We are in month 2 of our cash out.

We are in month 2 of our cash out.

Our last Portfolio Reviews were back on September 16th and we had already lightened up back on August 17th ("Top of the Market Tuesday – Cashing Out While We Can") with the S&P 500 at 4,472. On September 16th, we were at 4,495 but that just meant we had a whole month to wriggle out of our positions without any panic. Now it's October 12th and the S&P finished the day yesterday at 4,361 – so down a bit, but not much overall.

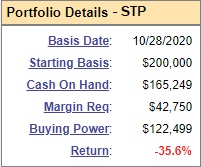

Still, it's been a great month for our Short-Term Portfolio (STP), which is where we keep our hedges to protect our long-term positions as it's gone from $94,705 to $128,727 as of yesterday's close, a gain of $34,022 (35.9%) on just a 2.9% dip in the S&P 500. Needless to say we are highly leveraged to the downside but we still need to be certain we are adequately covering our long positions (more on those later) for what could be a 20% correction in the indexes that is unlikely to spare any position.

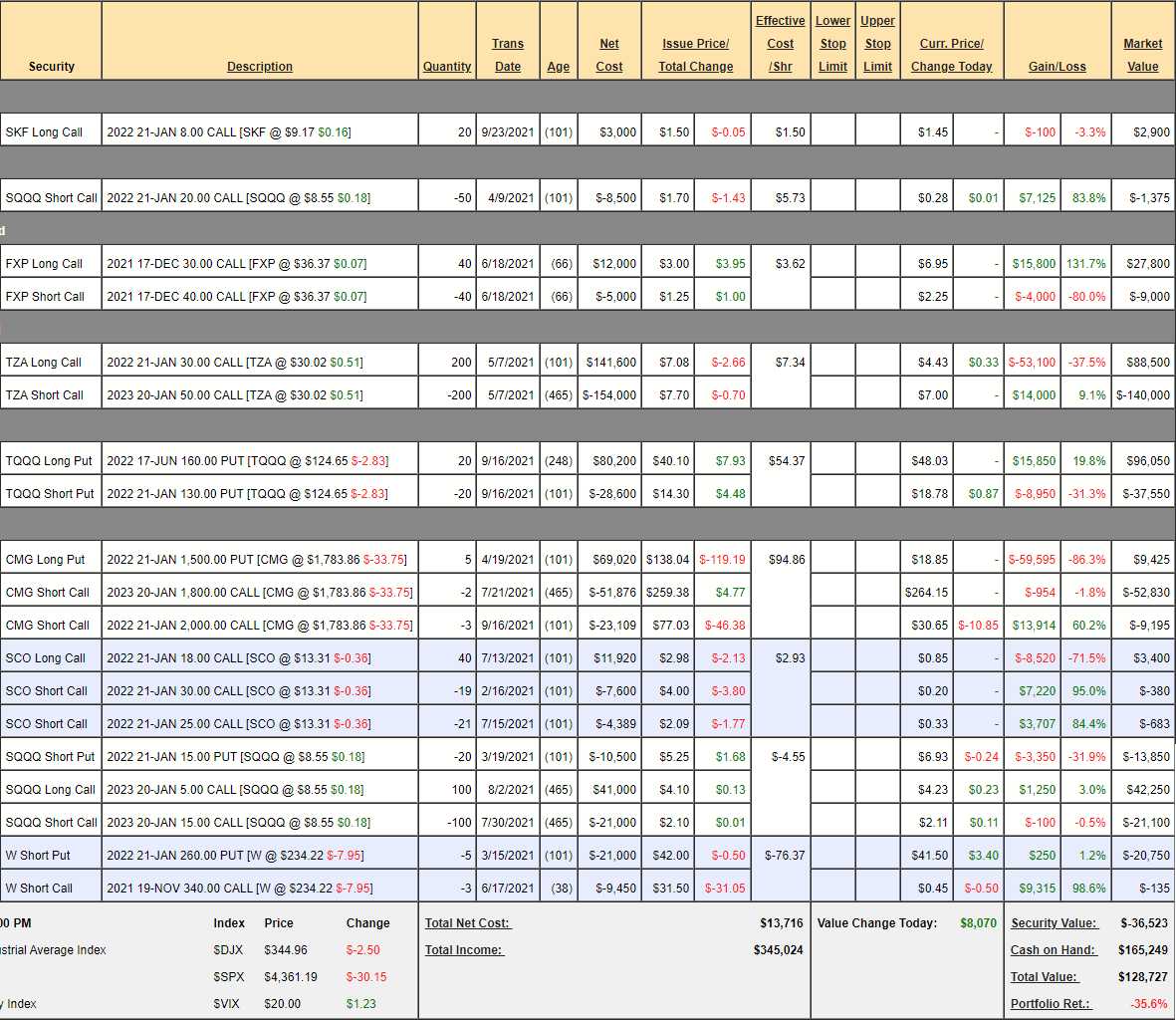

- SKF – An ultra-short on the Financials we added since our last reveiw. Between inflation, rate changes, lack of stimulus and China's property melt-down – I figured it was good to hedge in that sector (not that we're very invested in Financials). These are just straight- up long calls looking for a quick gain – none so far. If they pop to $10 the Delta is 0.75 so we should make 50% – that's our goal (+$1,500).

- SQQQ – These are leftover short calls that will expire worthless and pay us $1,375 in 50 days.

- FXP – We cleverly shorted China back in June and, so far, so good. We're at target for the full $40,000 and the current net is only $18,800 so $21,200 left to gain if China gets worse, which seems pretty likely. Good for a new hedge with just 66 days to go and over 100% upside potential.

- TZA – One of our major hedges. It's a $400,000 spread that's at the money but we have to invest in rolling the Jan $30 calls out in time as the short calls won't expire for another year. It did, however, make for a very cheap $400,000 spread as we had a net $13,000 credit to start. We're waiting on earnings to see what happens. Since we're at the money at $30, a 20% drop on this 3x ETF would take us up 60% to $48 and put us pretty much in the money so let's call this $250,000 worth of downside protection.

