By Jacob Wolinsky. Originally published at ValueWalk.

The latest issue of ‘The Globe’, Eurizon’s publication describing the Company’s investment view.

Q3 2021 hedge fund letters, conferences and more

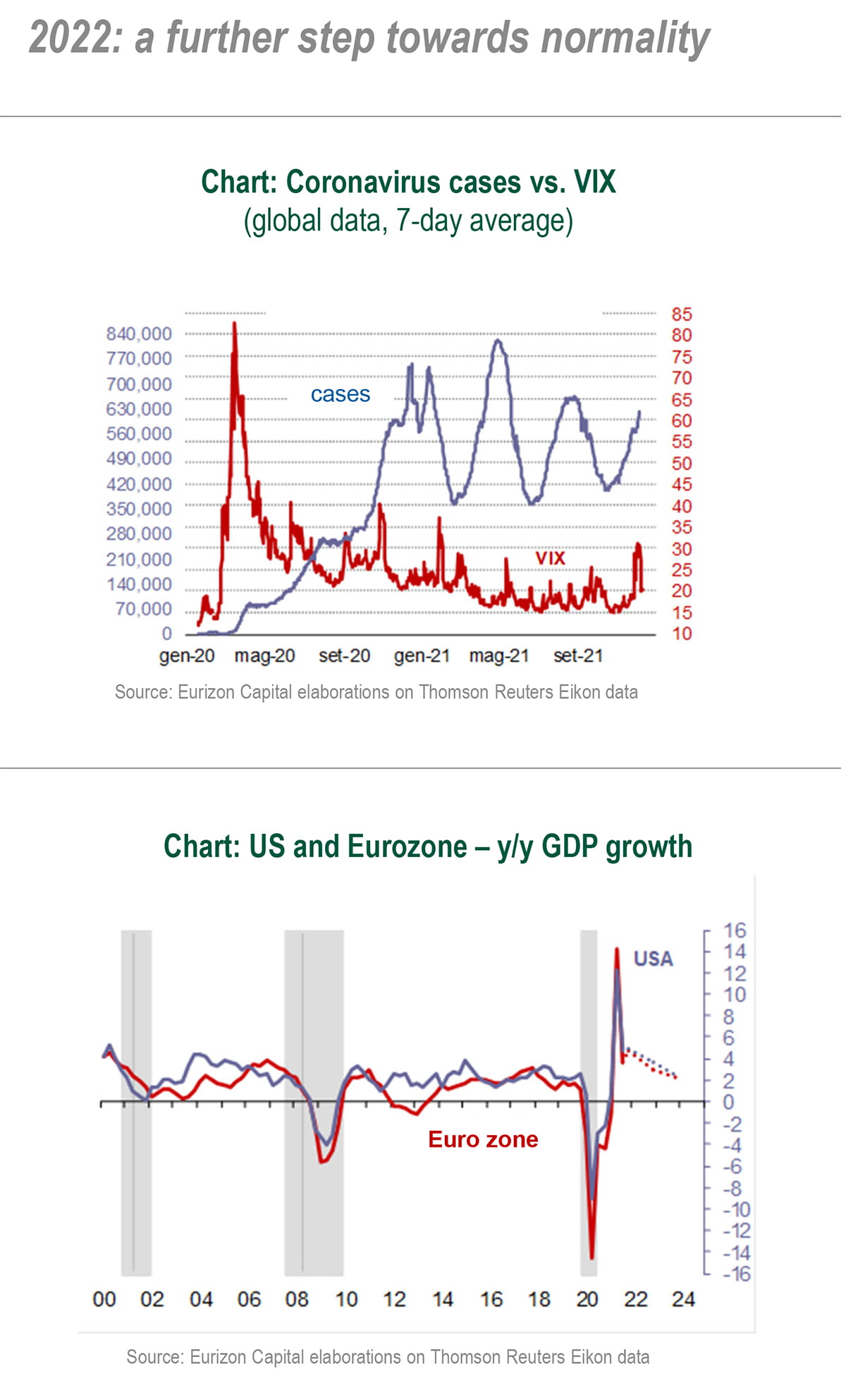

In 2022, the economic cycle is expected to continue. Global growth will lose some steam after accelerating sharply in 2021, and this should allow an easing of inflation pressures. Within a context of sustainable growth and declining inflation, the reduction of monetary stimulus by the Central Banks should be well tolerated by the markets. If Central Banks have to tackle more persistent inflation than expected, the situation could be different.

