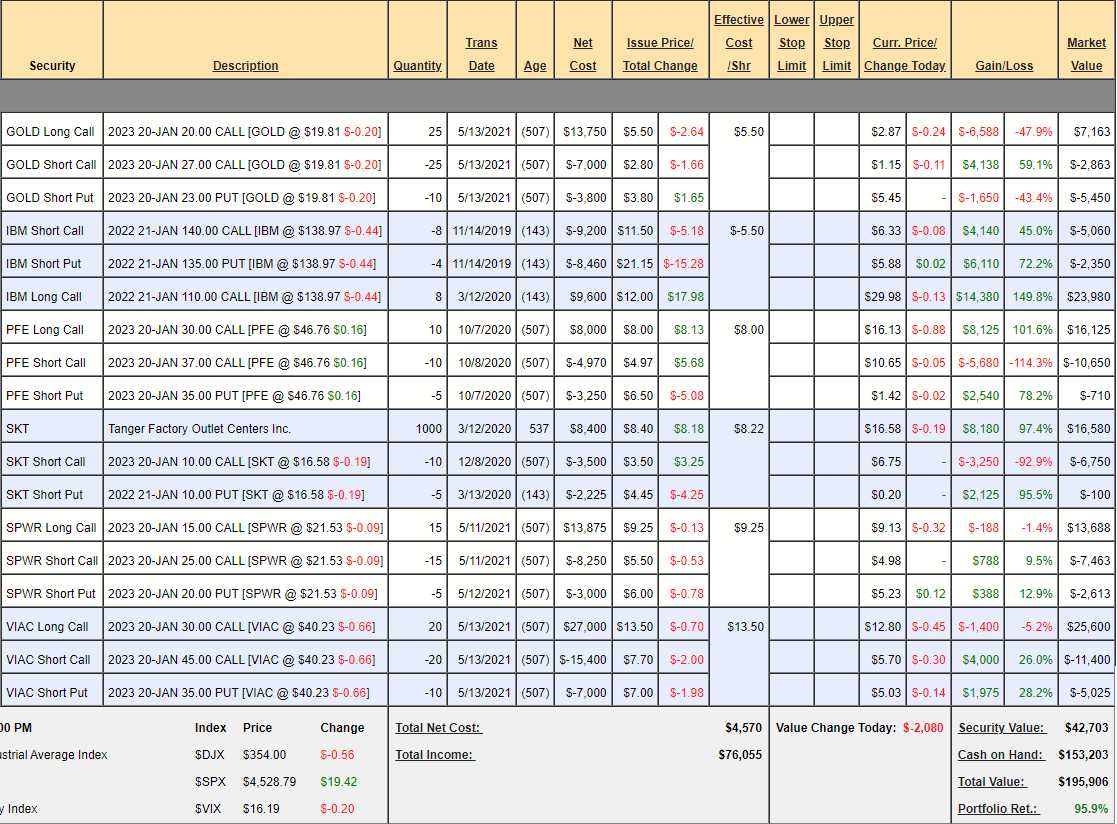

$195,900.

That's up 95.9% in less than two years for our Money Talk Portfolio, the one we we only trade quarterly in our live appearances on BNN's Money Talk but, due to Covid, we pre-tape on Tuesdays so I put up the reviews the day we're taping instead. It's tricky to pick stocks that we aren't allowed to adjust so, needless to say, these are all trades I love but it is time to close our IBM trade – as we expected in our August 18th Review.

As you can see from our last show (May 12th), we were at $187,000 so we've gained $8,000+ since then but we want to stay "Cashy and Cautious" coming into Q3 earnings, which we think is going to indicate a somewhat disappointing Summer as Covid began to re-surge. We are also concerned that the Fed is going to be forced to taper soon and that the Government is not going to be able to keep spending 20% of our GDP on stimulus to maintain a 6.6% growth rate – not as we cross over $30Tn in debt the next quarter.

That is the true cost of our record-high markets – a $3.1Tn (so far) this year). If we pass the infrastructure bill, that's another $1Tn and we'll be over $32Tn by next June. Our entire GDP is "just" $20Tn and 15% of it is debt financing in order to BUY our "growth" – that is why we are being cautious – it's clearly unsustainable but Japan is close to 300% of their GDP in debt yet they keep borrowing – so why shouldn't we?

That is the true cost of our record-high markets – a $3.1Tn (so far) this year). If we pass the infrastructure bill, that's another $1Tn and we'll be over $32Tn by next June. Our entire GDP is "just" $20Tn and 15% of it is debt financing in order to BUY our "growth" – that is why we are being cautious – it's clearly unsustainable but Japan is close to 300% of their GDP in debt yet they keep borrowing – so why shouldn't we?

On the May show, we added trade ideas for Viacom (VIAC) and Barrick Gold (GOLD) and VIAC has been flat, but Barrick got weaker. Despite being flat, we gained on our VIAC position as the volatility died down – a huge advantage we have in the market as premium sellers – time is always on our side on these trades.

