1,017,376.

That is the official count of Covid 19 infections yesterday, almost double the record of 585,013 set on Thursday. That's NOT EVEN inclucing data from 6 states, which took the holiday off on Monday and will catch up reporting today – so tomorrow is likely to be an even more disturbing daily number than today though it's hard to be more disturbing than 1 in 300 of us catching Covid in a single day. There are 365 days in a year – you WILL get your turn! Now we will see if I was right on Wednesday, when I said:

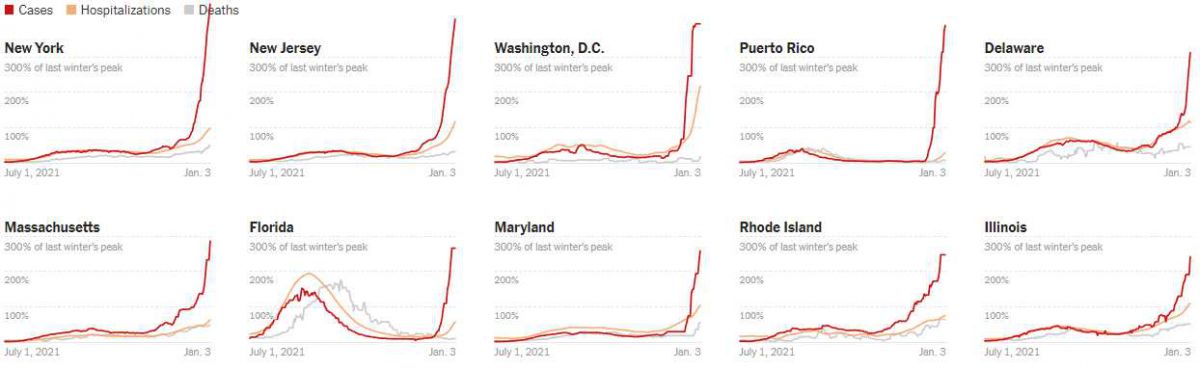

Can the markets keep ignoring this surge in cases? Certainly not if we're talking 1M cases per day next week. Even if Omicron were as mild as the flu – having 7M people per week get sick would be damaging to the economy. At the moment, "THEY" keep pointing out that hospitalizations and deaths are not maching the record highs – but that's because those are LAGGING indicators that FOLLOW the infections. Yes, that's very obvious but, unfortunately, you have to actually say these things out loud to cut through the BS that's pumped out by the Corporate Media.

The "bright side" of Omicron is supposed to be less hospitalizations… Well, as we know, hospitalizations are a lagging indicator and look at Washington DC, which was the first place to get hit hard – hospitalizations are now 200% over their past peak with infections up 500% so yes, less hospitalizations per infection but we are still being ovewhelmed by the total number of infections.

So far, the market is HAPPY about the news as it makes it more likely the stimulus will pass and it makes it less likely the Fed will be hiking any time soon. That means even more inflation – including inflated stock prices – can still be in our future – despite all the death and disease (less people to divide up the winnings with!).

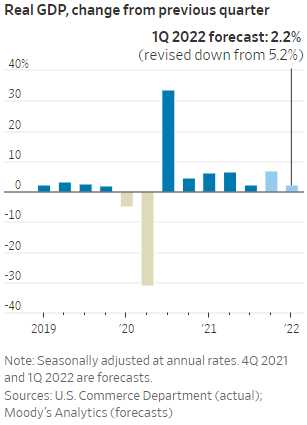

So far, the market is being completely unrealistic – still hoveing around the highs. Mark Zandi, Chief Economist at Moody’s Analytics, downgraded his first-quarter U.S. gross domestic product forecast to 2.2% growth from 5.2% as he “can see the economic damage mounting going into the first quarter.” That's a more than 50% cut in GDP forecast, folks!

So far, the market is being completely unrealistic – still hoveing around the highs. Mark Zandi, Chief Economist at Moody’s Analytics, downgraded his first-quarter U.S. gross domestic product forecast to 2.2% growth from 5.2% as he “can see the economic damage mounting going into the first quarter.” That's a more than 50% cut in GDP forecast, folks!

Zandi pointed to softer spending on travel and cancellations of sporting events and Broadway shows due to the disruptive Covid-19 outbreak. “It feels like a very similar dynamic as when Delta hit,” Mr. Zandi said, referring to the Delta variant of Covid-19 that gripped the U.S. in the summer.