- TQQQ – Surprisingly the short Jan puts went into the money already but we have plenty of time to roll and it's a $60,000 spread, in the money at net $58,500 but the roll gives us a lot more potential so we'll keep it in play.

- CMG – Finally coming down a bit. In fact, the shorts are 100% premium and, if they exprie worthless, we collect $62,025 and, if earnings disappoint, we might make up that January put money too.

- SCO – Well this turned ugly on us as we were trying to short oil but, fortunately, we sold a lot of calls and had a nearly net $0 cost – so no harm done. It's a 2x Ultra-Short ETF so, if oil drops 20% to $65, this goes up 40% to $18.62 which means it's simply not worth keeping the longs, not even to "protect" the short calls but let's just cash the whole thing out and forget it.

- SQQQ – Our other major hedge is not so big anymore as it's just a $100,000 spread at net $7,300 but that's quite a bargian with $92,700 upside potential (though it wouold take a 30% drop to get there). Realistically, a 20% drop in the Nasdaq would be a 60% gain in SQQQ from $8.55 to $13.68 so about $85,000 would be the target but still great for net $7,300, right? Let's beef these up by buying 100 more 2023 $5 calls for $4.23 ($42,250) and selling 100 March $12 calls for $1.05 ($10,500) and rolling our 20 Jan $15 puts at $6.93 ($13,850) to 40 of the 2023 $10 puts at $4.30 ($17,200).

- So we've spent net $28,400 but now, at $12, we have $140,000 and the potential to roll the short March calls to higher strikes so a nice investment in more protection. Call it $110,000 of downside protection.

- W – We cashed out the bear put spread last month and these are just the leftovers waiting to expire. Hopefully it bounces a bit as we're already past goal on the short puts

So that's $444,725 in downside protection (likely) if the market drops 20%. Since we've cut back on our longs – that seems very adequate but we'll get a better overall picture as we review our Long-Term Portfolio and other bullish Member Portfolios. BALANCE is the key to navigating an uncertain market but we're finally going to get a look at Q3 earnings and guidance for Q4 and THEN we can see if we're in the mood to do more shopping.

IN PROGRESS