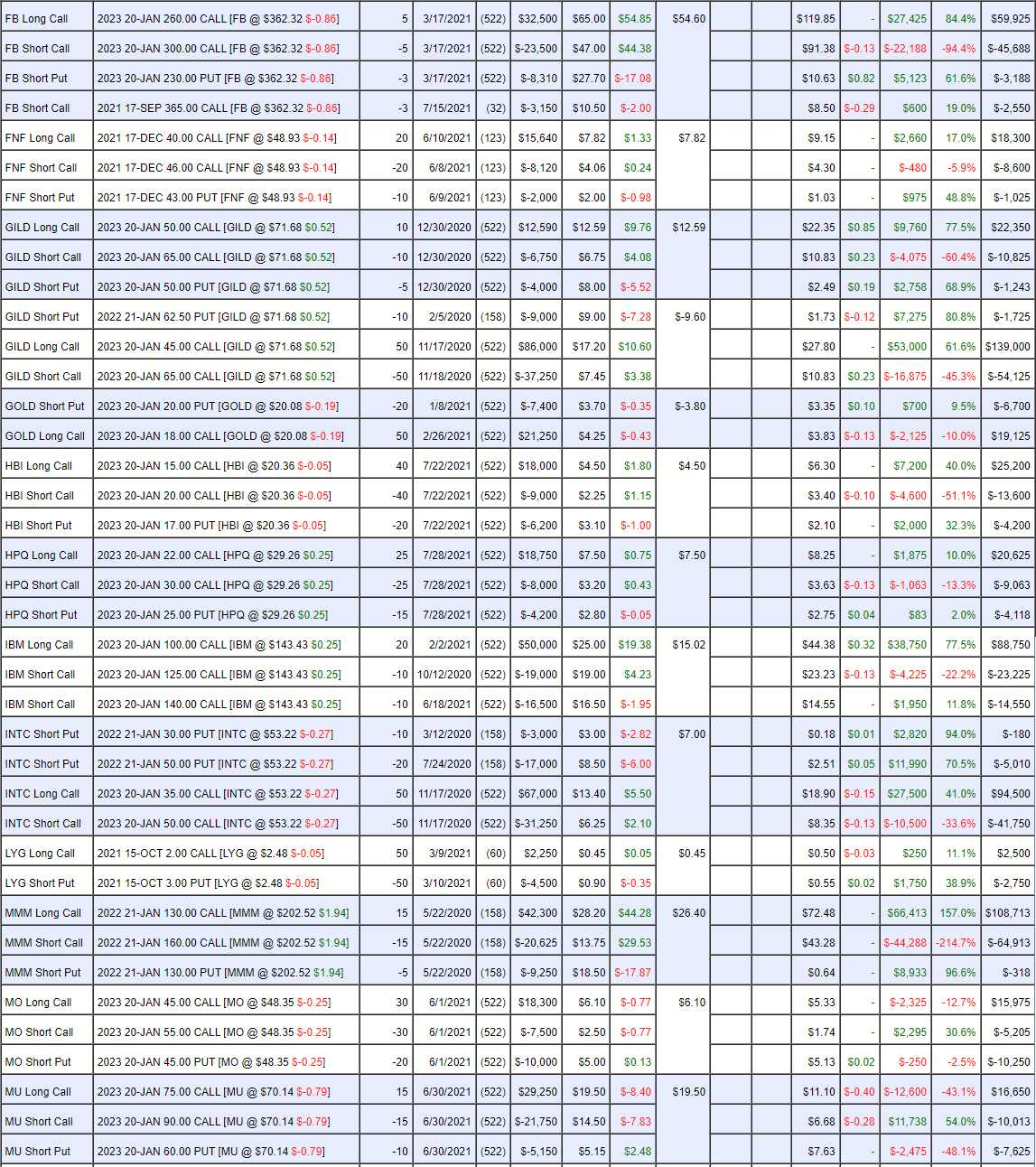

- CIM – As noted above, we love them and we love the dividends and we get called away 33% below the current price so, no worries.