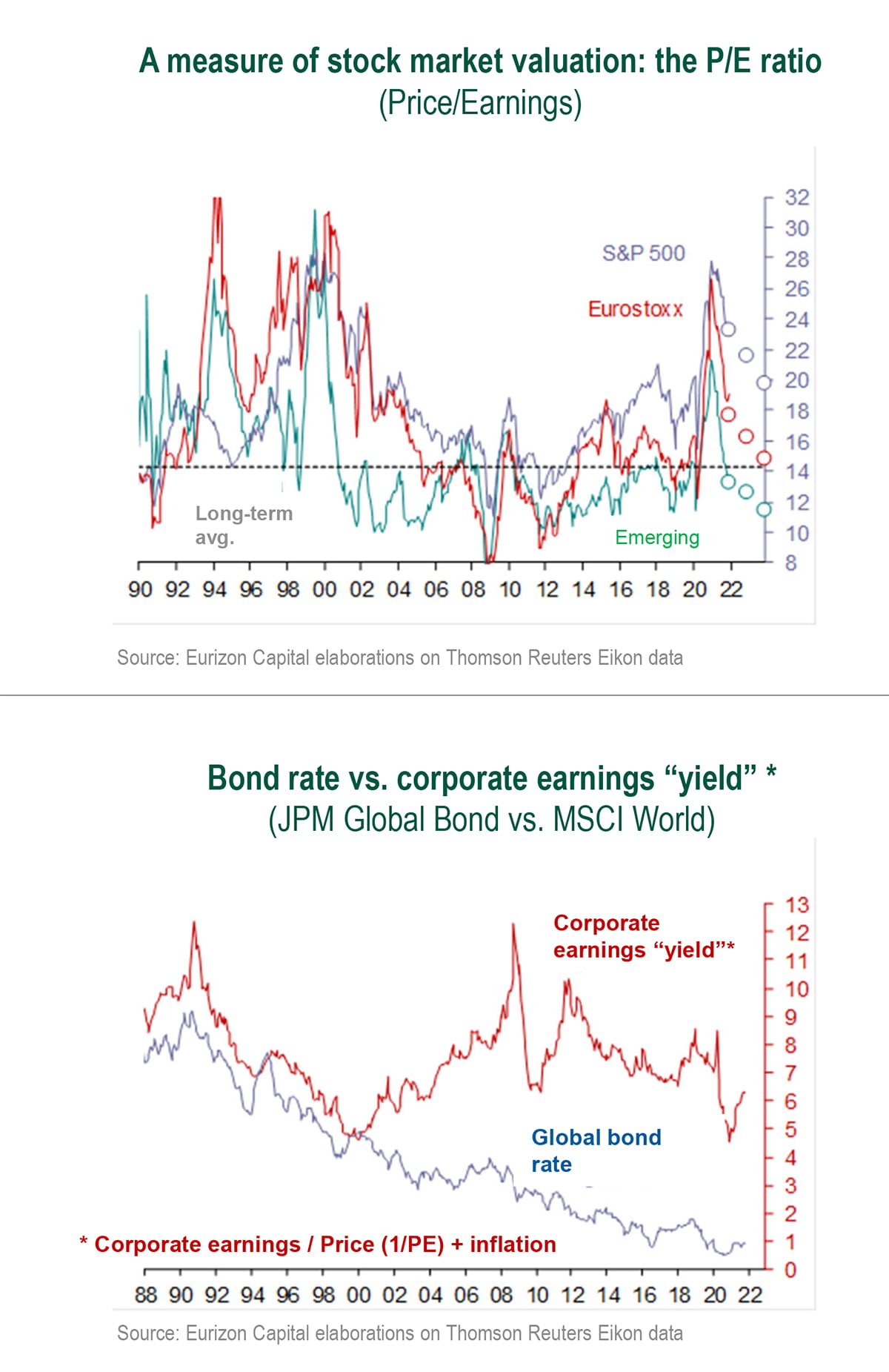

Under the baseline scenario, procyclical market trends should be confirmed. Government bond rates in the US and Germany should be driven upwards by the removal of monetary stimulus. Prospected absolute return on spread bonds seems modest and limited to carry. Stocks are expected to generate positive return, albeit below 2021 levels; earnings growth will return to levels in line with the long-term average (8-10%) after flaring up last year (S&P 500 +50%, Eurostoxx +70%).

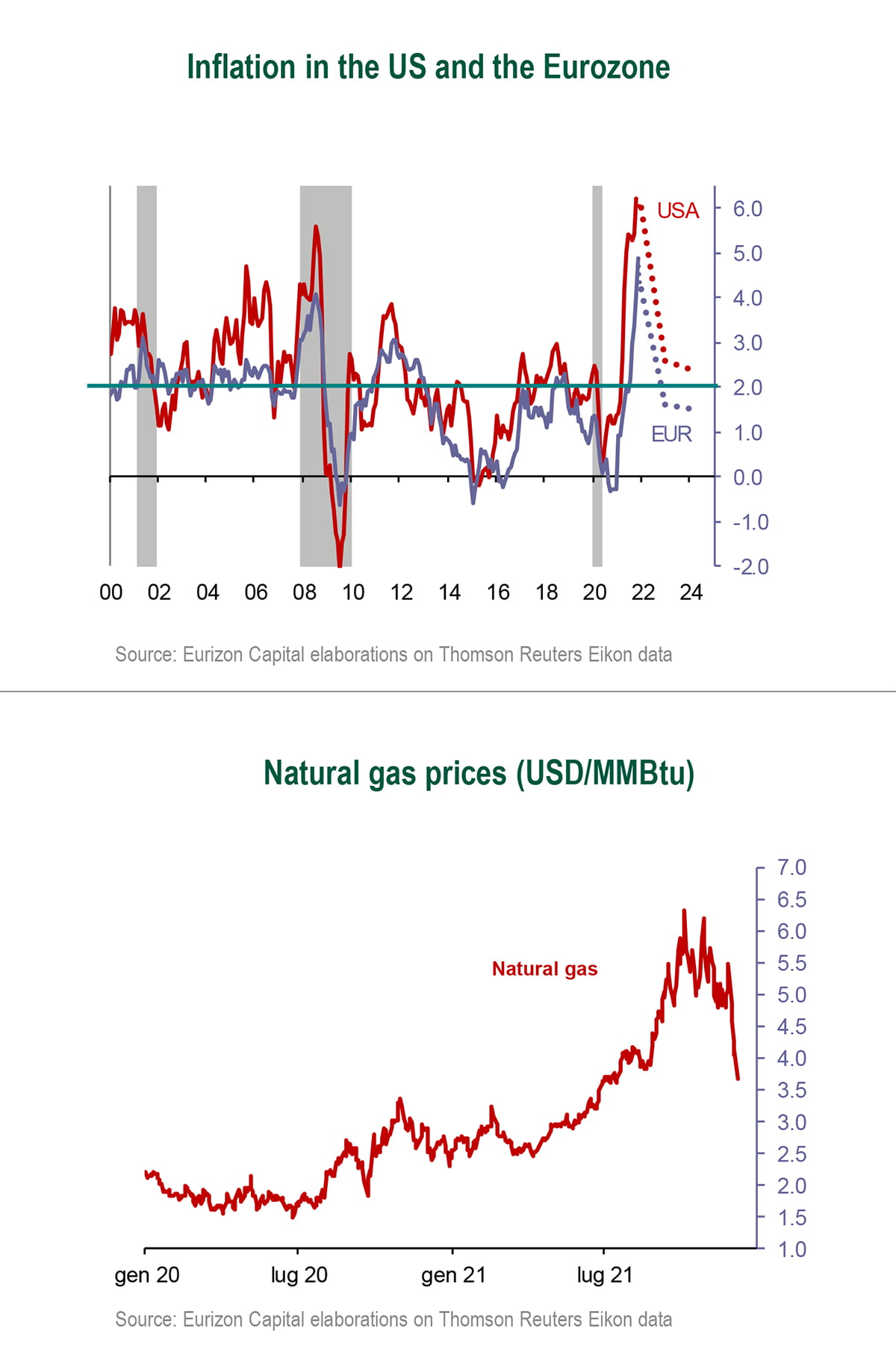

The evolution of inflation is the main risk factor, although developments in terms of the pandemic may also affect the pace of economic growth.

