Actually, this is kind of part 2, as we reviewed the LTP in yesterday's Report.

Actually, this is kind of part 2, as we reviewed the LTP in yesterday's Report.

The Dow fell 500 points from Tuesday's close at yesterday's low and we're not cutting back our positions because of that but we are cutting back our positions because THAT is how easily this market can fall. We've had a very low-volume rallly, petty much for the last 18 months and the problem with low-volume rallies is they don't tend to build any support – so you can give up your gains with incredible speed.

Yesterday's drop erased the entire month of August's gains as we got back to 35,000 on the Dow and our strong bounce line is 35,200 – which is right where we are this morning but I think we'll fail and head lower and there's no real support until 34,000 – which is only down 5% – so not a big deal, even if it happens.

Key support for the S&P 500 is 4,200. On the Nadaq it's 14,500 and on the Russell – back to 2,000 – 10% lower than we are now. Although we are very well-hedged for a 10% drop – why ride it out. We had a lot of trades in our Long-Term Portfolio that already made a lot of money and protecting those gains is expensive (hedging costs) so it's easier and smarter to just get back to CASH!!! and let September play out before jumping back in. This is something we did almost exactly two years ago – and we certainly didn't regret that.

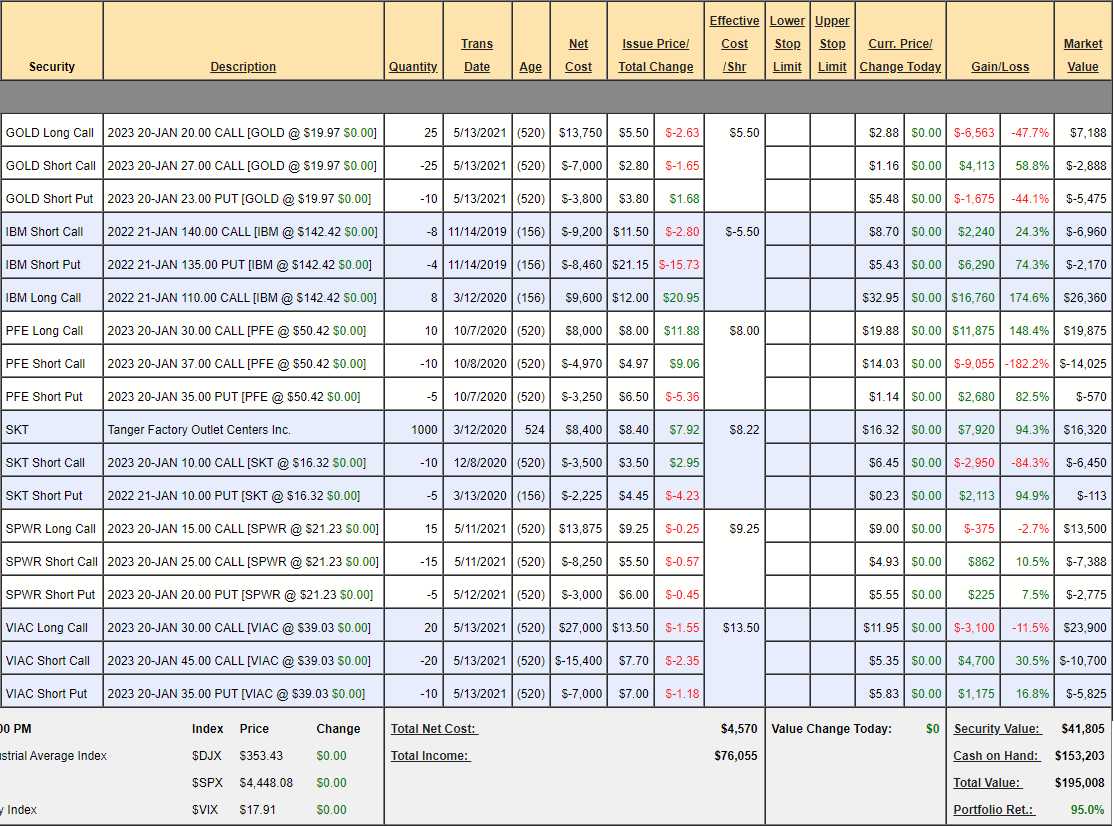

Money Talk Portfolio Review: There's not much to review here as we only adjust the MTP when I'm on the show, which I will be in two weeks. Being up 100% is a nice place to quit and start a new portfolio but we'll decide in two weeks. We actually lost a little ground from last month as we're now only up 95% at $195,008 from $199,489 in our last review. As it's a touchless portfolio other than our quartely Televised adjustments, these are generally bullet-proof positions so we'll see what we can bear to part with:

- GOLD – This is a $17,500 spread currently with a net $1,175 credit so the upside potential is $18,675 (1,589%) at $27 in Jan, 2023. GOLD did crash down to $12.42 last March but then rocketed higher to $30.75 last August and then was back to $18.57 in February and now $19.97 so we may go lower before we go higher but the upside potential, the fact that gold (the metal) is a great inflation hedge and the fact that we REALLY don't mind owning 1,000 shares at $23 for the very long-terrm, make this one a KEEPER!

