My daughter got Covid for Christmas.

My daughter got Covid for Christmas.

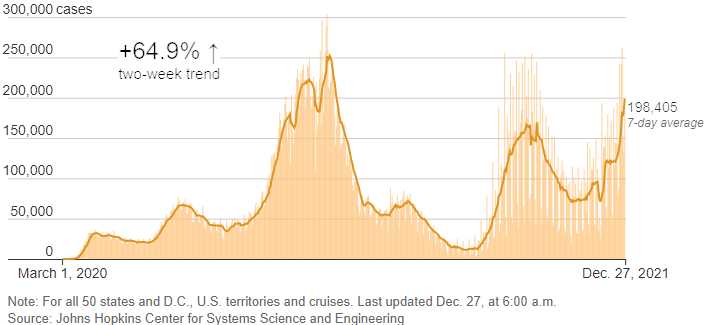

So did 1.5M other people in the past week, ruining a lot of Christmas' and how many people went to family gatherings not knowing they had it (it's almost impossible to find test kits in NY/NJ). So a Covid test kit is a great new holiday gift and we should invest in test kit companies because one person gets it and a dozen people she was in contact with end up getting tests – at $20 each – that's Capitalism in action!

Jackie goes to school in Hoboken at Stevens, where she has an apartment with 4 other girls and where they plan on holding in-person classes next semester (3 weeks from now) and she came home and visited her friends and got sick the next day (Christmas Eve) and took a home test, which showed positive. There was nowhere to get a confirming test so hopefully today or tomorrow but it was impossible to book an appointment and the last place we want her to go is a hospital or clinic, packed with people who have various strains of covid.

Friends in New Jersey tell us not one pharmacy or walk-in clinic in a 100-mile radius has appointments available in the next week. The question that haunts us now is that, almost two years into this crisis and an $11 Trillion U.S. Fiscal and Monetary spending deluge, we still don’t have an adequate testing infrastructure? It blows us away – we are still dealing with endless waiting lines, no availability of testing appointments, shortages of at-home tests and overwhelmed testing labs scrambling to process vials. Where did all that money go?

So we're going to get her to a drive-through center for a proper test but, if it's positive, then she has to isolate for 10 days (of course she is already self-quarantining and Christmas was ruined). Still, thank God it seems no worse than the flu at the moment – not that that's a picnic. She says she has the worst headache she's ever had but breathing is OK.

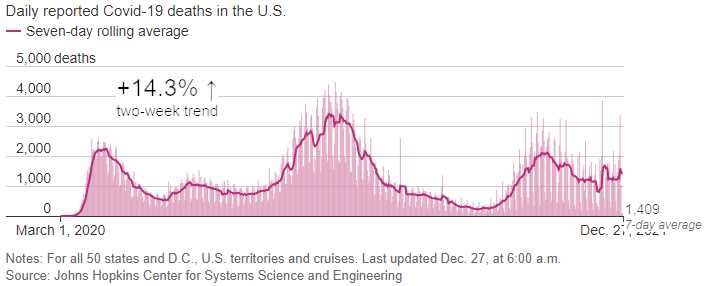

Around the country, we had another 9/11-type day on Thursday, with 3,354 deaths and we're averaging 1,409 deaths per day – up from 300 over the summer and before Omicron, which is, as I'm sure you've heard – "milder" We have a different sort of problem now as so many people are sick at the same time it's affecting the workforce – including health care professionals.

Around the country, we had another 9/11-type day on Thursday, with 3,354 deaths and we're averaging 1,409 deaths per day – up from 300 over the summer and before Omicron, which is, as I'm sure you've heard – "milder" We have a different sort of problem now as so many people are sick at the same time it's affecting the workforce – including health care professionals.

If we already have a shortage of Doctors and Nurses, it certainly doesn't help of 1-2% of them have Covid, does it? Understaffed airlines had to cancel over 2,800 flights this weekend, including 1,200 yesterday alone. Ironically, this then causes hundreds of passengers per flight to spend hours in crowded airport termiinals with nothing to do but breath on each other…. At the moment, the US solution has been to change the guidlines so health care workers can go back to work after 5 days instead of 10 days – that does not sound like a great idea.