On the May show, we added trade ideas for Viacom (VIAC) and Barrick Gold (GOLD) and VIAC has been flat, but Barrick got weaker. Despite being flat, we gained on our VIAC position as the volatility died down – a huge advantage we have in the market as premium sellers – time is always on our side on these trades.

Since we are so much in CASH!!!, we will take advantage and improve our GOLD position and there are still bargains to be had, so we can add a couple of new ones as well:

- GOLD – This is a $17,500 spread that's currently a net $1,150 credit so there is $18,650 of upside potential if GOLD is over $27 in Jan of 2023, which is still a very realistic target. The Fundamentals on gold haven't changed and we still like Barrick long-term so let's just take advantage of this dip by rolling the 2023 $20 calls, which are now $2.87, down to the 2023 $15 calls at $5.65 for net $2.78 so we're buying $5 of intrinsic value for $2.78 – a 44% discount! That widens our spread to $30,000 and our initial outlay was $2,950 so now we're in for net $9,900 with $20,100 of upside potential.

- IBM – This is a $24,000 spread at net $16,570 and, if we were able to trade it every day I'd let it ride as we can make another $7,430 if IBM holds $140 into January but we're worried about the market and we already have a massive gain so it's silly to take the risk – we're going to cash this one in.

- PFE – Booster shots are coming. With 16 months to go we're at net $4,765 on the $7,000 spread but we have no imaginable danger (and we don't mind owning 500 shares of PFE at $35) and we don't need the cash so I guess this will be a KEEPER with $2,235 (46%) left to gain.

- SKT – Miles in the money now so we're going to get called away at $10 for $10,000 and it's now net $9,730 and they just paid us a $178 dividend, so 5 more of those is $890 and $270 more for the stock at $10 is $1,160 and that's only 11.9% and we can do better things with our money so we're going to cash this out. .

- SPWR – They pulled way back and barely better than our entry on this $15,000 spread, which is currently net $3,612 so $11,388 (315%) upside potential if SPWR reclaims $25 in 16 months. When the 2024 calls come out we are going to roll out our long calls and get more aggressive but, for now, this is great for a new trade as well.

- VIAC – I cannot believe this stock is so flat. They just made $1.036Bn last Q after making $911M in Q1, so on pace for making $4Bn this year and, at $40, you can buy the whole company for $26Bn, which we would love to do! This is a $30,000 spread we paid net $4,600 for and now it's net $9,175 so we still have $20,825 (226%) left to gain at just $45 so this too is fantastic for a new trade – even though we're already up $4,575 (99.4%) – aren't options fun?

So here we have 5 remaining spreads with $54,548 of upside potential, another 50% gain on our originally $100,000 portfolio but we're only using a small amount of our buying power so we're in a great position to add a couple of new trades to the mix:

Getting rid of IBM has left us with only SPWR for tech so let's pick up Hewlett-Packard (HPQ) who had great earnings but sold off a bit as the CEO warned of supply constraints due to ship shortages. While it may cause short-term problems, as long-term investors this is an opportunity! $29.74/share is only $35.75Bn in market cap and HPQ drops over $4Bn to the bottom line fairly consistently so a p/e under 10 for one of the bluest of blue chip corporations sounds good to me and we can leverage our upside using options as such:

- Sell 20 HPQ 2023 $27 puts for $3.30 ($6,600)

- Buy 40 HPQ 2023 $30 calls for $3.75 ($15,000)

- Sell 40 HPQ 2023 $35 calls for $2.10 ($8,400)

Here we have a $20,000 spread for net $0 so we have the whole $20,000 of upside potential if HPQ is over $35 in 16 months. Our worst-case, since we are using no cash, is to be assigned 2,000 shares of HPQ at $27, 10% below the current price – and we already think $30 is a bargain!

On-line sports betting is legal in most of the US now and Boyd Gaming is poised to take advantage of that with 28 low-rent casinos that make very good money ($500M) already yet you can buy the whole thing for just $7Bn at $62. Even better, they only lost $135M last year so we're not terribly worried about another shut-down either. With way lower operating costs than their peers, BYD is poised to win big on sports betting.

- Sell 10 BYD 2023 $50 puts for $6.50 ($6,500)

- Buy 20 BYD 2023 $55 calls at $16 ($32,000)

- Sell 20 BYD 2023 $75 calls for $8.50 ($17,000)

- Sell 5 BYD Jan $70 calls for $4 ($2,000)

That's net $6,500 on the $40,000 spread that's $14,000 in the money to start so the upside potential is $33,500 (515%) at $75 or better. We made a 1/4 sale of short calls using 144 of our 508 days. Three more sales like that and we have a free spread so no reason to press our luck. Worst case is owning 1,000 shares at net $56.50 – still 10% off the current price.

That's another $53,500 of upside potential on our two new trade ideas so now the Money Talk Portfolio has the potential to make another $108,048 between now and Jan, 2023. Remember, this is a no-touch portfolio – we're stuck with these trades until the next time I'm on the show, probably around Thanksgiving for my annual Trade of the Year pick.

CASH!!! is our hedge in this portfolio – we have plenty of it on the sidelines.