- IBM – This is a $24,000 spread at net $17,230 so there's $6,770 (39%) left to gain if IBM holds $140 into January but we already made $25,290 as we started with a credit due to aggressive put selling that paid off already. So we're really risking $25,290 to make $6,770 (26%) more and, though it's short-term, the risk does not justify the reward so we're going to kill it.

- PFE – Booster shots are coming. With 16 months to go we're at net $5,280 on the $7,000 spread but we have no imaginable danger (and we don't mind owning 500 shares of PFE at $35) and we don't need the cash so I guess this will be a KEEPER with $1,720 (32%) left to gain.

- SKT – Miles in the money now so we're going to get called away at $10 for $10,000 and it's now net $9,757 and they just paid us a $178 dividend, so 5 more of those is $890 and $243 more for the stock at $10 is $1,133 and that's only 11.6% and we can do better things with our money so kill it.

- SPWR – They pulled way back and barely better than our entry on this $15,000 spread, which is currently net $3,337 so $11,663 (349%) upside potential if SPWR reclaims $25 in 16 months. This one I'd be happy to DD on – KEEPER!

- VIAC – I cannot believe this is cheaper than last month ($43.44). Another one I'd rather double down on than cut. It's a $30,000 spread and $45 is not very far away as a target – so nothing to adjust. We're at net $7,375 despite being $18,000 in the money (I kid you not – options are FANTASTIC!) and there's $22,625 (306%) upside potential. KEEPER KEEPER!! (our first double keeper!).

So it looks like we're killing 2 positions (1/3) and the 4 that are left have $54,683 of upside potential between now and Jan 2023, which is a fine amount to make in any portfolio. Even better, we are about 80% in CASH!! so we don't have to worry about a downturn and we have tons of money to shop with if there is one (or even if there is not).

These decisions are not final until a week from next Wednesday's show but not likely to change. Also, we will probably have to come up with a new trade – other than doubling down on SPWR and VIAC….