Credit- and debit-card data from JPMorgan Chase indicate that spending in services-related categories such as airlines and restaurants remained depressed last week. Now, the surging Omicron variant is “going to change people’s behavior at the margin” and crimp demand for the spending on services that makes up a large slice of economic growth as people stay home, said Ian Shepherdson, chief economist at Pantheon Macroeconomics. Pantheon Macroeconomics recently cut its forecast for U.S. growth to 3% annualized in the first quarter of 2022 from 5%.

For the week ended Dec. 26th, the number of seated diners in U.S. restaurants was down 27% from 2019 levels, the widest gap since April, according to data from OpenTable. In-store spending at retailers and restaurants also fell in late November and early December. For the week ended Nov. 30, spending was down 5.3% from the previous week. For the week ended Dec. 7, it was down 5.6% before rising 3.4% in the week ended Dec. 14, according to payment-card spending data tabulated by the Commerce Department. Have things gotten better since then or worse?

We are reaping what we have sown by pretending everything was fine over the holidays, allowing far too many gatherings to take place even with statistics that show the average Omicron victim infects 10 other people. Even with all their vaccines, testing and restrictions, Hong Kong is taking more drastic measures as even they are suffering from a dramatic uptick in Covid cases.

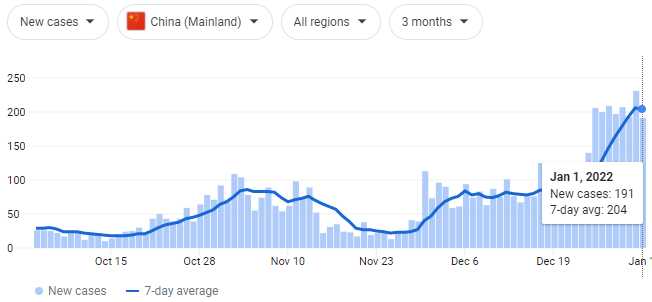

In mainland China, Zhengzhou became the second major city in Henan province to impose a partial lockdown this week. Eurasia Group warned that China’s zero-Covid policy will this year “fail to contain infections, leading to larger outbreaks, requiring in turn more severe lockdowns.” As I mentioned yesterday, China's economy is already in trouble – eventually you find the straw that breaks the camel's back…

The Chinese city of Xi'an has been in lockdown for the past two weeks and shortages of food and medical care have worsened in the past 12 days since officials sealed off the city of 13 million people to stymie a flareup that has already led to more than 1,600 infections – a shocking number for China. More posts are starting to emerge on Chinese social media criticizing the government’s poor management and complaining that access to food is extremely limited.

Like the rest of the World, China now has to decide whether or not to cancel New Year's, which is February 1st. There's a week-long national holiday and it's like our Christmas/New Year's for shopping and travel – cancelling it would be an economic disaster but allowing it to go on could become a national health crisis. Interesting times.

Like the rest of the World, China now has to decide whether or not to cancel New Year's, which is February 1st. There's a week-long national holiday and it's like our Christmas/New Year's for shopping and travel – cancelling it would be an economic disaster but allowing it to go on could become a national health crisis. Interesting times.

Can the markets continue to "ignore and soar" while this is going on across the globe? There is a bright side to everyone catching the virus this winter – herd immunity. It is a real thing and a mild version of the virus may just get us to where we need to be a bit faster. But, that's an experiment in progress and WISHING for a positive outcome does not make it so. Meanwhile, the damage we fact in getting to herd immunity in Q1 is going to be very real indeed.

Oil (/CL) Futures hit our shorting spot at $77 this morning, with the OPEC meeting happening today. Omicron may stop OPEC from increasing production by 400,000 barrels/day, as planned, but $77 on /CL is $80 on Brent (/BZ) and that is simply not a sustainable level for Brent so I do like the short play here in the Futures.

Oil (/CL) Futures hit our shorting spot at $77 this morning, with the OPEC meeting happening today. Omicron may stop OPEC from increasing production by 400,000 barrels/day, as planned, but $77 on /CL is $80 on Brent (/BZ) and that is simply not a sustainable level for Brent so I do like the short play here in the Futures.

We will see how the indexes hold up as the volume returns this week. It takes a while for traders to get out of vaction mode and now we'll see how much reality they are willing to take as they come back to rising Covid cases and declining GDP estimates.