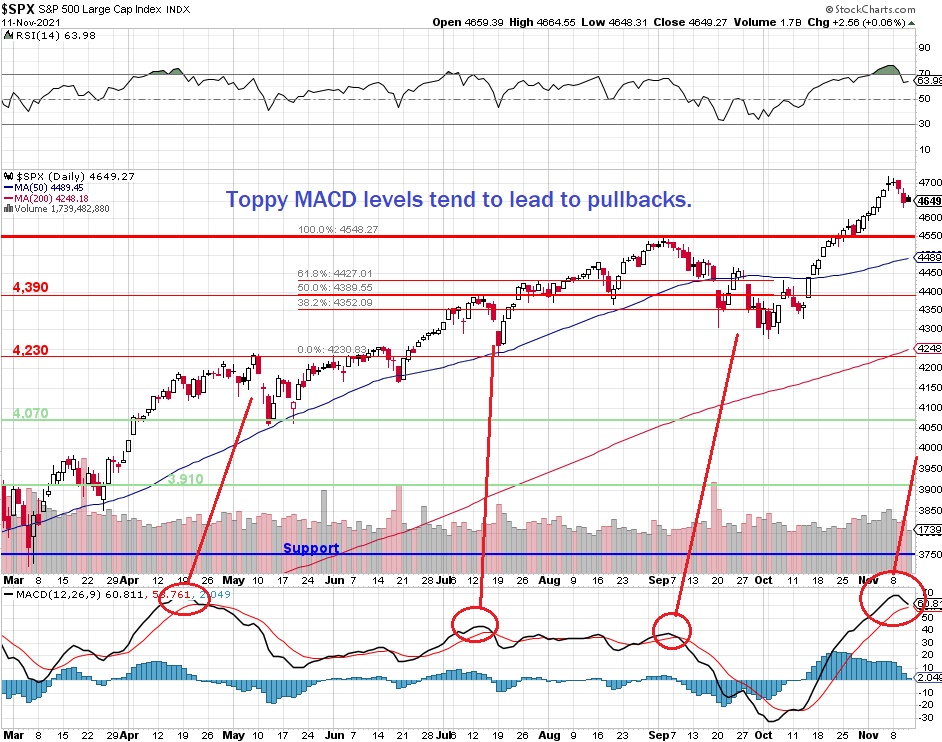

Danger ahead.

Danger ahead.

We passed the stimulus bill – that did not strenghten the market. The Fed did not change rates and only began a very gradual tapering process – that did not strengthen the market. Q3 earnings were better than expected – that did not strenghten the markets. What will?

We are in a very overbought situation at the moment and, heading into the holidays – it's always a good idea to be well-hedged but the thin market trading around the holidays is the bulls' best friend at the moment as it's the high-volume days that tend to send things lower.

Still, proceed with caution in the two weeks before Thanksgiving and then, if we have made it through November – we might have a Santa Claus rally after all.

According to Indeed, there were more than 11M job openings in early November, far more than the 7.4M people who are considered unemployed. We used to fill those jobs with immigrants but those were made illegal under the last administration so now they just sit empty – for reasons we discussed in yesterday's PSW Report. Many of the open jobs are in Warehousing, Shipping and Consumer-Facing Retail, a trend that is likely to be supercharged by the holiday shopping season and strong consumer demand.

4.3M workers quit their jobs in August, as workers are only just beginning to exercise bargaining power for their labor. With 11M open jobs – there's always someone willing to pay more if your boss is not and workers are starting to understand that – a condition similar to the one we had in the late 80s and 90s – when 10% annual raises and two-week bonuses were expected.

4.3M workers quit their jobs in August, as workers are only just beginning to exercise bargaining power for their labor. With 11M open jobs – there's always someone willing to pay more if your boss is not and workers are starting to understand that – a condition similar to the one we had in the late 80s and 90s – when 10% annual raises and two-week bonuses were expected.