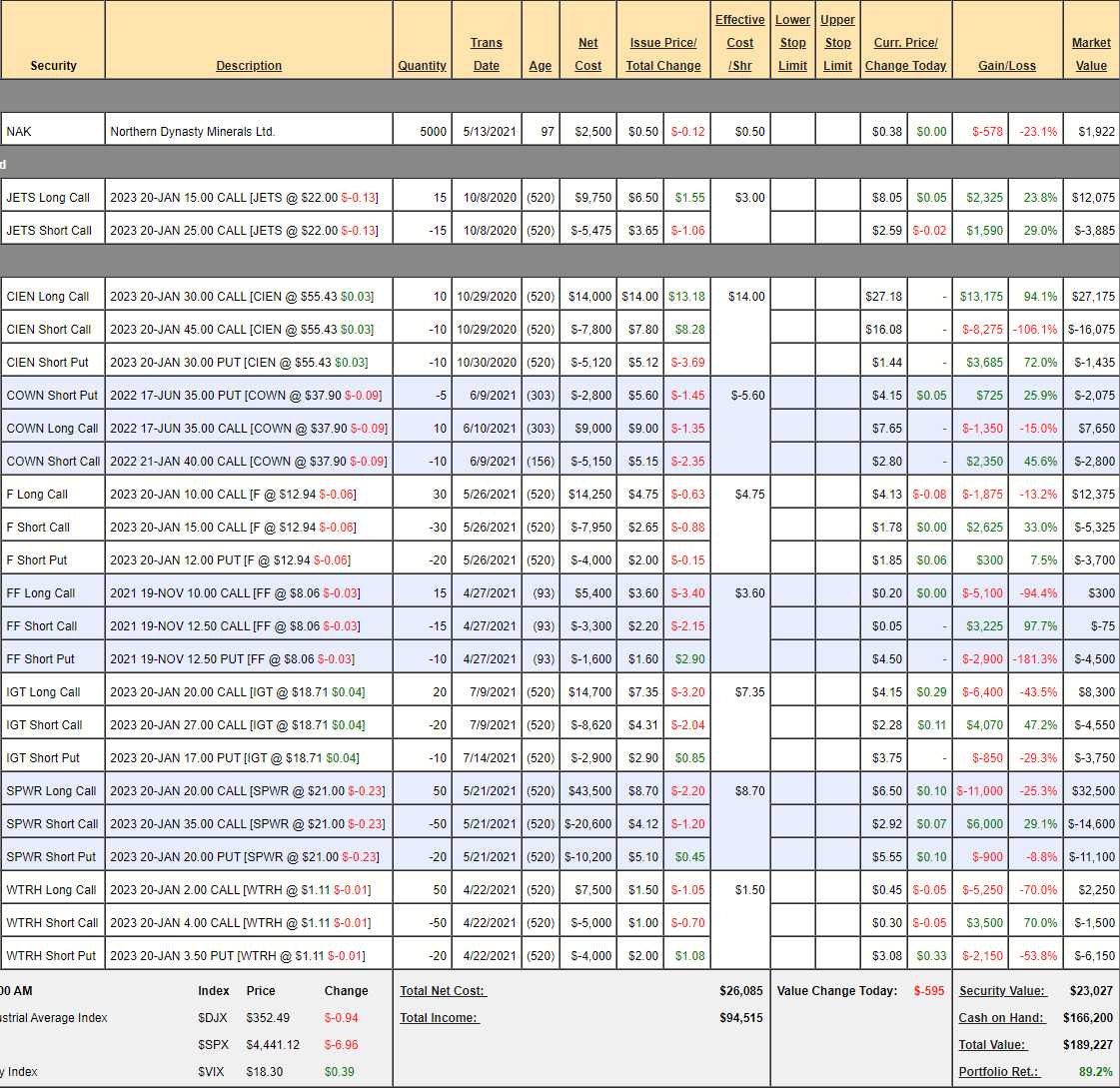

Future is Now Portfolio Review: $189,227 is down $12,188 from our last review but still up 89.2% overall. As I said last month, these are stocks of the future – not of the moment so they are going to be choppy. We'll see how they stand up to a skeptical review in an atmosphere where I'd rather not take any risks:

- NAK – Still a lottery ticket pending their environmental review, which is chugging along at slow speeds. KEEPER.

- JETS – Covid resurgence has taken away our reason for this trade. Kill it.

- CIEN – Well over target at net $9,665 out of $15,000 potential and we love them long-term so KEEPER with $5,335 (55%) left to gain.

- COWN – Very undervalued and only net $2,775 on the $5,000 spread so $2,225 (80%) left to gain and we only risk owning 500 shares. KEEPER.

- F – Here's we're only net $3,350 on the $15,000 spread so $11,650 (347%) left to gain. We don't mind owning 2,000 shares of F and $15 does not seem like an aggressive target so – KEEPER.

- FF – Future Fuel is Falling Falling since paying out a $2.50 special dividend (the sheet is wrong – we have the old calls that are worth more) so far far but they made $3.5M last Q and they paid another 0.06 dividend. The problem was the price of feedstock for their biofuels went up faster than they could raise prices – that's the commodities game. More importantly, sales were up 56% and we're buying the whole company for 347M at $8.17 so we are going to roll the 15 Nov $10 calls at $1.50 ($2,250) to 30 of the Feb $7.50 calls at $1.30 ($3,900) and we won't roll the puts yet – we'll see how things play out. The old puts are $2.25, not $4.50 so having the wrong FF options on our sheet exaggerates our loss by about $4,000. It will fix itself when they expire.

- IGT – Has not done well since we picked it in early July. Seems silly as they beat on earnings by $1.38 (0.11 expected) and revenues were up 73.3% for the year and that was a 14% beat and they raised outlook. Don't ask me why our fellow traders are such idiots but let's take advantage and roll our 20 2023 $20 calls at $4.15 ($8,300) to 30 of the 2023 $12 calls at $8.15 ($24,450) and now we're aggressively long. If we end up hitting our target, we'll collect $45,000 on what is now net $16,150 so $28,850 (178%) upside potential at $27.

- SPWR – You already know it's a KEEPER, right? It's a big position with a current net loss but $35 is still a realistic target and I'm waiting for 2024s to come out before we roll the $20 calls out. It's a $75,000 spread and currently net $6,800 so $68,200 upside potential at $35 but let's call it $43,200 (635%) upside potential at $30 to be a bit more conservative.

- WTRH – They finally stopped falling. This was intially a net $1,500 credit so our worst case is ownng 2,000 shares at $3.50 ($7,000) less the $1,500 is net $5,500 or $2.75/share. That's our worst case and our losses are limited to that $5,500 – even if they go BK. BUT, I see these guys signing up another fast food chain every week and I think they are just grinding it out in early stages so I'm not inclined to sell with a $3,900 loss when all we can do is lose $1,600 more. HOWEVER – I'm also not inclined to spend more money – so we'll just give it another quarter and see how things progress.

As expected, just one position to kill and the rest will wait for the future. There's $73,560 of potential gains (in the positions we believe in enough to assign value) and that's plenty for this size portfolio to make in the following year so no pressure.