And the markets are back!

And the markets are back!

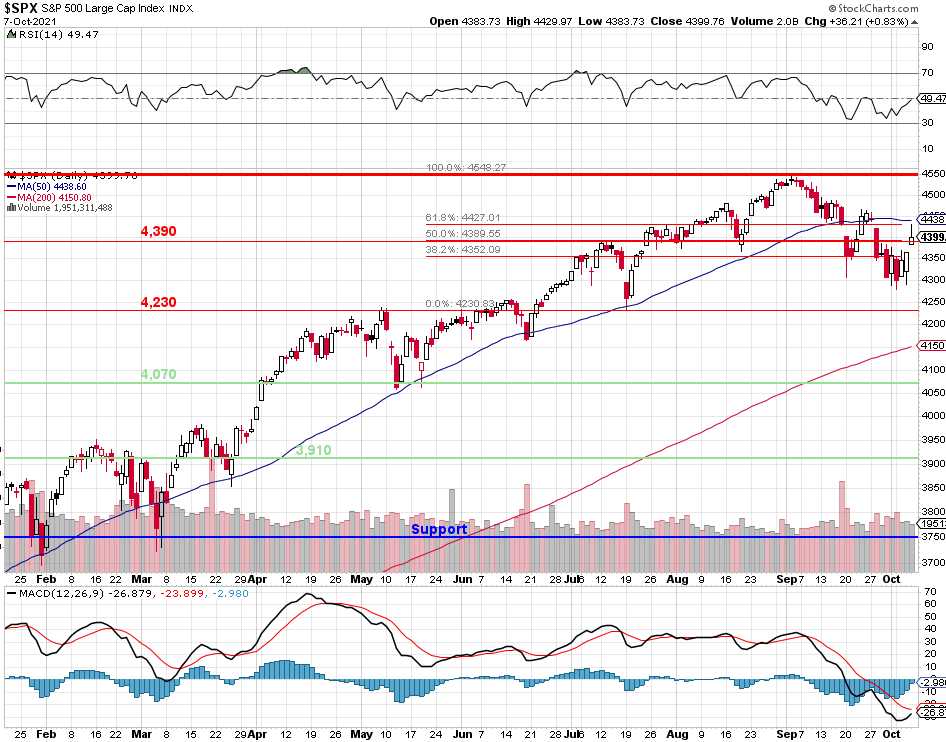

Well, back to where we were in the middle of July but hey, it does feel like we had a rally, doesn't it? As noted yesterday, 4,400 on the S&P 500 is only the Strong Bounce Line as we have fallen from 4,550 so there's still 150-points to go before we are back to the August highs – so let's not get too excited that we're up for the week.

A strong bounce, however, was the minimum goal for this week to keep the rally alive – so we're forced to remain neutral now and see how next week will play out – but below that line is no longer an option for a "healthy" market.

Our 2-day rally has been on very low volume. Next week we get CPI, PPI, Retail Sales and Consumer Sentiment reports, and Earnings Season kicks off Wednesday night with reports from BLK, DAL, FRC and JPM with many banks following Thursday and Friday. Walgreens (WBA) reports on Thursday morning and I think they'll beat the $1.03 that's expected but, even if they don't – those are nice quarterly earnings against $47.85 shares in what is still one of our favorite value stocks:

We cashed in our WBA positions when the stock was $55, which was way over our targets but now I'm worried we won't see below $45 so, in the Long-Term Portfolio, we can sell 10 of the WBA 2024 $45 puts for $8.50 and that will net us in for $36.50, where we'd LOVE to own 1,000 shares of WBA for the long-haul. If WBA does not go lower, we simply keep the $8,500 for prominsing to buy WBA at $45 over the next two years. Easy money for any stock you REALLY would like to buy if the price goes lower.

8:30 Update: Jobs were a big miss, with only 194,000 being added vs 500,000 expected by leading Economorons and that leaves us still 5M jobs shy of where we were in 2019 but how could that possibly matter, right? Certainly the market seems happy to ignore it. There are supposedly 11M jobs available but that would indicate that the people who are not employed are not right to fill these jobs so we have a persistent Labor Shortage AND high Unemployment because we don't properly educate or re-train our workers in a dynamic work envirinment and these are the consequences.

8:30 Update: Jobs were a big miss, with only 194,000 being added vs 500,000 expected by leading Economorons and that leaves us still 5M jobs shy of where we were in 2019 but how could that possibly matter, right? Certainly the market seems happy to ignore it. There are supposedly 11M jobs available but that would indicate that the people who are not employed are not right to fill these jobs so we have a persistent Labor Shortage AND high Unemployment because we don't properly educate or re-train our workers in a dynamic work envirinment and these are the consequences.

The jobless rate remains higher than the pre-pandemic level of 3.5%. But other measures – chiefly, wage growth – suggest the labor market is tight. The average hourly pay of private-sector workers climbed 4.6% in September compared with a year earlier, Labor Department data show, as employers raised wages to compete over a shrunken pool of workers.

One might wonder how Q3 Earnings could be on target when we're missing jobs numbers by 60% but worrying isn't something traders in this market are prone to doing – so we'll see what happens next week. Meanwhile, less jobs means less demand for Dollars and that's knocking down the Dollar index, which is great for our Silver (/SI) Futures so let's not be greedy and set a stop at $10,000 and half off at $12,500 if we keep going higher – what a ride and congratulations to all who played!

Have a great weekend,

– Phil