Labor-force participation, or the share of working-age people employed or looking for work, has remained lower than normal despite strong job growth during the recovery. Employers, especially in lower wage sectors like food service, might normally hire workers who are unemployed, but are now looking to entice people to leave their current jobs for better pay or benefits.

New openings, especially seasonal ones with set end dates, are growing rapidly. The National Retail Federation, an industry group, anticipates that retailers will hire 500,000 to 665,000 seasonal workers compared with the 486,000 they hired in 2020. Target Corp. aims to hire 100,000 seasonal workers and around 30,000 warehouse employees, while Walmart Inc. wants to hire 150,000, many of which are offered as permanent positions.

Logistics companies are also staffing up and offering incentives as they race competitors to fill positions. United Parcel Service Inc. is hiring an additional 100,000 employees nationwide for seasonal positions, and they have enlisted current employees to help. Employees can earn $200 for every job applicant they steer toward the company, provided the person works through the holiday rush. Amazon plans to hire 150,000 seasonal employees starting at $18 per hour, with sign-on bonuses of up to $3,000.

That all sounds great, of course, but it's also expensive for those companies and can impact the bottom lines as business competes for labor – even as their materials costs are also rising. Inflationary economies are tricky to navigate, companies move ahead and fall behind on the curve in cycles – especially if the inflation is not "transitory" and one-year later – it's getting harder and harder for the Fed to make that case.

That all sounds great, of course, but it's also expensive for those companies and can impact the bottom lines as business competes for labor – even as their materials costs are also rising. Inflationary economies are tricky to navigate, companies move ahead and fall behind on the curve in cycles – especially if the inflation is not "transitory" and one-year later – it's getting harder and harder for the Fed to make that case.

As it's Friday, a fun play is going long on Oil (/CL) off the $80 line with tight stops below. Oil contracts pay $10 per penny move so you risk a $50 loss by keeping a stop at $79.95 but, since oil has fallen from $85 to $80 and $80 should be a good support line, the weak bounce would be 20% of the fall or $1 back to $81 and I think we fail there but strong would be $82 and those are $1,000 or $2,000 potential gains so the reward potential greatly outweighs the risk – and that's what makes a good futures trade.

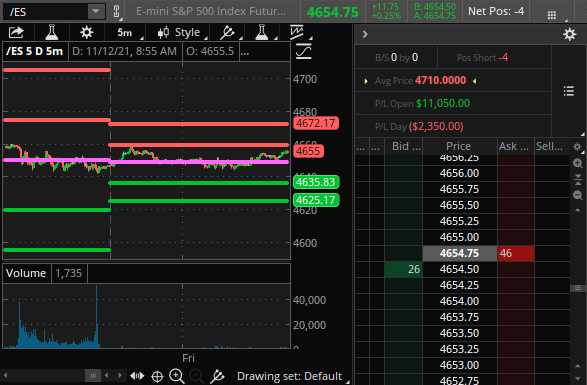

We have 4 short S&P 500 (/ES) shorts remaining and they are currently up $11,000 but it would be irresponsible not to set a stop on 2 at the $10,000 mark (about 4,660) to lock in $5,000 of our profits and then we can set stops way up at $2,500 on the remaining two – so our worst case would be making $7,500 while we still have nice profits to make should /ES slide further.

We have 4 short S&P 500 (/ES) shorts remaining and they are currently up $11,000 but it would be irresponsible not to set a stop on 2 at the $10,000 mark (about 4,660) to lock in $5,000 of our profits and then we can set stops way up at $2,500 on the remaining two – so our worst case would be making $7,500 while we still have nice profits to make should /ES slide further.

If the Nasdaq fails that 16,000 line again, we can get more comfortable with our S&P shorts and the Dow getting back over 36,000 would be a warning sign that it's time to pack it in for the time being. Overall, I strongly hope we have an excuse to carry all 4 shorts into the weekend – I don't see any particular reason next week would be stronger than next week and December 3rd is the Debt Ceiling nonsense again – could be a nice bonus round for the bears.

Have a great weekend,

– Phil