You’re Hot then You’re Cold

Courtesy of Michael Batnick

Remember the stay-at-home stocks? These names were the epicenter of the greatest speculative stock market mania since the dot-com bubble. And similar to that movie, think Uncut Gems, this one isn’t ending well either.

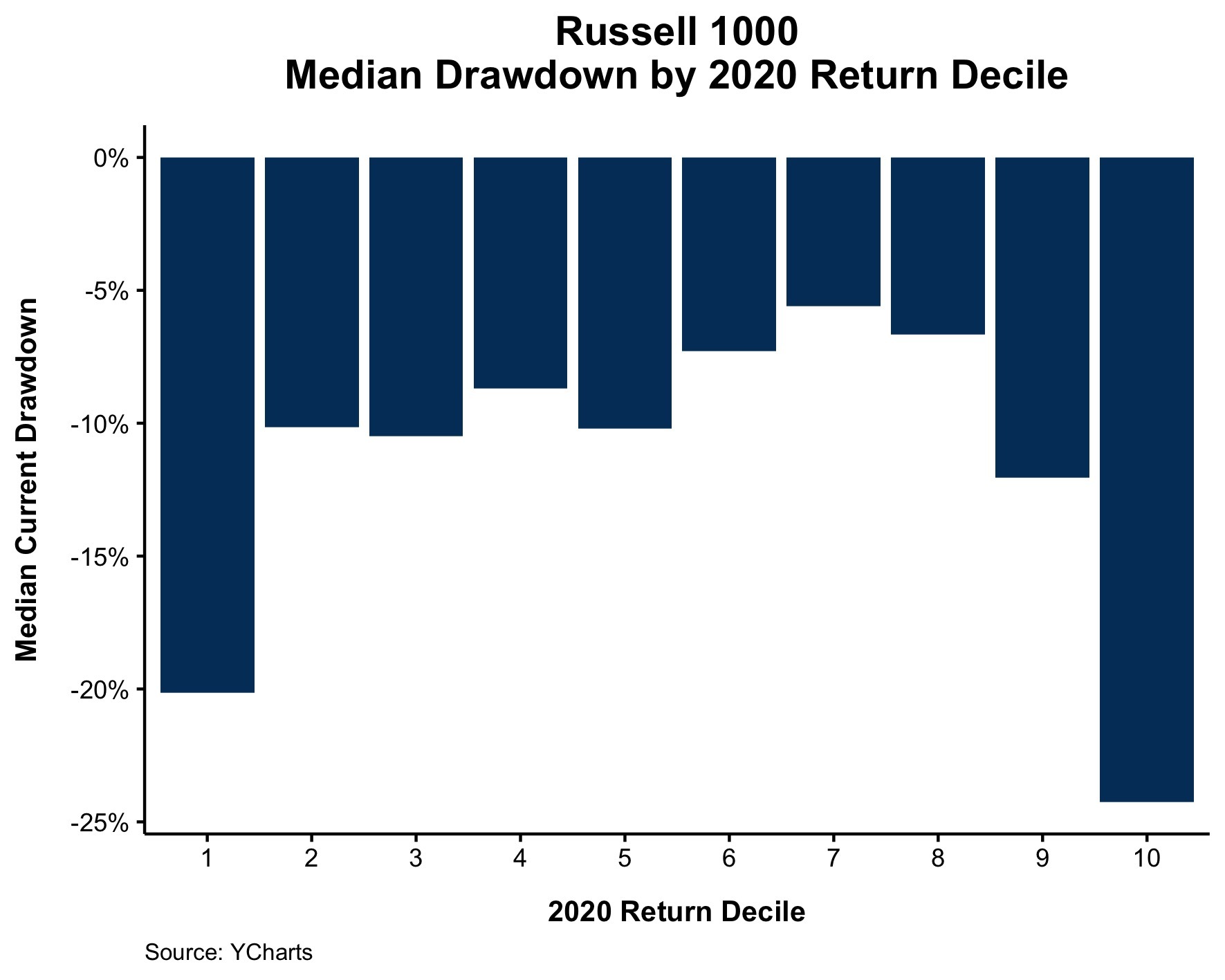

The chart below shows the 2020 returns plotted alongside their current drawdown.

The following chart zooms in with some household names.

DraftKings, one of the most exciting SPACs of 2020, gained 336% last year. And it continued to go vertical in the first three months of the year, tacking on another 55%! And then it crashed. The stock is down 54% from its high back in March. If misery loves company, then DKNG is a happy camper. Teladoc, Zoom, Peloton, and many others have had a similar experience play out over the last few months.

Are the best-performing stocks of 2020 really getting hit the hardest, or do I think they are because they’re the biggest names? To answer this question, I had Nick Maggiulli break down the numbers for me in the following way: Split the Russell 1000 into ten equal buckets based on their 2020 performance. And then show the median drawdown for the stock in each bucket.

This revealed an interesting finding:

The two areas of the market that are doing significantly worse than the rest are the companies that had the worst performance in 2020 (bucket 1) and the companies that had the best performance in 2020 (bucket 10). All of the stocks in bucket 10 returned at least 77% in 2020. Now the median stock in that category is down 23%.

It’s nice when the data confirms your suspicions.

Most of the time, it’s a fool’s errand to try and determine why stocks are falling. Usually, I’m a “more sellers than buyers” kind of guy. But with this, I think it’s pretty clear that it’s an inflation thing.

Josh and I will get into this, and much more on the latest episode of What Are Your Thoughts? Check us out at 5:30 live.