In China, focus will be on economic policy decisions. In January and April, new Presidents of the Republic will be elected in Italy and France; in November, the US Congress will be renewed (mid-term elections).

Macro Economy

- Global growth should slow in 2022, after flaring up in 2021, and this should allow an easing of inflation pressures.

- The Central Banks are in any case set to reduce monetary stimulus, all the more rapidly if inflation proves persistent.

Asset Allocation

- According to our baseline scenario, economic growth will continue to recover at the global level, even as monetary stimulus is reduced.

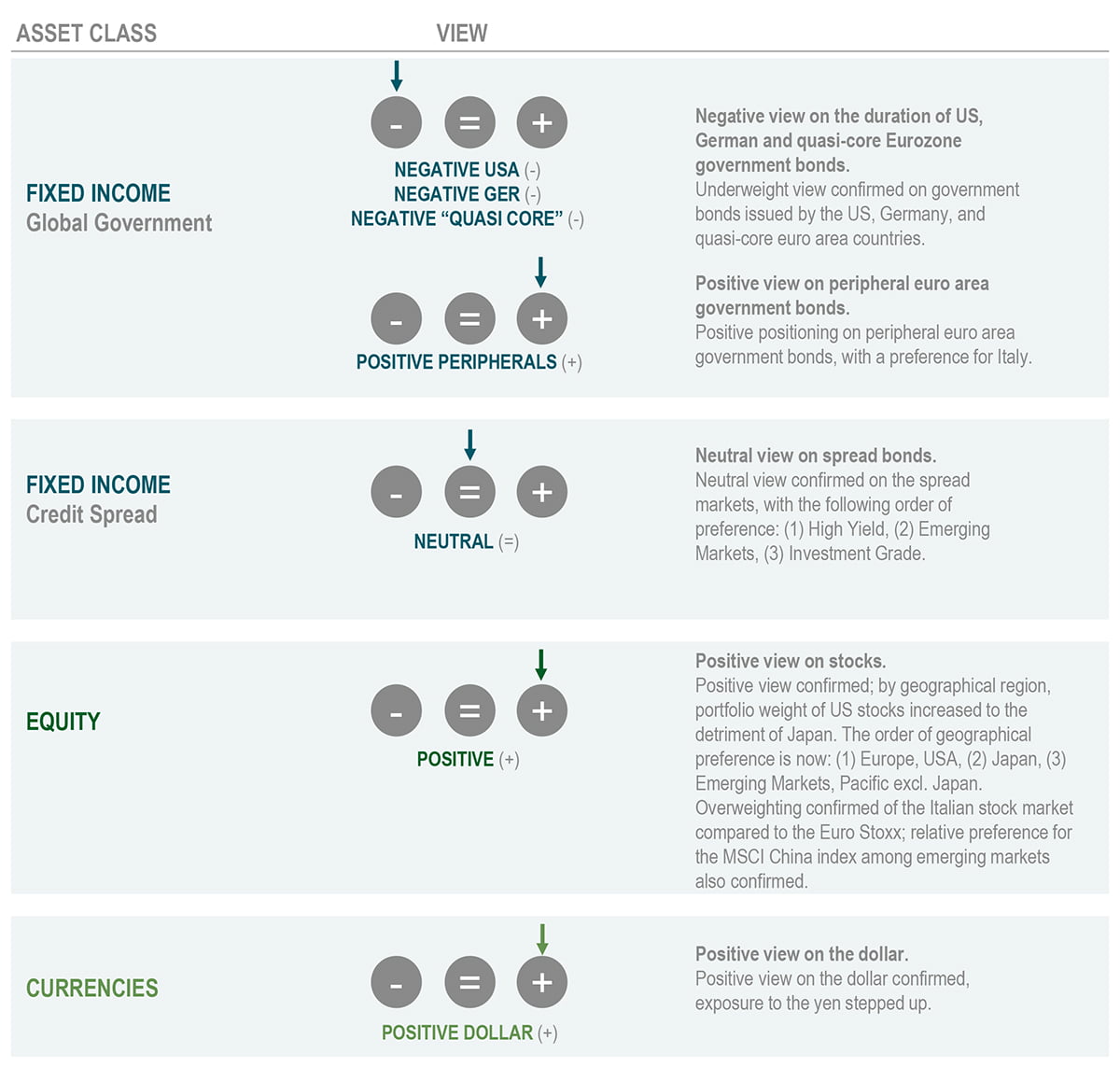

- Pro-cyclical approach to portfolio management confirmed, underweighting duration and overweighting stocks. Positions on the dollar confirmed, exposure to the yen stepped up.

Fixed Income

- Long-term rates in the US and Germany are likely to increase in 2022, as the economic recovery continues and monetary stimulus is removed.

- Spread bonds hold more appeal than core government bonds, but yields-to-maturity are historically low.

Equity

- Outlook for the stock markets favourable in 2022, although forecast return is lower and exposed to greater volatility than in 2021.

- Earnings growth is expected to return to normal levels (8-10% in year-on-year terms) after proving extraordinarily strong in 2021.

Currencies

- Dollar set to remain well supported as the Fed starts to remove quantitative stimulus.

- Portfolio weight of the yen stepped up to buffer potential bouts of volatility on risk assets.

Investment View

According to our baseline scenario, economic growth will continue to recover at the global level, even as monetary stimulus is reduced. Existing pro-cyclical approach confirmed.

Asset Classes Compared

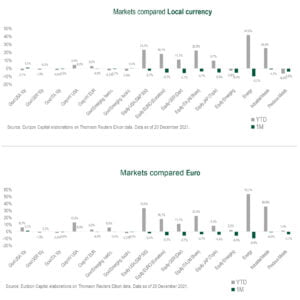

In 2021 the Stock markets performed very well, led by the US and Europe, as opposed to neutral performances in the emerging economies of Asia and Latin America. Government bond rates in the US and Germany increased in the opening quarter of the year, and expressed a lateral trend in the following months of 2021. In the year, spreads narrowed on the High Yield bond market, widened for emerging bonds, and widened moderately in Italy. The dollar gained ground in the year.

2022 Scenario

- The goal in 2021 was to replace the “V” for virus with the “V” for vaccines, and was successfully achieved. Although the virus is still with us, lifestyles are almost back to normal and translated into an extraordinary reacceleration of the economy.

- The goal in 2022 will be to take a further step towards normality.