None of this seems to be bothering the stock market, even though it's clearly going to affect productivity, etc. for Q1. Holiday sales were up 8.5% over last year as consumers spent more money on clothes, jewelry and electronics, according to a report from Mastercard SpendingPulse. Sales surged 47% for apparel, 32% for jewelry and 16% for electronics compared with 2020, with all three categories up at least 20% from their pre-pandemic levels in 2019 as well. Department stores saw a 21% jump from last year and gained 11% from two years ago. Online shopping surged 11%, according to the report, which tracks retail sales across all payment types. E-commerce now accounts for roughly 21% of all holiday sales.

None of this seems to be bothering the stock market, even though it's clearly going to affect productivity, etc. for Q1. Holiday sales were up 8.5% over last year as consumers spent more money on clothes, jewelry and electronics, according to a report from Mastercard SpendingPulse. Sales surged 47% for apparel, 32% for jewelry and 16% for electronics compared with 2020, with all three categories up at least 20% from their pre-pandemic levels in 2019 as well. Department stores saw a 21% jump from last year and gained 11% from two years ago. Online shopping surged 11%, according to the report, which tracks retail sales across all payment types. E-commerce now accounts for roughly 21% of all holiday sales.

Of course, those of us who are actually shopping know that the 8.5% increase is not because we're buying more stuff but because the stuff we are buying is more expensive. There was a lot of sticker shop at those retail stores and a lot less sales than usual. People may be making a little more money in a tight labor market but it's not making it to the bank with so many rising expenses along the way.

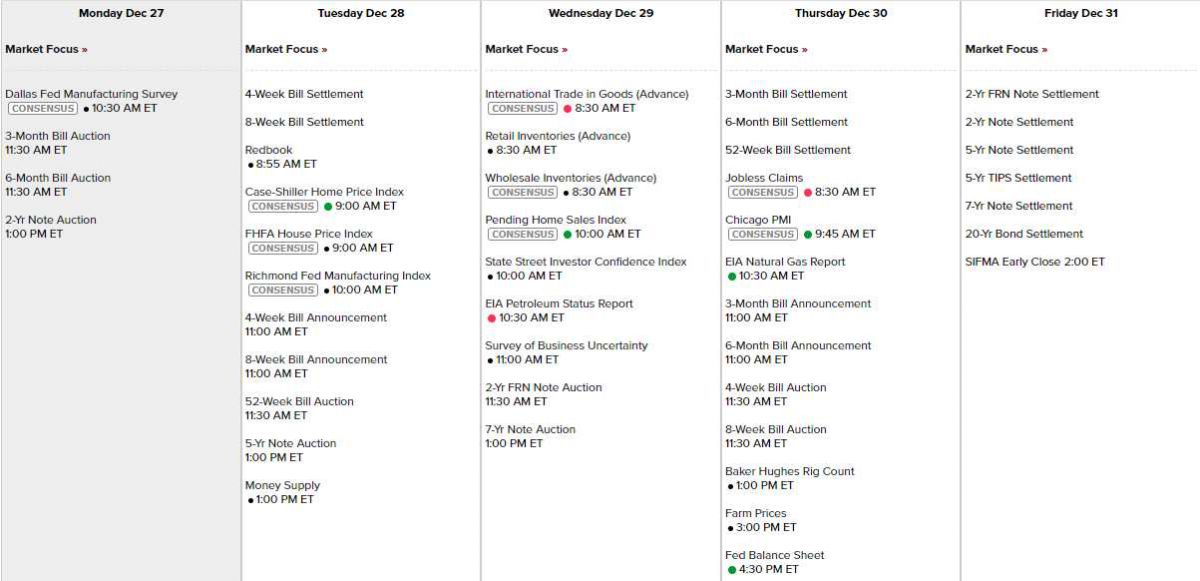

We'll start to see Q4 earnings in a couple of weeks and we're finally done with Q3 reporting so it's all about the data this week – and there's not much of that either so it's going to be another low-volume week with most people taking Friday off – although the markets are technically open in the US. The Fed is off from speaking and there's very little data – as I said last week, this is a good time to take a break:

Just keep that in mind…

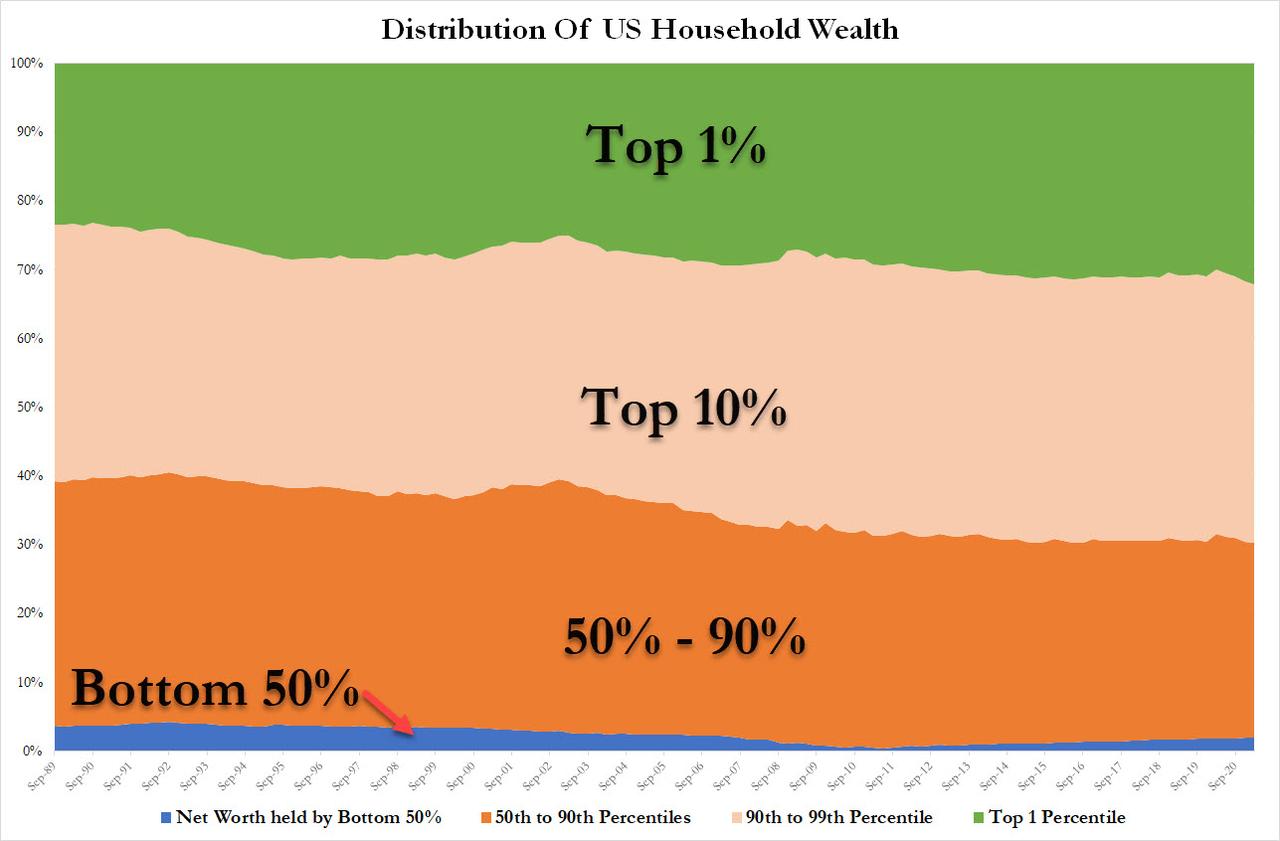

Since August – we have had THREE sub-80 readings from the University of Michigan Consumer Economic Confidence Data. Looking back over the last 30 years – it is HIGHLY unusual for the Fed to hike rates with consumers in this kind of pain. Inflation´s taxing powers over the consumer have already hiked rates 100bps for the Fed in our view – colossal demand destruction has taken place. These stagflationary conditions erode people’s real disposable income, making them worse off. Ultimately, most of the $11 Trillion ended up benefiting the top wealthiest Americans, by inflating the prices of assets such as bonds and stocks and lowering interest rates for borrowers with the highest credit rating. For the average citizen, this has been a very raw deal.