Volatility Is Back

Courtesy of Michael Batnick

The stock market is up 17% year-to-date. Last year it was up 18%. The year before that it gained 31%.

If this is the beginning of the end, which I’m not saying it is, but if it is, I wanted to remind you that the market has done very well over the years. A pullback in the indices would be normal. The uninterrupted gains that we’ve grown accustomed to are an outlier.

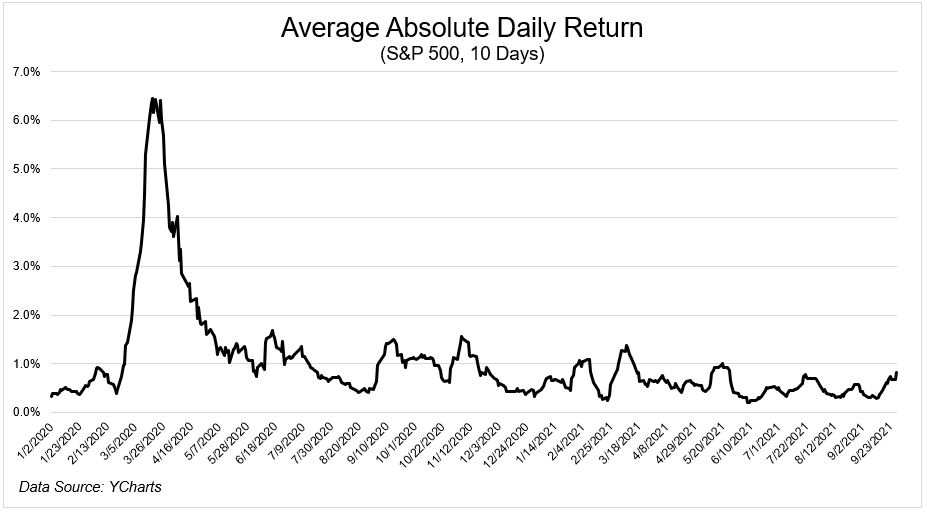

Markets were quiet for the first eight months of the year. The ninth month, as it often does, has reintroduced the noise.

Noise is a relative term. It’s not like the market is in free fall right now, but if the TV has been on mute for the past few months, it’s natural to hear alarm bells even though the volume is only on 4.

Assuming you invest to fund your retirement and not your salary, you shouldn’t be bothered by stock market declines. And if you’re still contributing to your retirement accounts, then you should hope you get the opportunity to buy at lower prices. Stock market declines are the source of future stock market returns. Without risk, there can be no reward.

I haven’t had to write something like this in a while and to be honest, I’m a little embarrassed to be doing it when we’re barely off the highs. But dammit, this feels good and it’s been too long, so I’m going for it.

As I’ve written and spoken about recently, just because the S&P 500 is barely down, the same can’t be said for all stocks. And if you’re picking individual names, then there’s a strong likelihood that your portfolio is down much more than “only 4%.”

Zoom is 56% below its highs in October. Teladoc is down 58% from its highs in February. So is Zillow. Arkk is in a 30% drawdown. Last year’s darling is unchanged since December.

The market is holding up while a lot of names are getting destroyed. How much longer it does this is anyone’s guess.

Josh and I are going to discuss this and much more on tonight’s What Are Your Thoughts?

Josh and I use YCharts when creating visuals for this show, as well as for many aspects of their business.