- In terms of the virus, this will mean overcoming the Omicron wave, and any potential subsequent waves, without having to resort to particularly invasive restrictive measures. In this case the impact of the virus on market volatility will remain modest, as was the case in 2021, much unlike 2020.

- On the economic front, furthering the return to normal will mean a slowdown of economic growth after the major positive shock introduced by reopenings. According to the baseline the scenario, global growth will lose some steam compared to 2021, while staying stronger than the average for the latest economic cycles. A full return to normal is more likely to be achieved in 2023.

- According to the baseline scenario, moderating growth should ease pressures on the production system and distribution chains, resulting in gradual re-absorption of inflation pressures. This will be the main goal for 2022, and there is good reason to believe it will be achieved.

- For instance, energy commodity prices have stopped rising since October. For a few months, the second-round effects of past increase will continue to show, but prices should then moderate.

- However, more persistent than expected inflation, despite a slowdown of economic growth, represents the factor of risk weighing on the scenario.

- The extent to which this may generate volatility will mostly depend on the approach taken by the Central Banks. In all likeliness, faced with a loss of steam of the economy, the Fed and the ECB will be cautious in removing stimulus. However, should Central Bank focus be on inflation, regardless of the strength of the economy, uncertainty on the length of the current economic cycle would increase, and market volatility with it.

- The return to normal, in 2022, will also mean that the Central Banks will attempt to progressively remove stimulus measures.

