6.2%.

6.2%.

That was the jump in the Consumer Price Index, which measures what consumers pay for goods and services, from last October. Even worse, the Core CPI, which excludes food and energy, was up 4.6% – miles over the Fed's 2% price target. That's the fastest 12-month change since 1990 and our 5th consecutive month topping 5%.

On a monthly basis, the CPI increased a seasonally adjusted 0.9% in October from the prior month, a sharp acceleration from September’s 0.4% rise and the same as June’s 0.9% pace. Price increases were broad-based, with higher costs for new and used autos, gasoline and other energy costs, furniture, rent and medical care while prices fell for airfare and alchohol – saving us from a total disaster – for now.

Consumer spending increased at an annual rate of 1.6% in the third quarter, a sharp slowdown from a 12% increase in the prior quarter. However, much of that deceleration was due to scarcity of new cars and other durable goods. Consumer spending on services last quarter climbed at the brisk annual rate of 7.9%. Businesses are also passing on higher costs to consumers. 60% of small-business owners said they had raised prices in the previous 90 days. 80% of the companies surveyed reported higher labor costs, while 72% said vendors had increased prices and more than half experienced higher costs for raw materials and other inputs.

We still have labor shortages, shipping shortages, chip shortages, auto shortages… – this stuff is not going to go away but the Fed continues do downplay the situaion, which is a polite way of saying they are lying to us. How can it be a good thing when the Fed is lying? They are lying to give themselves and excuse to continue a policy (QE + ZIRP) that is at the root of this inflationary catastrophe.

The dearth of workers needed to meet consumer demand is also putting upward pressure on wages, adding to companies’ motivations for raising prices to offset higher labor costs. Higher food and energy prices—driven up by pandemic-related production snags, weather and geopolitical factors—are also spurring inflation, said Richard F. Moody, chief economist at Regions Financial Corp.

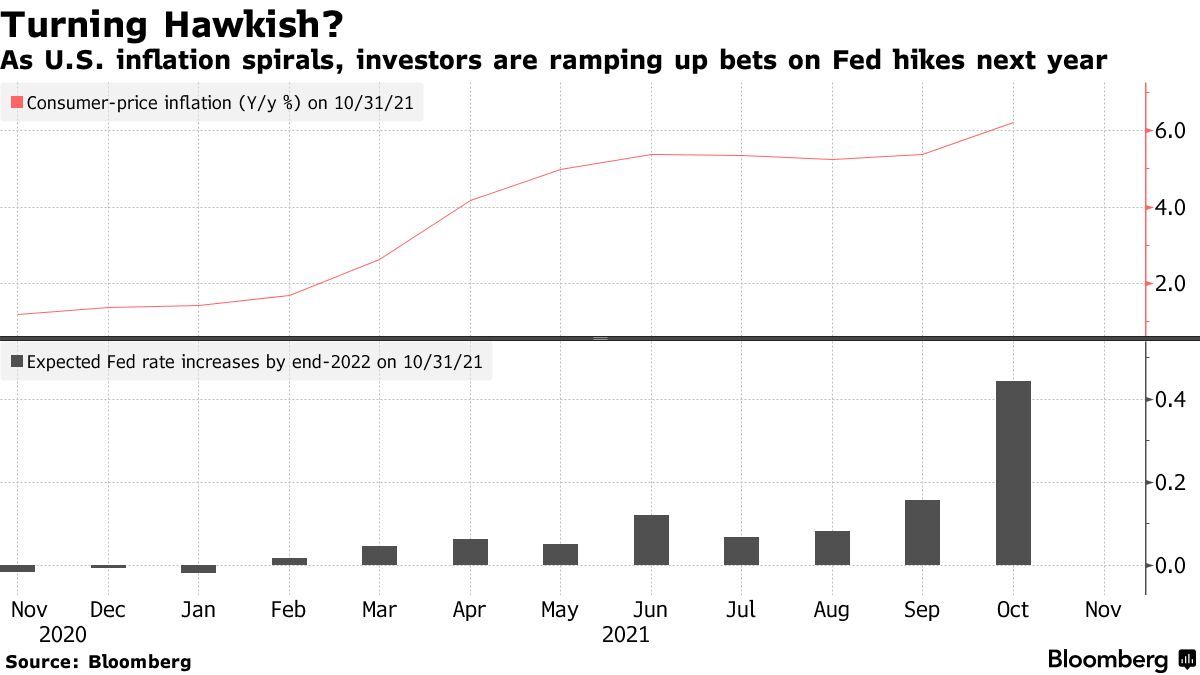

Inflation is starting to take a bite out of the bond market and THAT is the limitation on the Fed's power. They can pretend anything they want internally but, when their policies are wrong – people outside the US and even large investors in the US, stop buying our bonds. That causes rates to go higher whether the Fed intends it or not and, when things happen against the Fed's intentions, they begin to look weak and people begin to lose faith in the Fed's ability to control policy and things get very ugly from there because, like the Great and Powerful Oz – the Fed relies mainly on smoke and mirrors to create the illusion of control. Look behind the curtain and the whole thing falls apart.

Inflation is starting to take a bite out of the bond market and THAT is the limitation on the Fed's power. They can pretend anything they want internally but, when their policies are wrong – people outside the US and even large investors in the US, stop buying our bonds. That causes rates to go higher whether the Fed intends it or not and, when things happen against the Fed's intentions, they begin to look weak and people begin to lose faith in the Fed's ability to control policy and things get very ugly from there because, like the Great and Powerful Oz – the Fed relies mainly on smoke and mirrors to create the illusion of control. Look behind the curtain and the whole thing falls apart.