- SKT – Pulled back off $20 but we love them. Just paid us an 0.178 dividend too!

- TTE – Love them too but we'll be called away at $40 and done with it.

- APO – So undervalued, have to keep them.

- BABA – Big pain recently. This company is at about 1/2 their proper value. Last Q showed great growth but everyone is freaking out about China but I don't think they are out to destroy tech companies (not all of them). Going to let it ride.

- BIG – Not very exciting. Kill it.

- BRK.B – Miles in the money. Kill it.

- CHL – Stuck with these.

- CSCO – $56,000 out of $60,000. Kill it.

- DOW – Brand new. KEEPER!

- FB – This one is an income-producer so it's a KEEPER!

- FNF – $9,000 out of a potential $12,000, kill it.

- GILD #1 – Too good to kill and 50% more to gain so KEEPER!

- GILD #2 – $80,000 out of $100,000 potential would be silly to risk – even though I love it. Kill it.

- GOLD – Can't kill this one, I want MORE! KEEPER!

- HBI – $7,000 out of $20,000 potential with a low-risk of ownership. KEEPER!

- HPQ – Brand new. KEEPER!

- IBM – $35,000 profit, $140,000 if we're forced to own it. Killl it.

- INTC – Can't kill our Trade of the Year, can we? Let's buy back the short puts to remove any danger and that leaves us net $53,000 on the $75,000 spread. We started with net $15,750 so already up 200% but $22,000 more to gain BUT if we're buying back the puts we're in for $21,000 and a $30,000 with $17,000 left to gain… Damn, we have to kill it. The problem is we can easily make 30% on $50,000 over 18 months – so why leave it in any trade that not going to triple up for us?

- LYG – I like it but kill it.

- MMM – Kill it.

- MO – They pay a 7% dividend so we wouldn't mind owning them which means there's really no downside. KEEPER!

- MU – Let's just keep the short puts and see how that goes. We don't mind starting a new position at net $55 and, if it goes lower, we'll just buy a nice, lower-strike spread. If it goes higher, we get paid $7,000 for not owning them.

- NRG – $22,000 out of $34,000 potential but we started with $4,000 so it's a "bird in the hand" situation. Kill it.

- PAA – We're effectively half cashed out anyway and enjoying the 7.5% dividend so KEEPER!

- PBR – Glad to get out of the energy sector with a nice profit. Kill it.

- PFE – $32,000 out of $35,000. Kill it.

- PHM – Can double up if it stays flat so KEEPER!

- QSR – Small entry and we'd REALLY like to own them for net $54 so KEEPER!

- REYN – We just doubled down on these so KEEPER!

- RIO – They just paid out a special dividend and screwed up all the options and that's why the stock dropped. There's nice upside here so KEEPER!

- SPWR – You know I'm not letting go of SPWR at $22. KEEPER! This is a $112,500 spread at $35 and it's currently net $4,688 so $107,821 (2,299%) upside potential over the next 18 months while Biden is pushing solar and SPWR is headquartered in San Jose.

- T – Another 7% dividend we don't mind getting so there's no downside to being assigned and for 15 years we've been buying T when it's under $30 so why stop now? KEEPER!

- TROX – Plenty left to gain and I love them. KEEPER!

- UBS – It's only a $12,500 spread at net $10,000 so no point. Kill it.

- VIAC – We're aggressively long. KEEPER!

- VLO – Not excited about it. Kill it.

- VTRS – Kill it.

- W – That's a short so KEEPER!

- WBA – I love them but net $64,000 out of $75,000 potential means kill it.

- WPM – Another one I love but only $7,500 out of $30,000 potential is a KEEPER!

- WU – I'm not excited enough to keep them so kill it.

So we've cut about half the portfolio and moved to about 80% CASH and I'm much more comfortable riding out the correction like this than having so many (42 full and 22 short puts) to have to worry about. We'll be making similar adjustments to our other portfolios as the week goes on.