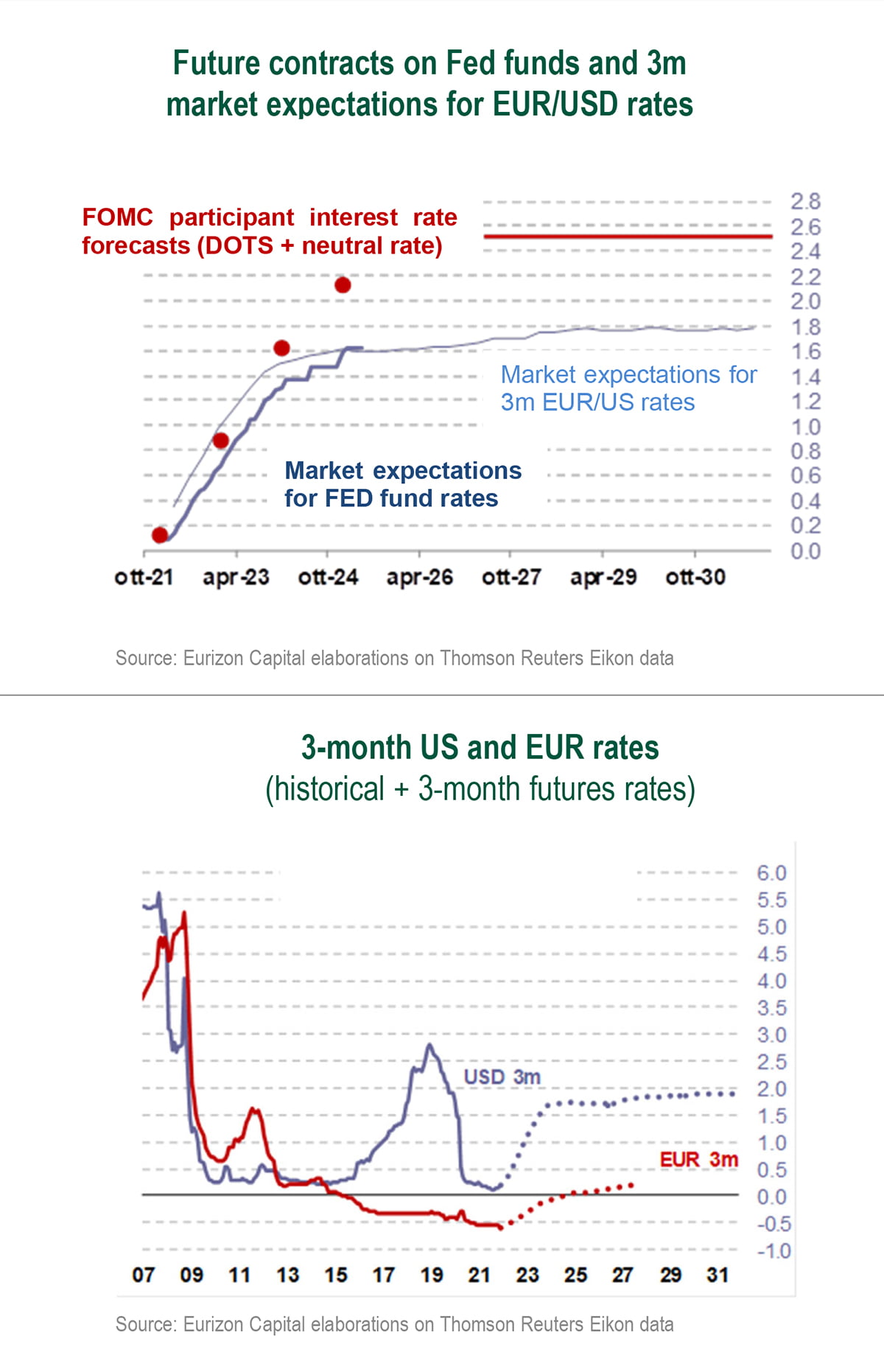

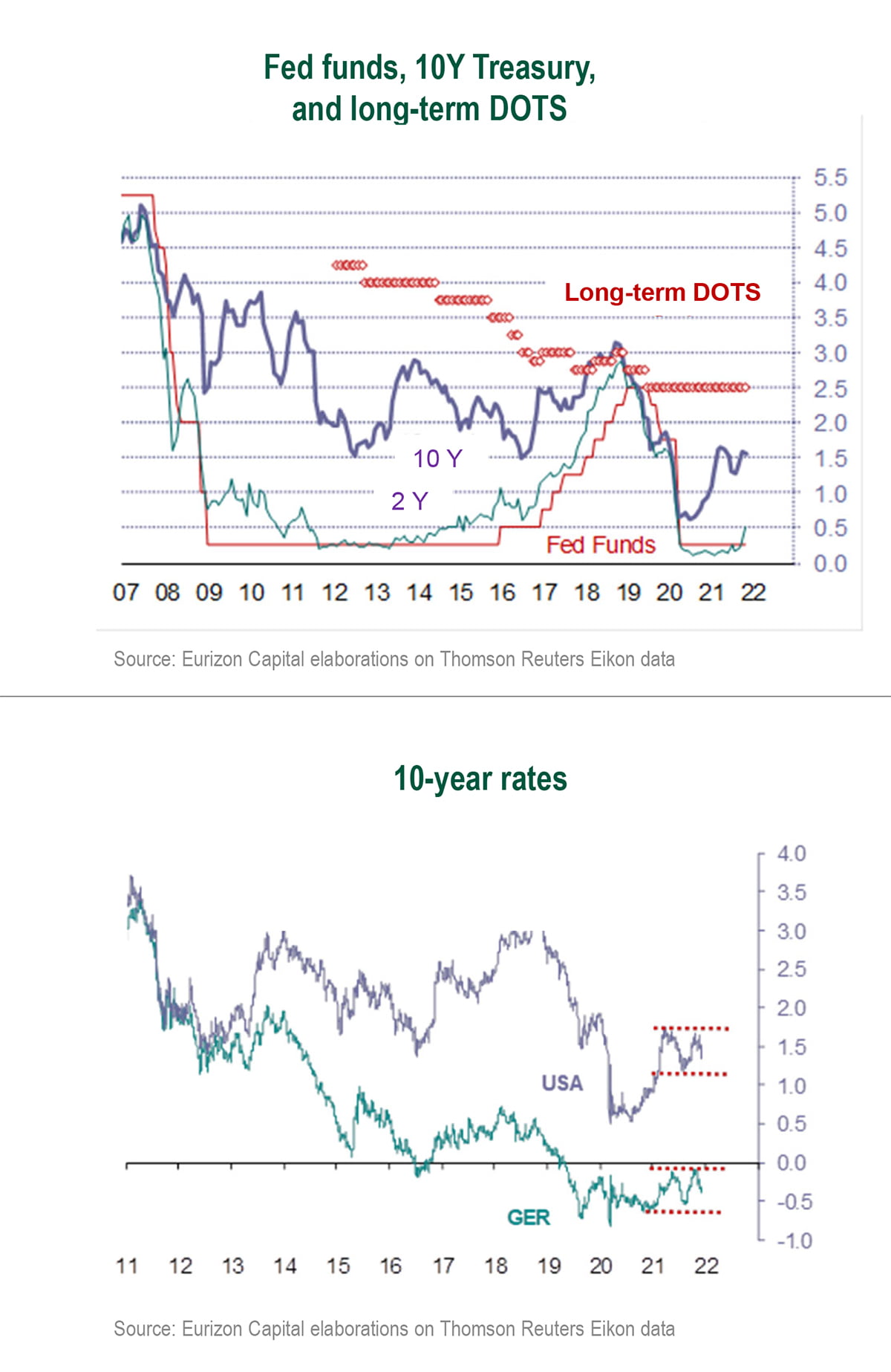

- The Fed has in fact already kicked off the process, by reducing asst purchases starting in last November. And at the December FOMC it indicated that it intends to accelerate along this path, terminating asset purchases by the end of March 2022, in order to start hiking fed funds rates in the second half of the year.

- The ECB will probably follow a similar agenda, at a lag of a few months. QE will probably continue throughout 2022, and rate hikes should begin in 2023.

- The more the removal of monetary stimulus is determined by a return to normal economic activity, with an easing of inflation pressures, the better it will be handed by the economy and the markets. On the other hand, if Central Banks focus primarily on containing inflation, the risk of volatility will be higher.

- Strictly on the political front, an important theme in 2022 will be the election of new Presidents of the Republic in Italy and France.

- The election of the Italian President of the Republic will take place by the end of January. Focus will then turn back to the stability of the government, that will have to continue implementing the NRRP, in a pre-electoral year (the legislature will end in March 2023). Political uncertainty, combined with the reduction of ECB asset purchases, will be factors to take into account in assessing the evolution of the BTP–Bund spread.

- In France the election will be held in April. The two-round French electoral system makes the election of a President with extremist views unlikely. The market impact of the vote should therefore be limited. The outcome of the election will be important, however, in terms of the leadership that will take future decisions in Europe, also in light of the new composition of the German government.

- Also on the agenda are the midterm elections in the United States, in November, that will renew the House and one third of the Senate. This will be the first real test for the US administration, that can currently count on a full Democrat majority in Congress.

- Lastly, China deserves special attention.