What we're seeing in the above chart is a drastic change in investor sentiment, with expectations of the Fed hiking rates going from 0.1% to 0.45% next year over the last 90 days. An acceleration of the timetable could show up at next month’s meeting of the rate-setting Federal Open Market Committee. Last time the Fed released a so-called “dot-plot” in September, it showed an even split on whether rates will rise next year.

The Biden administration is vowing to address rising inflation, aware that voters are becoming increasingly worried about how higher prices may eat into their paychecks. After the inflation report was released Wednesday, the White House issued a statement from Mr. Biden saying, “Inflation hurts Americans pocketbooks, and reversing this trend is a top priority for me.”

The Biden administration is vowing to address rising inflation, aware that voters are becoming increasingly worried about how higher prices may eat into their paychecks. After the inflation report was released Wednesday, the White House issued a statement from Mr. Biden saying, “Inflation hurts Americans pocketbooks, and reversing this trend is a top priority for me.”

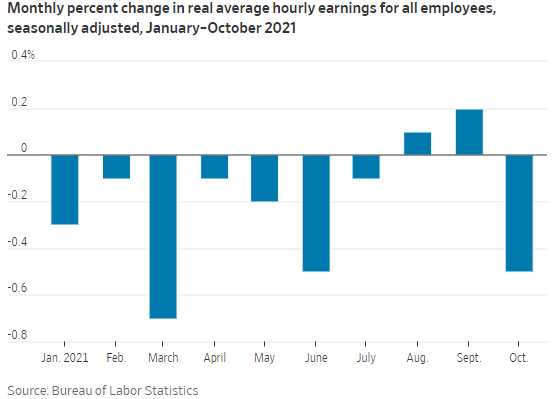

And Biden should be concerned because, as we discussed in yesterday's Live Trading Webinar, the living conditions for the average voter are getting worse and worse. In a separate report Wednesday, the Labor Department said average hourly earnings after inflation FELL 0.5% in the month. Real wages are down 2.2% since January. American purchasing power has declined, and the average standard of living has fallen, despite unheard of levels of government spending.

The Fed can say any BS it wants and the Government can point to all their statistics but voters aren't idiots and they KNOW when they have less money left at the end of each month and the KNOW when $200 worth of groceries no longer fills a shopping cart. People KNOW there is inflation – no matter how much the Government tries to deny it and they KNOW that their wages are not keeping up with it – no matter how many MSM stories there are about the "amazing" job market.

Why aren't workers jumping at these jobs? Well, if you are making nothing or driving Uber for $1,000/month and someone offers you a job at $30/hr, which is $3,600/month but take-home is $2,800 and it's 30 miles away so 60 x 20 is 1,200 miles/30 miles/gallon is 40 gallons of gas x $3.50 = $140 and you need better clothes and they have to be cleaned and lunch is more expensive… It all adds up and maybe the net is you are being offered less money than if you just spent more time driving Uber – so the job isn't worth taking. If your kids would need day care – it becomes impossible to accept the job.

Why aren't workers jumping at these jobs? Well, if you are making nothing or driving Uber for $1,000/month and someone offers you a job at $30/hr, which is $3,600/month but take-home is $2,800 and it's 30 miles away so 60 x 20 is 1,200 miles/30 miles/gallon is 40 gallons of gas x $3.50 = $140 and you need better clothes and they have to be cleaned and lunch is more expensive… It all adds up and maybe the net is you are being offered less money than if you just spent more time driving Uber – so the job isn't worth taking. If your kids would need day care – it becomes impossible to accept the job.

And that's $30/hr – imagine trying to make that work for $15!

As I mentioned on Monday, inflation can be good for the investing class as our market gains are able to keep up with inflation due to the illusion that is created of higher earnings (by that very same inflation). Those inflationary gains are then multiplied 10, 20 or 30 times (p/e) for much higher valuations – even though the company is simply selling the same product at a higher price with the same percentage of profits. Just don't be the last sucker buying into that kind of market….

For example, you can play miner Barrick Gold (GOLD) as an inflation hedge with the following options spread:

- Sell 10 GOLD 2024 $17 puts for $2.35 ($2,350)

- Buy 20 GOLD 2024 $15 calls for $6.60 ($13,200)

- Sell 20 GOLD 2024 $20 calls for $4.10 ($8,200)

That's net $2,650 on the $10,000 spread that's 100% in the money to start so GOLD would have to drop below $17.65 before this trade was a loss. That's your worst case, owning 1,000 shares of GOLD for net $17.65, 13.6% below yesterday's close. The upside potential of the trade is $7,350 – a 277% gain and all GOLD has to do is not go lower.

Of course, if you just want to hedge against inflation with a smaller bet, you can:

- Sell 5 GOLD 2024 $20 puts at $4.25 ($2,125)

- Buy 15 GOLD 2024 $22 calls for $3.25 ($4,875)

- Sell 15 GOLD 2024 $27 calls for $2.10 ($3,150)

In this case we have a higher target ($27) but the spread is a net $400 credit and our worst case would be owning 500 shares of GOLD at net $19.20 (5% below the current price) while our upside potential is $7,900 (1,975%) – that should keep you ahead of inflation.