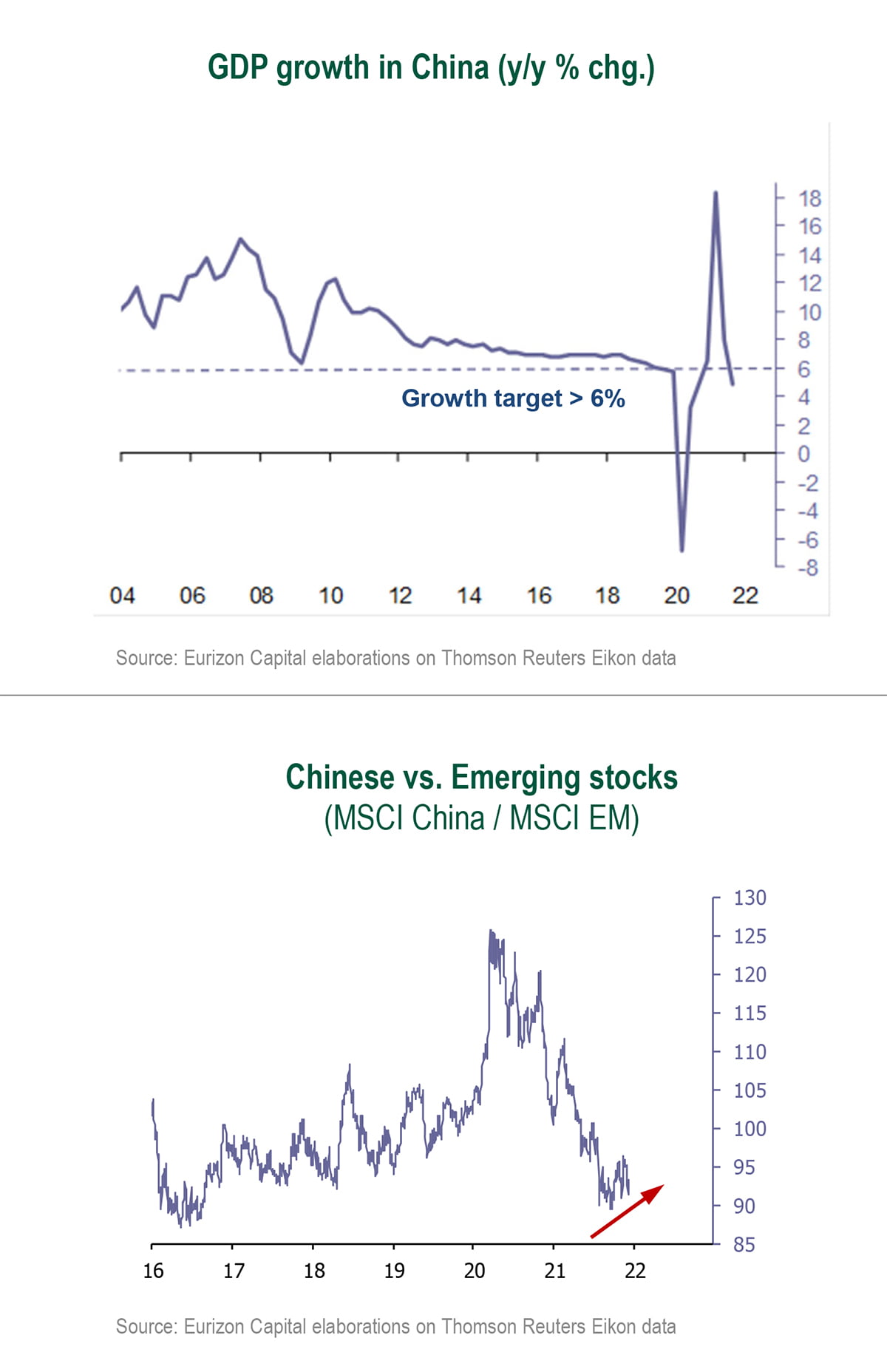

- GDP growth has dropped below the medium term goal of the Chinese govenment, of at least 6% y/y, but unlike in the past, the economic authorities are proving reluctant for the time being to visibly eased credit conditions, that they were prompt to tighten at the beginning of 2021. However, a slackening of the restrictive measures still seems to be the likeliest option in the opening months of the new year, with the aim of preventing an excessive slowdown of the economy.

- The foreign investors’ assessment of China will also depend heavily on whether or not the Xi administration will want to press forward with its anti-market regulatory action, initiated last summer. However, it seems unlikely that China will want to further isolate, a strategy that could ultimately act as a boomerang.

- Under the baseline scenario, a less hostile attitude to the market economy, and a few growthsupportive stimulus measures, could reverse the trend of the Chinese Stock market, that over the past two years has been worse than the already weak overall performance of the emerging markets.

- According to our baseline scenario, the financial markets should confirm pro-cyclical trends.

- The main guiding theme for the markets will be how the combination of growth and inflation intersects with Central Bank decisions.

- Historically, when the Fed starts tightening monetary policy, shortterm government bond rates (2- year maturity) tend to rise, anticipating the increase of fed funds rates. The long ends of the curves, on the other hand, tend to decline in waiting to assess the resilience of the economic cycle. This was the case in 2014/2015, in the long preparative run-up the rate hike cycle, and has been happening for a few months, in anticipation of the upswing of Fed rates in the second half of 2022. After the initial rate hikes, if investors show confidence in the strength of the economy, rates on the longer end of the curve typically resume rising.

- In the present situation, the more persistent inflation proves to be, the more the increase of government bond rates will be accompanied by a flattening of the curves. Vice versa, if the removal of stimulus takes place while inflation is on the decline, interest rate maturity curves could steepen.

- Eurizon Capital hold an underweight view on the US and EUR government bond duration.

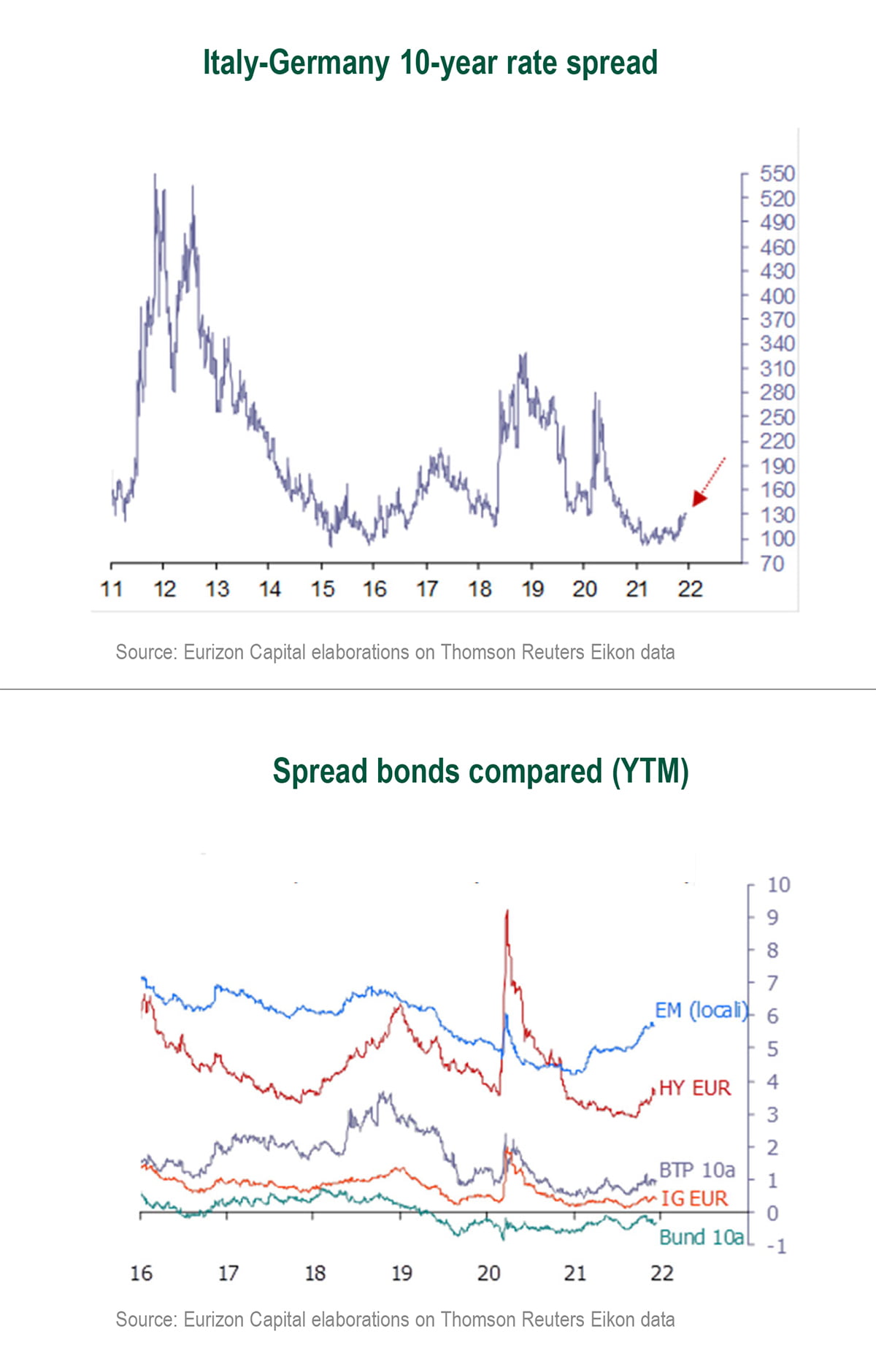

- Within a context of rising core rates, the outlook for spread bonds in terms of absolute return seems modest and limited to carry.

- For what concerns peripheral euro area government bonds, spreads have widened slightly since last October, in waiting for the ECB’s decisions on purchases. At its December policy meeting the ECB confirmed it will reduce purchases in 2022, albeit gradually and at a slower pace than the Fed. This approach should prevent a further widening of spreads. Italian spreads have widened (from 100 bp in October to 130 at present) also as a result of the uncertainty clouding the election of the President of the Republic and the resilience of the government. Uncertainty seems set to continue at least into the opening months of 2022.

- As regards the other spread bond markets, at least in the first part of 2022, High Yield bonds will hold more appeal than emerging market bonds, which need greater clarity on the evolution of the pandemic, as well as on the combination of growth and inflation, to tighten spreads. Among emerging bonds, the appeal of Chinese government issues is confirmed.

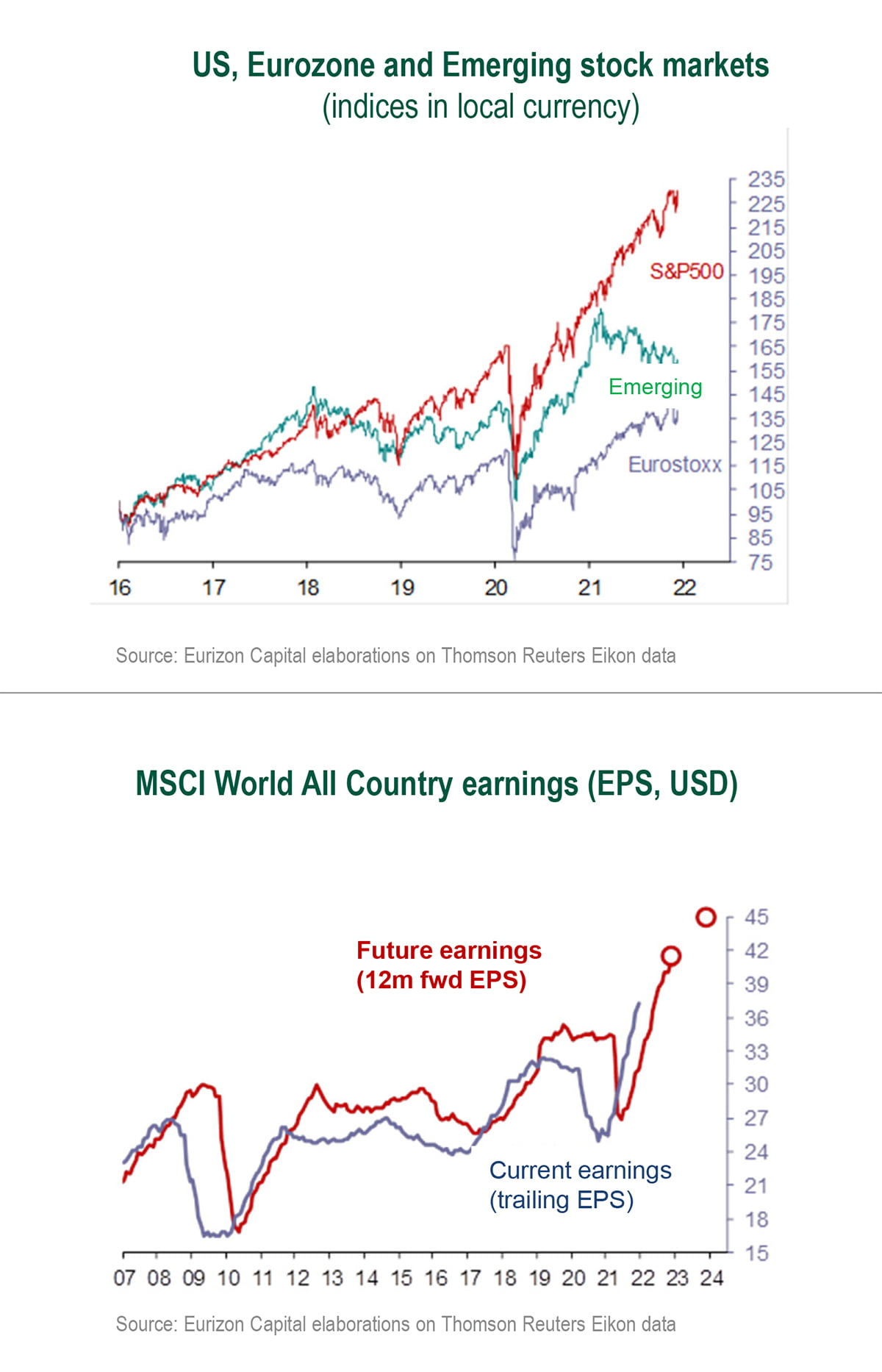

- The stock markets have performed very strongly for 20 months now. From the lows marked in March 2020, the US stock index has climbed consistently, with only a few instances of volatility. In 2020, the US upswing had been accompanied by the emerging markets, that faltered in 2021, giving way to the Eurozone stock markets. This year, the Eurostoxx has kept up with the S&P 500, after a weaker 2020.

- The outlook for stocks sill seems to be favourable in 2022, although forecast return is inevitably lower than in 2021. This is because earnings growth will slow towards the historical average. Consensus forecasts point to 8-10% y/y growth in the advanced markets, after the 2021 surge that saw the S&P 500 score gains of +50% and the Eurostoxx rise by +70%.

- In the emerging markets, forecast earnings growth in 2022 is lower than for the advanced countries. The emerging economies, especially in Asia and Latin America, are being more affected than the advanced countries by the long wave of the pandemic, the still unresolved disruptions of trade, and the impact on inflation, that their Central Banks have already attempted to counter with restrictive monetary policies.

- For what concerns valuations, the excesses recorded in the opening months of 2021 have been partly reabsorbed. Multiples (Price/Earnings ratios) have decreased as a result of quotations rising less than earnings. As a result, the equity risk premium, already high, increased further, with corporate earnings on the rise and bond rates essentially stable.

- The re-absorption of valuation excesses is more evident in the emerging markets and for the Eurostoxx, less so for the US Stock market, where high-growth sectors, for instance technology, have shown stable multiples. However, the US Stock market is still the most appealing in risk-return terms. Its composition by industry makes it more defensive than the other markets, thanks to the weight of growth sectors (technology) that can perform well in case of an only partial macro recovery, and may also benefit from potential rotation to the advantage of cyclical sector if the macro recovery proves more stable.

- Among the other markets, the Eurozone and Japan seem to hold more appeal, at least in the opening months of the new year, than the emerging markets, that will probably need clearer signals of the sustainability of the economic recovery and of easing inflation pressures to interrupt their underperformance.

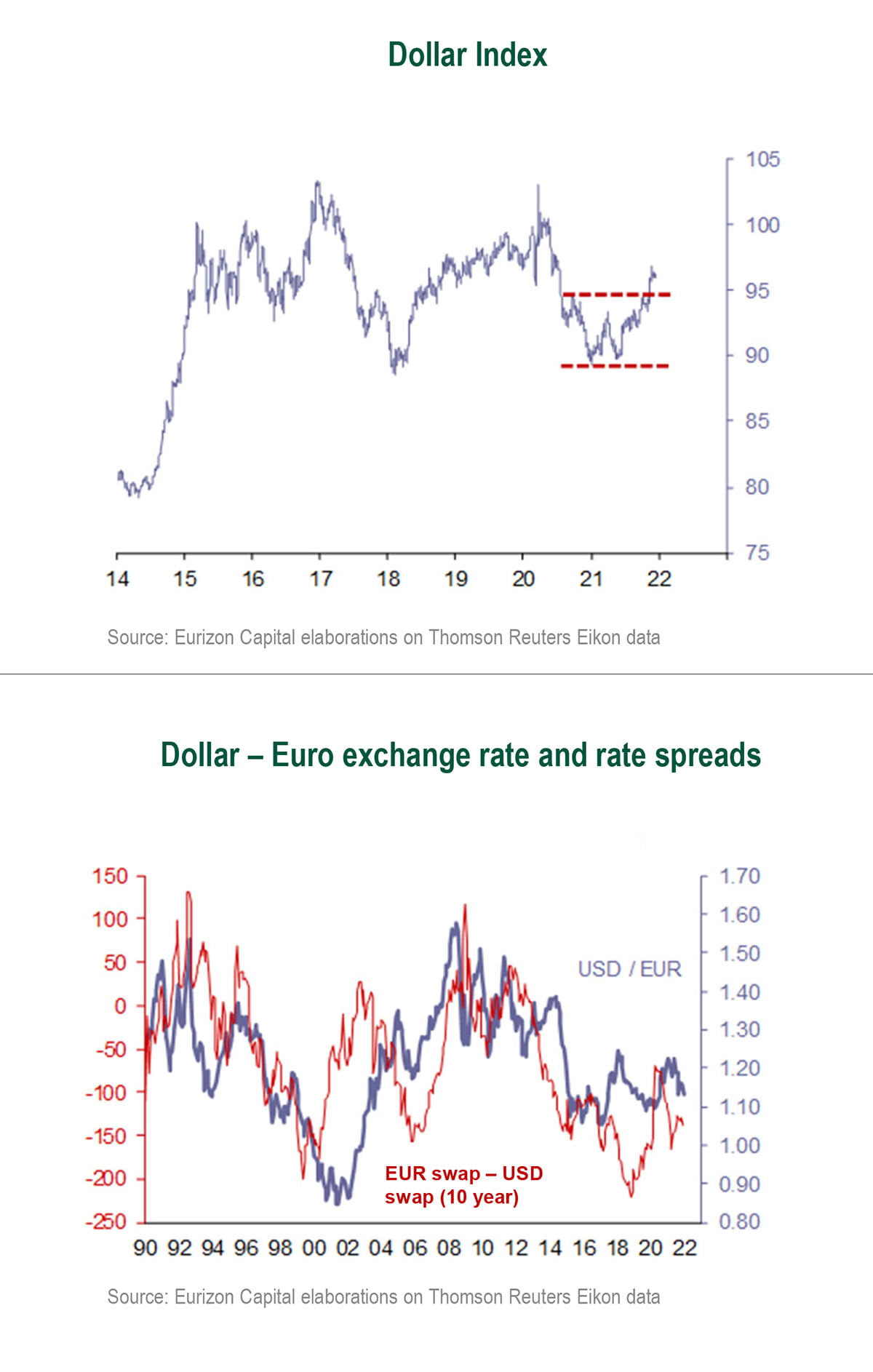

- The dollar recovered in 2021. Against the other currencies taken together (dollar index), the dollar is mid way between its pre-Covid levels and the lows hit at the end of 2020. Against the euro, the change this year was from 1.23 to 1.13; before Covid, the exchange rate was 1.08.

- In the opening months of 2022, the dollar could keep up its recovery, supported by a reduction of monetary stimulus, that the Federal Reserve is set to implement at a faster pace than the other Central Banks. Therefore, it is confirmed a bullish position on the US dollar, that could also act as a safe haven in case of market volatility bouts.

- For the same reason, dictated by hedging needs, the intention is to open the year with a long yen position, in a year that is expected to prove favourable for risk assets, albeit subject to more volatility than in 2021.

Updated on

Sign up for ValueWalk’s free newsletter here.